Second Quarter Results: Agilent Technologies, Bruker, Danaher, Merck KGaA and Shimadzu

Chemical End-markets Drive Agilent Growth

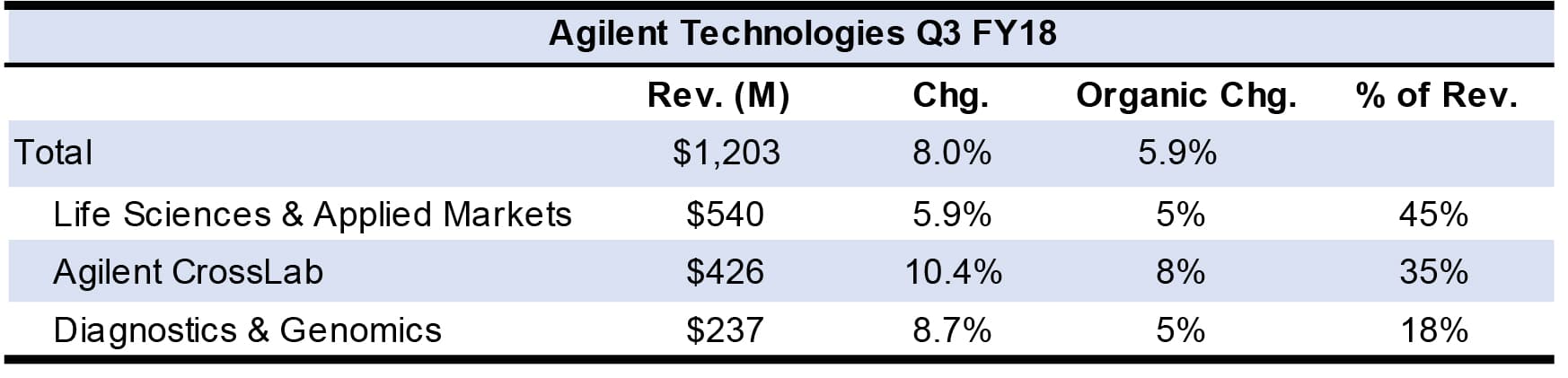

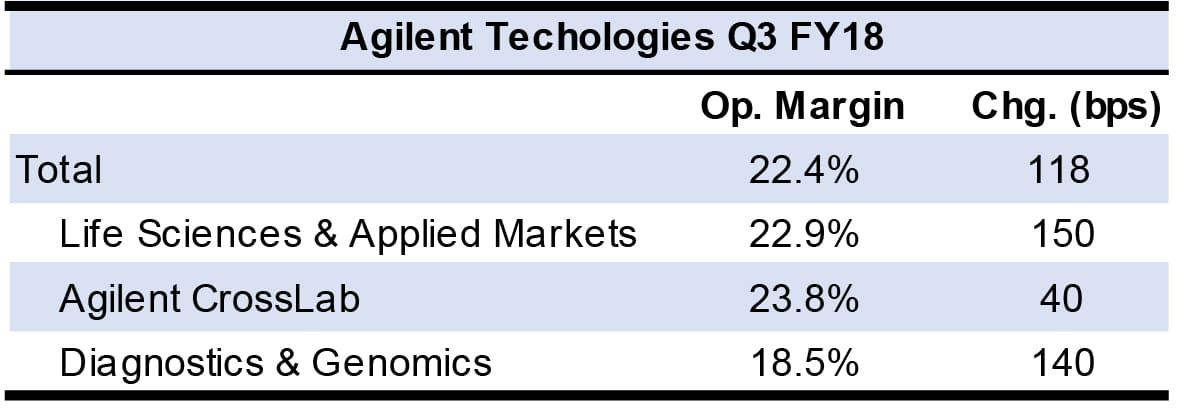

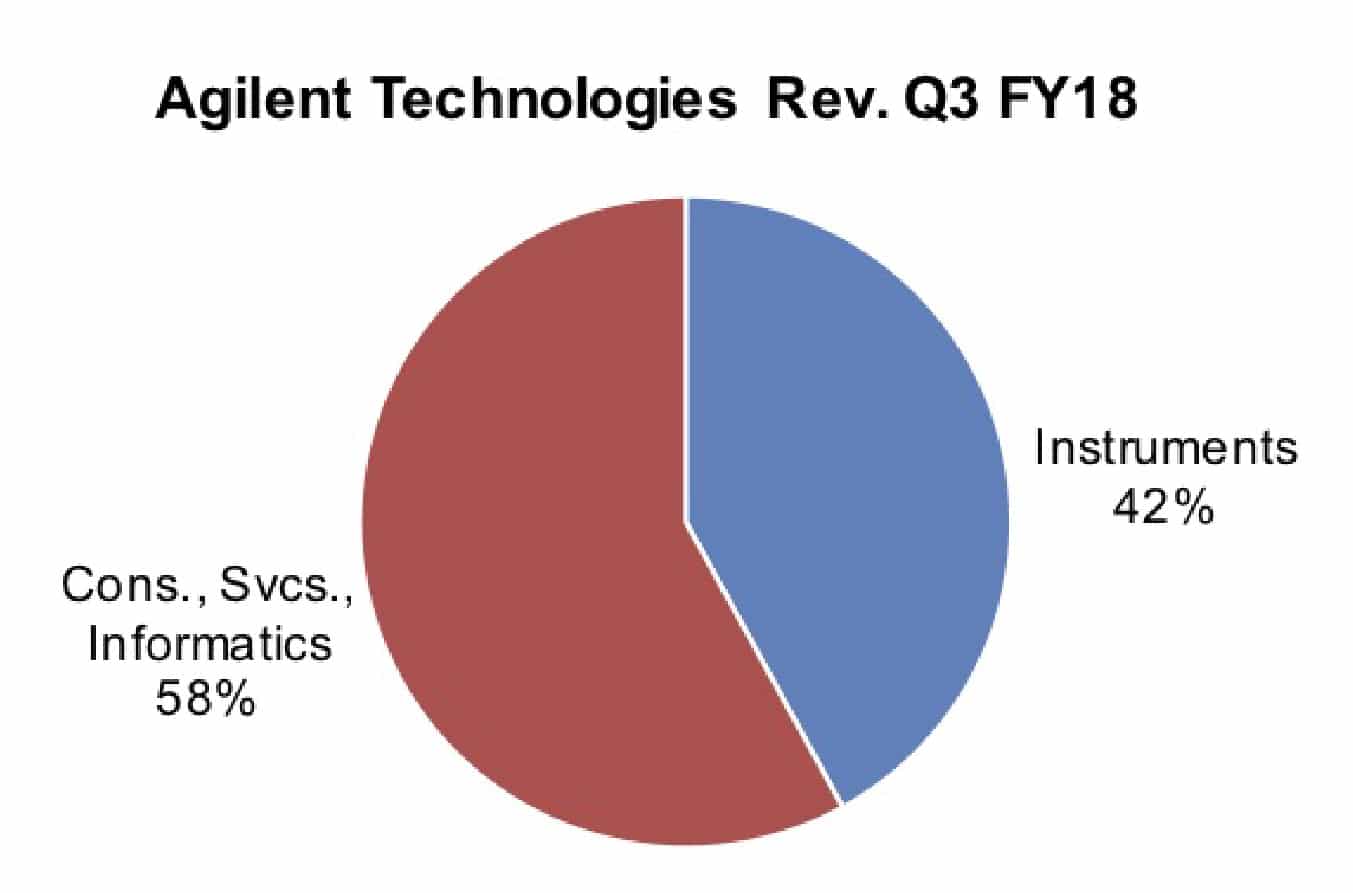

Agilent Technologies’ fiscal 2018 third quarter revenues included 1.6% growth and 0.5% growth from currency and acquisitions, respectively (see IBO 8/15/18). Consumables, services and informatics accounted for 58% of sales.

Click to enlarge

Click to enlarge

By end-market, chemical and energy sales grew the fastest, up 12% to make up 25% of company sales. End-market growth was led by the division’s chemicals segment, which also includes semiconductor and materials testing sales.

Pharmaceutical and biotech sales rose 8% to account for 30% of company sales, with growth for both biopharma and small molecule end-markets. Product lines showing strength included MS, cell analysis, CrossLab and genomics.

Diagnostics and clinical sales increased 5% and included double-digit revenue growth for the genomics businesses as well as increased revenue for the reagent partnership business. However, the company reported weakness in the pain management market and the Nucleic Acid Solutions Division business, for which sales declined.

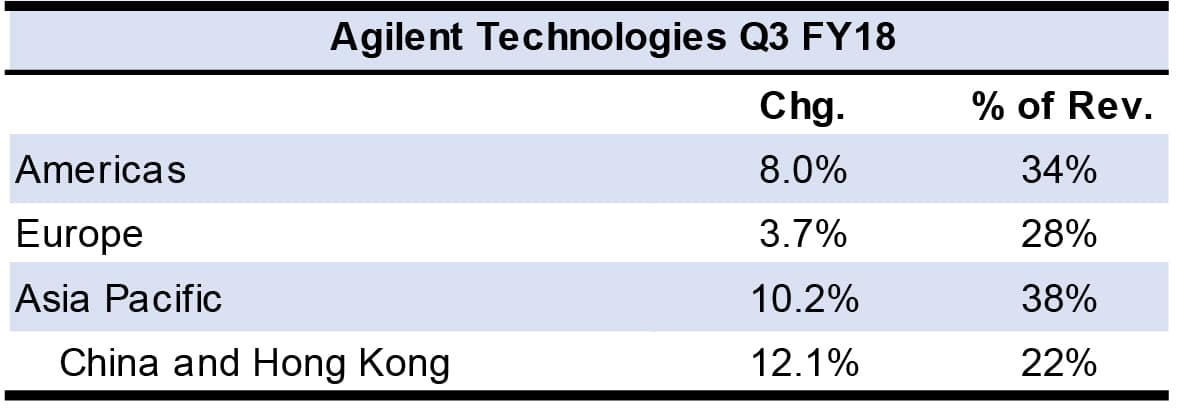

Sales to academic and government customers increased 3%, with double-digit growth in China and the rest of Asia. This market accounted for 8% of company revenues.

Sales to the food end-market fell 1%, with sales to Europe declining as a result of a tough annual comparison. Food sales in China also declined due to the ongoing reorganization of ministries. These changes to the ministries also affected Environmental and forensics sales, which were flat for the company as a whole.

Despite slowing sales in these Chinese markets, China sales for Agilent in total jumped 12.1% to make up close to 60% of Asia-Pacific sales. Chinese sales grew double digits for the chemicals and energy, and pharma markets, as well as for Diagnostics and Genomics, and Cross Lab.

Click to enlarge

Life Sciences and Applied Markets Group revenue growth was led by LC/MS, cell analysis and IPC-MS sales. Sales of the Agilent CrossLab Group included mid-teens growth in China. The company also reported in the quarter that over half of consumables sales were digital for the first time.

Click to enlarge

Agilent increased its fiscal 2018 core revenue guidance by $10 million to 6.1% organic growth. Fiscal fourth quarter revenues are expected to total $1.24–$1.26 billion, compared to $1.19 billion in the same period a year ago.

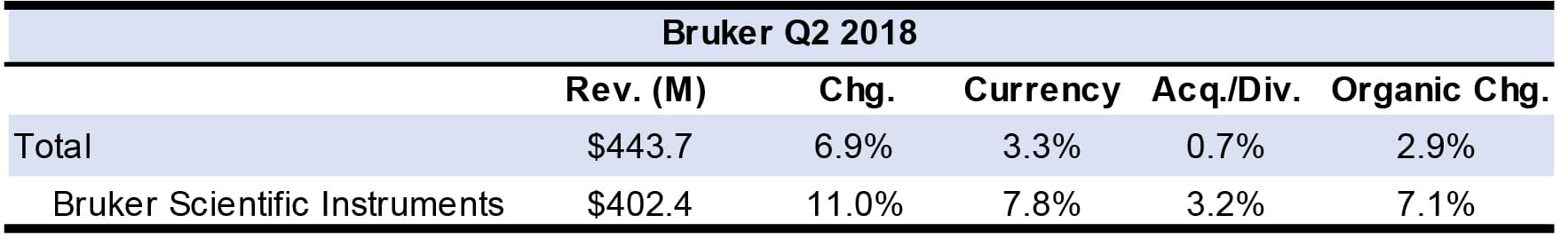

Bruker BSI Sales Increase Double Digits

Second quarter Bruker Scientific Instrument (BSI) sales increased to make up over 90% of company revenues. (See IBO 8/15/18.) BSI Systems sales grew 10.3% to account for 71% of BSI revenues, while Aftermarket sales jumped 12.7%.

Click to enlarge

Click to enlarge

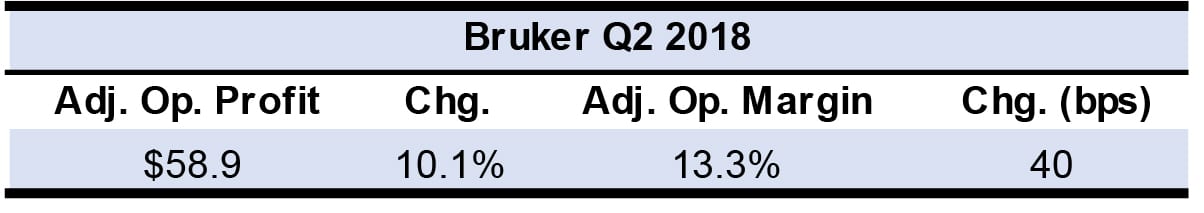

All three BSI units reported revenue growth. In the first half, BioSpin sales rose in the low single digits, with particularly strong growth for NMR sales for clinical and phenomic applications. Rebounding from last year, preclinical imaging sales showed positive growth, especially PET/SPECT systems.

First-half sales for CALID grew mid-single digits. MS sales increased as microbiology and life science system revenues were higher. Within CALID, Optics sales also grew, but Detection sales declined.

First-half Nano sales increased high single digits as industrial demand remained strong.. Highlights included sales to industrial and academic research, and semiconductor metrology end-markets. AXS revenue increased due to industrial materials–research applications.

Click to enlarge

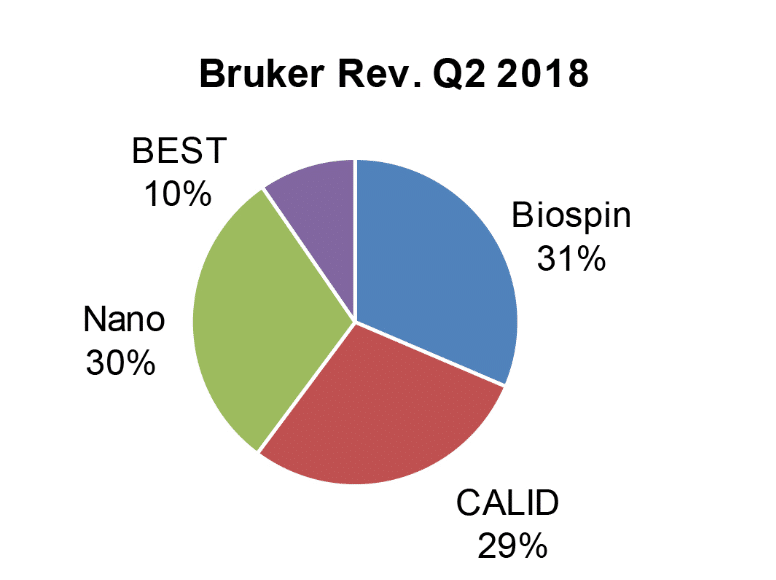

By region, both European and Asia Pacific BSI sales rose low double digits. In the Americas, BSI sales rose mid-single digits.

Click to enlarge

Bruker updated its 2018 revenue guidance from 7% to 6.5% growth, including 3.5% organic growth, up from a previous estimate of 3%. Currency is expected to reduce growth by 2%, while acquisitions will add 1% growth.

Danaher Life Sciences Leads Segments’ Growth

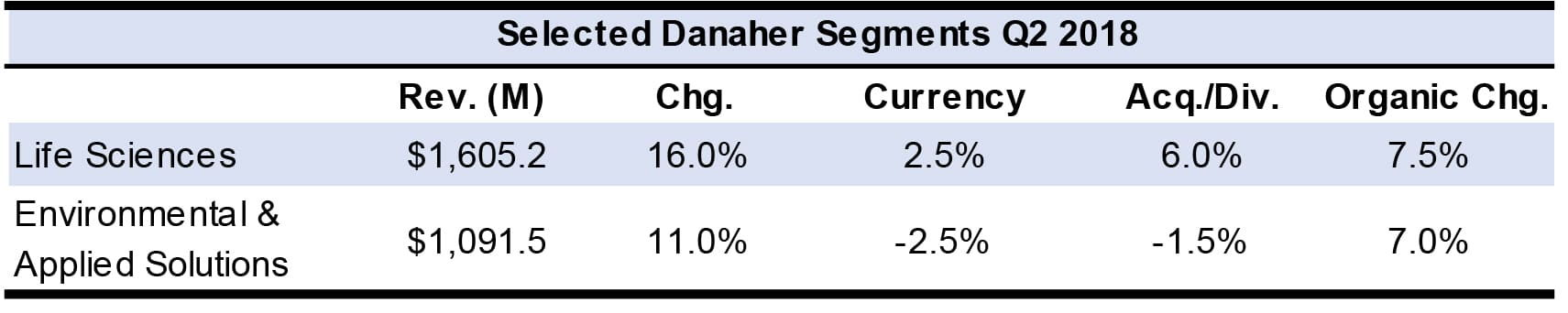

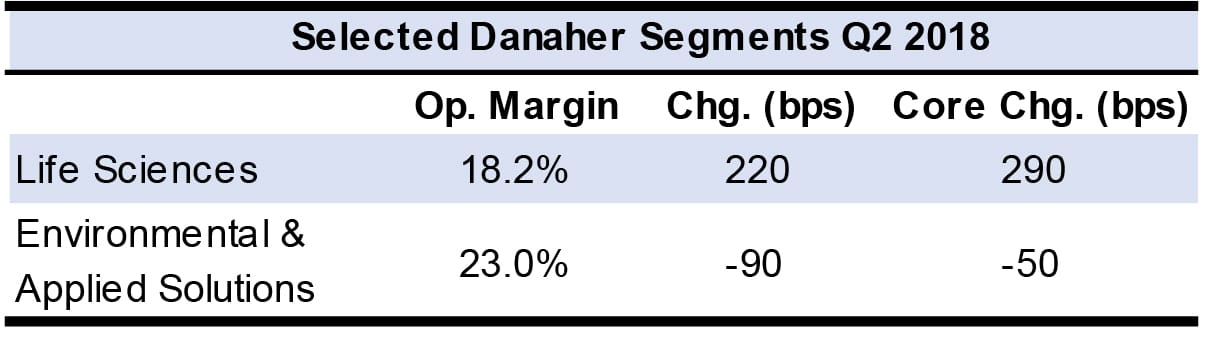

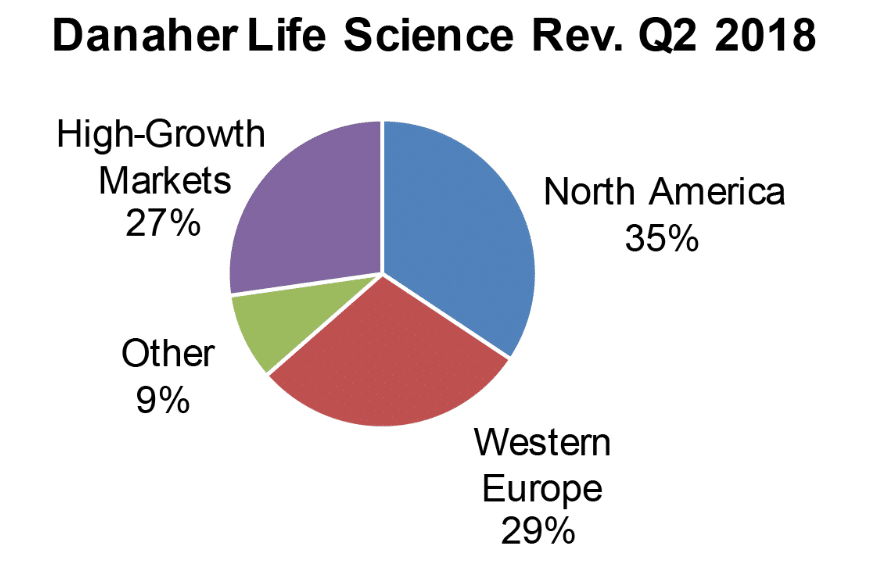

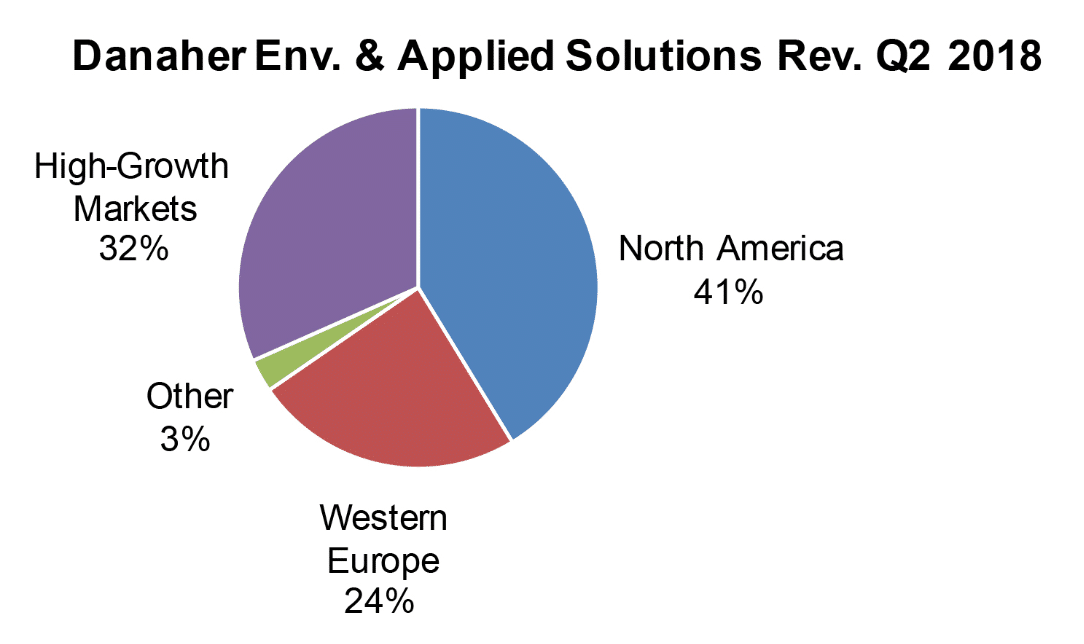

Core Danaher revenues rose 6% for the second quarter. (See IBO 7/31/18.) The Life Sciences, and Environmental and Applied Solutions led all divisions’ growth, with sales for both up double digits.

Click to enlarge

Click to enlarge

Within the Life Sciences segment, Leica Microsystems revenue rose low double digits and SCIEX revenue grew high single digits. Sales for Pall increased mid-single digits, including double-digit growth for biopharmaceutical sales. In addition, the company reported solid growth for Beckman Coulter Life Sciences, citing new product sales. Japanese sales for Life Sciences were also strong.

Click to enlarge

Within the Environmental and Applied Solutions segment, water quality sales grew high single digits, including a double-digit increase for Hach sales. Hach reported good sales in industrial as well as municipal markets.

Click to enlarge

Danaher forecasts third quarter core revenues to increase 4%–4.5%. Full-year core revenues are expected to rise mid-single digits.

Bioprocess Sales Drive Merck KGaA Life Science

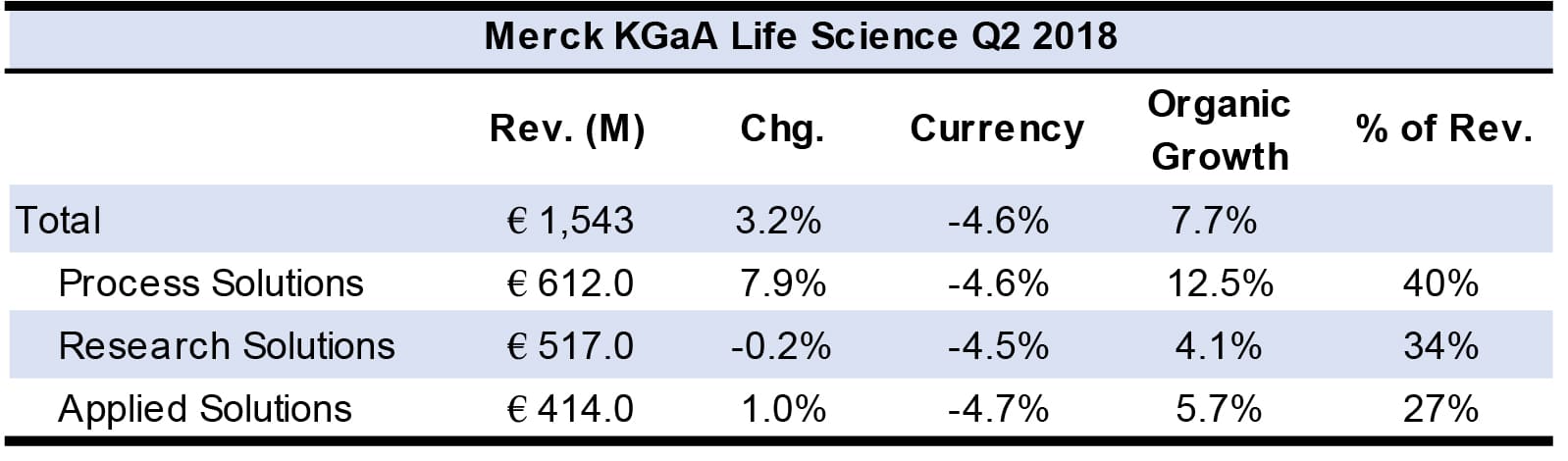

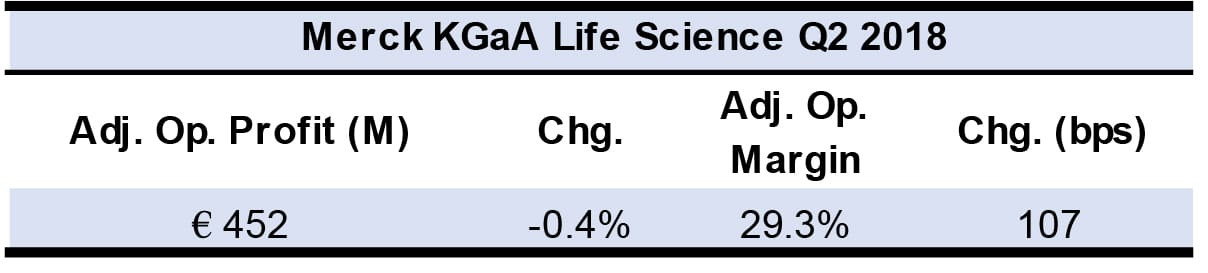

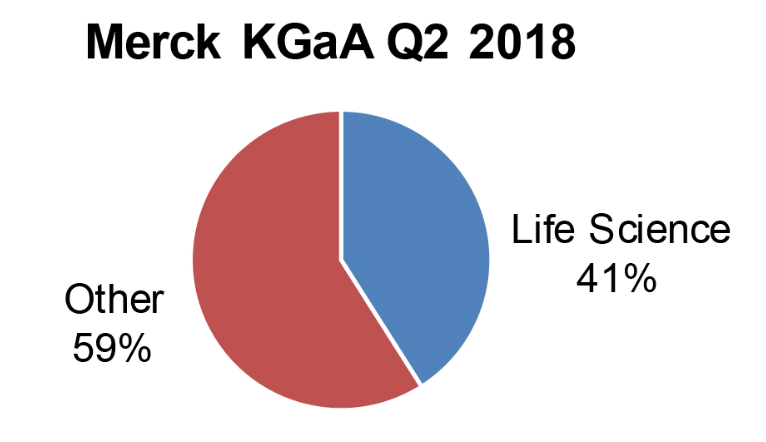

Merck KGaA Life Science represented 41% of total company sales in the second quarter, reporting the fastest growth rate among the company’s three business segments. (See IBO 8/15/18.)

Click to enlarge

Click to enlarge

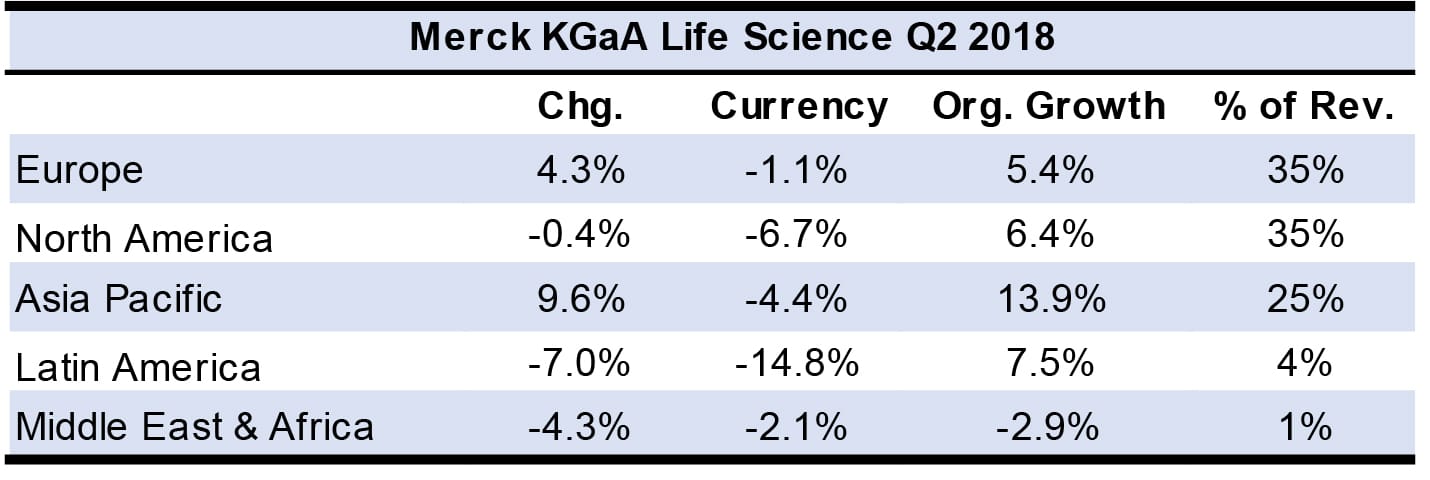

Within the Life Science unit, Process Solutions posted the fastest growth rate, driven by the bioprocessing business’ sales in Asia-Pacific and North America. Product line highlights were single-use, downstream and cell culture media products. Sales of Research Solutions were led by sales of life science reagents and kits, and sales in North America and Europe. In the Applied Solutions business, revenue increases were led by Advanced Analytical and lab water segment revenue, as well as sales in North American and Asia-Pacific.

Click to enlarge

The company forecast Life Science sales to grow 5%–6% on an organic basis for 2018, compared to a previous forecast of 4% organic growth.

Click to enlarge

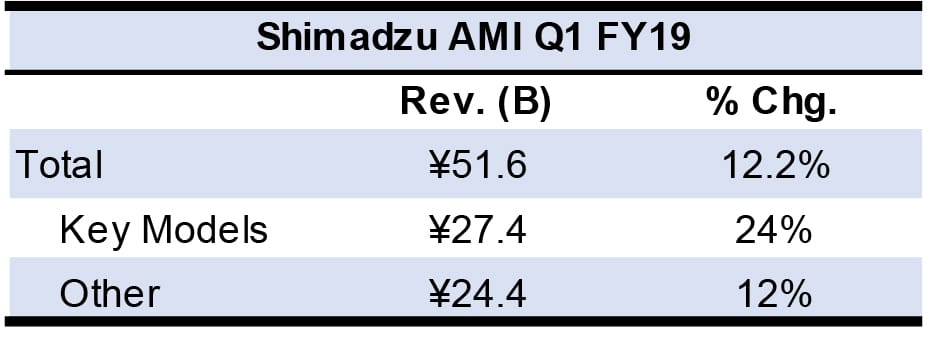

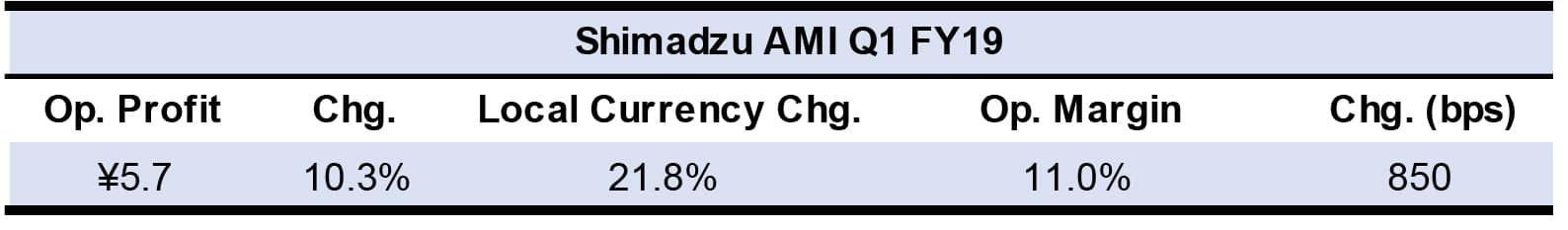

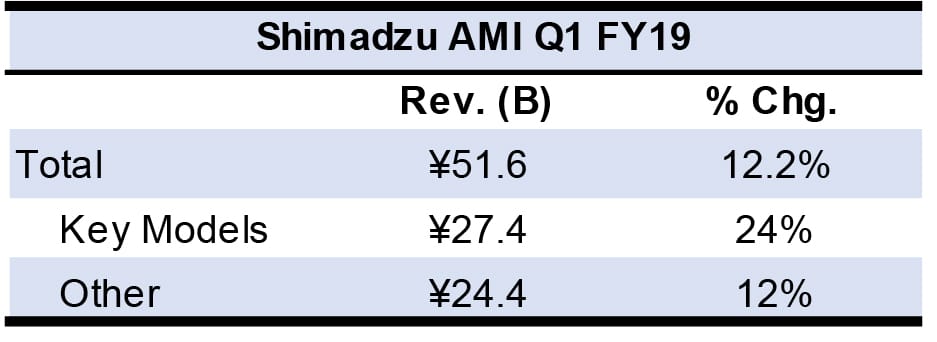

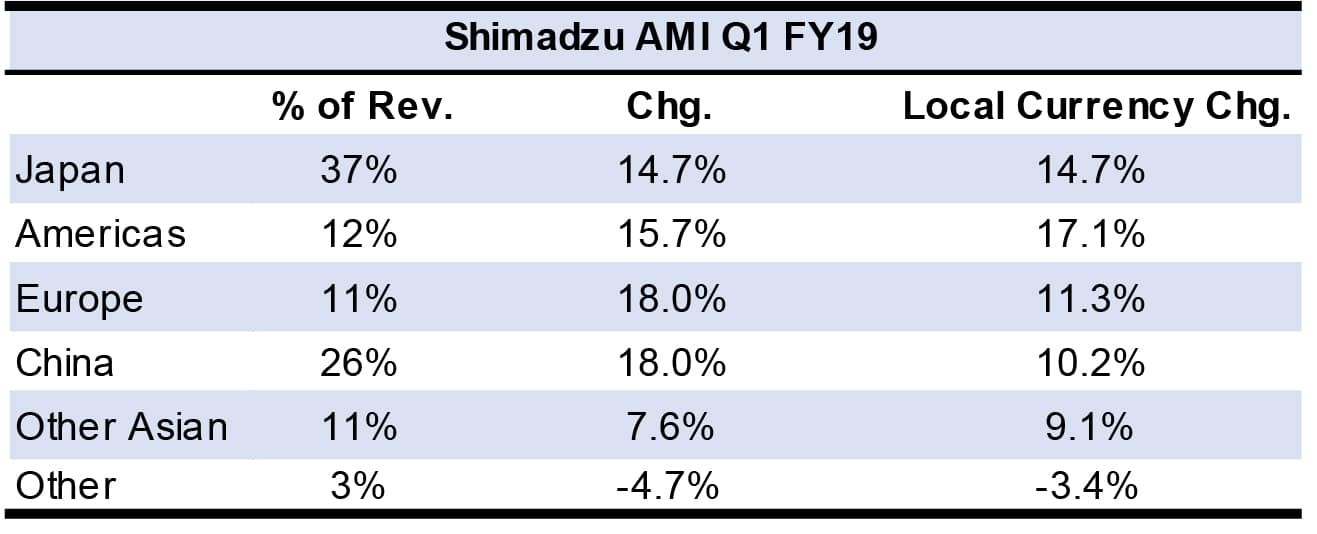

Shimadzu AMI Sales Led by the Americas

Shimadzu Analytical & Measuring Instruments’ (AMI) first quarter fiscal 2019 sales rose 12.0% to make up 60% of total company revenues. (See IBO 8/15/18.) AMI orders grew 5.7%, led by an 11.3% increase in India and 8.2% growth in China.

Click to enlarge

Click to enlarge

By product line, revenue growth was led by sales of environmental measurement instruments, including water quality products, in China. LC and MS sales showed strength in North America and Europe, in particular LC sales to pharmaceutical and CRO customers. However, LC and MS sales declined in Japan and China. As for GC, sales rose outside of Japan and were especially strong in China related to petrochemical sales.

Click to enlarge

By end-market, CRO revenue increased. In the materials/machinery/electrical/automotive market, sales to the materials field for regulatory compliance were especially strong. In Japan, sales to the academic market were a highlight.

Sales outside of Japan represented 63% of AMI revenue. Geographically, North American sales rose 17.1% in local currency to ¥5.5 billion ($50.4 million = ¥109.08 = $1). South American sales rose 20.1% in local currency to ¥0.9 billion ($82.3 million).

Click to enlarge

For fiscal 2019, the sales growth forecast remains the same with a 9.4% increase bolstered by changes in currency effects.