Foreign vs. Domestic: IBO Surveys Chinese Scientists on Instrument Brand Preferences

As part of China’s 13th Five Year Plan, China has been focusing on accelerating technological innovation in the nation. Chinese scientific output has been surging as the country increases its international scientific research collaborations and federal initiatives to foster research. These new advancements open diverse opportunities for analytical instrument and lab product companies, both foreign and domestic, in China.

To assess if and how these changes have influenced research scientists’ views on foreign and domestic lab instrument brands in China, IBO asked Chinese scientists their views on the types of lab instruments they utilize most frequently and the attitudes they hold towards foreign versus domestic brands. IBO defines a lab instrument as an instrument that receives an electrical current and detects and/or measures a specified substance in a sample.

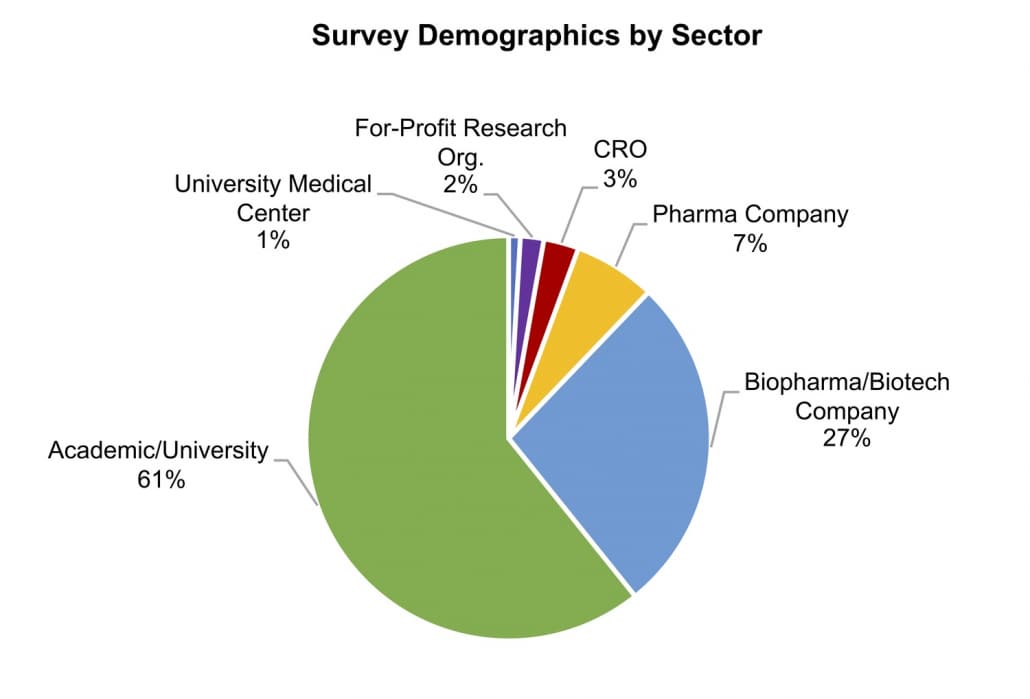

Between September 25 and October 5, IBO conducted a survey of 107 qualified Chinese respondents using BioInformatics Inc.’s Science Advisory Board, an online community of scientific experts. The respondents came from varied fields, with the majority coming from the academic and biopharmaceutical/biotechnology sectors.

Respondents also had diverse employment backgrounds, with the majority, or 34%, working as educators (professors, assistant professors or teachers), and 21% managing, directing or supervising labs. Department heads and principal investigators also participated in the survey, accounting for 15% and 10% of respondents, respectively. The remaining 19% of survey participants was made up of graduate students, lab technicians, bioengineers, QA/QC workers and staff scientists.

Survey Results

In regards to domestic versus foreign brands, 35% of respondents indicated that at least half of the lab instruments they used were from domestic brands. Seventeen, or 16% of respondents, stated that exactly 50% of the instruments they used were domestic brands, with 2 respondents, 1 from the biopharma sector and 1 from academia, indicating that 100% of all instruments they used were domestic.

In contrast, 64% of respondents reported that most of the instruments they use were foreign brands. The largest subset was 30 respondents, or 28% of the total, who stated that 70% of the instruments they use are foreign. Similar to the two outliers who use 100% domestic Chinese instruments in their labs, one respondent from academia indicated that all instruments they used were foreign.

These figures may be explained by examining data regarding the number of domestic and foreign brands available in the respondents’ labs. Generally, the share of domestic brands within the surveyed labs has not increased, with only 38 participants, or 36%, stating that they had seen increased use of Chinese brands in their labs in the past three years. Sixty-four percent indicated that they had not seen the percentage of domestic brands in their labs grow. This may explain why over 60% of respondents specified that the majority of instruments in their labs are foreign brands.

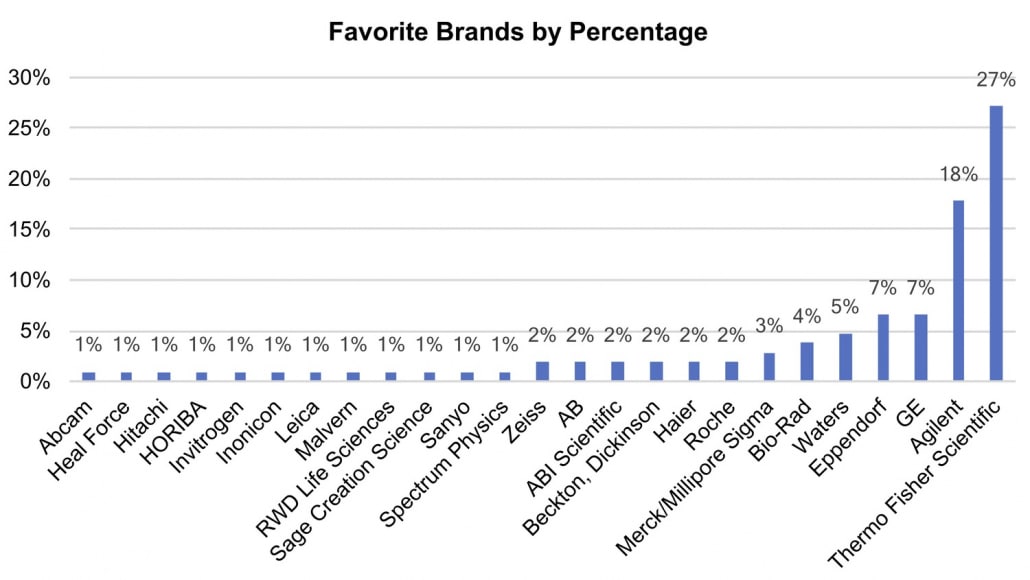

Respondents were also asked to indicate their favorite brand of lab instrumentation, regardless of whether the company was foreign or domestic. Companies such as Agilent Technologies, Eppendorf, GE and Waters were stated by multiple respondents, while Thermo Fisher Scientific emerged as the clear preference, with over a quarter of total participants citing the broad-based company as their favorite (see chart above).

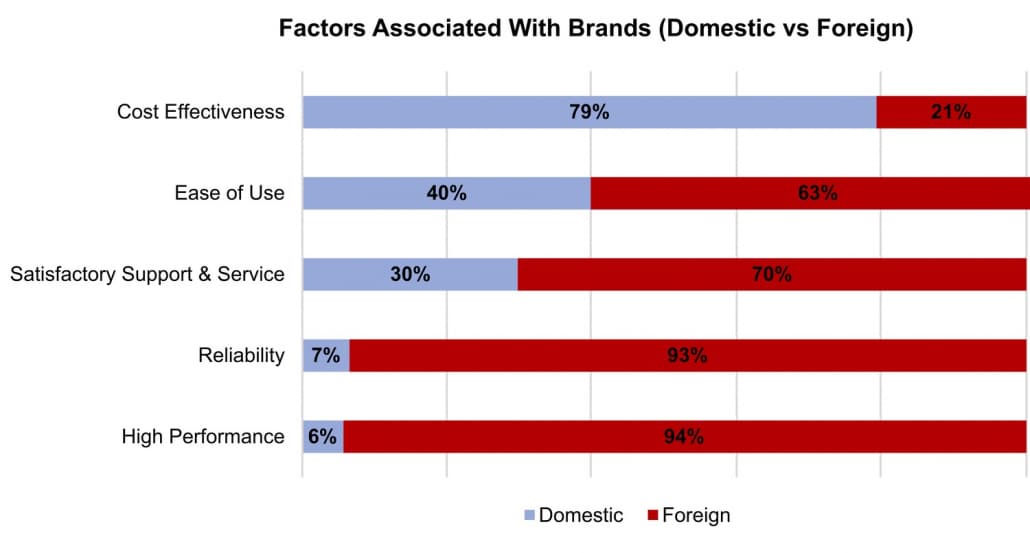

Survey participants associated certain capabilities with either domestic or foreign brands. Interestingly, despite the considerable number of researchers that indicated they use domestically branded instruments, an overwhelming majority of respondents stated that they associate high performance and reliability of lab instruments with foreign companies’ instruments (see chart below).

Satisfactory company support and service, and instrument ease of use were factors that showed slightly less of a discrepancy amongst respondents, with 67 respondents associating foreign companies’ instruments with ease of use and 75 stating that foreign companies provide better support and service. The major advantage that Chinese instruments have, according to survey results, is their cost effectiveness, with 79% of respondents indicating that domestic companies’ instruments are more reasonably priced.

Although these basic factors are more associated with foreign brands, the vendor landscape in China is changing and may influence attitudes towards domestic brands in the future. According to 81 respondents, or 76%, there has been a rise in the establishment of Chinese lab instrument companies. Therefore, as more and more Chinese analytical instrument companies set up shop in the country, it will be noteworthy to assess if the Chinese researchers’ responses change in any way, as opportunities to purchase from and work alongside domestic instrument companies will increase.