Bio-Techne Looks Ahead

Life science research and diagnostic tools firm Bio-Techne updated its latest progress and business plan at its investors’ day presentation earlier this month. The company has grown rapidly following the transition to new leadership in 2013. Among its most well-known product lines are proteins, antibodies, automated Western blotting instrumentation and hematology controls. For the fiscal year ending June 30, the company reported a 14.2% increase in revenues to $643 million. Excluding acquisitions and currency effects, sales grew 9%. The combined annual growth rate over the five-year period was 16%.

Acquisitions have been a key part of its strategy, with Bio-Techne having purchased 14 companies since 2013. As the company emphasized in its presentation, its reagent offerings are the core of its business with acquisitions built around using these offerings to develop specific workflows or with the company’s instrumentation offerings. As CFO Jim Hippel told investors, “We see our core reagents as the center of the wheel, and all these businesses the various spokes that go out from it.”

Bio-Techne’s most recent acquisitions of Exosome Diagnostics and Quad Technologies, both purchased this summer, are representative of this strategy. Acquired in June, Quad Technologies provides tools for cell separation and activation for the research and manufacturing of cell therapies. Bio-Techne’s antibodies will be used in Quad Technologies’ MagCloudz cell separation kits, which are an alternative to traditional bead-based magnetic separation.

Exosome Diagnostics marks Bio-Techne’s entry into the liquid biopsy market, with a technology for the analysis of cell-free DNA as well as exosomes in blood samples. In contrast to other liquid biopsy techniques that measure only cell-free DNA or circulating tumor cells, exosomes carry RNA transcript information. Bio-Techne’s biologicals, including cytokines, will be used as part of Exosome Diagnostics’ tests. The acquisition also completes a broader strategy goal of the company. Bio-Techne CEO Charles Kummeth commented, “Following this acquisition, the company now sells solutions to the entire workflow of cancer: research, diagnostics and therapeutics.”

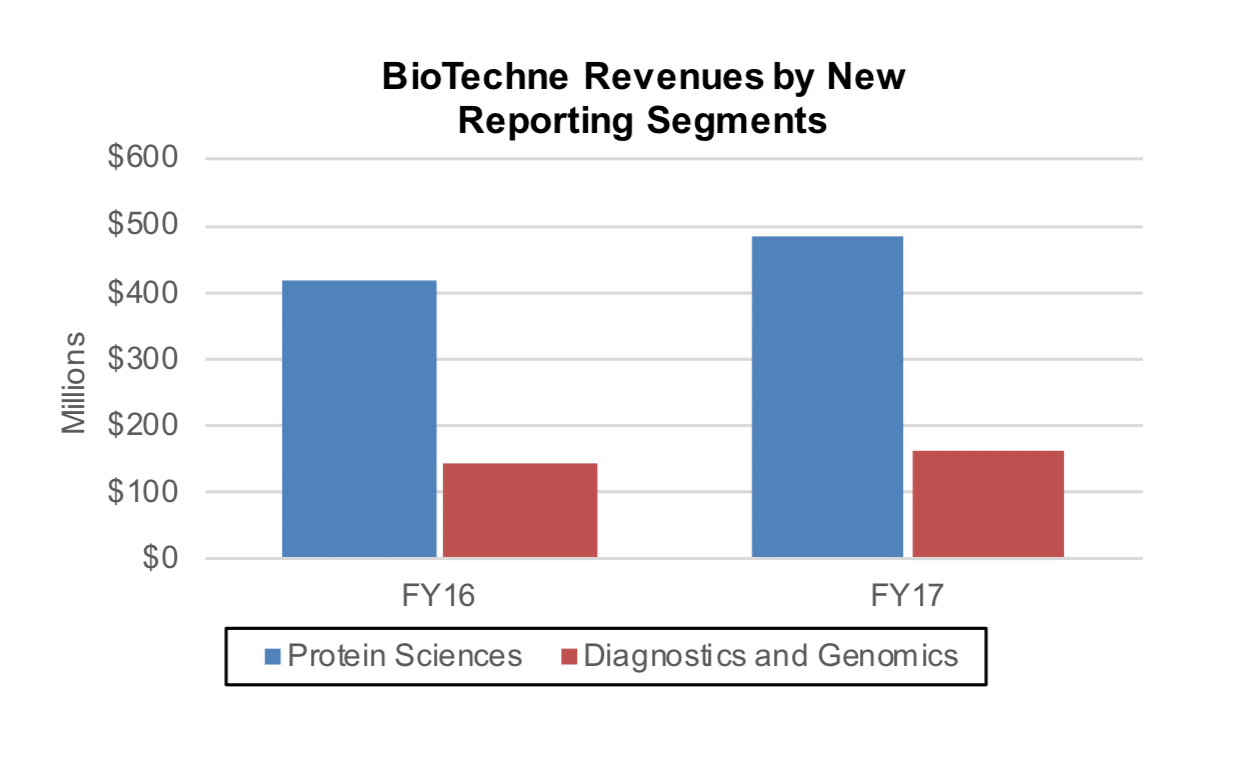

Starting with fiscal 2019, Exosome Diagnostics forms part of Bio-Techne’s new Genomics division, which is made up of two new reporting segments: Diagnostics and Genomics. The other businesses are now part of the Protein Sciences segment, consisting of the company’s newly named Reagent Solutions and Analytical Solutions businesses.

Bio-Techne also used the investor event to update its mid-term revenue outlook, with a goal of $1.2 billion in revenues in fiscal 2023, excluding future acquisitions. Protein Sciences revenue are forecast to grow more than 8%–11%. Diagnostics & Genomics Segment sales are expected to increase over 20%. Although Bio-Techne will continue acquire firms, the company’s focus has changed. As Mr. Kummeth told investors, “We’re going to remain active, but we’re going to be more and more opportunistic. We’re probably really focused more now on driving this core and what is organic, and being more opportunistic on the M&A front.”

Source: Company SEC filing