Fourth Quarter 2017 Results: Danaher, Illumina, PerkinElmer, Thermo Fisher Scientific, QIAGEN

Life Science Lifts Danaher Growth

Q4 2017

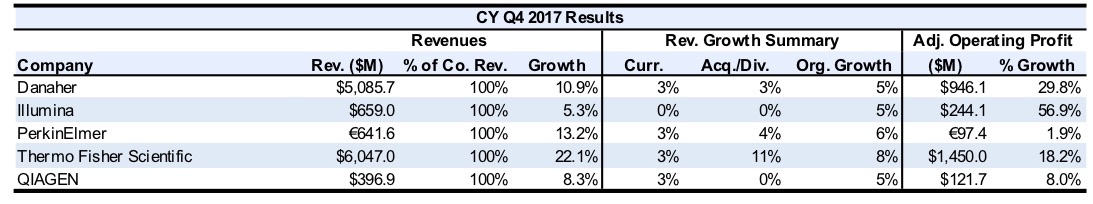

In the fourth quarter of 2017, total sales for Danaher advanced 10.9% to $5.1 billion. Organically, total company sales rose 5.5%, driven by strong Life Science, Diagnostics and Environmental & Applied Solutions (EAS) growth. Currency effects added 3% to overall sales growth, while acquisitions boosted growth by 2.5%. Operating profit increased significantly, leaping 29.9% to $946.1 million, while operating margin rose 2.7 percentage points to 18.6%.

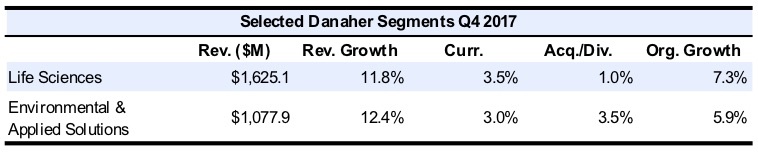

Fourth quarter 2017 Life Science segment (LS) sales increased 11.8% to $1,625.1 million, driven by better-than-expected sales of LS products, along with successful new product innovations. Organically, LS sales rose 7.3%, representing the segment’s highest organic growth rate in more than four years. Segment operating margin was 20.0%, an increase of 312 basis points.

Beckman Coulter Life Sciences (BCLS) reported high single-digit organic growth for the second consecutive quarter. Organic growth for the business was primarily driven by continued strength in flow cytometry, along with strong particle counting product sales. Over the last three years, BCLS has launched around 20 new products, also driving sales growth.

Leica Microsystems delivered organic growth in the low-single digits, supported by moderate growth in Western Europe, along with strength in the medical and research end-markets. SCIEX MS sales grew in the mid-single digits, propelled by strength in the food, environmental and pharmaceutical end-markets.

Fourth quarter 2017 organic sales for Pall advanced nearly double digits, led by microelectronics and single-use technologies sales, along with increased strength in the biopharmaceutical and industrial end-markets.

For Danaher’s EAS segment, fourth quarter 2017 revenue advanced 12.4% to $1,077.9 million, up 5.9% organically. Operating profit increased 8.1% to $248.6 million, while operating margin fell 91 basis points to 23.1% due to increased investment spending within the Water Quality business.

Organic sales for Hach grew mid-single digits, primarily driven by strength in the municipal and industrial end-markets, along with continued growth in China.

FY 2017

Danaher sales for full-year 2017 increased 8.6% to $18.3 billion. Organically, sales rose 3.5%, driven by overall strength, especially in Life Science and Diagnostics. Additionally, continued growth investments and good commercial execution contributed to overall sales growth. Operating profit advanced nearly double digits, up 9.8% to $3,021.2 million. However, operating margin increased just 20 basis points to 16.5% due to increased investment spending.

LS sales for the year increased 6.4% to $5,710.1 million, accounting for 31% of total company revenues. Operating profit grew significantly, up 22.6% to $1,004.3 million, the largest of all business segments. Operating margin rose 233 basis points to 17.6%, with LS as the only business segment to experience such an increase.

EAS recorded 2017 sales growth of 7.5% to $3,968.8 million, the third highest of sales among Danaher’s segments. Operating profit grew moderately at 5.1%, reaching $914.6 million. EAS operating margin fell the least among the segments, sliding just 51 basis points to 23.0%.

As for first quarter 2018, organic sales growth is expected to be 3.5%–4.0%. For the full year, Danaher projects organic sales growth to be around the same, at 4.0%.

Double-Digit Growth for Illumina

Q4 2017

Illumina delivered fourth quarter 2017 sales of $778 million, an increase of 25.7%. The strong growth was a result of solid performances from the company’s sequencing and array-related products. Sequencing instruments, as well as sequencing consumables, both exceeded expectations. Operating margin advanced 6.3 percentage points to 31.4%, also representing a 4.6 percentage point increase sequentially.

Microarray sales accounted for 16% of total company revenues, advancing 21.0% to $123 million. Additionally, direct-to-consumer demand also rose, increasing overall microarray sales. Microarray consumables delivered 8.0% growth to $82 million, while microarray instrument sales slid down to $8 million.

Sequencing sales for fourth quarter 2017 amounted to $655 million, representing 84% of total revenues. Sequencing instrument revenue, driven by a NovaSeq shipments, amounted to $131 million. NovaSeq shipments during the quarter surpassed 85, representing the highest amount shipped of all quarters in 2017. However, Illumina did not ship any HiSeq X systems in the quarter. As for sequencing consumables, sales increased significantly, ascending 31.0% to $432.0 million. NovaSeq and NextSeq consumables sales led the strong growth, contributing more than $100 million in sales.

Total Consumables sales vaulted 26.3% to $514 million. Consumables sales accounted for 66% of total revenues. Fourth quarter 2017 total Instrument sales leaped 21.9% to $139.0 million, accounting for 18% of total revenues. As such, total product revenue for the fourth quarter rose 26.0% to $659.0 million. Service & Other revenue also increased double-digits, up 26.6% to $119 million, driven by genotyping services and sequencing services. Increased consumer demand as well as instrument maintenance contracts also added to overall sales growth.

Geographically, the Americas delivered the fastest sales growth, up 32% due to strong growth in both sequencing instruments and consumables. The EMEA region also grew notably, increasing 25%. As for the Asia Pacific, sales advanced 9%, primarily driven by double-digit shipment growth in China.

FY 2017

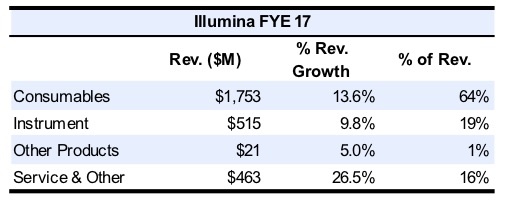

Full-year 2017 revenue for Illumina advanced 14.8% to $2,752 million, driven by strong overall sales from all segments. Consumables and Services & Other, in particular, performed the strongest.

Illumina’s clinical business continued to show growth in 2017, driven by oncology sales. Oncology sales were led by increased demand for therapy-selection and liquid biopsy products. As such, oncology testing shipments grew 40% in 2017.

Microarray sales for 2017 advanced 20.0%, driven by increased consumer samples processed throughout the year. Microarray consumables sales increased 5.0% to $285 million, while microarray instruments sales amounted to $31 million.

Full-year 2017 sequencing consumables sales increased 15.0% to $1,468 million, driven by a strong performance from NovaSeq and NextSeq. Sequencing instruments delivered notable growth, up 8.0% to $484 million, driven by NovaSeq sales. However, sales were partially offset by lower HiSeq shipments. For the year, NovaSeq shipments amounted to approximately 285, whereas in 2018, the company expects shipments between 330 and 350 systems.

For the first quarter, Illumina expects its total sales to be approximately $35 million lower than its sales from the fourth quarter. As for full-year 2018, the company expects total revenue to rise 13%–14%.

Diagnostics Drives PerkinElmer Expansion

Q4 2017

For fourth quarter 2017, PerkinElmer sales increased 13.2%, 6.0% organically, to $641.6 million, beating company expectations. Adjusted operating income rose 13.6% to $137.0 million.

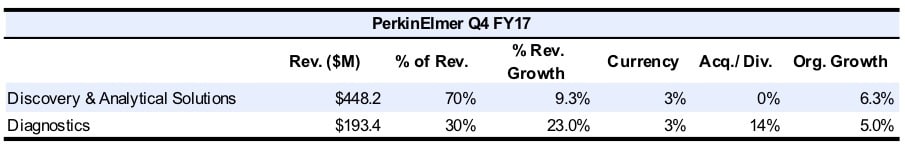

Fourth quarter 2017 Discovery & Analytical Solutions (DAS) sales increased 9.3%, 6.3% organically, to $448.2 million, driven by significant demand for the segment’s environmental and food-related products, along with better-than-expected sales for pharmaceutical and biotech products and services. By end-market, industrial sales grew low-single digits, while academic sales fell low-single digits due to a tough prior year comparison. However, the company expects both end-market sales to recover and perform better in the first half of 2018. Adjusted operating income for DAS amounted to $93.7 million, an increase of 13.0%. Adjusted operating margin grew 70 basis points to 20.9%.

Diagnostics sales soared 23.0% to reach $193.4 million, driven by increased demand for reproductive health and applied genomics products. Organically, sales rose 5.0% as currency effects and acquisitions added 3% and 14% to sales growth, respectively. Adjusted operating income also increased double digits, up 23.7% to $59.5 million. Adjusted operating margin resulted in a 20 basis point increase to 30.8%.

Geographically, all major geographies delivered robust organic sales growth for the company, with Europe growing the fastest, up low double digits. Asia followed closely with high-single digit organic growth, whereas organic sales growth in the Americas was in the low-single digits. In the BRIC region, organic sales growth continued to expand, driven by a strong recovery in Brazil, along with double-digit growth in China.

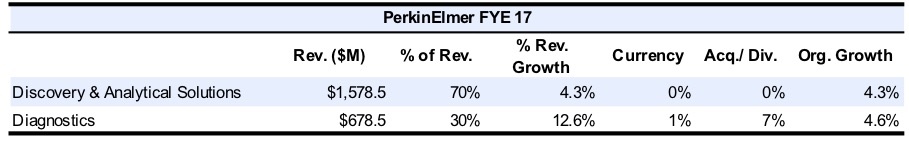

FY 2017

In 2017, full-year sales for PerkinElmer advanced 6.7% to $2,257.0 million. Organically, sales grew 4.4% as currency effects and acquisitions together added 2.3% to reported sales growth. Adjusted operating income increased 8.7%, delivering an adjusted operating margin of 18.9%.

For full-year 2018, PerkinElmer expects sales growth to be 20%, representing revenues of $2.72–$2.74 billion. Organically, sales growth is expected to be 5%–6%. Additionally, revenue from EUROIMMUN is projected to generate $360 million in sales. As for the first quarter, total company revenues are expected to grow organically by mid-single digits, amounting to $615 million.

Geographically, PerkinElmer expects organic revenue growth in the Americas to be in the mid-single digits in 2018. As for the European region, the company also projects mid-single digit organic sales growth. Sales in Asia are expected to grow organically in the high-single digits.

Healthy Finish for QIAGEN in 2017

Q4 2017

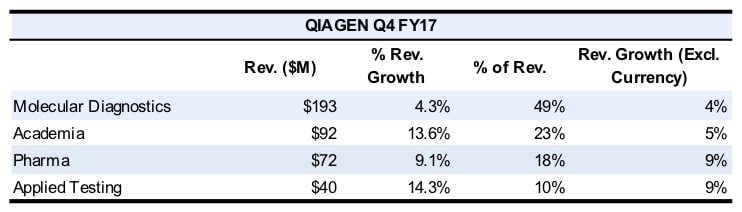

Fourth quarter 2017 sales for QIAGEN advanced 8.2% to $396.9 million (see Bottom Line). On a constant currency basis, sales growth was 5.0%, excluding the approximate three percentage-point contribution from currency effects. Adjusted operating income grew 8.0% to $121.7 million, resulting in an adjusted operating margin of 31.0%.

Molecular Diagnostics sales grew 4.3% to $193.0 million. Similarly, in constant currencies, sales growth increased by 4.0%. Segment sales accounted for nearly half of total company revenues.

Sales in Academia increased 13.6% to $92.0 million, accounting for 23% of total company revenues. On a constant currency basis, sales growth, however, reached just 5.0%. Academia growth was driven by double-digit sales increases for instruments, along with high-single digit growth for consumables.

Pharma sales experienced notable growth, advancing 9.1% to $72.0 million. Sales growth in constant currencies grew at the same rate, driven by double-digit growth for consumables and related products. However, growth was partially offset by weak instrument sales.

Applied Testing sales rose 14.3% to $40 million, driven by continued strength in human ID and forensics solutions demand. Sales increased 9.0% in constant currencies.

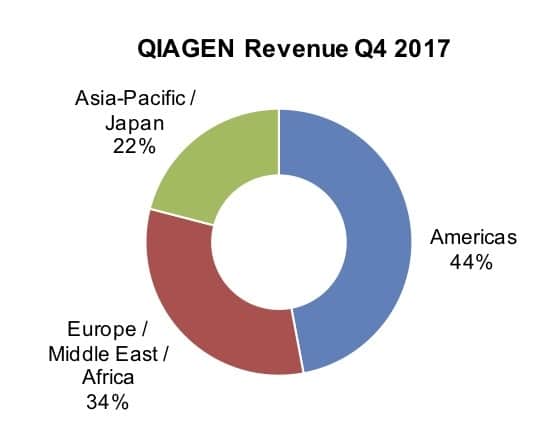

Geographically, the Americas accounted for 44% of total company revenues. Sales growth in the Americas advanced 7.0% in constant currencies, driven by strength in the US and Brazil. However, sales in Mexico declined double digits. In the EMEA region, constant currency sales growth reached 6.0%. EMEA sales accounted for 34% of total company revenues. Sales in the Asia Pacific and Japan region increased just 1%, in constant currencies. The APAC region represented 22% of total company revenues.

FY 2017

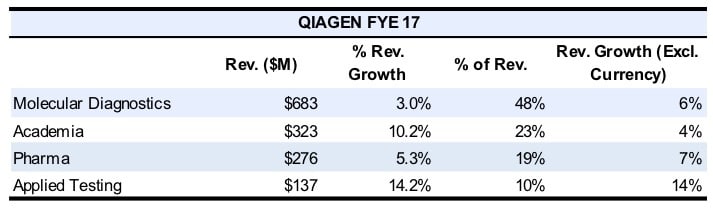

Full-year 2017 QIAGEN revenues advanced 6.1% on both a reported and constant currency basis to $1,419.0 million. Adjusted operating income rose 14.0% to $371.5 million, while adjusted operating margin rose two percentage points to 26.0%.

Geographically, sales in the Americas rose 4.0% in constant currencies. Excluding US HPV test sales, region sales delivered 6.0% constant currency growth. The Americas accounted for 46% of total company sales. In the EMEA region, sales grew at a constant currency rate of 9.0%, accounting for 33% of total company sales. The Asia Pacific and Japanese region delivered constant currency sales growth of 7.0%, representing 21% of company sales.

For the full year of 2018, QIAGEN expects total company revenues to grow between 6% and 7% in constant currencies. Currency effects are projected to add 3%–4% to overall reported sales growth for the full year. As for the first quarter, the company expects revenues to grow 5% in constant currencies. Additionally, acquisitions are not expected to contribute to first quarter sales growth.

Lab Products & Services Lift Thermo Fisher Scientifc

Q4 2017

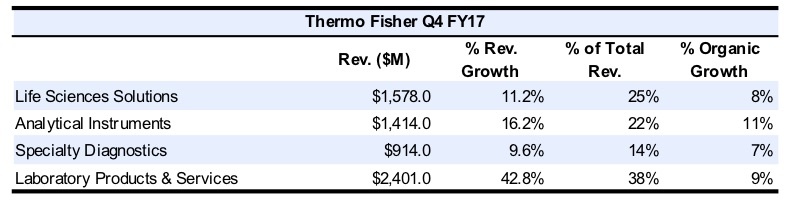

Thermo Fisher Scientific sales in the fourth quarter advanced 22.1% to $6,047.0 million, driven by strong sales from the Asia Pacific, specifically in China and South Korea. Organically, sales grew 8.0% as currency effects and acquisitions added 3% and 11% to sales growth, respectively.

By end-market, pharmaceutical and biotech sales growth rose double digits, up 10% due to strong performances from the bioproduction and clinical trial businesses. In the academic and government end-market, sales advanced in the high-single digits, driven by overall strength in most geographic regions, along with increased demand for MS and electron microscopy systems. In the diagnostics and healthcare end-market, sales delivered high-single digit growth, largely driven by solid demand for biomarker test products. As for the industrial and applied end-market, sales growth hit mid-single digits due to strength across a variety of businesses.

Life Science Solutions (LS) sales increased 11.2% to $1,578.0 million, driven by strength in the bioproduction and biosciences businesses. Organically, sales rose 8.0%. Adjusted operating margin for the segment advanced 270 basis points to 35.6%.

Analytical Instruments (AI) sales grew double digits, up 16.2% to $1,414.0 million, primarily driven by overall strength in all areas of businesses. Organic growth also excelled, up 11.0%. Adjusted operating margin was flat, however, at 24.5%.

Laboratory Products & Services sales experienced significant growth, accelerating 42.8% to $2,401.0 million. The company’s channel business, along with its clinical trials and logistics business, contributed to the strong growth. Organically, however, sales growth remained in the single digits at 9.0%. Segment sales accounted for the majority of total company sales for the quarter, at 38%. Adjusted operating margin fell 150 basis points to 12.5%.

Geographically, sales in North America advanced in the high single digits, growing at a pace just below Asia Pacific’s, where sales were up in the low teens. Asia Pacific’s double-digit sales growth was primarily driven by China’s high-teen sales growth. As for the European region, sales grew mid-single digits.

FY 2017

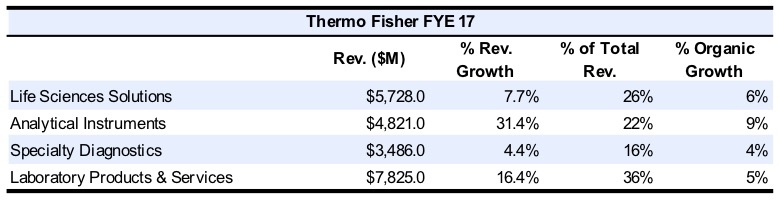

Full-year 2017 sales for Thermo Fisher increased 14.5% to $20.9 billion as a result of significant sales growth from the Analytical Instruments and Laboratory Products & Services segments. Currency effects contributed little to sales growth, but acquisitions added 9.0%. Organic sales growth for the year amounted to 5.0%.

By end-market, pharmaceutical and biotech sales advanced high-single digits, driven by strong growth across all of the company’s businesses. The academic and government end-market delivered mid-single digit sales growth, while industrial and applied sales increased mid-single digits as well, driven by the chemical analysis business.

Geographically, sales in the Asia Pacific grew double digits, whereas sales growth for the rest of the world remained in the mid-single digits. High-growth regions, including China, India and South Korea, represented 21% of total company sales. China delivered high-teen sales growth, accounting for 10% of total company sales. Additionally, Thermo Fisher’s e-commerce sales in China vaulted 50% for the year. Thermo Fisher expects China to continue delivering the fastest growth rate among all the major geographies.

Life Science Solutions (LS) sales grew 7.7% to $5,728.0 million. Organically, LS sales rose 6.0%. LS adjusted operating margin increased to 33.1%, a gain of 310 basis points. Sales for Analytical Instruments (AI) leaped 31.4% to $4,821.0 million, an increase of 9.0% organically. AI adjusted operating margin grew one percentage point, finishing the year at 21.3%. Laboratory Products & Services (LPS) revenue grew 16.4%, 5.0% organically, to $7,825.0 million. LPS adjusted operating margin, however, fell 1.5 percentage points to 12.9%.

For full-year 2018, Thermo Fisher expects revenues to be between $23.42 billion and $23.72 billion, indicating a 12%–13% increase. Organically, full-year sales growth is expected to be around 4%–5%. Currency effects and acquisitions are projected to add 1% and 7% to reported sales growth, respectively.