2023 Dividend Changes for Laboratory Tool Companies Reflect a Chink in the Armor

The role of what dividend-paying companies in the US stock market would play in 2023 shifted from positive to negative as 2023 continued to be another year of volatility. According to the Wall Street Journal, analysts forecasted in the beginning of 2023 that dividend-paying companies in the stock market would be wise investments for investors as the companies were seen as reliable sources of income. Furthermore, dividend-paying firms were seen as having positive cash flow and strong earnings amidst a turbulent 2022 marred by high inflation and mixed macroeconomic data. Analysts stated that a company that can pay dividends in a high-interest rate environment exhibits good financial and stock market standing. On the other hand, analysts noted that if the stock market proved volatile, dividend-paying companies could also prove volatile investments.

Unfortunately, the US stock market continued its volatility into 2023 as factors such as rising interest rates, less-than-stellar earnings results and an overall economic slowdown persisted, leading investors to rely on safe havens such as government bonds and growth-focused tech stocks. According to the Wall Street Journal, by mid-2023, dividend-paying firms were seen as a liability for investors.

Despite the negative factors, according to the S&P Dow Jones Indices, a division of S&P Global, companies in the S&P 500 paid an estimated $588.2 billion towards dividends in 2023, a 4.2% increase. Although the S&P Dow Jones Indices also noted that 2,548 firms increased their dividends, this was a 9.9% decrease and was indicative of companies being cautious about their financial outlook for calendar year 2023. At the same time, 386 companies in the S&P 500 decreased their dividend payments, a 22.2% increase.

As stated in the Instrument Business Outlook (IBO) blog article “Dividends as an Indicator for Laboratory Tool Industry Companies in 2022,” a consistent dividend payment schedule can reflect a company’s good financial standing and solid presence in its respective industry. As a result, a recurring dividend payment promotes continued investment from shareholders. Furthermore, a dividend payment increase, whether quarterly, annually or intermittently, promotes further positive investor sentiment, possibly indicating a company is improving its financial or market standing. In addition, as the previous blog articles stated, an increase in dividend payment can cause a temporary rise in share price, which usually makes a new investor pay a premium.

However, a decrease or suspension in dividend payment can signal various things for a company. On the one hand, a lowered or suspended dividend payment could indicate a company’s poor earnings performance, which could lead to it not having profits to pay shareholders. Another negative factor is the firm preserving cash to reduce outstanding debt. However, a decrease in dividend payment does not always mean a company is in a tenuous financial or stock market position. For instance, a company may want to reallocate funds to prepare for a stock buyback, reinvest in its operations or accumulate cash for M&A activity. Additionally, the company could be taking measures to weather an upcoming or present recession.

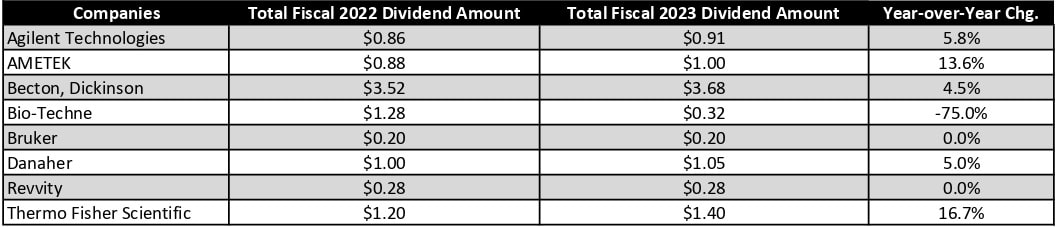

Eight laboratory tool firms are highlighted here due to their significant and distinct presence in the scientific tools market and regular dividend payment distribution. The companies are Agilent Technologies, Bio-Techne, Bruker, Danaher, Revvity and Thermo Fisher Scientific. Additionally, AMETEK and Becton, Dickinson (BD) are included due to their having selected laboratory product lines.

When referring to the eight companies’ stock market performances and dividend payment schedules, the calendar year 2023 period is utilized. On the other hand, financial figures for revenue performance and cash and cash equivalents are based on each company’s fiscal 2023 reporting period. AMETEK, Bruker, Danaher, Revvity and Thermo Fisher follow the calendar year 2023 with annual reporting periods ending December 31, 2023. Therefore, the companies’ first nine-month 2023 revenues and cash and cash equivalent figures are used for this blog.

However, Agilent, BD, and Bio-Techne’s respective annual reporting periods occurred during the calendar year and not at year’s end. Specifically, Agilent, BD and Bio-Techne’s fiscal years ended on October 31, 2023, September 30, 2023 and June 30, 2023, respectively. As a result, financial information from these three companies encompasses the calendar years 2022 and 2023 and is referred to as a fiscal year. Otherwise, all 2023 references are to calendar year 2023.

Agilent Technologies and Becton, Dickinson

Agilent and BD, respectively, increased their dividend payment in the fourth quarter 2023. Specifically, Agilent increased its dividend by one cent to $0.24 from $0.23, and BD raised its dividend payment from $0.91 to $0.95. However, regarding factors that led Agilent and BD to augment their dividend amount, both companies’ situations do not fully align. Agilent and BD’s annual 2023 stock performances both landed in negative territory, with the former experiencing a 7.1% decrease and the latter a 6.9% contraction. Also, Agilent and BD’s respective cash and cash equivalents at the end of their respective fiscal 2023 periods increased 51.0% and 40.8%, respectively. On the other hand, Agilent’s fiscal 2023 sales declined 0.3% to $6.8 billion, yet BD’s annual 2023 sales grew 2.7% to $19.4 billion.

Though Agilent did not give a specific reason why it increased its dividend by the end of fiscal 2023, the company noted it has increased its quarterly dividend payment during the fourth quarter since 2012. Additionally, BD highlighted its consistency in increasing its dividend payments, making 2023 the 52nd year. In conclusion, both companies saw the increase of their respective fourth quarter dividend as a tradition despite their annual financial and operational performances.

AMETEK

AMETEK’s quarterly dividend for calendar year 2023 grew 13.6% to $0.25 per quarter and was distributed each quarter throughout the year. The company performed well in 2023 reinforcing its quarterly dividend increase. Specifically, AMETEK’s first nine-month 2023 sales and cash and cash equivalents expanded 7.5% and 171.6% to $4.9 billion and $841.9 million, respectively. Also, the company’s annual 2023 share price recorded an 18.0% increase.

AMETEK has distributed quarterly dividends since 1997, with the initial one being $0.60. AMETEK paid the $0.60 dividend consecutively until 2014 when the company increased it to $0.90. The company has steadily expanded its dividend payments from 2019.

Bio-Techne

Since the fourth quarter of 2014, Bio-Techne has distributed a $0.32 quarterly dividend payment. However, in November 2022, Bio-Techne’s Board approved a four-for-one stock split in the form of a stock dividend, which went into effect in the first quarter 2023. As a result, the company’s quarterly dividend amount changed from $0.32 to $0.08. Bio-Techne paid $0.08 per quarter for the remainder of 2023. Bio-Techne stated that this change made stock ownership more accessible to both employees and investors.

Regarding other factors, Bio-Techne’s fiscal 2023 revenues rose 2.8% to $1.1 billion, yet the company experienced sales headwinds in its instrument line and the Asia Pacific region. Nonetheless, its cash and cash equivalents experienced a 4.6% increase. However, the company’s 2023 stock performance landed in negative territory, finishing at a 6.9% decrease.

Bruker

Bruker paid a $0.05 dividend per quarter throughout 2023. The company first issued a dividend in 2016 which was a $0.04 quarterly payment and maintained that payment schedule until the beginning of 2022 when Bruker increased it to $0.05.

Amidst an uncertain macroeconomy and lab tools industry performance, Bruker’s first nine-month 2023 company sales grew 15.8% to $21.1 billion thanks to its Bruker Scientific Instrument division meeting demand in various end-markets. On the other hand, Bruker’s cash and cash equivalents for the first nine-month period declined by 41.7%. Though the company doesn’t give a specific reason that its cash and cash equivalents contracted, Bruker did complete seven M&A deals in 2023. Nonetheless, Bruker’s annual 2023 stock price expanded 7.5%, reflecting positive investor sentiment as the company held a solid position in the lab tools sector.

Danaher

Despite increasing its quarterly dividend amount at the beginning of 2023, Danaher is the only firm in the table to have decreased its dividend payment within the year. Specifically, the company lowered it from $0.27 to $0.24 in the fourth quarter. Historically, since 2017, Danaher has increased its quarterly dividend at the beginning of the first quarter and maintained that respective year’s quarterly dividend amount until the following year.

Though Danaher did not give a specific reason why it changed its dividend amount in the fourth quarter 2023, the company underwent significant changes in its operations in 2023. Specifically, the company spun off its Water Quality and Product Quality & Innovation business, weathered weak COVID-19-related demand, and experienced consistently declining sales for its newly created Biotechnology division. Although its cash and cash equivalents surged 138.4% for the first nine months of 2023, Danaher suffered an 8.2% revenue decrease for the same period to $21.2 billion. The company’s 2023 year-end stock performance also decreased, falling 12.8%.

Revvity

Revvity paid a $0.07 dividend throughout 2023 which has been the case since the calendar year third quarter 2001. Since divesting its Analytical and Enterprise Solutions business on May 9, 2023, Revvity has gone through a transition period. Revvity’s first nine-month 2023 revenues suffered a 20.1% contraction to $2.1 billion as the company weathered broad-based regional sales declines and decreased Diagnostics division sales. Additionally, the company’s full-year 2023 share price performance decreased 22.0%. However, Revvity’s cash and cash equivalents saw a 150.2% surge.

Thermo Fisher Scientific

Thermo Fisher has a tradition of consistency regarding its dividend history. In 2012, the company established a $0.13 dividend payment, which increased during the fourth quarter of that year to $0.15. The company maintained the $0.15 dividend until 2018, when it raised it to $0.17. Since 2018, Thermo Fisher has increased its quarterly dividend incrementally every first quarter. This trend continued between the fourth quarter 2022 and the first quarter 2023, when the company changed its quarterly dividend payment from $0.30 to $0.35.

Amid Thermo Fisher maintaining its dividend payment tradition, the company experienced sales declines across its businesses for the first nine month 2023 period, concluding with a 4.5% revenue decrease to $32.0 billion. Furthermore, the company’s 2023 share price decreased 3.6%. However, Thermo Fisher’s cash flow surged by 110.2% by the end of the third quarter.

Conclusion

Like in 2022, the eight laboratory tool companies examined here that paid a consistent quarterly dividend in 2023 showed an industry still able to weather both macroeconomic challenges and industry-specific ones such as waning sales in the Asia Pacific region and the pharmaceutical end-market. However, companies such as Danaher which decreased its dividend payment within 2023, also suggest an industry that must make necessary adjustments. Whether those adjustments are signs of hard times for shareholders remains to be seen for 2024.