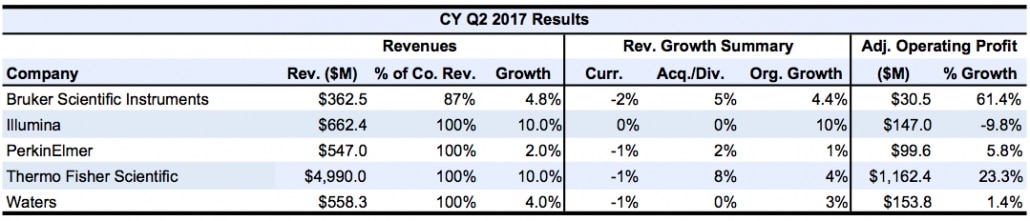

Second Quarter Results: Bruker, Illumina, PerkinElmer, Thermo Fisher Scientific and Waters

Bruker Delivers Strong Second Quarter

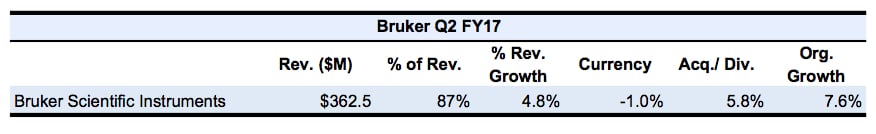

Second quarter sales for Bruker advanced 11.6% to reach $414.9 million (see Bottom Line). Bruker’s revenues for the quarter grew 7.6% organically due to growth in its BioSpin, CALID and BEST Groups. The acquisitions of B-OST (Oxford Instruments Superconducting Wire), Hysitron and InVivo contributed 5.8% to revenue growth. Bruker’s adjusted operating profit rose 61.4% due to an increased gross profit and operating margin. Adjusted operating margin grew 170 basis points to 12.5%, while adjusted gross margin contracted 100 basis points to 2.1%.

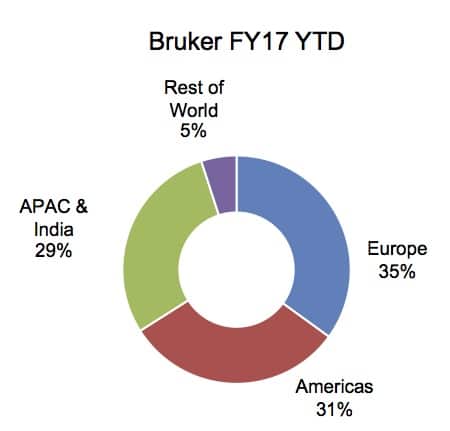

Geographically, in constant currency, Bruker’s European sales rose in the high single digits due in part to acquisitions; North American sales grew in the low single digits, with improvement in academic orders; while Asia-Pacific organic revenues increased nearly 20%, largely driven by a strong performance in China.

Bruker Scientific Instruments’ (BSI) revenue grew 4.8% to $362.5 million to account for 87% of total revenues. BSI System sales grew 7.7%, and Aftermarket sales increased 4.8%, accounting for 72% and 28% of the segment revenue, respectively.

Within BSI, BioSpin’s organic revenue rose mid-single digits driven in part by sales of low-field NMR systems. Preclinical imaging sales were higher as well. BioSpin’s aftermarket and service businesses also continued their expansion. However, BioSpin no longer expects to record sales from a 1 GHz NMR system this year, as installation has been delayed to mid-2018. The Group reported stronger academic and industrial markets

Similarly, the CALID Group experienced stronger academic and industrial demand. CALID Group’s revenue grew in the mid-teens on an organic basis, led by sales of the rapifleX MALDI MS, in addition to solid demand for the Biotyper MALDI MS, as well as consumables and service. In the first half of the year, Daltonics’ sales increased in the low single digits in constant currency, but the Detection business declined due to a strong year-over-year comparison. The Group’s Optics first-half revenues grew in the mid-single digits, as the business reported strong applied and industrial demand. Lastly, InVivo, a consumables company acquired earlier this year (see IBO 1/15/17), provided modest revenue growth for the quarter.

Bruker NANO’s quarterly revenue declined on an organic basis, as semiconductor metrology revenue declined. However, Bruker expects a strong recovery in semiconductor metrology revenue for the rest of 2017. The segment’s AXS business, having recovered from a difficult 2016 with noticeably higher margins, also posted higher revenue growth.

For 2017, the company raised its revenue growth forecast to 4.5%–6%, including organic revenue growth of 1.5%–2%, versus its previous guidance of 2%–3.5%. Bruker expects its revenue from acquisitions to add about 3.5%–4% to full-year growth.

Illumina Surpasses Forecast

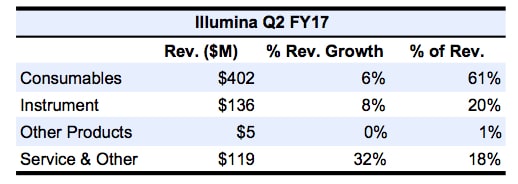

Second quarter sales for Illumina outperformed expectations, increasing 10.4% to $662.4 million (see Bottom Line). The strong performance was led by higher-than-expected sequencing consumables and microarrays sales growth. However, adjusted operating income declined 10.3% to $146.6 million due to lower gross margins, and higher R&D and SG&A expenses.

Chinese sales showed the fastest growth, up 15% due to NovaSeq, HiSeq X consumables and NextSeq NIPT sales. Not far behind, European revenues rose 15%. Europe’s strong sales growth came primarily from an increase in sequencing consumables sales. Asia-Pacific revenue rose 12%, although Japan remained weak. Sales in the Americas increased 8%.

By end-market, oncology represented more than 20% of shipment growth, led by commercial molecular diagnostic and liquid biopsy demand.

During the quarter, Illumina tripled its NovaSeq manufacturing capacity compared to the first quarter, allowing shipping and installation of around 80 instruments. NovaSeq orders also exceeded expectations, outdoing the company’s forecast by 30%. The backlog stands at over 100 systems. Consequently, previous systems such as HiSeq experienced a decline in sales, with around 30 HiSeq systems no longer part of the installed base.

Total NovaSeq orders since its launch in January totaled 230. About two-thirds of NovaSeq orders came from HiSeq and HiSeq X labs, and around one-third were from new-to-sequencing and benchtop-only customers. The new-to-sequencing and benchtop customers represented around half of NextSeq, MiniSeq and MiSeq shipments. Overall, consumer customers led order growth.

Microarray revenue, including services, increased 16% to around $110 million. Microarray service and other revenue increased 32.2% to $119 million, driven by the consumer market.

Instrument revenues increased 7.9% to $136 million, primarily due to higher shipments of NovaSeq. Sequencing instrument sales grew 9%, reaching $130 million.

Revenues for the Consumables segment grew 6.1% to $402 million to account for 61% of total revenues. Sequencing consumables sales grew 9% to $338 million, while sales of microarray consumables declined 7%. Sales of HiSeq consumables revenue decreased sequentially. However, HiSeq X consumables experienced increased sales growth as utilization gains increased in China and liquid biopsy studies increased. Similarly, NextSeq consumables experienced strong revenue growth, as customers continue to standardize on the system into their production environments.

Service and Other revenue increased 32.2% to $119 million, driven by increased sales of genotyping services and instrument service contracts. Service and Other revenue grew 93%.

For 2017, Illumina has updated its revenue projection from 10%–12% to approximately 12% based on first-half results. The company expects a continued decline in the HiSeq and HiSeq X placements. For the third quarter, Illumina expects to expand its manufacturing capacity in order to ship even more NovaSeqs. The company expects NovaSeq margins to improve over the next four to six quarters.

PerkinElmer Faces Challenges

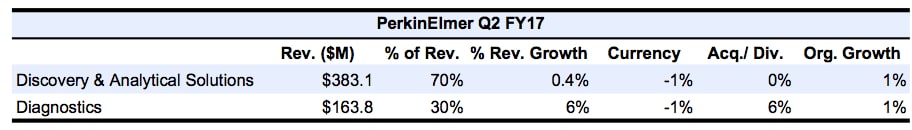

Second quarter revenues for PerkinElmer reached $547.0 million, a 2.0% increase (see Bottom Line), but were below company expectations due to a weaker-than-expected academic market outside the US and a malware attack on one of its third-party logistics providers in Europe. On an organic basis, sales grew 1%. Together, these factors reduced organic sales growth by around 200 basis points, evenly divided between the two business units. Adjusted operating income advanced 5.8% to $99.6 million, leaving the company with an 18.2% operating margin, a 70 basis points increase.

Geographically, the Americas’ organic sales grew in the mid-single digits. In Europe, organic sales decreased in the low-single digits due to weak academic and government sales growth. Due to a strong year-over-year comparison, revenue in Asia was flat. BRIC countries recorded a revenue increase in the low teens, with Chinese revenue up in double digits.

Discovery & Analytical Solutions (DAS) revenue growth was modest, growing 0.4% to $383.1 million, or 70% of total revenues. However, the segment’s sales growth was partially offset by unfavorable impacts from foreign currency, and a weak academic and government market in Europe and Asia. Organic revenue for the segment advanced 1%, while adjusted operating income increased 6.6% to $64.0 million. The segment’s steady sales performance came primarily from mid-teens growth for the laboratory services business, especially from pharmaceutical and biotech customers.

By end-market, industrial sales growth increased around 2%–3%, driven by Asia. Academic and government sales were down low single digits but in the US increased in the high single digits. However, academic sales declined in Europe and Asia. Pharmaceutical and biotech revenue growth was up in the low single digits, driven by lab services. The service business’s annual revenues totaled approximately $600 million. Environmental revenue increased in the low single digits, as sales of the company’s new ICP-MS system added to sales growth. However, food sales declined due to a year-over-year comparison.

Diagnostics sales advanced 5.9% to $163.8 million to account for 30% of total revenue. Segment organic revenue increased 1%, and adjusted operating income grew 3.2% to $48.8 million. Additionally, the segment experienced a sales increase from its continued expansion in the newborn and infectious disease screening businesses. Newborn testing revenue rose in the high single digits.

For the third quarter, PerkinElmer expects organic revenue to grow around 5%, and reported revenue to range between $550 and $555 million. The company raised its full-year revenue guidance to $2.23–$2.24 billion, from its previous guidance of $2.20–$2.22 billion due to more positive foreign exchange effects and acquisitions. On an organic basis, the forecast for revenue growth remained at 4%.

Thermo Fisher Scientific Sales Benefit from FEI

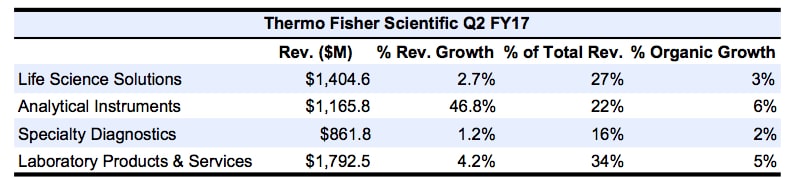

Thermo Fisher Scientific reported a strong second quarter performance, with revenues climbing 10.0% to $4.99 billion. The company’s organic revenue grew by 4%, while acquisitions increased revenue by 8%, supported primarily by recently acquired FEI (see IBO 1/31/16) and strong sales growth. Foreign currency translations reduced revenue growth by 1%.

The pharmaceutical and biotech markets continued to be a strength for Thermo Fisher, as sales climbed mid-single digits. In the industrial and applied markets, revenues grew modestly at about the company average. In the second quarter, Thermo Fisher reported a continued increase in demand in its research and safety market channel from its industrial consumers, while experiencing a revival in its chemical analysis business. Bookings in the industrial market increased, as well as long and short-cycle revenues. In the applied market, environmental and food safety revenue growth remained solid, matching expectations. Revenue in the academic and government markets grew in the low-single digits, as did the sales in the diagnostics and healthcare markets.

The company saw strong performances across all product lines, with especially strong growth in biosciences, chromatography and MS. Bioproduction grew reasonably, yet growth slowed down compared to the last few quarters.

Geographically, North American sales grew at the company average, while sales in Asia-Pacific grew in the high-single digits range. In particular, China experienced strong revenue growth, increasing more than 15%. Much of the sales growth from China came from strong pharmaceutical, biotech and life science research sales, as well as the applied, healthcare and diagnostics markets. India, similarly, experienced a mid-teen increase. However, in Europe, sales growth was moderate, increasing in the low single digits. As for the Rest of World, revenue growth was flat.

Sales for the Life Science Solutions segment grew 2.7% to reach $1.4 billion, making it the second largest segment of Thermo Fisher, led by the biosciences business. The Life Science Solutions segment grew organically by approximately 3%. The microarray and eBiosciences businesses both saw strong growth.

With the acquired FEI business now fully integrated, the Analytical Instruments segment’s revenues jumped 46.8% to $1.17 billion. Organically, sales grew 6%. The strong organic growth in the segment was driven by positive sales for the chromatography and MS businesses, while the overall segment growth emerged from the success of the electron microscopy business, including Cryo-EM sales. The electron microscopy business reported solid sales as FEI’s Cryo-EM systems continue to perform well, with strong growth in revenues and bookings. In the materials science business, including semiconductors and applications for electron microscopy, revenue growth was strong.

In Thermo Fisher’s Specialty Diagnostics segment, sales grew a 1.2% to $862 million, placing the segment in last place among total segment revenue growth. Organic revenue increased by 2%, as the segment’s transplant diagnostics business delivered healthy revenue growth.

The Laboratory Products & Services segment represented the largest proportion of revenue for the company, increasing by 4.2% to reach $1.79 billion. Similarly, the segment’s organic growth increased 5%. The segment’s growth came from its strong channel business, biopharma services and clinical trials business. Moreover, the channel business was very strong globally, but especially in the US and in Europe.

For 2017, Thermo Fisher raised its guidance to reflect its substantial growth in the second quarter. The company upgraded its revenue guidance to $19.71–$19.89 billion versus its previous $19.51–$19.71 billion range, signifying an 8%–9% increase. Thermo Fisher continues to expect organic growth of 4% for 2017.. Lastly, the company expects its acquisitions to contribute just slightly under 5% to sales growth for the year.

Thermo Fisher expects the Asia-Pacific region to continue its strong performance for the rest of the year, with sales in China again increasing in the mid-to-high double digits. In Europe, the company expects its performance to stay on track with its guidance of just below the company average.

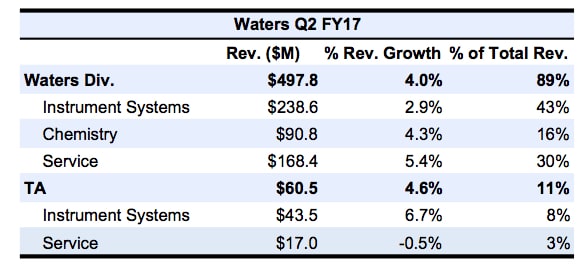

Industrial Gains Continue for Waters

Waters second quarter sales grew 4.0%, reaching $558.2 million. Foreign currency translation reduced sales growth by 1%. Organically, revenues grew 3%. Waters’ adjusted operating income increased 7.2% to $167.2 million due to higher sales volume and reduced costs.

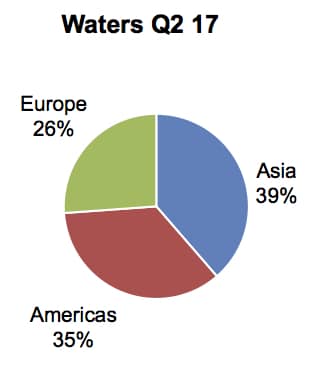

Product sales grew steadily as recurring revenues, and sales of LC/MS and thermal analysis systems increased. The pharmaceutical and industrial markets lifted company sales growth, while a moderate governmental and academic market partially affected gains.

Geographically, Asia represented the largest revenue generator, with sales ascending 13.3% to account for 39% of total company revenues. Sales in China rose 18.0% to make up 44% of Asian revenue, led by industrial sales, as well as solid demand from pharmaceutical customers. In constant currency, sales in China and India each grew double digits. In Japan, sales increased 4.7%, also driven by the pharmaceutical, government and academic markets. In Europe, sales increased by 1.8%, including negative currency effects of 3%. Conversely, sales in the US slid 2.3% due to slower demand in the pharmaceutical and industrial markets.

Instrument sales grew 3.3% for the quarter, while recurring revenue rose 4.6% to make up 51% and 49% of revenues, respectively. Instrument sales and recurring revenues sales growth were offset by foreign currency translation, reducing sales by 1% and 2%, respectively.

In the pharmaceutical market, sales increased 3%. However, sales growth was offset by 1% foreign currency translations. In the industrial market, sales grew 5%, or 7% in constant currency. Revenue in the government and academic market was up 7%, but grew 5% in constant currency.

Waters Instrument Systems sales grew 3% in constant currency, led by strong demand for the ACQUITY Arc HPLC, QDa MS, and IMS Q-Tof MS systems, as well as other LC and MS systems. ACQUITY Arc continued to show strong revenue growth, and LC/MS systems, such as Xevo TQ-XS and Xevo TQ-S, also showed a solid increase. Waters’ chemistry consumables sales increased by 4%, due to the rise in demand for application-specific testing kits. For the Waters division, Japanese revenue grew 4%. In Europe, sales increased by 2% for the quarter. In contrast, sales in the US decreased by 3%, and sales for the rest of the world declined 9%.

TA’s total sales grew 4.6%, with a 2% increase from recent acquisitions, resulting in organic growth of approximately 3%. TA Instrument Systems sales expanded 6.7%, 6% in constant currency, led by the company’s recently introduced Discovery product line. In Asia, TA’s total sales increased 17%, with the largest portion of sales in China and India. Japanese revenue growth was also significant, leaping 17%. In Europe, TA sales declined 3%. Sales also declined in the US falling 2%. In the rest of the world, TA sales rose 18%.

For the third quarter, Waters expects constant currency sales growth in the mid-single digits. For the full year, Waters forecasts sales growth of 5%–6%, with a 1% reduction in growth due to currency effects. As for gross margins, Waters expects a full year growth range of 58.5% to 59%, on track with its previous guidance.