Dividends and the Financial and Market Status of Laboratory Tool Companies in 2020

At the beginning of 2020, the US stock market indicated it would continue to be bullish like it had been for more than 10 years. However, by March, the COVID-19 virus was beginning to spread worldwide, swiftly impacting both the US and global economies. As a result, industries began to enact cost-saving measures and adjust business operations to weather the financial effects.

One cost-saving measure a public company can adopt is suspending or trimming its quarterly dividend payments to shareholders, which can have the effect of negatively influencing investor sentiment about the company of its industry. On April 2, Bloomberg analysts forecast that 21 companies in the S&P 500 were expected to cut their calendar year second quarter dividend payments in order to save cash.

On May 31, Barron’s reported that 40 companies in the S&P 500 had suspended their dividends in the first and second quarters, while 18 businesses had announced dividend cuts. In addition, many companies pulled their 2020 annual sales guidance due to the uncertain direction of the economy. The “dividend massacre,” as Barron’s called it, is a signal that various industries are facing financial headwinds as a result of COVID-19.

The laboratory tool industry, which as defined here excludes companies that are solely devoted to diagnostics products, also had to adjust to the sudden end-market changes stemming from the pandemic. Global lockdown measures that closed or curtailed operations at many labs caused tepid demand for many lab tool companies’ product lines, forcing them to adapt their business operations and financial outlooks. This was true even for some lab tool companies offering products for COVID-19 -related activities such as diagnostic testing, and vaccine and therapy development.

A change in the status of a laboratory tool provider’s dividend payout amount may be an indicator of its market and financial status as well as may influence investor sentiment.

In September 2019, Instrument Business Outlook (IBO) published a blog titled “Scientific Instruments Companies and Dividends,” which summarized the market fundamentals of dividend payments and the role they play as a barometer of the financial and market state of a company and/or industry. The information stemming from that article outlines the decisions a company may make regarding its dividends by using market fundamentals.

In general, when a company keeps a consistent dividend payment schedule it may mean a steady economic outlook, and the routine payment encourages shareholders to maintain their investments. An increase in the dividend payment amount, whether on a quarterly, annual or intermittent basis, may signal that a business’s financial position or market outlook is improving and may boost investor sentiment. In contrast, a decrease or suspension of a dividend payment may indicate that a company’s financial situation has changed; for example, it may need to preserve cash as sales slow. Also, a rise in dividend payment can cause a temporary increase in share price, which usually requires a new investor to pay a premium.

Eleven laboratory tool companies that make regular dividend payments are reviewed here. Each participates in different sectors of the scientific instrument market and each to a different extent. The major providers reviewed here are Agilent Technologies, Bio-Techne, Bruker, Danaher, Kewaunee Scientific, PerkinElmer, and Thermo Fisher Scientific. AMETEK, Becton, Dickinson (BD), Luminex and MTS Systems offer a more selected line of laboratory products through certain divisions.

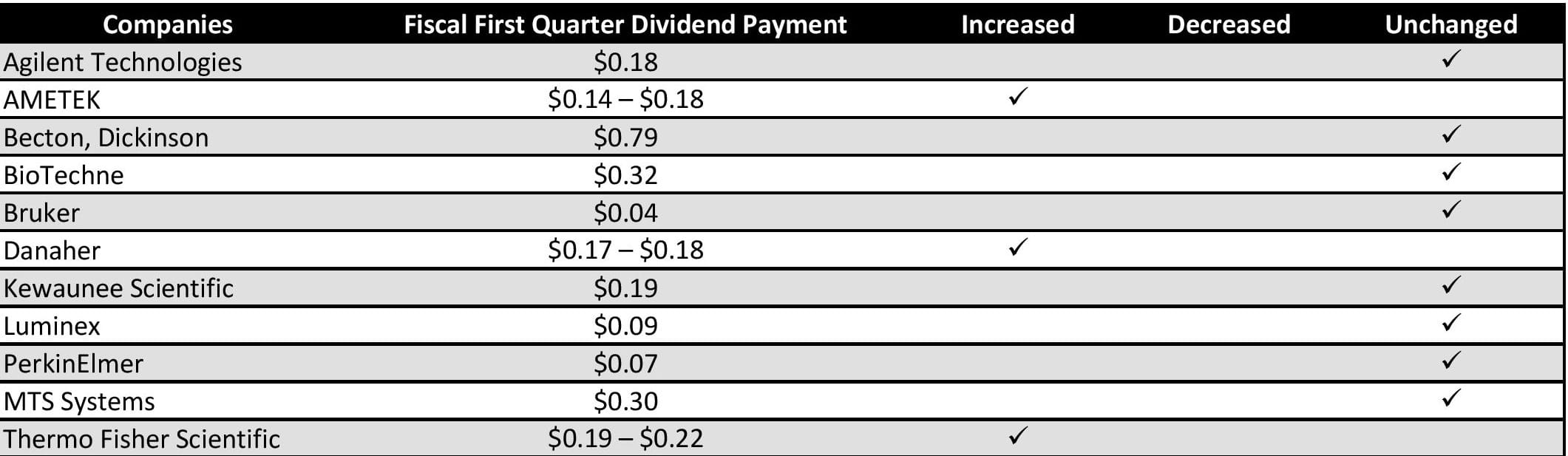

Calendar First Quarter Ending March 31

In the first quarter, the impact of the COVID-19 virus on laboratory product suppliers was mainly confined to China as labs closed and the economic activity in the country came to a halt. But as the virus spread worldwide, many companies noted a more pronounced effect in March. Nonetheless, 7 of the 11 corporations examined here reported sales growth in the first quarter ranging from the low single digits to the low teens. Specifically, first quarter revenues for BD, Bio-Techne, Danaher, Kewaunee Scientific, Luminex, PerkinElmer and Thermo Fisher rose 1.4%, 5.3%, 3.0%, 5.7%, 9.7%, 0.6%, and 1.7%, respectively. In contrast, AMETEK, Bruker and MTS Systems experienced revenue declines, posting 6.6%, 8.1% and 9.3% decreases. Agilent concluded the quarter flat.

Also, as of March 31, all 11 companies had posted declines in share price in line with US stock market conditions, except for Luminex, which experienced an 18.9% uptick. Specifically, share prices for Agilent, AMETEK, BD, Bio-Techne, Bruker, Danaher, Kewaunee Scientific, PerkinElmer, MTS Systems and Thermo Fisher fell 16.0%, 27.8%, 15.5%, 13.6%, 29.6%, 9.8%, 43.2%, 22.5%, 53.2% and 12.7%, respectively. Despite the macroeconomic financial scenario, most of the companies maintained their dividend payments throughout the quarter, while AMETEK, Danaher and Thermo Fisher announced dividend increases.

AMETEK was an outlier compared to Danaher and Thermo Fisher. It suffered a quarterly revenue decline but increased its dividend payment by 28.6% to $0.18 from $0.14. The company explained this decision by reaffirming its confidence in its product lines and the adjustment business strategies, which improved its quarterly operating margin. Additionally, AMETEK highlighted that its cash flow could be used for M&A activity and to continue to pay dividends to its shareholders.

Danaher augmented its dividend by a cent to $0.18 from $0.17 in the first quarter yet did not provide commentary about the decision. Amongst the three companies increasing their dividend payments, Thermo Fisher enacted the biggest change, a 15.8% increase to $0.22 from the previous $0.19. Yet like Danaher, it did not comment on the decision.

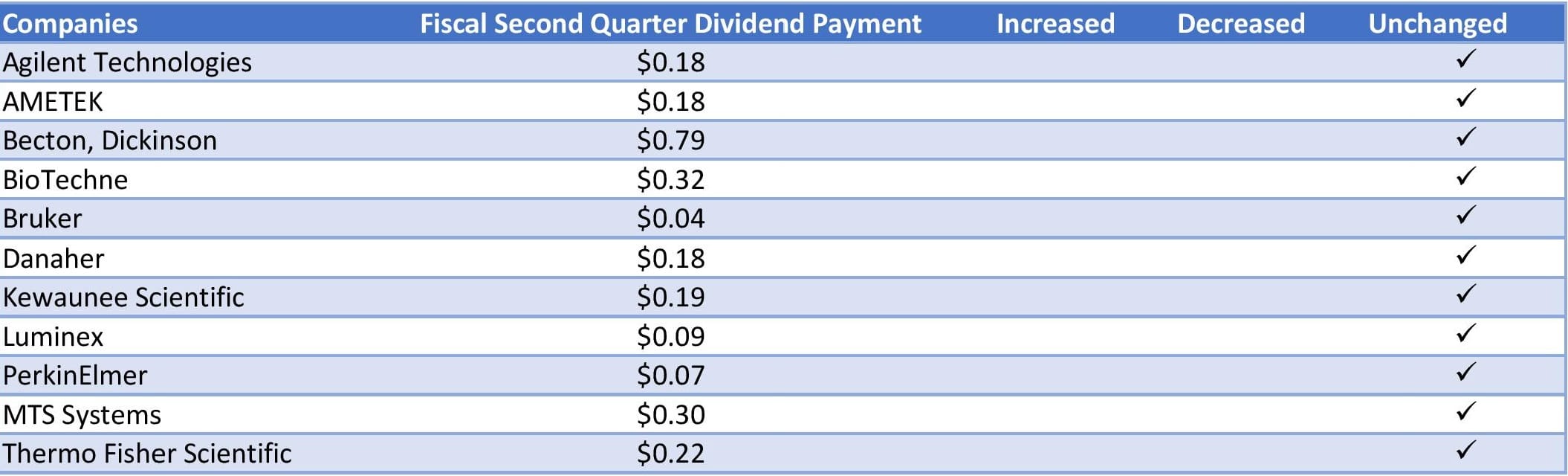

Fiscal Second Quarter Ending June 30

In the calendar year second quarter, the impact of the COVID-19 pandemic resulted in mixed financial results for the reviewed companies. Four of the 11 posted positive sales growth ranging from the high single-digits to the low thirties thanks to strong demand for their products and services meeting the needs for COVID-19 testing and vaccine-capacity preparation. The laboratory tool providers that posted positive sales growth were Danaher, Luminex, PerkinElmer and Thermo Fisher, rising 19.2%, 31.2%, 12.3% and 9.5%, respectively. In contrast, AMETEK, BD, Bio-Techne, Bruker, Kewaunee Scientific and MTS Systems finished the quarter with sales falling 21.5%, 11.4%, 8.3%, 13.4%, 1.4% and 15.5%, respectively. These businesses cited various disruptions stemming from the epidemic, which resulted in delayed orders, soft demand for multiple lab product lines and other negative results. As of the publication date of this article, Agilent has not announced its second quarter results.

By the end of the second quarter, 11 out of the 12 companies share prices had moved downward in tandem with their reported quarterly sales performance. For instance, as aforementioned, AMETEK, BD, Bruker, Kewaunee Scientific and MTS Systems posted negative sales growth and posted declines in share prices, which sank 10.4%, 12.0%, 20.2%, 30.9%, and 63.4%, respectively year to date.

In contrast, in addition to achieving quarterly revenue growth, Danaher, Luminex, PerkinElmer and Thermo Fisher also posted an increased share price of 15.2%, 40.5%, 1.0% and 11.5%, respectively. The only company that did not adhere to this trend was Bio-Techne, which, despite posting negative revenue growth, saw its share price performance experience a 20.3% uptick. Although not yet having announced its second quarter financials, Agilent experienced a 3.6% gain in share price by June 30.

Conclusion

The relatively stable dividend payments maintained by the 11 laboratory tool companies so far in 2020 provide a snapshot of a relatively resilient industry but one that is adapting to global economic uncertainty and customer disruptions. Since these companies have products and services that can meet COVID-19-related market demand and, in the case of other markets, labs worldwide are returning to or are expected to resume operations in the near term, sustaining dividends is a welcomed sign for shareholders.