Double-digit R&D Growth in FY16

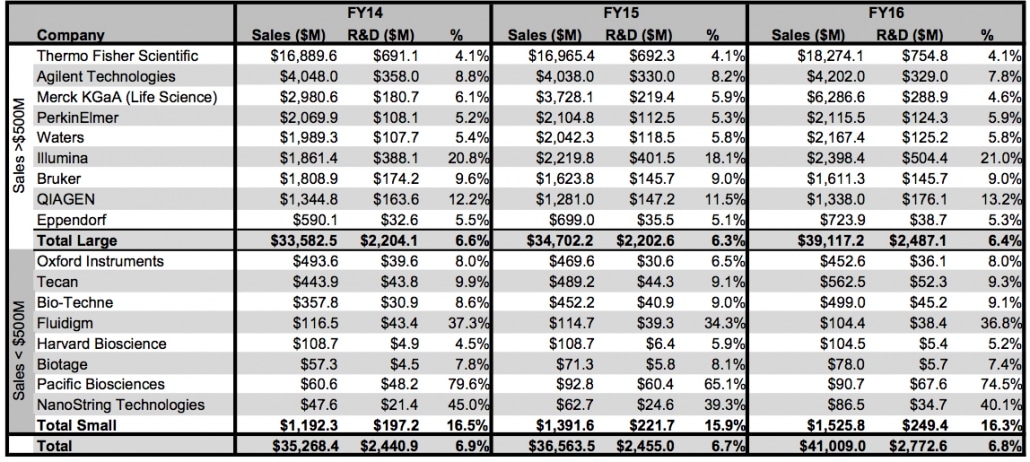

Total R&D spending for 17 publicly held analytical instrument and laboratory product companies leaped 12.9% in fiscal 2016 to $2,776 million (FY17 results are included for Oxford Instruments, whose fiscal year ended March 31 (see First Quarter 2017 Financial Results). The increase in R&D spending reflects the companies’ cumulative 12.2% jump in FY16 revenues to $41,009 million, as well as continued investment in clinical markets and sequencing technology.

Although revenue and R&D spending growth showed big gains, the cumulative percentage of sales devoted to R&D for the companies in the table remained roughly the same at nearly 7%. But median annual R&D expenditure per revenues for the companies was 9.8% versus 6.4% in FY15.

Although currency and acquisitions affected R&D spending, only Merck KGaA Life Science experienced a significant bump in both sales and R&D spending last fiscal year as a result of an acquisition (see IBO 11/30/15). Organically, sales grew 6.3% for the company. Thermo Fisher Scientific, Agilent Technologies, PerkinElmer and Bio-Techne also made bolt-on acquisitions during the year, adding to R&D expenses. As a percentage of manufacturing revenue, Thermo Fisher Scientific’s FY16 R&D spending was 6.3%.

The figures in the table below are based on FY16 sales and R&D spending as reported in company financial and regulatory documents. Foreign company sales figures have been converted to US dollars. Companies were chosen based on the availability of R&D figures and their involvement in instrumentation markets.

Sequencing Companies Lead the Pack

Growth in R&D spending in fiscal 2016 followed a familiar pattern, as it was led by life science firms with new or rapidly growing technologies. R&D expenditures excluding acquisitions rose more than 25% for two companies, Illumina and NanoString Technologies. Similarly, the five companies with double-digit percentage increases in the ratio of R&D to revenues are dedicated to life science technology: Fluidigm, Illumina, NanoString Technologies, Pacific Biosciences and QIAGEN. These same companies were also the only companies in the table to boast double-digit R&D-to-sales ratios in FY15. For Illumina, NanoString and QIAGEN, the investments also represent expansion of their diagnostic product lines and applications.

In particular, growth in DNA sequencing companies’ R&D spending raced ahead of revenue gains. Although Illumina’s FY16 sales grew 8.0%, R&D spending was up 25.6% to over $500 million. QIAGEN increased its R&D spending 19.7%, even though sales rose 4.5%. Pacific Biosciences’ R&D expenditures were up 11.9%, no doubt affected by its former partnership with Roche (see IBO 12/15/16), despite a 2.2% decline in sales.

But these were not the only companies devoting more resources to R&D in FY16. In total, R&D spending increases remained ahead of revenue growth for 13 of the 17 companies in the table. Notably, PerkinElmer R&D spending rose 10.5% in the face of a 0.5% increase in sales. And Eppendorf R&D was up 9.0% compared to revenue growth of 3.6%.

PerkinElmer’s increase growth in R&D follows last year’s modest increase and the company’s more focused R&D efforts in key areas. Addressing the R&D increase on the company’s second quarter 2016 conference, Chairman, President and CEO Robert F. Friel responded, “As we have communicated previously, we are concentrating a greater portion of our growth investments in four priority areas. These areas include food quality and safety, pharma services and solutions, reproductive health, and emerging market diagnostics, and represent roughly 40% of PerkinElmer’s total revenues.”

Bruker R&D increased this fiscal year following FY15’s decline and company-wide changes, including expense controls. “We are using benefits of our initiatives in our restructuring actions to invest in commercial activities and R&D activities, so we’re not starving the business of investment with our restructuring actions,” said Bruker CFO Anthony L. Mattacchione on the company’s third quarter 2016 conference call.

Also upping R&D investments last fiscal year following a decline in spending in FY15 were Oxford Instruments and QIAGEN. The FY15 drop in QIAGEN’s spending followed the release of its GeneReader NGS system. QIAGEN’s fiscal 2016 R&D investments included new Centers of Excellence. At its fall 2016 Analyst Day, the company disclosed that molecular diagnostics accounts for about 10% of R&D to sales. Oxford Instruments’ R&D increase includes currency effects.

Larger Companies’ R&D Spending

R&D spending for companies in the table with over $500 million in annual revenues rose a total of 12.7% in FY16, slightly less than sales growth of 12.9%. The tight correlation of R&D spending growth to sales growth for larger companies is also evident in the table’s FY15 figures, when R&D was flat and sales grew 3.3%.

Even when removing Illumina’s hefty R&D spending, the large companies’ R&D still rose double-digits last fiscal year, up 10.1%, with sales up 13.0%. But without Illumina, the ratio of R&D sales to revenue for larger companies dropped by more than half to 6.4%, indicating Illumina’s influential share of R&D spending among these companies.

In fact, Illumina spent the most on R&D of any company in the table with the exception of Thermo Fisher Scientific. This strategy looks set to continue in line with ongoing sequencing technology and market developments. Illumina President and CEO Francis A. deSouza told analysts on the company’s fourth quarter 2016 conference call, “We continue to invest a lot in R&D. And we believe there is a lot of headroom that we can invest in either to provide better, faster, cheaper sequencing and get us to that $100 genome or to provide more sample-to-answer solutions that would be enabling in applied markets and in the clinical markets.”

Smaller Companies’ R&D Spending

R&D spending by the eight companies in the table with revenues of less than $500 million grew 12.5% in fiscal 2016, nearly the same rate as FY15 despite sales growth. Sales for these companies increased 9.6% in FY16 versus growth of 16.7% in FY15. Two smaller companies, Biotage and Harvard Bioscience, recorded a decrease in R&D as a percentage of sales. Harvard Bioscience posted declining sales growth last year, and Biotage moderated spending following FY15’s 25.3% rise in R&D spending.

In addition to Harvard Bioscience, Biotage, Fluidigm and Oxford Instruments also decreased R&D spending last fiscal year. The decrease was in line with declining sales for both Fluidigm and Harvard Bioscience. For Fluidigm, it was the third straight year of decreased R&D spending, congruent with a drop in sales and fewer product introductions. In fiscal 2017, Oxford Instruments completed the first year of a new program to increase the company’s sales, including more collaborative R&D across businesses and a focus on higher growth markets. The company’s Vitality Index, which measures the percentage of sales from products introduced in the prior three years, was level at 31%.