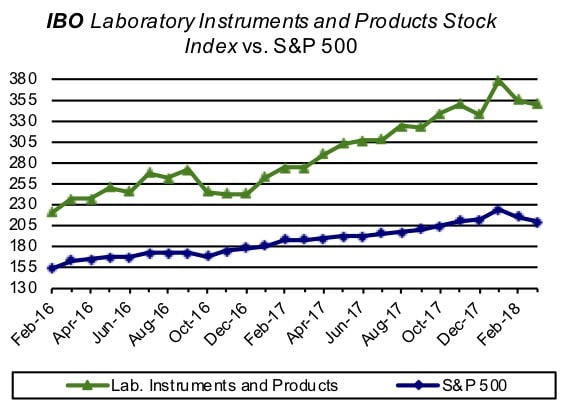

IBO Stock Indexes Continue Their Slide

In the midst of looming uncertainty due to President Trump’s tariff announcements during the month, which focused specifically on steel and aluminum, US equity markets moved downwards as investors remained cautious. The good news was a revision to GDP estimates. The US GDP for the fourth quarter of 2017 increased at a rate of 2.9%, the third estimate from the Bureau of Economic Analysis, representing a 40 basis point increase over the second estimate. The growth in the GDP rate was primarily driven by strong personal consumption expenditures, private inventory investment and local government spending.

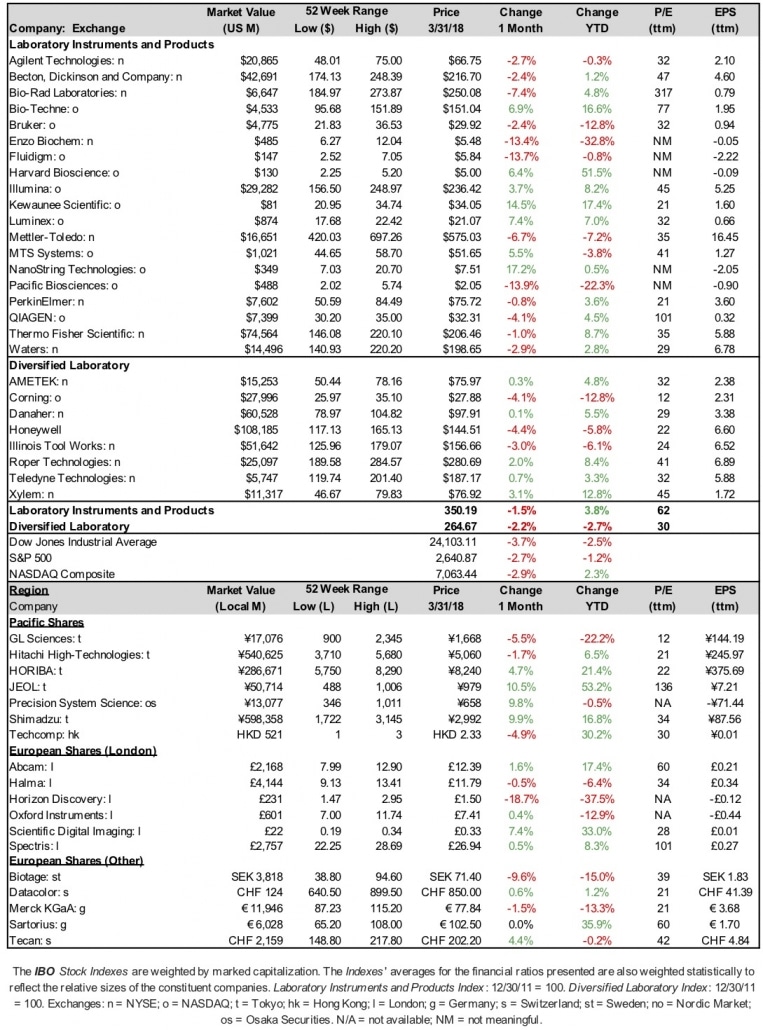

US markets slipped for the month, with the Dow Jones Industrial Average down 3.7% to 24,103.11. The S&P 500, along with the NASDAQ Composite, fell 2.7% and 2.9%, respectively. The S&P 500 finished the month at 2,640.87, while the NASDAQ Composite dropped to 7,063.44. The three indexes peaked for the month on March 12, after which all three then began their downturns.

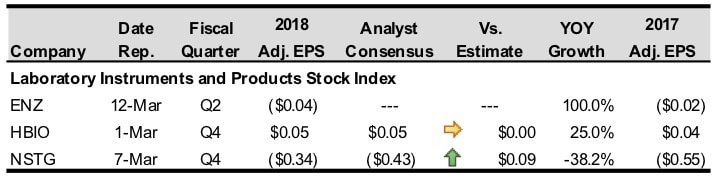

Laboratory Instruments and Products Stock Index

Companies in IBO’s Laboratory Instruments and Products mostly fell as the Index slid 1.5% to 350.19. Year to date, however, the Index is up 3.8%. Strong movers in the Index included Kewaunee Scientific and NanoString Technologies. Both delivered double-digit share growth for the month.

On March 1, Kewaunee Scientific announced a dividend payout of $0.17, or a 2.28% payout ratio, payable on March 23. The company’s share price advanced 14.5% to $34.05 for the month, up 17.4% year to date. NanoString Technologies closed the month at $7.51, a 17.2% increase. On March 8, Morgan Stanley gave the stock a $12.00 price target.

Bio-Techne shares also grew for the month, up 6.9% to $151.04. Year to date, Bio-Techne shares are up double digits, increasing 16.6%. On March 1, Deutsche Bank gave the stock a “buy” rating, along with a price target increase from $154.00 to $163.00.

Conversely, Enzo Biochem, Fluidigm and Pacific Biosciences share prices fell double digits this month. Enzo Biochem shares fell 13.4% to $5.48, while Fluidigm shares decreased 13.7% to $5.84. On March 2, Fluidigm announced an exchange of convertible senior notes, worth a total of $125.0 million. Pacific Biosciences’ share price sunk 13.9% to $2.05. Year to date, Pacific Biosciences shares are down 22.3%.

On March 5, BMO Capital Markets presented a “market perform” rating for Becton, Dickinson shares, along with a $249.00 price target. Despite the rating, Becton, Dickinson’s share price fell 2.4% for the month, finishing at $216.70.

Bio-Rad Laboratories received an upgraded price target of $290.00 from Wells Fargo on March 20, representing a $10.00, or 3.6% increase. The investment group also gave the stock an “outperform” rating. But, for the month, Bio-Rad Laboratories shares fell 7.4% to $250.08.

Mettler-Toledo share price decreased 6.7% for the month, closing at $575.03. On March 1, Deutsche Bank reiterated its “hold” rating for the stock, but increased the price target from $600.00 to $630.00

Diversified Laboratory Stock Index

The Index fell 2.2% for the month, closing at 264.67. Xylem shares grew the fastest, up 3.1% to $76.92. On March 6, Cowen Group gave the stock a “buy” rating, along with an $80.00 price target. Conversely, Honeywell shares fell 4.4% to $144.51, the most in the Index.

Corning shares decreased 4.1% for the month, closing at $27.88. Year to date, Corning shares have fallen 12.8%. On March 9, Citigroup lowered its price target for the stock from $35.00 to $32.00.

Shares of Danaher rose 0.1% to $97.91 in March, benefiting from a price target increase of $108.00 by Credit Suisse. Additionally, on March 23, Danaher entered into a credit agreement with Bank of America, for a total amount of $1.0 billion.

Roper Technologies’ share price also advanced, increasing 2.0% to close at $280.69. On March 6, Cowen Group gave the stock a “buy” rating, along with a price target of $310.00. On March 12, Roper Technologies announced a dividend payout of $0.41, representing a 0.58% payout ratio, payable on April 23.

International Stocks

In Asian Pacific countries, most of the indexes that IBO follows slumped, falling low- to mid-single digits. Indonesia’s Jakarta Composite, along with the Philippines’ PSEi, both fell 6.1%. The former finished the month at 6,202.84, while the latter ended at 7,950.86. Conversely, South Korea’s Kospi advanced 1.2%, the highest of the Asia Pacific indexes IBO tracks, finishing at 2,455.67. Taiwan’s TAIEX and Malaysia’s KLCI both grew moderately, up 0.8% and 0.3%, respectively.

Asia Pacific shares in the IBO Stock Table delivered improved results as JEOL advanced 10.5% to ¥979.0 ($9.26 at ¥106 = $1). Similarly, Precision System Science and Shimadzu also experienced significant growth, up 9.8% and 9.9%, respectively. Precision System Science closed the month at ¥658.0 ($6.22), while Shimadzu finished at ¥2,992.0 ($28.30). However, GL Sciences, Hitachi High-Technologies and Techcomp were all down for the month, down 5.5%, 1.7% and 4.9%, respectively. GL Sciences closed at ¥1,668.0 ($15.78), down 22.2% year to date. Conversely, Techcomp finished at HKD 2.33 ($0.30 at HKD 7.8 = $1), up 30.2% year to date.

In the European region, the indexes that IBO follows ended mostly in negative territory for the month, with Sweden’s OMX Stockholm 30 down 3.0% to 1,535.35, the largest drop within the region. France’s CAC Index similarly fell 2.9%, closing at 5,167.30. Italy’s FTSE MIB fell the least, down 1.0% to 22,411.15.

European shares in the IBO Stock Table grew moderately for the month as overall growth was in the low to mid-single digits. Scientific Digital Imaging shares grew the most, advancing 7.4% to £0.33 ($0.46 at £0.71 = $1), up 33.0% year to date. Conversely, Horizon Discovery’s share price fell the most, dropping 18.7% to £1.50 ($2.11). Year to date, share price fell 37.5% for the company.

Also decreasing significantly is Biotage, down 9.6% for the month to finish at SEK 71.40 ($8.50 at SEK 8.4 = $1). Sartorius shares remained flat for the month, closing at €102.50 ($126.12 at €0.81 = $1), but is up 35.9% year to date. Merck KGaA announced its earnings on March 8, along with the news to increase dividends. The company increased its dividend payout by €0.05 ($0.06), amounting to a total of €1.25 ($1.54) per share. However, Merck KGaA shares fell 1.5% for the month, closing at €77.84 ($95.78).