The IBO 2018 Mid-year Forecast

In January, IBO published its annual forecast for the analytical and life science instrumentation and laboratory products industry, which provides estimates of growth across various segments of the industry for the coming year (see IBO 1/15/18). At that time, we forecast growth for the year at 4.7%, and although our general picture of the landscape remains fundamentally the same, it is necessary to adjust our estimates halfway through the year to offer readers a more informed opinion on what the final results for 2018 are expected to be.

It has been our custom to provide this mid-year update to the forecast, incorporating the results of industry participants and macroeconomic trends that affect the industry’s markets, including currency effects and international trade policies. These latter two effects have had somewhat countervailing tendencies, with the weakened dollar (particularly in the first quarter) providing a significant tailwind, while the threat of trade wars puts the strength of the global economy at risk. All in all, we have made a significant upgrade to our growth outlook for the whole year to 5.9%. However, much of the gain is expected to come from currency effects, which are estimated to provide a full percentage point boost to the market over the organic growth rate of 4.9%.

Click to enlarge

Economic Environment

In January, IBO predicted that currency effects would not have a strong effect in 2018; by the end of the first quarter, this turned out to be almost comically wrong. The euro, unphased by the lingering uncertainties of Brexit, forged ahead, and the British pound also continued to climb back from the depths of its depressed state. While the strong euro created difficulties for European countries’ exports, the domestic market found buying imported goods extremely attractive, propelling the European market forward both through increased spending and currency effects.

More recently, the threat of an escalating trade war between the Eurozone and the US has been, for the moment, defused. Although the long-term result of bilateral negotiations remains uncertain, European Commission President Juncker evidently was successful in explaining the situation to President Trump in their meeting at the White House earlier this month. The amicable outcome produced no tangible results, but the agreement to make an agreement is welcome news.

At the time of publication, there was no similar thaw in the US-Chinese relations, where the first round of tit-for-tat tariffs went into effect July 7. As IBO reported in our blog (see Tariffs to Affect US Imports of Chromatographs and Spectrometers from China), certain spectrometers, chromatographs and electrophoresis equipment are among the hundreds of items covered under the Trump Administration’s new tariffs. At present, there seems to be no hint of a reduction in tensions, and Trump has added fuel to the fire by indicating a willingness to impose tariffs on all Chinese products. However, the lesson we might draw from the European situation is that this is posturing in an attempt to gain leverage in negotiations. On that assumption, the situation should improve and not cause a significant dent in either US or Chinese demand. The alternative—an increase in scope of the trade war and China selling of US treasuries—is too dire to contemplate.

While the US government continues to adopt an “America First” pose, this has been accurately recast by the pundits as an “America Alone” tactic. Meanwhile, the rest of the world is free to act in a more collaborative spirit. After the US absented itself from the Trans-Pacific Partnership (TPP), the remaining parties agreed to continue talks, resulting in the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP). This agreement is substantially the same as the TPP, apart from the removal of a number of items placed in the earlier deal at the behest of the US. The CPTPP was signed in March, but has not yet been ratified by a majority of the 11 member nations bordering the Pacific shores of Asia, Australia and the Americas.

More recently, the EU and Japan have signed a significant new trade deal, described by the head of the European Commission as the “largest bilateral trade deal ever.” The deal reduces or eliminates tariffs on nearly all goods traded between the countries, including European foodstuffs and Japanese cars.

Meanwhile, in Latin America, the Pacific Alliance struggles to foster free trade in that region, but a lack of commitment, political instability in many nations, collapsing currencies and a new Mexican president skeptical of free trade have hampered any positive progress.

Turning to the updates of other watchers of the global economy, the International Monetary Fund’s (IMF) July “World Economic Outlook” did not alter its projected global GDP growth number from the previous outlook in April. Both reports issued guidance for total GDP growth at 3.9%. Individual countries and regions had slight adjustments to 2018 growth, with the most significant being a drop in the forecast of Latin America of 0.4%. The OECD increased its global growth estimate from 3.7% (November 2017) to 4.0% (May 2018). Generally speaking, the OECD numbers fall in line with the predictions of the IMF.

Click to enlarge

Updated Industry Forecast

Given the foregoing economic inputs and having followed more specific industry trends and analyzed financial results from industry participants, IBO has updated the industry growth estimate for 2018 upward from 4.7% to 5.9%. As noted above, about 1% of that gain can be attributed to estimated currency effects across the full year. The comparison between 2018 and 2017 is quite striking as the former year generally had a weakening dollar and the current year has a strengthening dollar (a trend we expect to continue). This results in strong positive currency effects through the first half of the year turning more negative in the tail end of the year.

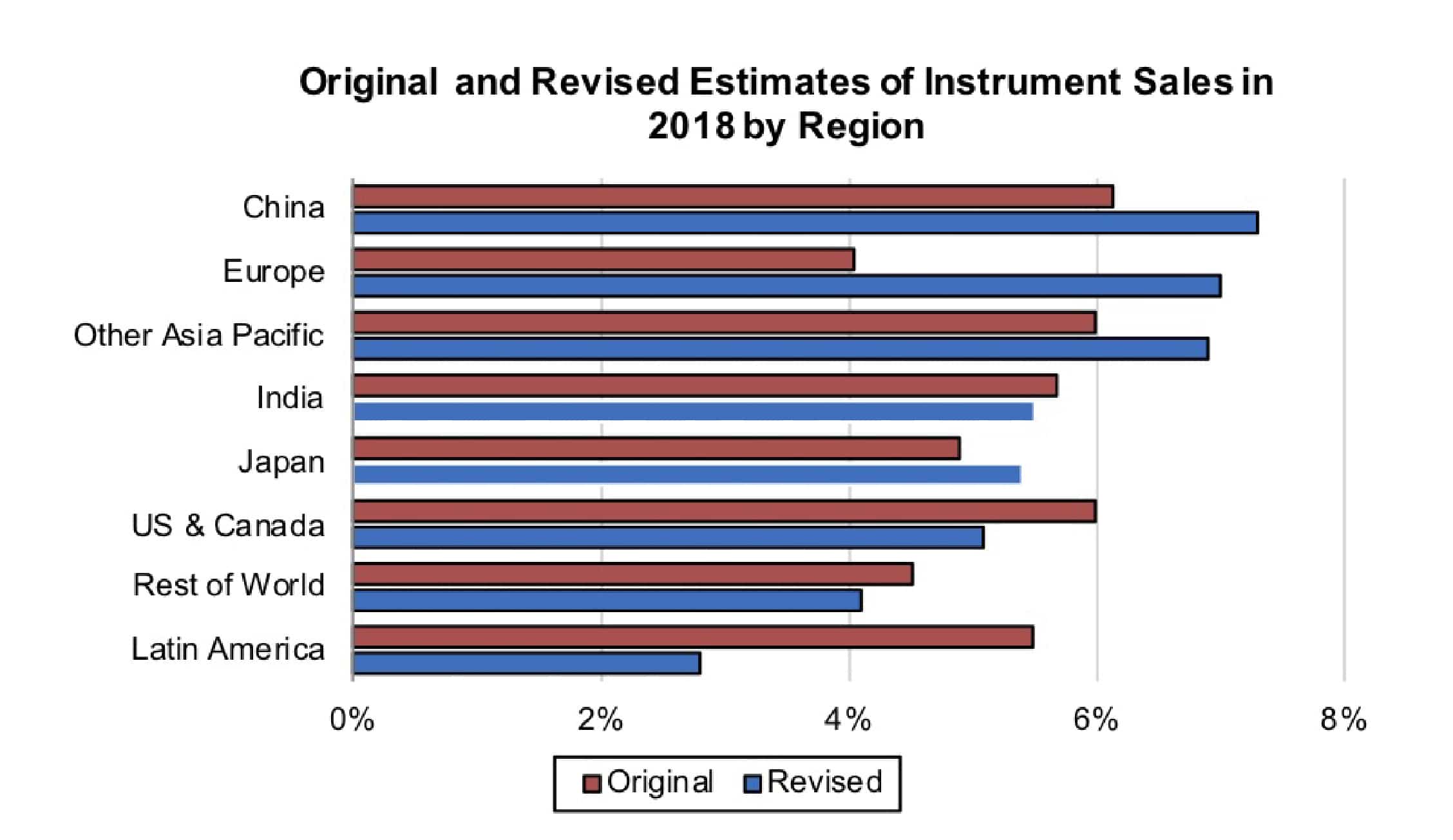

By geography, Europe’s increased forecast for its instrument market is the most favorable, driven primarily by the strong euro. Even if the dollar strengthens considerably, it will not be enough to erase the positive currency effects of the first half of the year. Our forecast updates European growth to 7% for the year.

Conversely, Latin America shows the strongest downgrade, with growth cut in half from our original estimates. The US & Canada market is now forecast to see grow 5.1% for the year, a 0.6% increase from the previous forecast, with the new tax plan passed in late 2017 having a stimulative effect on the US end-market. Our forecasts for China, Japan, and Other Asia Pacific have also advanced, with Southeast Asia experiencing the most striking increase in demand. India and Rest-of-World have been downgraded slightly.

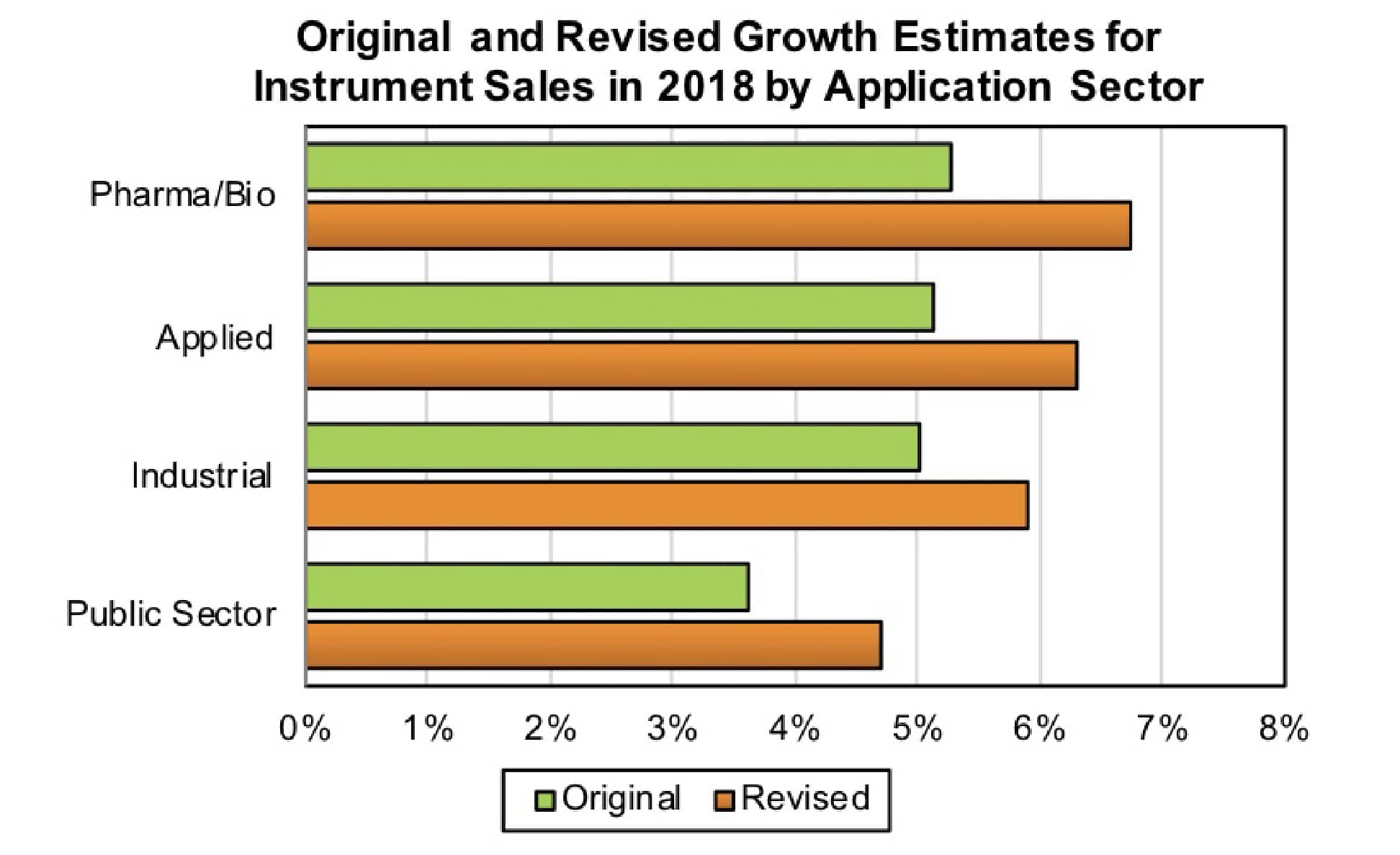

By application sector, the increased rosiness of the forecast lifts all segments, with pharma/bio seeing the strongest upgrade. It had already been forecast as the growth leader, and now sits well in advance of the other segments at 6.7% growth for the year. Strong hospital sales have driven our estimate for the applied sector over 6% as well, while the industrial and public sectors have been adjusted upward by smaller amounts.