M&A 2018: A Year of Bolt-Ons

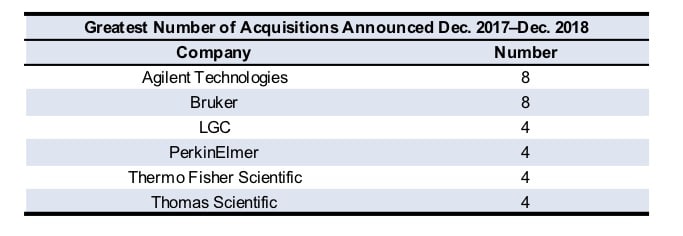

In 2018, M&A in the analytical instrument and lab products industry can be viewed as a tale of two companies, Agilent Technologies and Bruker. Together, the firms were responsible for the announcement of 16 purchases, as they acquired smaller-sized companies addressing each firm’s respective target markets.

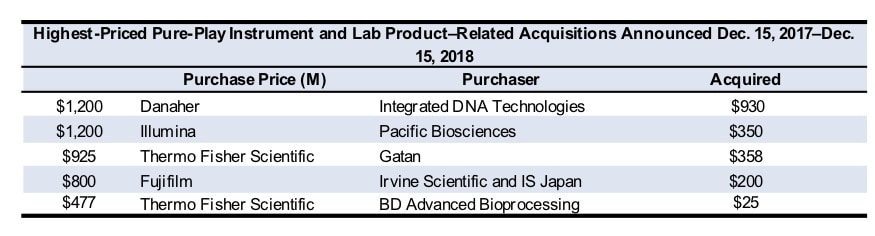

But the year was not without $1 billion deals, as Danaher and Illumina each paid over $1 billion with ambitious entries into new markets. Yet it was a relatively restrained year in terms of deal size after multi-billion dollar deals in the recent past, such as Avantor’s $6.5 billion purchase of VWR in 2017 (see IBO 5/15/17) and Thermo Fisher Scientific’s 2016 acquisition of FEI for $4.2 billion (see IBO 5/31/16).

This was against a backdrop of US tax reform, which was expected to increase company’s cash holdings and stimulate M&A. According to the “EY Global Capital Confidence Barometer”, a survey of 2,600 executives cross industries released in October, M&A activity this year was less than expected due to geopolitical uncertainty and regulations. But most executives expect the M&A market to improve over 12 months. Deloitte’s report on M&A trends next year, released last month, found most executives of the one thousand surveyed expect an increase in M&A volume and size in 2019, but concerns remain about the rise in interest rates.

In IBO’s annual review of M&A activity, we examine the acquisition activity reported in IBO between December 31, 2017 and December 15, 2018. Our analysis includes only pure-play deals, excluding acquisitions of dedicated diagnostic or process (analyses conducted inline and online during manufacturing) companies, even if made by a lab product company. Financial figures are drawn from publicly available sources. Sales and purchase price were not available for all announced acquisitions.

Target Markets

As in recent years, cell biology, sequencing and consumables companies were priorities for many lab instrument providers in 2018. Companies investing in cell biology included Agilent Technologies through its purchases of ACEA Biosciences (see IBO 9/30/18) and Luxcel Biosciences (see IBO 1/15/18), as well as Miltenyi Biotec, which added imaging to its cell analysis portfolio with the acquisition of LaVision Biotec (see IBO 10/31/18). ACEA Biosciences was not the only flow cytometry purchase this year as Luminex bought Merck KGaA’s divested business, also seeking to diversify (see IBO 10/31/18). Addressing the cell analysis market through the company’s core competence of advanced microscopy, Bruker added to its cell analysis capabilities with the purchase of JPK Instruments (see IBO 7/15/18) for $16.6 million.

However, the largest deal for cell biology involved cell media. In one of the year’s highest-priced deals overall, Fujifilm purchased Irvine Scientific and IS Japan for $800 million (see IBO 3/31/18), adding to its regenerative medicine business. This follows Fujifilm’s recent purchase of Wako Pure Chemicals, which also offers cell culture media, for $1.4 billion (see IBO 12/31/16).

Similarly, companies investing in cell media and serum included Bio-Techne, which acquired Atlanta Biologicals (see IBO 1/15/18), and BelHealth Investment Partners, which invested in Gemini Bio-products (see IBO 9/30/18). As with Fujifilm’s purchase, Bio-Techne’s acquisition of Quad Technologies’ cell separation reagent technology (see IBO 6/15/18) positions the business for serving cell-based research and therapeutics, from R&D through manufacturing.

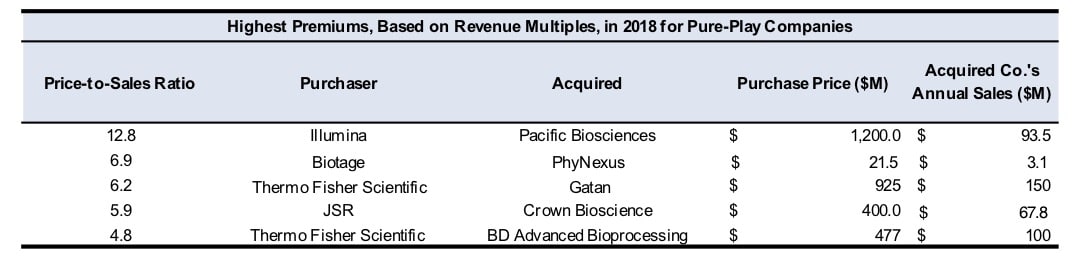

Agilent and Illumina continue to address the DNA sequencing market, accumulating technologies for a comprehensive offering across the workflow, an approach that has increasingly informed M&A of this technology in particular. DNA sequencing grabbed headlines with Illumina’s plan to purchase Pacific Biosciences, one of the few companies that has successfully commercialized a DNA sequencer (see IBO 11/15/18). In addition to a large investment in long-read technology, Illumina bought its first data analysis firm with its acquisition of Edico Genomics (see IBO 5/15/18) for $100 million (net of cash acquired). Agilent continued its streak of NGS workflow-related purchases, buying Advanced Analytical Technologies (see IBO 2/28/18) for $250 million and purchasing the remainder of NGS development partner Lasergen (see IBO 4/15/18). In 2017, Agilent added two assets in the space (see IBO 12/15/17).

In the NGS sample prep market, Tecan became the latest entrant, acquiring NuGEN Technologies (see IBO 8/31/18). Combining its expertise in standards and expansion in NGS, LGC purchased SeraCare Life Sciences (see IBO 11/30/18). In addition, the company’s purchase of Lucigen targets the NGS market (see IBO 2/28/18).

Recurring revenues provide a stable source of sales if end-markets face volatility, higher margins than instruments in the case of consumables and closer customer contact in the case of service. So it is not surprising that many traditional instrument companies have made M&A in these product lines a priority, including Agilent and Danaher. This year’s purchases include Danaher’s major investment in oligo maker Integrated DNA Technologies as well as its purchase of Chinese firm Bonne Agela (see IBO 2/15/18), Agilent’s pick up of Ultra Scientific (see IBO 5/31/18) and ProZyme (see IBO 6/30/18), Biotage’s planned acquisition of PhyNexus (see Executive Briefing), as well as the cell media and Tecan purchases described above.

Building Businesses

In addition to Agilent and Bruker, other companies that added strategically key products markets this year were LGC, Metrohm, Thermo Fisher Scientific and Waters. Thermo Fisher diversified its rapid growth electron microscopy (EM) business with the purchases of Phenom World (see IBO 12/31/17) and the planned buyout of Gatan (see IBO 6/30/18). In addition, Thermo Fisher took on BD’s Advanced Bioprocessing business (see IBO 9/15/18), adding new product lines to its bioprocess business. Like Thermo’s EM investment last year, Metrohm followed last year’s investments in Raman technologies, adding Innovative Photonic Solutions (see IBO 1/31/18) and B&W Tek (see IBO 7/31/18). LGC accumulated even more oligo companies, both oligo reagents with Berry and Associates (see IBO 9/30/18) and systems with BioAutomation (see IBO 5/15/18), as well as contributing to its standards business with SeraCare and now MBH Analytical (see Executive Briefing). Waters added to its series of TA purchases, buying Theta Industries (see IBO 9/30/18), supplementing its materials testing business, and additionally its offerings for clinical MS, adding clinical imaging, with the purchase of DESI technologies (see IBO 7/31/18).

Former Partners

Whether targeting suppliers, distributors or collaborators, a number of acquisitions this year focused on consolidating existing relationships or building upon successful development agreements. Distributor acquisitions included Agilent adding South Korean distributor Young In Scientific (see IBO 5/31/18) and TESCAN ORSAY’s purchase of Germany’s EO Elektronen-Optik-Service (see IBO 5/15/18). Product collaborations leading to acquisitions were Bruker’s purchase of Lactotronic (see IBO 7/15/18), HORIBA’s addition of AIST-NT (see IBO 1/15/18), Illumina’s gaining Edico and Tosoh Biosciences’ investment in SEMBA (see IBO 11/30/18).