IBO Sales Indexes: Life Science Index Leads Growth

Publicly held analytical instrument and lab product businesses continue to post healthy sales growth in the last quarter, continuing their 2018 streak. Calendar year third quarter for the 20 business units tracked by IBO’s Life Science and Analytical Sales Indexes posted a combined increase in organic sales of 7.2%.

Of the 20 companies that make up the Indexes, 7 businesses achieved double-digit growth: Agilent Technologies Crosslab, Bio-Techne Protein Sciences, Fluidigm, Illumina, HORIBA Process and Environmental Instruments & Systems and Scientific Instruments & Systems each; Oxford Instruments and Thermo Fisher Scientific Analytical Technologies. Acquisitions had a minimal effect on each of these businesses’ growth rate.

Growth was led by Illumina (see IBO 11/15/18) and Bio-Techne Protein Sciences (see Third Quarter Results: Agilent Technologies, Bio-Rad Laboratories, Bio-Techne, Bruker, Merck KGaA, QIAGEN and Shimadzu). Four companies, Bruker, Merck Life Science, PerkinElmer and Thermo Fisher, raised fiscal year guidance, while one company, Waters, lowered it. Agilent ended its fiscal year this quarter, reporting 7.1% core growth for the year, up from 6.7% in the prior fiscal year.

Companies once again reported momentum for the biopharmaceutical end-market, China, and consumables and service sales. Most businesses reported minimal effects of the US-China’s trade war. However, Illumina did note that for a second quarter consumables stocking by Chinese customers in case of tariffs increased its consumables revenue growth.

End-markets

Pharmaceutical sales were robust for many companies, including Thermo Fisher, which reported high teens growth. In contrast, Shimadzu Analytical & Measuring Instruments (AMI) and Waters reported restrained spending by its pharma customers, although Waters noted double-digit sales growth in China.

Similar, regional growth played a role in the growth of other end-markets. Agilent and Shimadzu AMI each highlighted environmental sales in China. Several businesses, including Thermo Fisher and Waters, noted positive developments in the US academic market. And globally, the academic market were good for many Index businesses, with both Agilent and Bio-Techne Protein Sciences recording double-digit sales growth.

Industrial markets, which include chemical and energy providers, were stable. Agilent and Thermo Fisher each reported strength among these customers. Activity in the food market appeared more mixed as PerkinElmer Discovery & Analytical Solutions reported double-digit growth but Agilent recorded flat sales, as changes at Chinese agencies once again affected its quarterly sales results for this sector. Both Bruker and Oxford Instruments noted strength for instrumentation for nano analysis applications.

Geographic Markets

Chinese sales fueled revenue increases for most businesses. Companies that reported double-digit revenue growth in the country included Agilent, Biotage, Bio-Techne, Illumina, Thermo Fisher and Waters. In contrast, Bruker noted weaker year-to-date growth and Waters cited slow sales for its TA unit. Nonetheless, companies in general were upbeat about the country’s prospects across end-markets for the calendar year fourth quarter and 2019.

Excluding China, Asia Pacific sales also grew, with Illumina reporting its strongest sales growth in the region since early 2014. Merck Life Science (LS), Oxford Instruments and PerkinElmer also recorded double-digit revenue increases.

North American sales maintained their strength. Merck LS and Waters posted particularly strong growth in Latin America. In general, European sales growth trailed other major regions but still grew.

Product Lines

Sales of life science product lines, notably those for sequencing and cell biology, were robust in the calendar year third quarter. Agilent Technologies and Bio-Rad Life Sciences highlighted cell biology sales, while Illumina, QIAGEN and Thermo Fisher each reported strong clinical NGS sales. MS continued to deliver growth for Agilent and Bruker Scientific Instruments. Shimadzu AMI and PerkinElmer noted strength in sales of spectroscopy systems. Other standout product lines included Agilent’s ICP-MS systems, Fluidigm’s mass cytometry systems, Illumina microarrays and Thermo Fisher’s electron microscopy business. Services sales were robust for Illumina and PerkinElmer.

Life Science Sales Index

Organic revenues of 10 businesses in the IBO Life Science Sales Index increased at a healthy pace in the calendar year third quarter, bolstered by especially strong results for Bio-Techne Protein Sciences, Merck LS and Illumina. Companies noted strength in both system and consumables sales, as well as healthy pharmaceutical and academic end-markets. The figures below include estimates for Tecan.

IBO Life Science Index: Bio-Rad Laboratories (Life Science); Biotage; Bio-Techne (Protein Sciences); Fluidigm; Illumina; Merck KGaA (Life Science); NanoString Technologies; Pacific Biosciences; QIAGEN (Life Sciences); Tecan (Life Sciences); Thermo Fisher Scientific (Life Science Solutions).

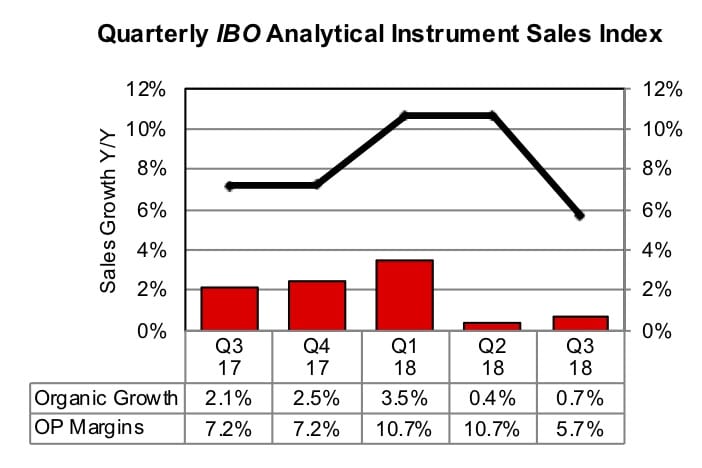

Analytical Sales Index

Sales for the businesses in IBO‘s Analytical Sales Index were essentially flat, affected by currency effects primarily as well as Waters’ slower sales growth. Several firms reported healthy growth driven by strength in specific product lines and by China. Operating profit growth slowed slightly as companies continued to invest for future growth. The figures below include estimates for Spectris.

IBO Analytical Instrument Index: Agilent Technologies (Life Sciences and Applied Markets, Agilent Crosslab); Bruker (Scientific Instruments); HORIBA (Process and Environmental Instruments & Systems, Scientific Instruments & Systems); Oxford Instruments; PerkinElmer (Discovery and Analytical Solutions); Shimadzu (Analytical and Measuring Instruments); Spectris (Materials Analysis); Thermo Fisher Scientific (Analytical Technologies); Waters.