Spring Business Climate Review: A Smooth Ride Ahead?

It’s been a good year for the analytical instrument and lab products industry so far based on the first quarter results of publicly held companies (see IBO Sales Indexes). And privately held players, such as Eppendorf and 10x Genomics, have indicated healthy business with their public announcements.

The US tax cuts, an NIH budget increase and investments by the Chinese government all suggest a robust investment environment for scientific instruments and equipment, and the related aftermarket. However, several factors have yet to play out. Most notably, the impact of the US tax cuts for businesses, which are expected to increase capital spending but have not yet shown a dramatic effect, as detailed in a recent Bloomberg article.

Another potential setback is the Trump administration’s proposed $50 billion in Chinese trade tariffs. Details are yet to be finalized but as the OECD points out in its latest “Economic Outlook,” published this month, the uncertainty created by trade tariffs proposals have likely affected business investments.

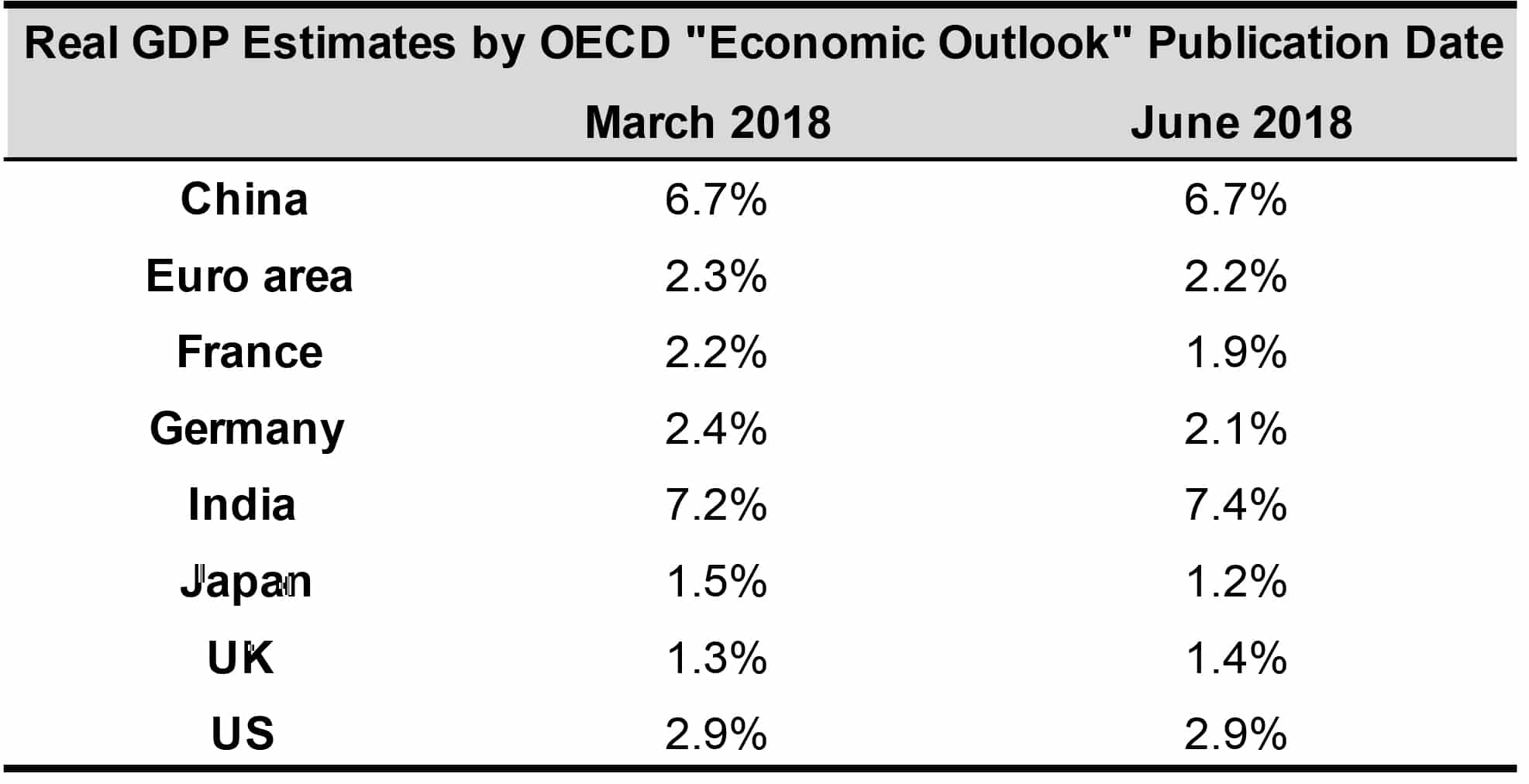

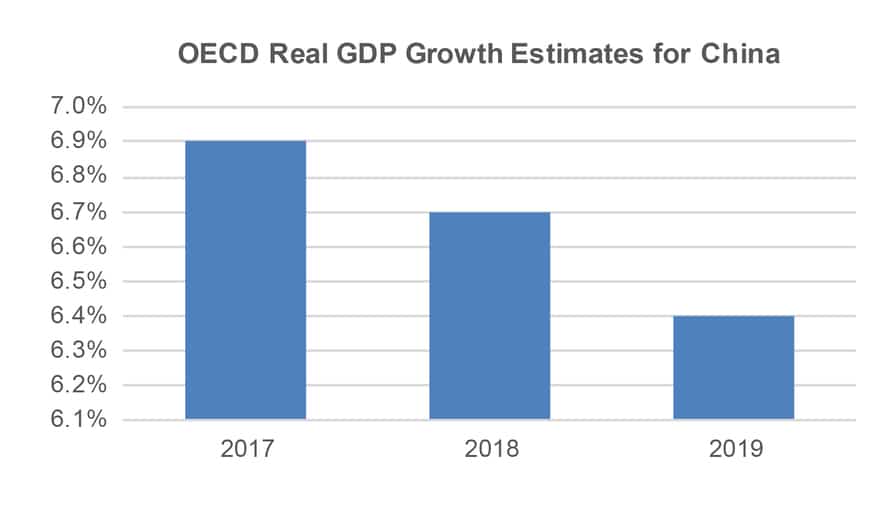

Despite the trade wrangling, China remains a critical market for most US businesses. According to the OECD, China’s real GDP is estimated to increase 6.7% this year (see table), down from 6.9% growth last year. However, the nation’s economy is expected to further slow in 2019, with GDP up 6.4% as structural changes endorsed by government policies seeks to steer the nation toward stable, sustainable growth.

IBO spoke with two instrument and lab product industry veterans about the road ahead this year for the industry. Bill Snider is the co-founder and partner at BroadOak Capital Partners, an investment bank specializing in the life science industry. (BroadOak is an investor is IBO’s parent company, The Science and Medicine Group.) He acknowledges that one possible risk to instrument and lab product demand this year is a slowing Chinese economy. But, in regards to US demand, he believes there are few risks. As he told IBO, “[The] slower US economy should not be a problem, but expectations are high.” The latest OECD estimates put US real GDP growth at 2.9% this year and 2.8% in 2019.

David Weber is vice president and CCO for Maravai Life Sciences, a life science consumables firm. He has over 35 years of industry experience, including holding positions at Affymetrix and Amersham Biosciences. He also sees little risk ahead for industry sales this year, stating, “Barring outside influences, the signs are quite good for lab instrument and product demand in 2018.” In regards to US demand, he shares Mr. Snider’s optimism. “For the moment, the economy remains fairly robust and government funding in the US and abroad for R&D remains reasonably strong,” adding that increasing US interest rates seem to pose little risk this year. Risks cited by him are the impact of Brexit, and economic destabilization and political instability in parts of the world.

“The corporate tax cut passed by the US Congress will most likely have virtually no effect on lab and reagent companies or their customers’ spending patterns.”

The US tax cuts, as well as higher corporate spending, could add as much as a half to three-quarters of a percentage point to US GDP growth in 2018 and 2019, according to the OECD. Commenting directly on the potential impact of tax cuts on spending by lab instrument and product companies and their customers, Mr. Snider stated, “That should be good news across the board. The tax cuts have freed up corporate cash flow, which should help capital equipment spending.”

But Mr. Weber doubts the impact on the cuts on the analytical instrument and lab product industry. “The corporate tax cut passed by the US Congress will most likely have virtually no effect on lab and reagent companies or their customers’ spending patterns. There is no clear evidence thus far of increased spending on R&D, for example.” Instead, he expects this cash will likely be used to fund company stock buybacks and higher dividends.

“The market is very healthy and auctions are attracting multiple bidders.”

The repatriation of cash from companies’ overseas operations, one benefit of the new tax law, has raised expectations for increased M&A activity across many sectors of the US economy. Such an environment would be no change from the brisk acquisition activity so far this year among lab instrument and lab products companies. Even so, Mr. Weber does not expect the level of industry M&A activity to change from last year. “I expect M&A activity to remain at about the same level this year compared to 2017. A fairly strong and vibrant environment exists, although valuations tend to be quite high,” he said, adding, “Strategic acquirers, private equity firms and others who can be creative in their approach are likely to be the most successful.”

Mr. Snider also sees a healthy M&A environment for the industry with good valuations. “M&A will continue to be strong and the multiples will remain high,” he commented. “The market is very healthy and auctions are attracting multiple bidders.”