Trump Budget Proposal Tests IBO Indexes

The US equity markets remained resilient in March despite uncertainties over President Trump’s pro-growth policies and selling pressure on global financial institutions following an investigative money laundering report. On March 20, the British newspaper The Guardian reported that a network of global banks were complicit in a $20–$80 billion money laundering scheme to move money out of Russia from 2010 to 2014, sending bank shares sharply lower. Furthermore, the devaluation of the US dollar in March exposed muted confidence that President Trump’s budget or tax proposals will be implemented.

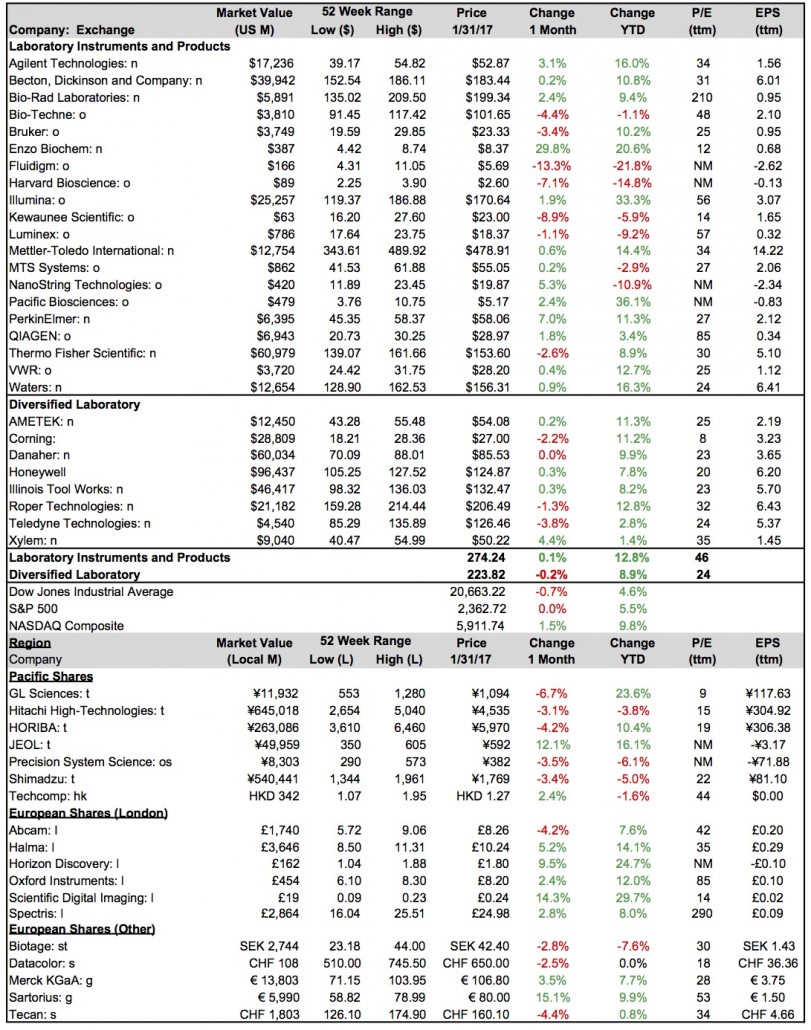

Nevertheless, consumer confidence remained robust, approaching levels not seen since the dotcom era in 2000. Finally, fourth quarter US GDP growth was slightly ahead of consensus, advancing 2.1% due to strong consumer spending. On the cautionary side, the GDP report showed increased inventory, as well as declining exports and federal government spending. For the month, the NASDAQ advanced 1.5%, while the Dow Jones Industrial Average slipped 0.7% and the S&P 500 was roughly unchanged. For the first quarter, the Dow, S&P 500 and NASDAQ are up 4.6%, 5.5% and 9.8%, respectively.

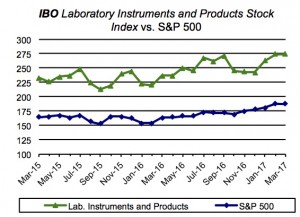

Laboratory Instrumentation Index

The Index edged higher by 0.1% in March and is up 12.8% for the year to 274.24. A majority of companies in the Index advanced for the month despite concerns over President Trump’s budget proposal, which included a 20% cut to NIH funding (see Industry Watch).

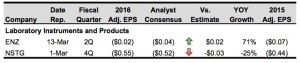

Enzo Biochem recorded the highest return for the month, soaring 29.8%. The company beat fiscal second quarter sales (see Bottom Line) and adjusted EPS estimates on March 13 due to increased margins for molecular diagnostic testing products and healthy revenue growth in its Life Sciences segment.

NanoString Technologies and PerkinElmer were the only two companies to experience notable price increases for the month, advancing 5.3% and 7.0%, respectively. PerkinElmer was upgraded by Janney Montgomery Scott on March 27 from “Neutral” to “Buy.”

On March 1, NanoString reported strong fiscal fourth 2016 quarter sales growth of 39% but missed adjusted EPS estimates. Despite the strong sales growth, academic demand for both instruments and consumables missed company estimates. The company projected its GAAP EPS loss to widen 11% in 2017 to $2.51–$2.69.

Conversely, shares for a number of companies in the Index were negatively impacted by earnings results or concerns over NIH funding. Fluidigm recorded the sharpest decline for the month, falling 13.3%. Kewaunee Scientific dropped 8.9% for the month after reporting weak EPS results in the previous month (see IBO 2/28/17).

On March 9, Harvard Bioscience reported lower organic sales growth for the fourth quarter 2016 (see Bottom Line), while adjusted EPS were flat at $0.01. The company projected 2017 adjusted EPS of $0.05–$0.07. Shares contracted 7.1% for the month.

In other ratings changes, on March 15, Morgan Stanley upgraded Agilent Technologies from “Equal Weight” to “Overweight.” On March 20, Leerink Swann upgraded Illumina from “Market Perform” to “Outperform.”

Diversified Instrumentation Index

The Index slipped 0.2% for the month to 223.82 but is up 8.9% year to date. Shares were mixed for the month as Xylem climbed 4.4% to lead the Index, while Teledyne Technologies lapsed 3.8%.

Danaher, which was roughly flat for the month, was downgraded by both Goldman Sachs and Citigroup from “Buy” to “Neutral” on March 14 and March 31, respectively. Illinois Tool Works was downgraded by Stifel on March 27 from “Buy” to “Hold.” Shares traded marginally higher for the month.

International

Most Asia Pacific equity markets traded in positive territory in March, except for Japan’s Nikkei 225 and China’s Shanghai Composite, which fell 1.1% and 0.6%, respectively. Indonesia’s Jakarta Composite and South Korea’s Kospi recorded the strongest momentum, advancing 3.4% and 3.3%, respectively.

Prices for most Pacific Rim companies in the IBO Stock Table declined this month, led by GL Sciences, which dropped 6.7%. However, JEOL and Techcomp ended the month in positive territory, rising 12.1% and 2.4%, respectively. On March 16, Techcomp reported that full-year 2016 sales advanced 6.5% (see Bottom Line), while EPS slumped 71% to $0.37 due to increased operational expenses within the Manufacturing segment.

All major European Indexes traded higher in March, led by Italy’s FTSE and Spain’s IBEX, which gained 8.4% and 9.5%, respectively.

Prices for the UK-based companies in the IBO Stock Table all traded higher in March except for Abcam, which contracted 4.2% despite strong earnings growth. On March 3, the company reported that adjusted EPS grew 33% to 2.86 pence ($0.04) for the six months ending December 31, 2016, driven by continued strength for RabMAb primary antibodies and demand in China. The company also raised its interim dividend by 20% to 2.825 pence ($0.04). The company maintained its full-year currency-neutral sales growth outlook of 9%–11%. On March 7, Numis Securities downgraded Abcam from “Add” to “Hold.”

In contrast, Scientific Digital Imaging and Horizon Discovery climbed 14.3% and 9.5% for the month, respectively.

Shares for other European companies were mixed for the month, as Sartorius jumped 15.1% and Tecan declined 4.4%. On March 15, Tecan reported that EPS for the second half of 2016 slipped 1.5% to CHF 2.70 ($2.72) as a result of increased operational expenses, especially for R&D. The company projected 2017 currency-neutral sales to grow at least 6%.

Merck KGaA, which improved 3.5% for the month, reported on March 9 that fourth quarter 2016 adjusted EPS jumped 26% to €1.43 ($1.54). Earnings growth benefited from the acquisition of Sigma-Aldrich (see IBO 11/30/15) and cost synergies within the Life Science segment, as well improved profitability in the Performance Materials segment. The company’s 2016 dividend increased 14% to €1.20 ($1.33). Merck KGaA projected slight to moderate organic revenue growth for 2017.