Strong Gains for IBO Stock Indexes

Global equity markets soared in April following France’s preliminary presidential elections, which favored the more euro and business friendly candidate, Emmanuel Macron. Major US Indexes reached historic highs further fueled by corporate earnings and President Trump’s one page double-spaced tax reform plan aimed at lowering corporate and capital gains taxes, as well as repealing the alternative minimum tax and estate tax. Despite the strong market vitality, the overall economic environment continued to struggle. First quarter US GDP growth was revised lower by 40 basis points to 0.7% due to a significant deceleration in consumer spending and lower inventory investments.

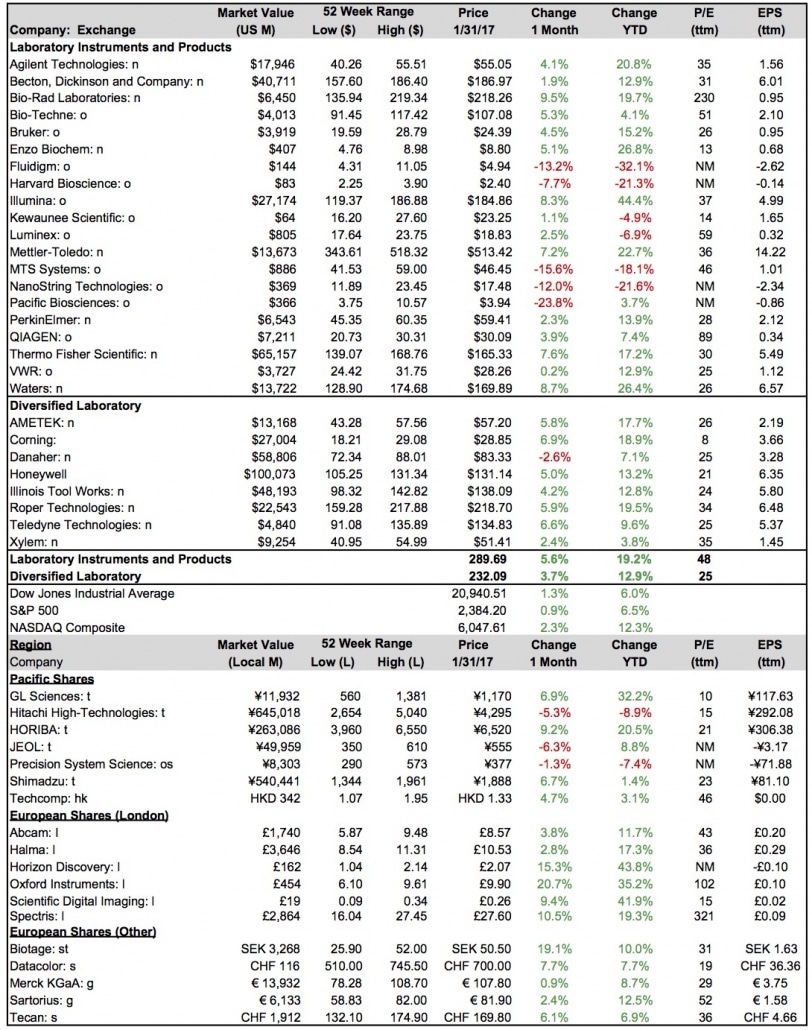

For the month, the Dow Jones Industrial Average, S&P 500 and NASDAQ advanced 1.3%, 0.9% and 2.3%, respectively. Year to date, the Dow, S&P 500 and NASDAQ are up a bullish 6.0%, 6.5% and 12.3%, respectively.

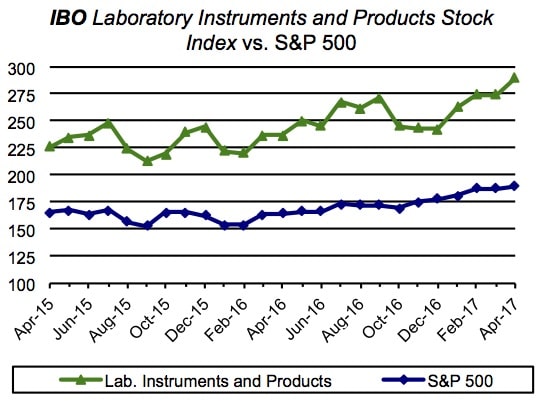

Laboratory Instruments and Products Stock Index

The Index climbed 5.6% for the month and is up an impressive 19.2% year to date to 289.69. Most companies ended the month in positive territory, led by Bio-Rad Laboratories, which advanced 9.5%.

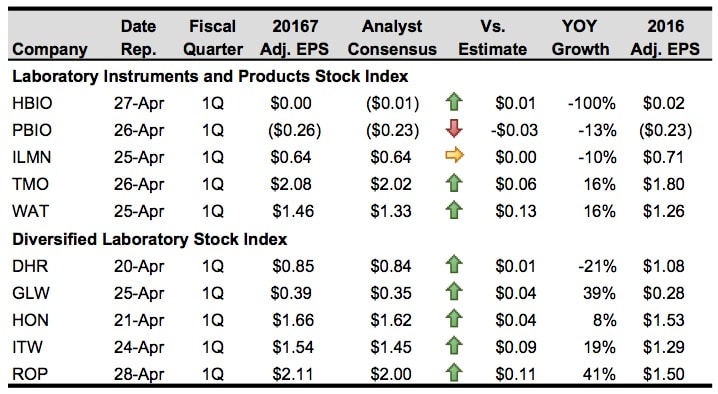

Thermo Fisher Scientific and Waters also posted healthy gains in April, climbing 7.6% and 8.7%, respectively, due to strong first quarter adjusted EPS results on April 26 and April 25, respectively. Earnings for these companies were driven by moderated currency headwinds, as well as continued strength in the biopharmaceutical markets and growth in China. In addition, industrial markets improved for Thermo Fisher and were strong for Waters. In spite of the strong operational performances, the companies’ increased earnings outlooks were primarily attributed to currency, as well as lower tax expenses for Waters and acquisition contributions for Thermo Fisher. Waters raised its 2017 adjusted EPS from $6.85–$7.10 to $7.20–$7.40. Thermo Fisher boosted its 2017 adjusted EPS range from $9.06–$9.24 to $9.12–$9.28.

Illumina expanded 8.4% for the month despite mixed quarterly financial results on April 25. The company reported an adjusted EPS decline of 10% to $0.64 for the first quarter, but results were in line with consensus. Sales for the company slightly exceeded analysts’ expectations (see Bottom Line), but margins were pressured by new product introductions. The company maintained its 2017 adjusted EPS outlook of $3.60–$3.70, and projected second quarter adjusted EPS of $0.65–$0.70.

Despite the strong Index growth, several companies declined in double digits for the month. Pacific Biosciences, which reported a wider-than-expected first quarter adjusted EPS loss of $0.26 on April 26, fell 23.8% in April, leading all decliners. The company provided a cautious outlook due to uncertainty in US government funding, and lowered its 2017 product and services sales projection from 40%–60% to 35%–45%. On a sequential basis, second quarter sales are expected to decline.

On April 27, Harvard Bioscience posted first quarter adjusted EPS just above analysts’ estimates due to improved operational efficiency. Despite reaffirming its 2017 adjusted EPS outlook of $0.05–$0.07, shares contracted 7.7% for the month.

In other news, on April 23, Moody’s Investors Service placed Becton, Dickinson’s (BD) “Baa2” senior unsecured and “Prime-2” debt under review for a downgrade following the $24 billion, including debt, proposed acquisition for C.R Bard. The projected transaction, while significantly expanding BD’s debt, presents compelling adjusted operating margins. BD shares were pressured following the announcement but ended the month up 1.9%

There were a number of ratings changes this month. On April 19, Cantor Fitzgerald downgraded PerkinElmer from “Overweight” to “Neutral.” NanoString Technologies was downgraded by Morgan Stanley on April 20 from “Overweight” to “Equal Weight.”

Diversified Instrumentation Stock Index

The Index climbed 3.7% for the month and is up 12.9% for the year to 232.09. All companies traded higher except for Danaher, which fell 2.6%. However, the company reported first quarter results on April 20 mostly in line with expectations. The company maintained its 2017 adjusted EPS guidance of $3.85–$3.95, and projected second quarter adjusted EPS to be $0.95–$0.98.

Corning recorded the strongest gain among Index companies in April, rising 6.9%. The company topped first quarter adjusted EPS expectations on April 25, driven by strength in its Optical Communications and Specialty Materials segments.

Similarly, Honeywell, Illinois Tool Works (ITW) and Roper Technologies all exceeded first quarter adjusted EPS estimates due to improved organic sales growth and operational efficiency, and raised full-year EPS outlooks.

On April 21, Honeywell raised the bottom range of its 2017 EPS outlook by $0.05 to $6.90–$7.10. On April 24, ITW advanced its 2017 adjusted EPS from $6.00–$6.20 to $6.20–$6.40. Second quarter adjusted EPS are expected to be $1.55−$1.65. Roper increased its 2017 adjusted EPS on April 28 from $8.82–$9.22 to $8.98–$9.28. Second quarter adjusted EPS is projected to be $2.16–$2.24.

International

Asia Pacific equity markets traded mostly higher in April, led by Hong Kong’s Hang Seng and South Korea’s Kospi, which improved 2.1% each. Japan’s Nikkei 225 advanced 1.5%. However, China’s Shanghai Composite and Thailand’s SET slipped 2.1% and 0.6%, respectively.

Prices for Pacific Rim companies in the IBO Stock Table were mixed. HORIBA recorded the largest gain among these companies, climbing 9.2%, while JEOL fell 6.3%.

Hitachi High-Technologies also contracted for the month, sliding 5.3%. This decline was primarily due to the announced purchase of Oxford Instruments’ Industrial Analysis business on April 26 (see Executive Briefing).

On April 26, the company reported that fiscal year EPS ending March 31 climbed 12% to ¥292.08 ($2.57), which was ahead of the company’s previous forecast due to improved operational performance. However, the company projected fiscal 2017 EPS to decline 13% to ¥254.49 ($2.31) despite stronger revenue growth.

All major European Indexes advanced in April except for the UK’s FTSE 100, which declined 1.6%. Meanwhile, France’s CAC and Sweden’s OMX 30 climbed 2.8% and 2.5%, respectively.

Prices for all European companies in the IBO Stock Table advanced in April.

Oxford Instruments produced the largest gain, leaping 20.7%. Shares jumped 11.8% on April 26 after reporting the sale of its Industrial Analysis business to Hitachi. On April 27, Oxford was upgraded by Numis Securities from “Hold” to “Buy.”

Biotage, Horizon Discovery and Spectris similarly recorded double-digit price increases in April, as shares advanced 19.1%, 15.3% and 10.5%, respectively. On April 27, Biotage reported that first quarter EPS climbed 57% to SEK 0.55 ($0.06) driven by strong demand for peptide products and an expanded direct sales network.

Sartorius, which advanced 2.4% for the month, reported on April 24 that adjusted first quarter EPS climbed 18% to €0.50 ($0.53). The company raised its full-year 2017 currency-neutral sales growth outlook from 8%–12% to 12%–16%, primarily due to recent acquisitions.

In ratings news, on April 7, HSBC Holdings downgraded Merck KGaA from “Hold” to “Reduce.” On April 6, HSBC Holdings upgraded Spectris from “Reduce” to “Hold,” and raised its price target from nearly 50% to GBX 2,500 ($31.21).\