IBO Stock Indexes Surge Through 2017

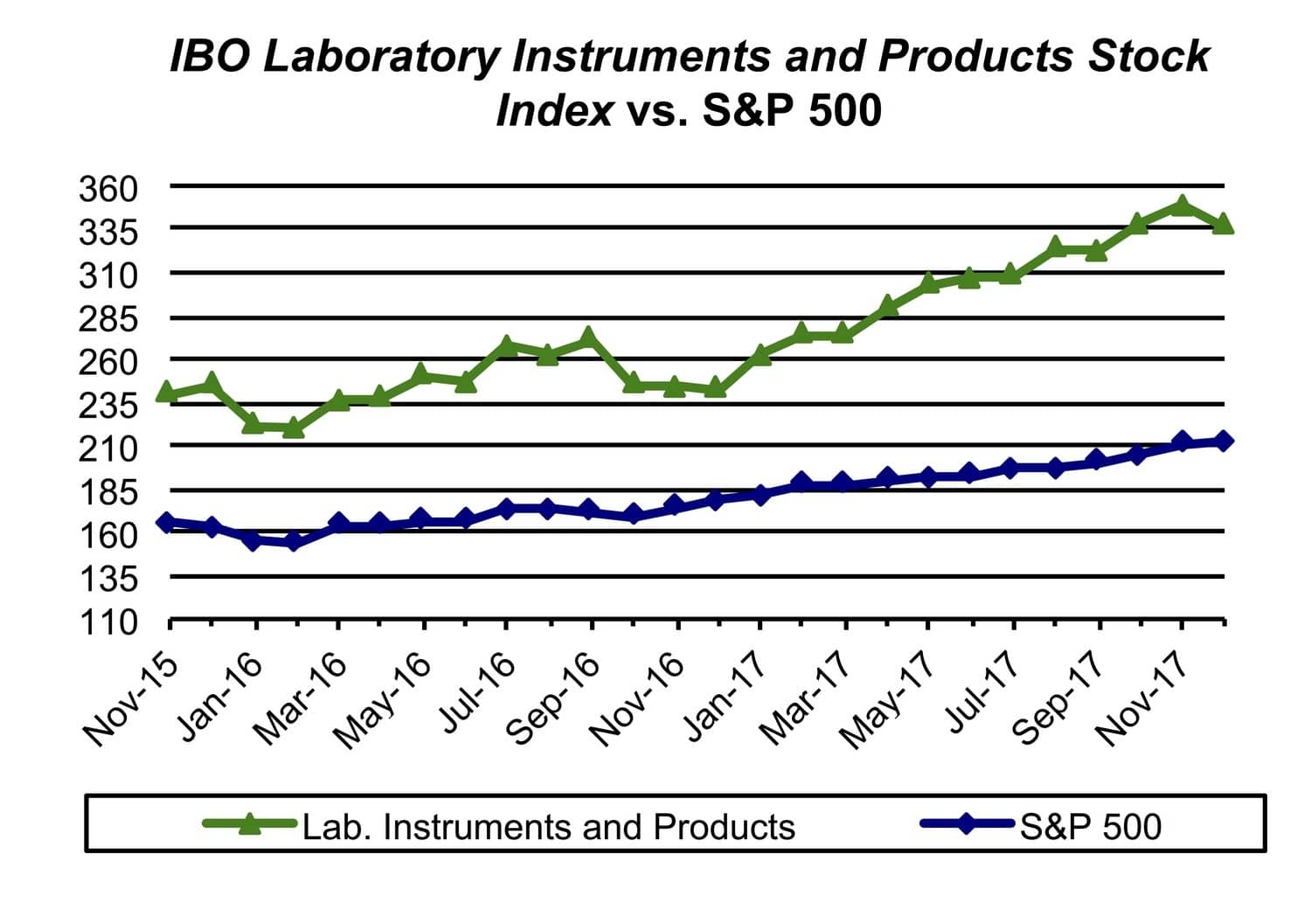

The IBO Indexes outperformed the three major US stock indexes in 2017, reflecting an overall strong performance by companies participating in the instrument and lab products market.

The US economy in 2017 remained robust as GDP growth remained above 3% for a second consecutive quarter. This most recent figure, an estimated 3.2%, was a sequential increase, surpassing the second quarter’s 3.1% growth. However, third quarter GDP growth failed to reach its target, according to the BEA’s estimate of 3.3%.

Overall, US GDP for the year accelerated due to higher consumer and government spending, as well as inventory investment. Compared to estimated GDP growth of 2.5% for all of 2017, for 2018, US GDP growth is expected decelerate 2.5%.

In December, the Fed raised the current interest rates to 1.5%, up a quarter of a percentage point. In 2018, rates are expected to hit 2.1%. And while the US inflation rate is estimated at 1.7% for 2017, lower than last year’s 2.1%, it is expected to rise in 2018 to 1.9%.

US equity markets in the IBO Stock Index finished the year in strong fashion, as the NASDAQ composite advanced 28.2% to 6,903.39. Similarly, the Dow Jones Industrial Average similarly grew 25.1% to 24,719.2, while the S&P 500 increased 19.4% to 2,673.61. For December, however, the three markets performed just modestly, increasing 0.4%, 1.8% and 1.0%, respectively.

The IBO Laboratory Instrument and Products Index delivered a strong performance in 2017, up an impressive 38.6%. On average, the Index has grown 16.0% since 2014. In particular, Bruker and Illumina have delivered significant growth in share prices, driven by strong revenue and earnings growth, along with reduced R&D expenses.

Similarly, the IBO Diversified Instrument Index has grown 14.6% over the same time frame, also driven by improved share prices in 2017. For the year, all shares in the Index ended in positive territory. AMETEK shares rose the most in terms of growth, up 49.1% to close at $72.47 for the year. Teledyne Technologies share price grew at a similar pace, increasing 47.3% to end the year at $181.15. Xylem and Roper Technologies’ shares also experienced significant growth, up 37.7% and 41.5%, respectively. Overall, all stocks in the Diversified Instrument Index finished the year with double-digit growth.

Laboratory Instruments and Products Stocks

In 2017, shares of most of the companies in the IBO Laboratory Instruments and Products Index delivered positive results. However, NanoString Technologies, Pacific Biosciences and Fluidigm all experienced double-digit decreases for the year, falling 66.5%, 30.5% and 19.1%, respectively. MTS Systems and Luminex shares both fell as well, however, decreasing just 5.3% and 2.6%, respectively. The Index’s fastest grower for the year was Illumina, increasing 70.6% to close at $218.49. Bruker’s share price also delivered strong growth, increasing 62.0% to finish at $34.32. In fact, Harvard Bioscience was the only company in the Index among the gainers to show a single-digit increase in share price, rather than a double-digit gain.

Despite the strong performances of Illumina and Bruker in 2017, on average, during the last three years, it has been Mettler-Toledo that has delivered the highest growth, increasing 27.9% since 2014 to finish the year at $619.52. For the year, Mettler-Toledo share price rose 48.0%. The two other largest gainers over the three-year period have been Bio-Rad Laboratories and Enzo Biochem, both of which are companies serving the life science and diagnostics markets.

Conversely, Fluidigm has fallen the most, dropping 39.9% to $5.89, on a three-year average, as it has faced new competition in the single-cell analysis market. NGS firm Pacfic Biosciences has also posted a three-year average decline as the company has faced strong competition.

International Stocks

For the year, Asia Pacific indexes all finished with positive growth. Hong Kong’s Hang Seng grew the fastest, increasing 25.2% to 29,919.15. Philippines’ PSEi also experienced significant growth, advancing 19.5% for the year. South Korea’s Kospi and India’s Sensex 30 both reached double-digit growth, finishing 2017 up 18.2% and 17.5%, respectively. However, Australia’s All Ordinaries increased just 0.5%.

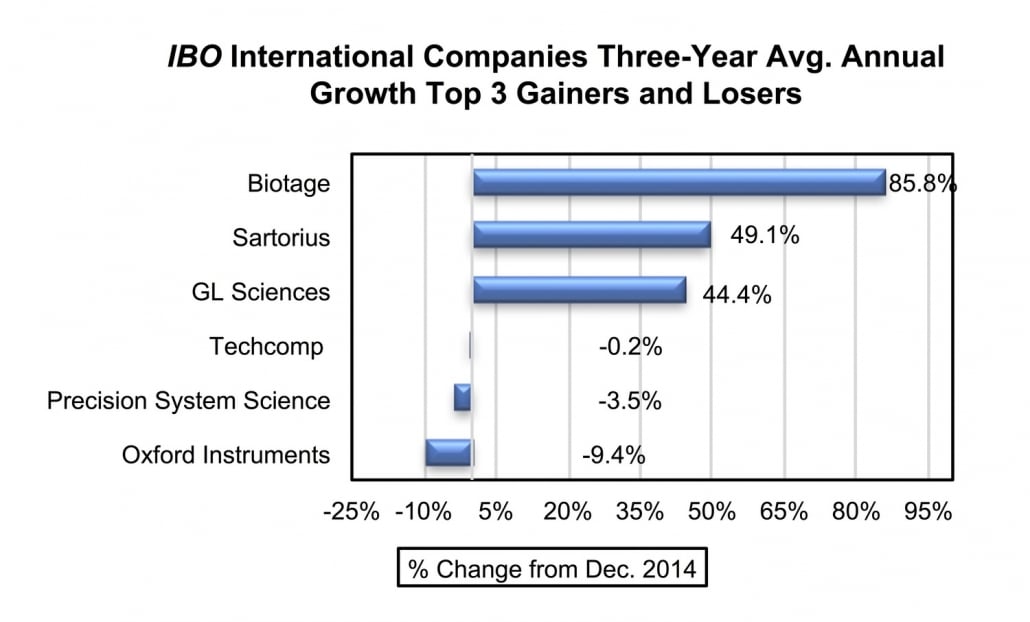

For the year, Asia Pacific shares in the IBO Stock Table all finished in positive territory. GL Sciences finished the year with impressive returns as share price leaped 142.3% to close at ¥2,144.0 ($19.10 at ¥112 = $1). This performance helped the company place among the top 3 international performers in the IBO Stock Table over a 3-year period.

Conversely, Hitachi High-Technologies’ share price experienced the slowest amount of growth, climbing just 0.7%. As for the remaining Asia Pacific shares in the IBO Stock Index, growth was in double-digits. Precision System Science shares delivered 62.4% growth, finishing the year at ¥661.0 ($5.88).

As for European indexes in 2017, Italy’s FTSE MIB delivered the fastest growth, advancing 18.0% for the year. Germany’s XETRA DAX, Spain’s IBEX 35, and Switzerland’s SMI all grew in double-digits, increasing 11.7%, 11.0% and 11.4%, respectively. The UK’s FTSE 100, however, experienced just modest growth, advancing 3.2% during 2017.

European shares in the IBO Stock Table experienced similar results to the Asia Pacific shares in the Stock Table, with just one company down for the year. Merck KGaA, which finished at €89.75 ($108.0 at €0.83 = $1), fell 9.5% in 2017. Conversely, Biotage experienced significant growth, advancing 83.0% to close at SEK 84.00 ($10.27 at SEK 8.2 = $1). In fact, Biotage is also the best performing international share in the IBO Stock Table over a three-year average. Among other European shares, Spectris and Sartorius share prices both delivered single-digit growth, advancing 7.5% and 3.6%. For the remaining European shares in the IBO Stock Table, share prices grew double digits.

In turn, the three international share prices that delivered the most negative growth on a three-year average were Oxford Instruments, Precision System Science and Techcomp. Compared to last year’s three-year average growth figures, Oxford Instruments, Precision System Science and Techcomp remained the bottom three again.

Laboratory Instrument and Products Stocks

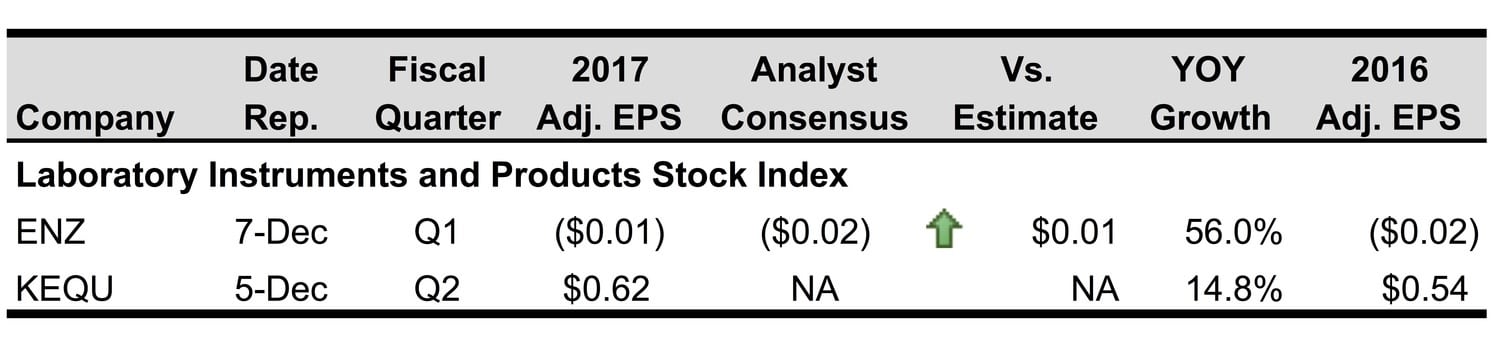

For the month, the IBO Laboratory Instruments and Products Index stocks fell 3.5% to 336.94, snapping a two-month increase. The Index’s largest gainer was Kewaunee Scientific, up 5.3% to $29.00, driven by a positive earnings report on December 5. The company reported an EPS of $0.62, a $0.08 or 14.8% increase. The rest of the shares in the Index finished the month in negative territory with Pacific Biosciences falling the most, down 17.2% to close at $2.64.

Enzo Biochem shares fell in similar fashion, dropping 16.9% to finish the month at $8.15. On December 7, Enzo Biochem reported its fiscal first quarter earnings, delivering an adjusted EPS of -$0.01, an increase of $0.02. Bio-Rad Laboratories’ share price also decreased double digits, down 12.0% to finish the month at $238.67.

Becton, Dickinson and Illumina both fell mid-single digits, dropping 6.2% and 5.0%, respectively, in December. Both share prices finished the month similarly at $214.06 and $218.49, respectively. PerkinElmer and Fluidigm both declined less, falling only 0.8% and 1.0%, respectively. PerkinElmer’s share price closed the month at $73.12, while Fluidigm shares finished at $5.89. Harvard Bioscience share price remained flat, unchanged at $3.30.

Diversified Laboratory Stocks

In December, all of the companies in the IBO Diversified Laboratory Index ended in the negative. AMETEK shares fell the least, declining only 0.3% at $72.47. Conversely, Roper Technologies’ share price decreased the most, ending the month at $259.00, a 3.1% drop. For the remaining share prices in the IBO Diversified Laboratory Index, the average loss rate was around 1%–2%, whereas the overall Diversified Laboratory Index decreased 1.6%. Corning, Danaher and Honeywell fell 1.2%, 1.6% and 1.7%, respectively.

International Stocks

For the Asia Pacific, most of the IBO market indexes grew positively, with Thailand’s SET increasing the fastest, up 14.5% to close the month at 1,753.71. Indonesia’s Jakarta Composite and Malaysia’s KLCI also experienced solid growth, rising 6.8% and 4.6% to 6,355.65 and 1,796.81, respectively. The market indexes that fell during the month were South Korea’s Kospi, China’s Shanghai Composite and Singapore’s STI, down 0.4%, 0.9% and 0.3%, respectively.

For the month, shares in IBO’s Asia Pacific region shares in the IBO Stock Table were mostly down, with GL Sciences and Hitachi High-Technologies being the only companies to have shown growth, rising 1.3% and 2.3%, respectively. Conversely, Shimadzu and HORIBA fell the most, down 4.3% and 3.0% for the month. Shimadzu closed at ¥2,562.0 ($22.8 at ¥112 = $1), while HORIBA finished the month at ¥6,790.0 ($60.4). Hong Kong’s Techcomp ended the month with no change at HKD 1.79 ($0.23 at HKD 7.82 = $1).

However, in Europe, most of the indexes declined, with Italy’s FTSE MIB down 2.3%. Sweden’s OMX Stockholm 30 similarly fell 2.1%, finishing the month at 1,576.94. The only gainers in the region were the UK’s FTSE 100, which grew a substantial 4.9%, and Switzerland’s SMI, which rose modestly, up 0.7%.

European shares within the IBO Stock Table delivered mixed results for the month, with Biotage’s share price growing the fastest at 9.4%. Biotage’s share price closed the month at SEK 84.00 ($14.30 at SEK = $1). Abcam’s shares also generated healthy growth, up 7.3% to finish the month at £10.55 ($ at £0.74= $1). Conversely, Datacolor and Oxford Instruments fell the most, down 5.6% and 3.6%, respectively. Tecan and Horizon Discovery’s share prices both remain unchanged, closing December at CHF 202.7 ($208.37 at CHF 0.97 = $1) and £2.40 ($3.25).