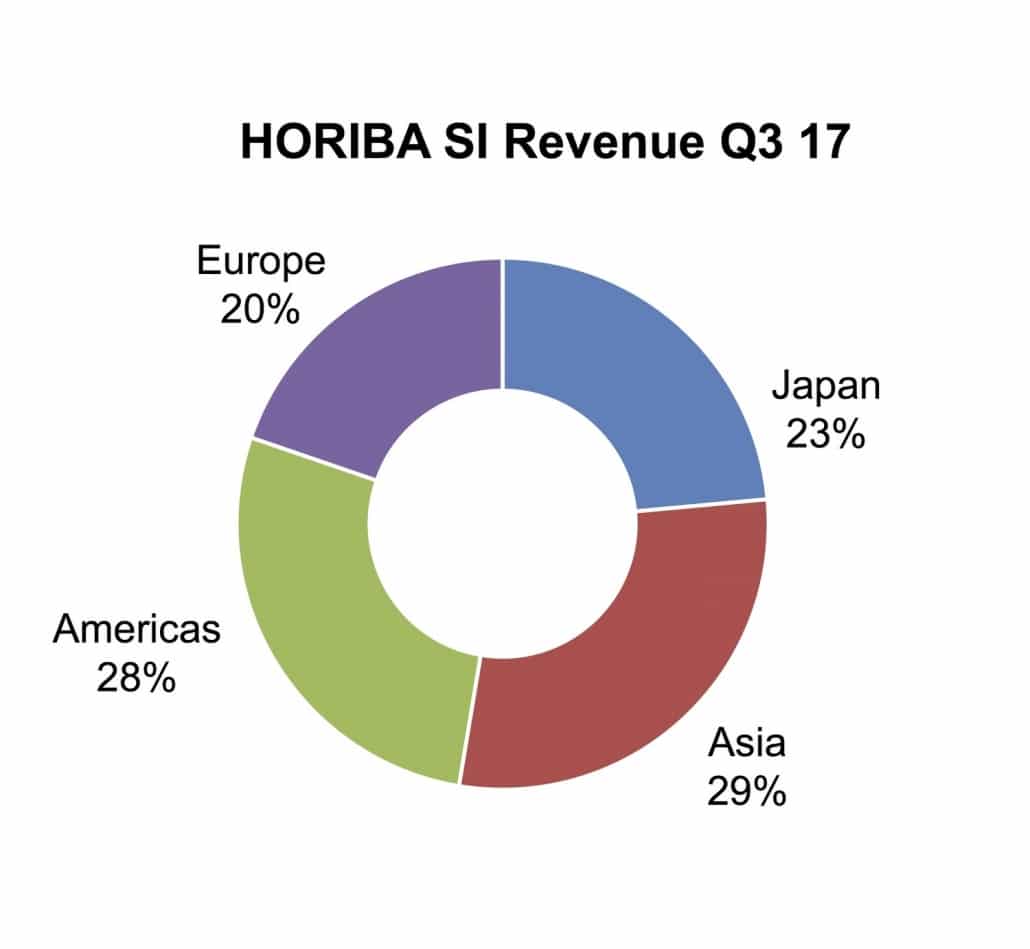

Third Quarter Results: Fluidigm, HORIBA, Merck KGaA, Pacific Biosciences and QIAGEN

Strong Third Quarter for Fluidigm

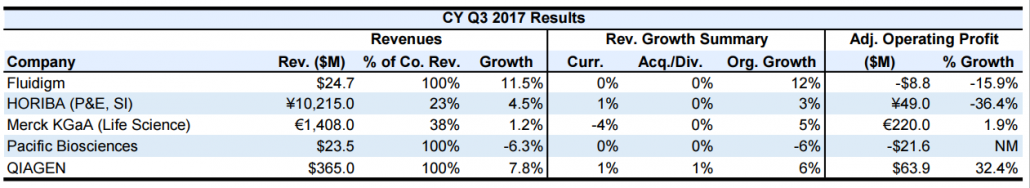

Third quarter sales for Fluidigm grew 11.5% to $24.7 million, driven by higher product revenue from mass cytometry products. Sequentially, sales also increased, up 3.3%.

Instrument sales for the quarter increased 14.7%, amounting to $10.5 million. However, sales growth was partially offset by weak demand for genomics products. Overall instrument sales accounted for 43% of total company revenue. License and Grant sales remained flat for the quarter.

Consumables revenue rose 14.0% to $10.1 million, accounting for 41% of total company revenues. Consumables sales were primarily driven by increased sales growth for both mass cytometry reagents and high-throughput genomics IFCs. However, consumables sales growth was partially offset by decreased single-cell genomics sales and lower than average selling prices. Service revenue was mainly flat for the quarter, dipping just 0.5% to $4.1 million.

Overall, product revenue increased 14.4% to $20.6 million, driven by strong mass cytometry revenue. Weak genomics revenue offset overall product sales. Mass cytometry product revenue increased 101.9% to $10.3 million, largely driven by instrument and consumables revenue. Mass cytometry sales delivered strong double-digit growth in the pharma market, up 54.0%, and in the research market, up 87.0%. As for genomic products, sales decreased 20.1%, mostly due to lower single-cell genomics revenue. Single-cell genomics sales fell both sequentially and on a year-over-year basis.

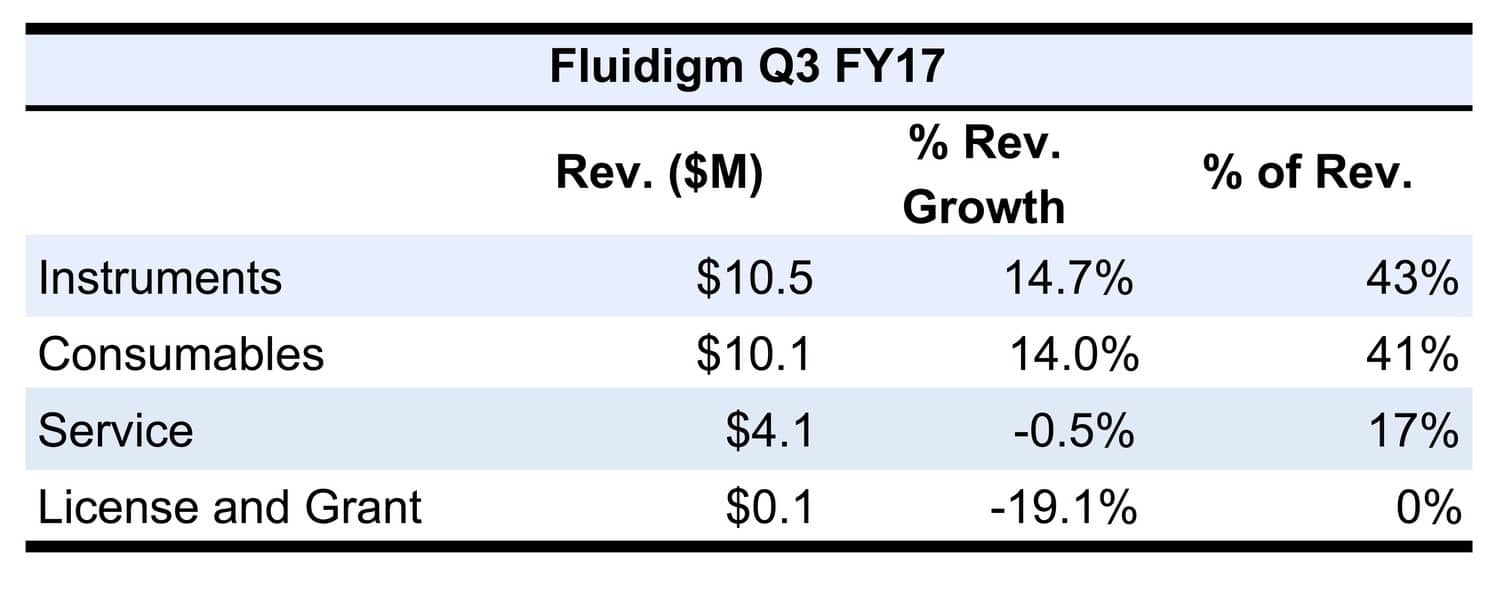

Geographically, sales in all regions except for the US increased for the quarter; however, US sales still represented the majority of total region sales at 45%. US sales for the quarter fell 10.9% to $11.2 million, largely due to weak genomics product sales, particularly for single-cell genomics. Sales in Europe vaulted 48.5% to $7.7 million due to higher genomics product sales.

Sales in the Asia Pacific region also grew significantly, up 34.0% to $4.9 million. Sales in Asia were driven by China’s strong performance both in mass cytometry and genomics products. Sales in China alone amounted to $2.8 million, an increase of 21.7%. Additionally, Chinese sales represented 11% of total company sales. As for the rest of the world, sales increased 20.0% to $1.0 million.

For the fourth quarter, Fluidigm expects sales to be $25.5–$28.5 million, an increase from last year’s fourth quarter revenue of $25.1 million.

SI Revenue Lifts HORIBA for Third Quarter

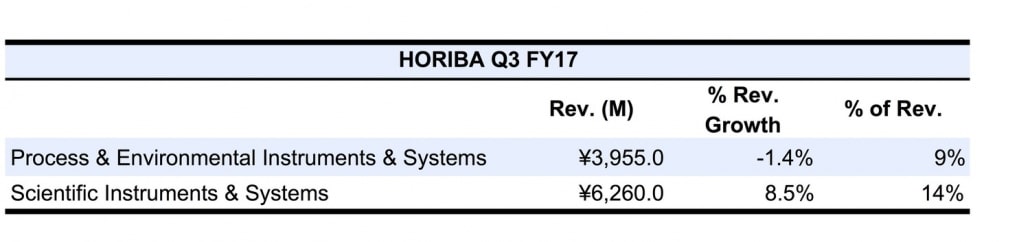

For the third quarter, HORIBA’s Scientific Instruments & Systems (SI) sales increased 8.5% to ¥6,260.0 million ($55.7 million at ¥112.4 = $1). Segment sales amounted to 14% of total company revenues. SI operating loss for the quarter totaled ¥51.0 million ($0.45 million), an improvement of ¥126.0 million ($1.1 million) from last year’s third quarter. Year to date, segment sales fell 2.0% to ¥17,773.0 million ($158.2 million) due to lower-than-expected sales of analytical instruments in Japan and Europe. Operating loss year-to-date amounted to ¥492.0 million ($4.4 million) in part due to higher R&D expenses.

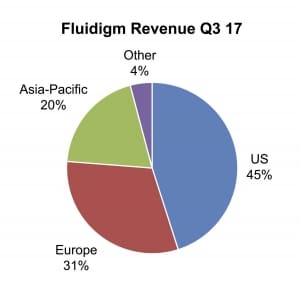

Geographically, for HORIBA’s SI segment, third quarter sales in Asia grew 25.8% to ¥1,821.0 million ($16.2 million), accounting for 29% of segment sales. Representing 28% of segment sales was the Americas, for which sales increased 17.8% to ¥1,729.0 million ($15.4 million). Sales in Europe also experienced healthy growth, up 19.1% to ¥1,236.0 million ($11.0 million). However, sales in Japan fell 18.8% to ¥1,473.0 million ($13.1 million) due to lower analytical instrument sales.

Third quarter sales for HORIBA’s Process & Environmental Instruments & Systems (P&E) segment slid 1.4% to ¥3,955.0 million ($35.2 million). For the quarter, P&E sales accounted for 9% of total company revenue. Operating income fell 60.6% to ¥100.0 million ($0.89 million). Year to date, however, segment sales rose 1.9% to ¥12,034.0 million ($107.1 million), driven by robust sales of stack gas analyzers to Japan and China. Operating income fell 62.4% to ¥422.0 million ($3.8 million) year to date due to weak profitability in Asia and the Americas.

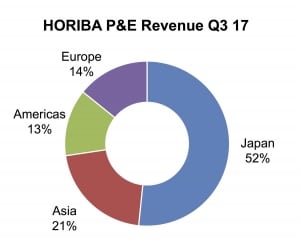

Geographically, the P&E segment’s largest contributor to third quarter sales was Japan, accounting for 52% of segment sales. Segment sales in Japan amounted to ¥2,043.0 million ($18.2 million), a decrease of 0.5%. However, for the rest of Asia, sales increased 45.8% to ¥831.0 million ($7.4 million), driven by strong sales in China. Europe also experienced double-digit growth, up 20.1% to ¥562.0 million ($5.0 million). European sales for the quarter accounted for 14% of segment sales. Conversely, sales in the Americas were down double digits, decreasing 43.4% to ¥520.0 million ($4.6 million), largely due to slow process-measurement equipment sales.

For the fourth quarter, HORIBA expects P&E segment sales to reach ¥4,965.0 million ($44.2 million) and its SI segment to hit ¥8,226.0 million ($73.2 million) in sales. As for the full year, the company projects P&E sales to be approximately ¥17,000.0 million ($151.3 million), a downgrade of ¥1,000.0 million ($8.9 million) from the previous guidance. The sales forecast for the SI segment was revised upwards by ¥1,000.0 million ($8.9 million) to ¥26,000 million ($231.4 million) due to the strong performance of Asia.

Life Science Sales Steady for Merck KGaA

Merck KGaA’s Life Science division (LS) delivered €1,408.0 million ($1,659.4 million at €0.85 = 1$) in revenue, an increase of 1.3%. Organically, LS sales grew 4.8%, with currency effects negatively impacting sales by 3.9 percentage points. Acquisitions, on the other hand, favorably affected sales by 0.4 percentage points.

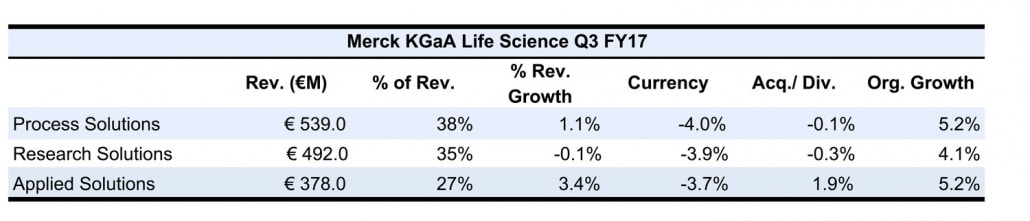

Process Solutions segment sales increased 1.1% to €539.0 million ($635.2 million) on a reported basis. Currency effects negatively impacted sales growth by 4.0 percentage points, while acquisitions deducted 0.1 percentage points. Organically, segment sales rose 5.2% driven by strong demand for single-use products and services. Additionally, the segment’s small molecules business also experienced significant growth, accounting for 30% of total Process Solutions sales. However, the segment’s filtration and chromatography business performed below expectations due to weaker demand globally. Process Solutions sales represented 38% of total LS revenue.

Sales for the Research Solutions segment were mostly flat for the quarter, falling just 0.1% to €492.0 million ($579.8 million). Currency effects and acquisitions both slowed sales growth, decreasing growth 3.9% and 0.3%, respectively. Organic sales growth remained healthy, increasing 4.1% due to solid demand for specialty lab chemicals, particularly the lab essentials portfolio. Additionally, continued strength in the segment’s e-commerce platform in Western Europe and China also contributed to sales growth. The segment’s sales accounted for 35% of total LS revenue.

Applied Solutions sales grew the fastest amongst the three LS segments, advancing 3.4% to €378.0 million ($455.5 million). Currency effects negatively impacted sales growth by 3.7 percentage points, while acquisitions added 1.9 percentage points due to strong BioControl (see IBO 1/15/17) systems sales. Organically, sales rose 5.2%, primarily driven by the segment’s strong performance in its Biomonitoring and Lab Water businesses. Overall, segment sales experienced growth across all regions and businesses. Applied Solutions segment revenue amounted to 27% of total LS revenue.

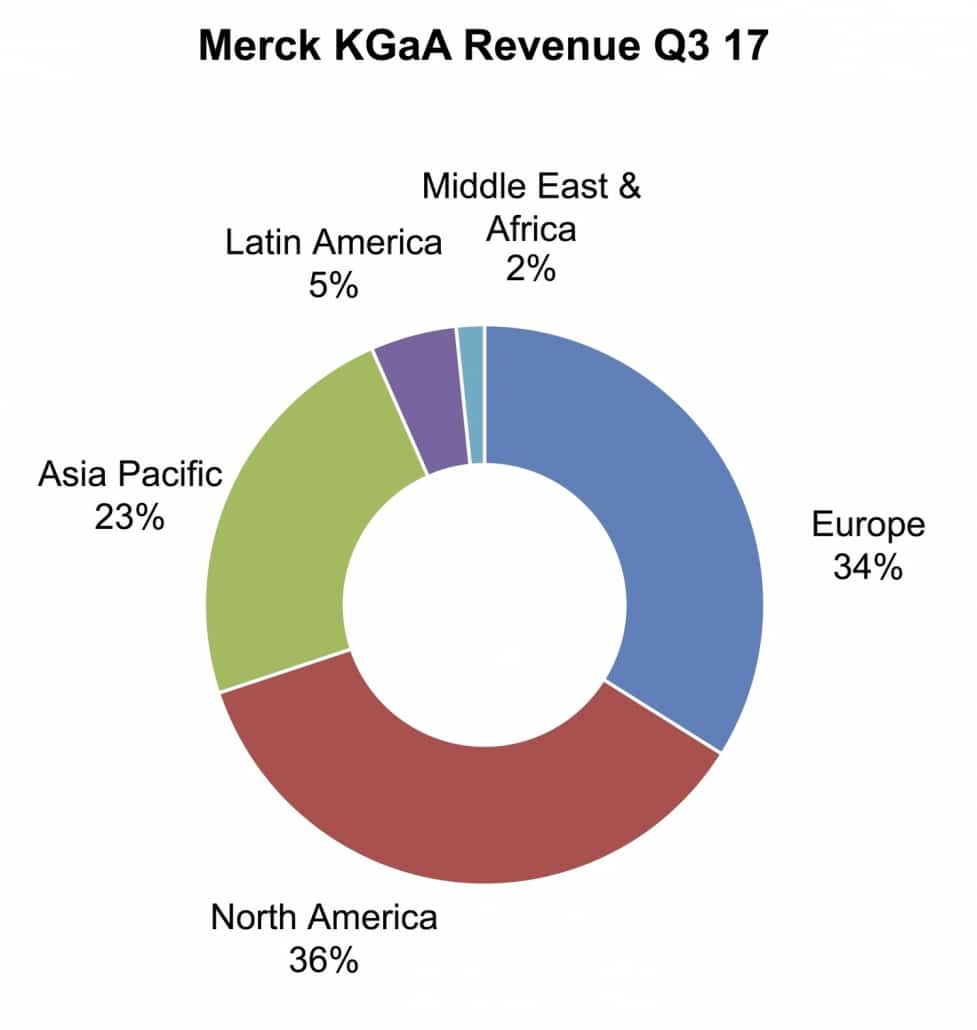

Geographically, North America accounted for the largest percentage of LS sales in the third quarter. North American sales rose 0.7%, on a reported basis, to €507.0 million ($597.5 million) to represent 36% of total LS revenue. Organically, sales increased 5.0%, driven by strong demand in the Upstream & Systems business. Continued sales growth for cell culture media and single-use products also added to North American sales. Sales in Europe advanced 1.9% to €478.0 million ($563.4 million) on a reported basis, accounting for 34% of total LS revenue. European sales grew 2.6% organically and were primarily driven by Research Solutions and Applied Solutions sales.

In the Asia Pacific region, sales were flat, up just 0.2% on a reported basis to €331.0 million ($390.1 million). Organically, however, sales increased 7.1% as currency effects adversely affected sales by 6.4 percentage points. APAC sales were mostly driven by Process Solutions, as cell culture media and single-use products experienced strong demand. Sales in the APAC region represented 23% of total LS revenue.

Sales in Latin America amounted to €70.0 million ($82.5 million), an increase of 3.9% on a reported basis. Organically, sales grew 6.8%, also driven by the Process Solutions segment.

For the full year, Merck KGaA confirmed its group revenue guidance of €15.3 billion ($18.0 billion), the lower end of the previously projected €15.3–€15.7 billion ($18.0–$18.5 million). As for the company’s LS segment, organic sales growth is expected to be around 4%, with EBITDA amounting to €1,780–€1,850 million ($2,097.8–$2,180.3 million).

Product Sales Grow Double Digits for Pacific Biosciences

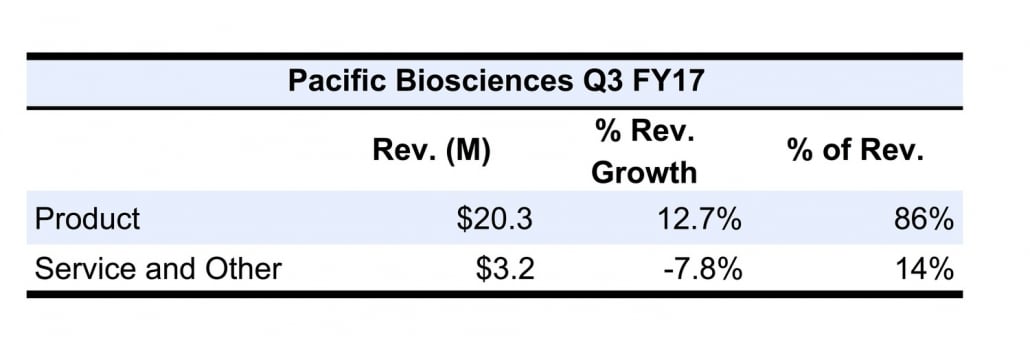

Third quarter revenues for Pacific Biosciences increased 9.4% to $23.5 million, excluding $3.6 million of terminated contractual revenue (see IBO 12/15/2016). However, including the terminated contractual revenue, third quarter sales fell 6.3%.

Product revenue grew 12.7% to $20.3 million for the quarter, driven by strong consumables sales. Instrument sales amounted to $9.7 million, a decrease of 15.6% due to lower-than-expected demand of Sequel and RSII instruments in the US and Europe. However, instrument sales were up 36.6% from $7.1 million sequentially. Consumables revenue leaped 63.1% to $10.6 million, largely driven by a higher installed base of instruments and growth in instrument utilization. Service and Other revenue fell 7.8% to $3.2 million.

Geographically, sales in China continued to experienced significant growth, exceeding 30% of total company sales for the quarter driven by strong Sequel sales to Novogene (see IBO 9/1/17). In the US, instrument sales experienced a slight recovery, but overall government spending still remained below expectations. European sales were significantly lower than expected due to the slow adaptation of Sequel instruments.

Due to slow sales in Europe and the US, Pacific Biosciences revised its full-year revenue guidance to approximately $90 million, a decrease from the previously projected $105–$115 million.

Healthy Gains for QIAGEN Third Quarter

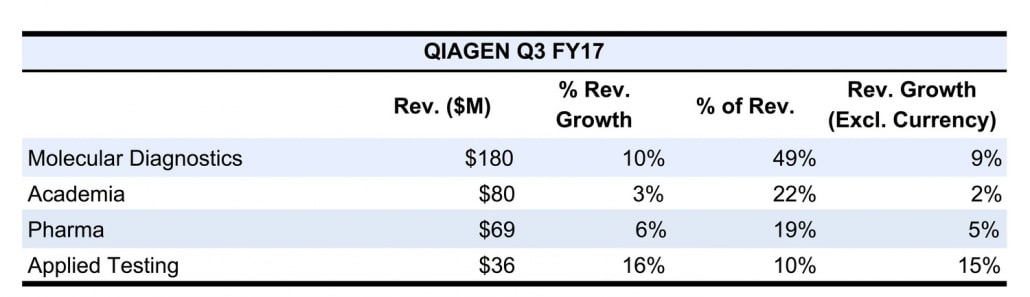

Third quarter sales for QIAGEN advanced 7.6% to $364.4 million, in line with company expectations. Currency effects had minimal impact on total company sales. Organically, sales grew around 6.5%, for which acquisitions added approximately 1.0%.

Consumables and related revenues grew 8% on a constant currency basis, representing around 88% of total company revenues. Instrument sales experienced a recovery from the first half of the year, increasing 2% in constant currencies to represent 12% of total company revenues.

Third quarter sales in QIAGEN’s Molecular Diagnostics segment advanced 9.0% on a constant currency basis, driven by strong QuantiFERON-TB and QIAsymphony automation system and consumables sales. QuantiFERON latent TB test sales grew at company expectations of 25% on a constant currency basis. QIAsymphony consumable sales increased double digits as well, along with revenue from companion diagnostic partnerships. HPV sales were mixed across all regions, with US HPV sales up 4%. HPV sales in Latin America and China both decreased due to the discontinuation of a tender and unexpected regulatory changes.

Academia segment sales increased 2.0% on a constant currency basis primarily due to strong consumables growth. However, a double-digit decline in instrument sales partially offset these gains. Pharmaceutical segment revenue grew 5.0% on a constant currency basis driven by growth in both consumables and instrument sales. Overall geographical sales growth, particularly in Europe, also contributed to segment sales.

For the quarter, sales in the Applied Testing segment leaped 15.0% in constant due to increased demand for Human ID and Forensics solutions in all geographies, especially the Americas and EMEA region.

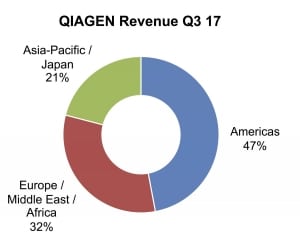

Geographically, sales in the Americas represented the majority of company revenues at 47%. Sales in the Americas rose 3.0% to $172.0 million due to modest growth in Brazil and the US, partially offset by a double-digit decline in Mexico. The EMEA region experienced double-digit growth, increasing 17.0%, 15.0% in constant currencies, to $117.0 million driven by strong sales in France, Turkey and the Netherlands. Sales in the northern area of Europe, along with sales in the Middle East, were weaker than expected, partially offsetting overall EMEA sales growth. However, EMEA sales still accounted for nearly a third of total company sales, at 32%. In Asia Pacific, sales grew 6.0% to $74.0 million, representing 21% of total company revenues. Healthy growth for the region came primarily from strong sales in China, South Korea and India.

For the fourth quarter, QIAGEN expects its adjusted net sales to grow between 5% and 6% on a constant currency basis. Organically, the company projects adjusted net sales growth to be about 4%–5%. As for the full year, QIAGEN expects adjusted net sales growth of about 7% in constant currencies, reaching the higher end of the previously projected 6%–7%. Organically, adjusted net sales are projected to grow 5%–6%, with 1%–2% growth from acquisitions.