First Quarter Financial Results: Agilent Technologies, Bio-Rad Laboratories, Hitachi High-Technologies, HORIBA, Pacific Biosciences

Changes in China Impact Agilent

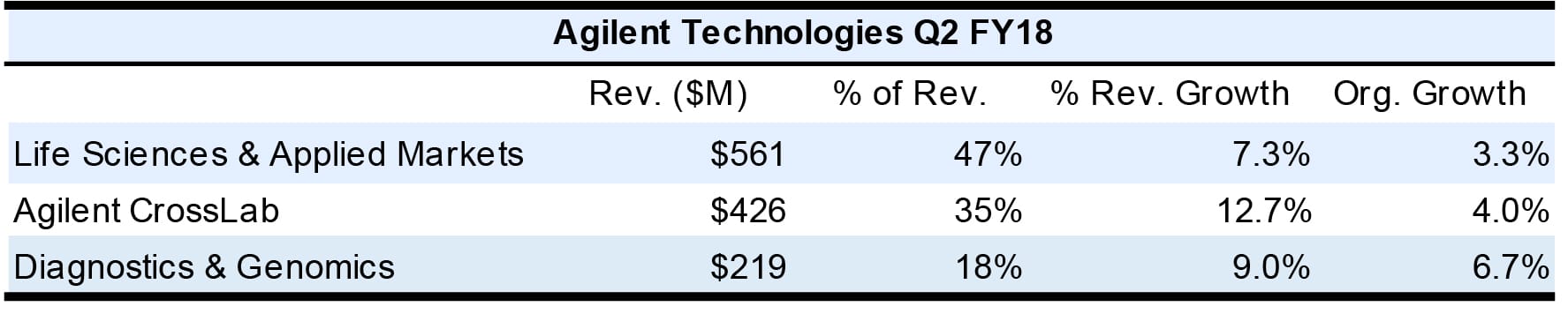

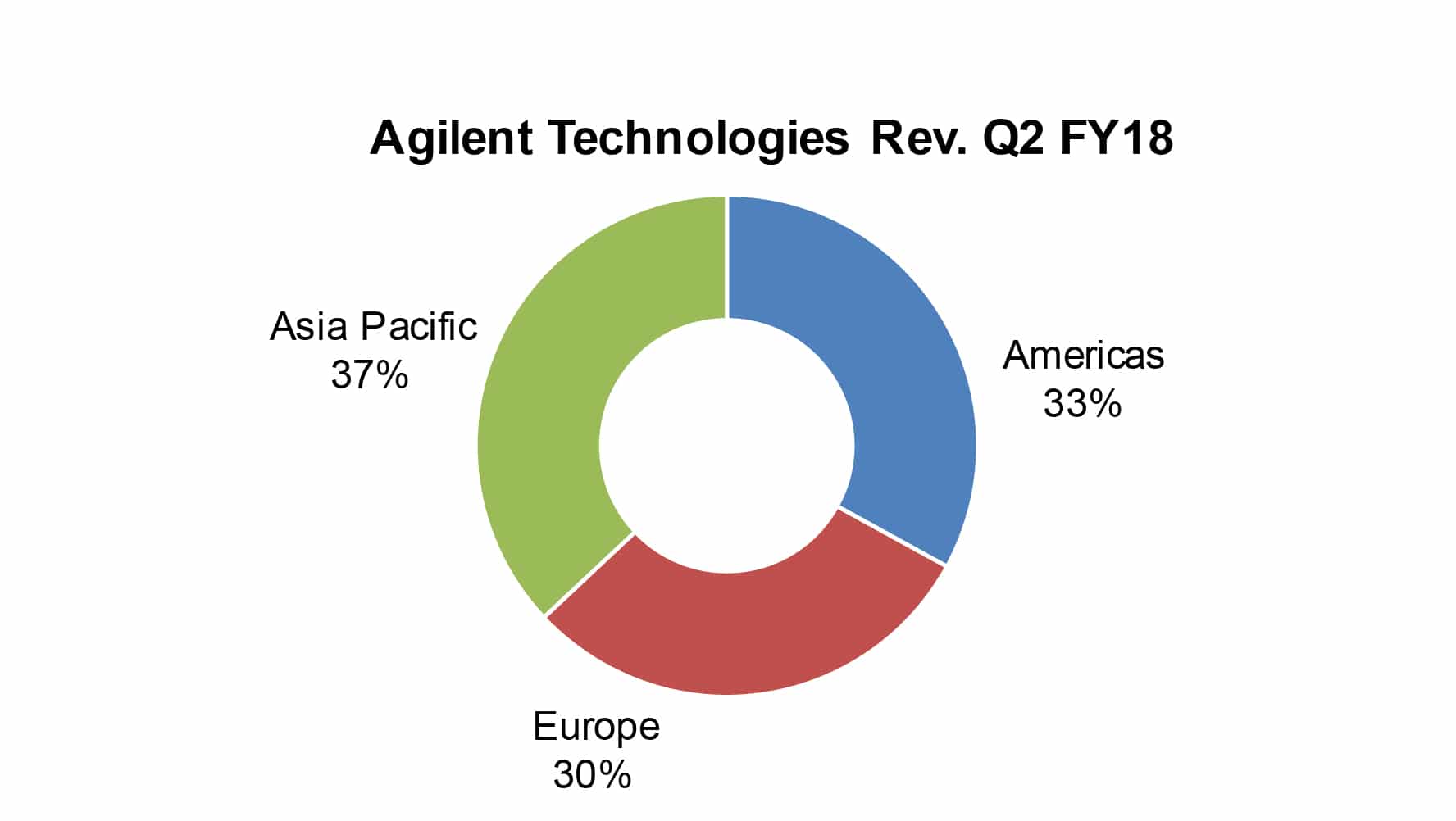

Total fiscal second quarter revenues for Agilent Technologies grew 9.4% (see IBO 5/15/18), as organic revenues gained 4.3%. As anticipated, the Chinese Lunar New Year holiday reduced organic sales growth by 1% due to fewer selling days. Sales were down another 1% due to a reorganization of Chinese ministries as well as delayed ICP-MS shipments due to high backlog and Chinese import issues. Consumables, Services and Informatics revenue accounted for 58% of revenues, with the remainder being Instruments. Operating margins declined three-tenths of a percentage point to 17.8%. Gross margin declined 53.7% to 53.4%.

All figures below are organic. By end-market, pharma and biotech sales grew the fastest, up 8% to account for 29% of revenues, with MS, consumables, service and genomics showing strong demand. Sales to the chemical & energy markets rose 5% to represent 24% of revenues, as the company noted a “slight pause” in orders due to trade concerns. However, the company reported strong sales growth for this end-market in China.

Academia and government revenue rose 2% to make up 9% of total sales, led by LC/MS, cell analysis and the CrossLab consumables and service business revenues. Revenue for the Diagnostics and Clinical end-market increased 3% to represent 16% company sales, with strong Reagent Partnership and Genetics sales, but a weaker US pain management market reduced growth by approximately two percentage points.

Food revenue fell 1% to account for 10% of company sales, as China reorganized its food safety ministries. The slowdown is expected to affect new instrument sales for 6 to 9 months. Environmental and Forensic sales rose 2% to 12% of company revenues, led by Forensic revenue. Environmental sales were affected by China’s reorganization of its environmental ministries.

By segment, the Life Sciences and Applied Markets Group reported strong sales for LC/MS, cell analysis and ICP-MS products. By geography, on a currency neutral basis, Group sales grew 10% in the Americas and 10% in Europe, but Asian sales fell 3%.

Agilent CrossLab revenue rose assisted by double-digit growth in pharma, and academia and government sales, as well as double-digit growth in China. Excluding currency effects, Group sales increased 7% in the Americas, 6% in Europe and 8% in Asia.

Genomics sales, including strong sales of SureSelect NGS target enrichment products, drove Diagnostics & Genomics Group sales growth. Excluding currency effects, Group sales in the Americas rose 3% and 13% in Europe but declined 6% in Asia due to the pathology business.

Regionally, sales in the Americas and Europe grew high single digits, but Chinese sales were flat. For the fiscal year, the company revised its expectations for Chinese sales growth from 10% to 7% due to the reorganizations of the food and environment industries. These government changes are expected to move $20 million in sales into fiscal 2019. However, Agilent raised its outlook for pharma from 5% to 6%. The company maintained its forecast of 5.5% organic growth for the fiscal year.

Bio-Rad Life Science Sales Excel

Bio-Rad Laboratories Life Science’s (LS) first quarter sales increased 13.5%, 8.9% excluding currency, to $197.8 million, or 36% of company sales (see IBO 5/15/18). Revenues included RainDance Technologies (see IBO 1/31/17) sales of $6 million, up from $2 million last year. Digital PCR, cell biology, gene expression and process media products fueled LS revenue growth. By region, North American sales were strongest. China and Europe also recorded good demand on a currency neutral basis.

LS gross margins increased approximately 5.2 percentage points due in part to the sales increases, a one-time expense related to RainDance last year, and lower royalty amortization for gene expression products.

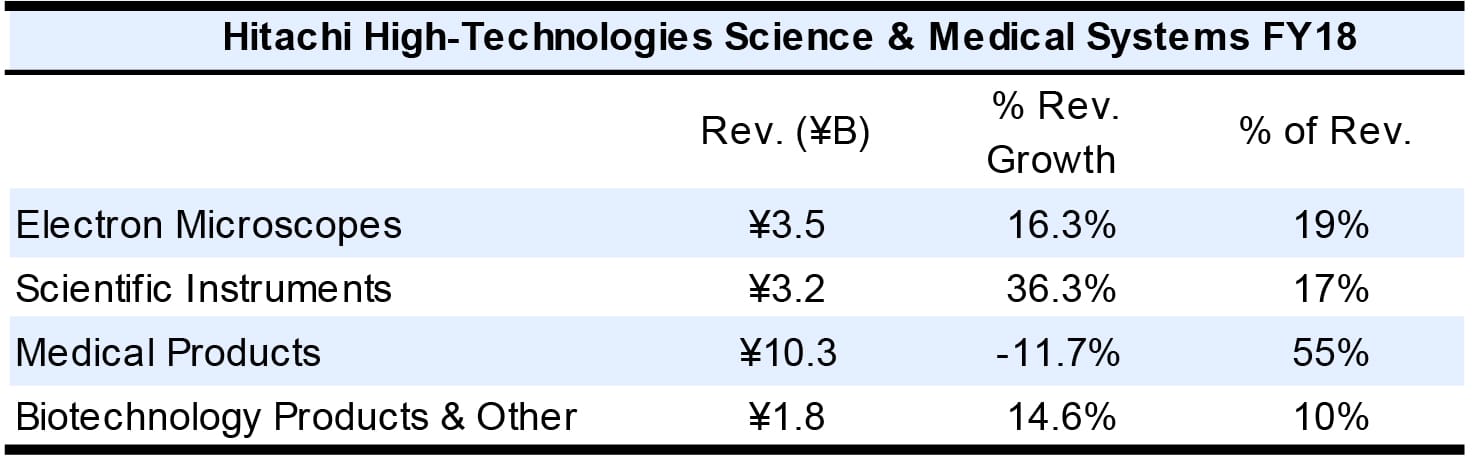

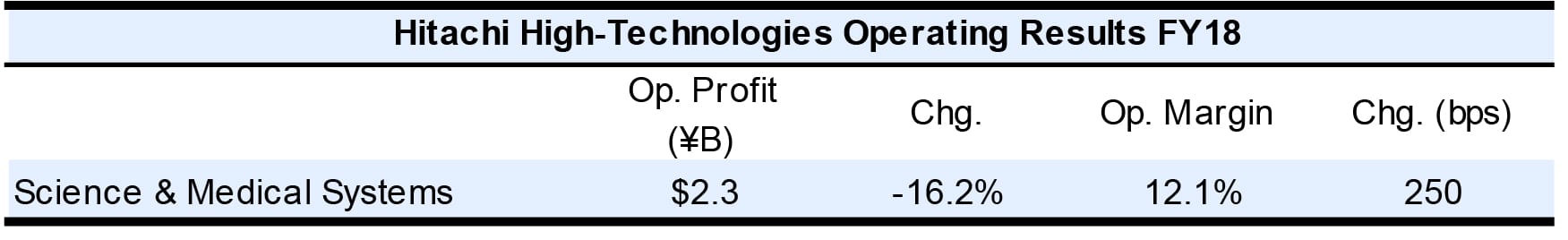

Hitachi High-Technologies AMI Fiscal Year Sales Flat

Hitachi High-Technologies Science & Medical Systems (SMS) for the year ending March 31 were nearly flat at ¥188.1 billion ($1.68 billion = ¥111.68 = $1) to make up 27% of company sales (see IBO 4/30/18). Segment operating margin declined due to inventory adjustments and strategic investments.

FY19 SMS revenue are expected to rise 9.0% to ¥2.1 billion ($1.84 billion). Scientific Instrument revenues are forecast to record the fastest growth, rising 15.4%. Medical Products sales should follow, up 10.2%. Electron Microscopes are expected to increase 4.0%, while Biotechnology Products and Other sales are forecast to be up 1.0%. Aims for the company’s increased R&D investments includes development of NGS products, MS for diagnostics and automation technology for electron microscopy.

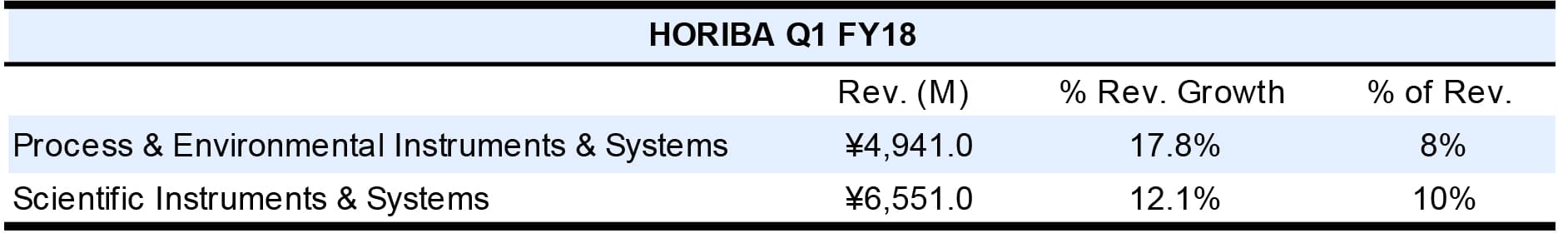

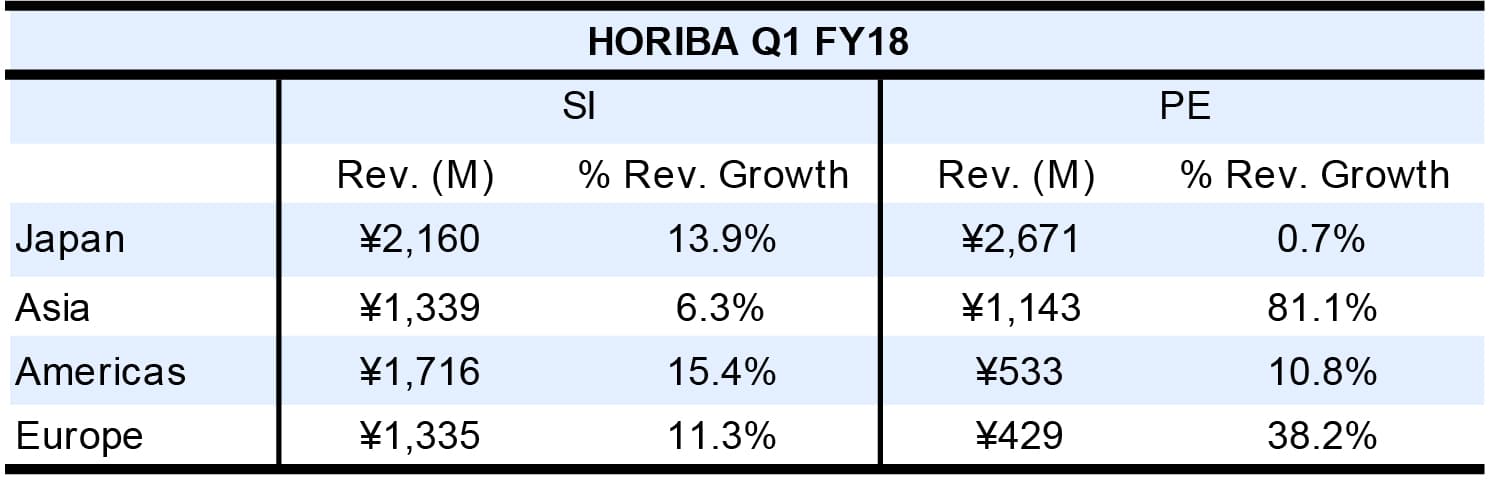

HORIBA Scientific Instrument Sales Rise Double Digits

HORIBA’s combined revenues for its Scientific Instruments and Systems (SI) and Process & Environmental Instruments and System (P&E) businesses rose 14.5% in the first quarter to ¥11,492 million ($105.8 million at ¥108.67 = $1) to make up 25% of total company sales (see IBO 5/15/18).

SI sales were driven by the Americas and Japan. SI orders increased 26.9% to ¥6,540 million ($6,018 million). SI second quarter revenue is forecast to rise 13.8% to ¥6,448 million ($59.3 million).

First quarter P&E revenue rose due to water quality analyzer and air pollution analyzer sales. P&E orders grew 16.7% to ¥4,366 million ($4,018 million). However, SI second quarter sales are forecast to fall 21.3% to ¥3,058 million ($2,814 million).

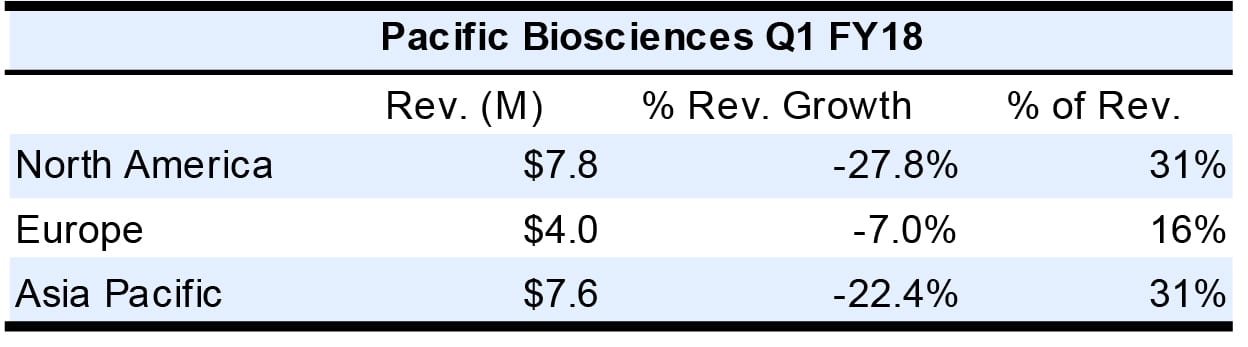

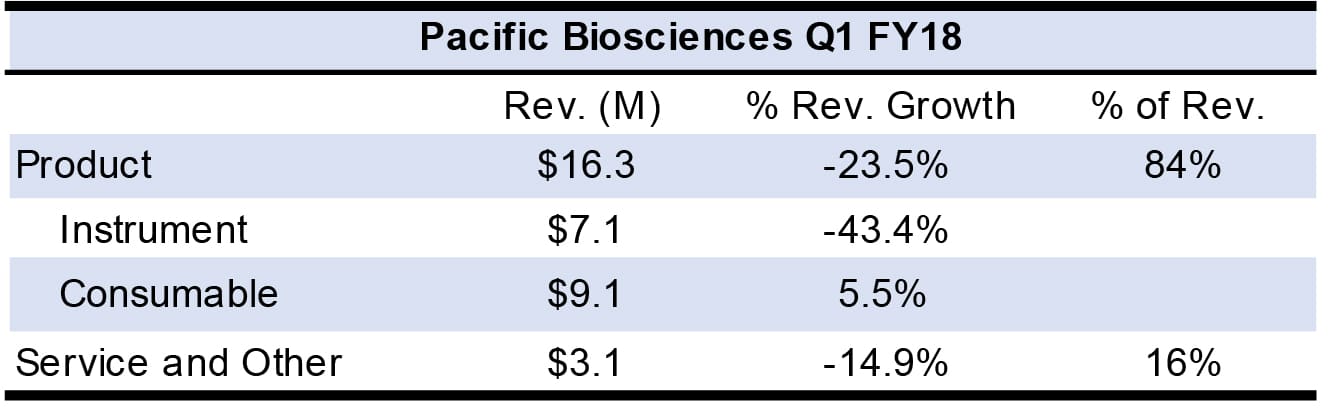

Pacific Biosciences Sales Decline

First quarter revenues for Pacific Biosciences declined 22.3% (see IBO 5/15/18) due to lower shipments, missing company expectations. Although Sequel instrument orders were the largest since the fourth quarter of 2015, a majority of the systems did not ship due ongoing preparation of customers’ facility. Other factors included a difficult year-over-year comparison. The company estimated an installed base of 400 instruments, including around 250 Sequel systems.

As for Consumables, while sales of Sequel consumables tripled, sales of RS II consumables continued to decline to account for 20% of total Consumable sales. Also affecting Consumables sales was the China’s Lunar New Year holiday, which lowered instrument usage, and facility issues with a large customer. Service and other revenue declined due to a fall RS II service sales, which are higher priced than Sequel services.

Geographically, the company highlighted Chinese demand, which accounted for more than 30% of total sales and included multi-unit orders. The country’s overall demand is attributed in part to animal and plant sequencing projects. Due to facility-preparedness timing and unpredictable order patterns, the company did not provide a revenue forecast for 2018.