Scientific Instrument Companies and Dividends

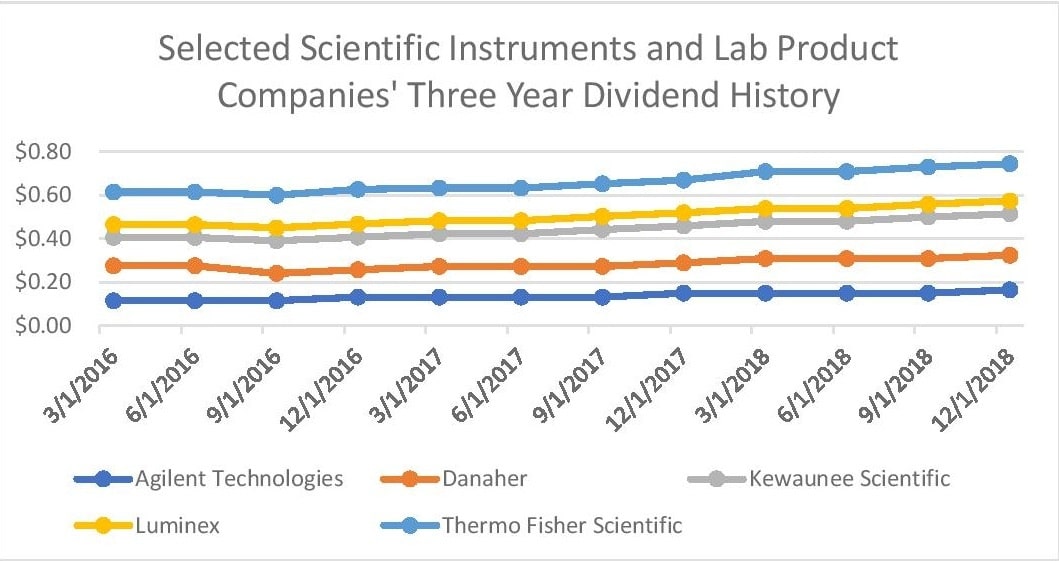

For the calendar year 2018, scientific instrument and lab product industry demand totaled $62.4 billion. Although numerous public companies provide cash dividend payments to their shareholders, of the 21 scientific and lab product companies reviewed here, only 6 paid dividends in the calendar year 2018, Agilent Technologies, BD, Danaher, Kewaunee Scientific, Luminex and Thermo Fisher Scientific. Instead, they used their cash flow to reinvest in projects or expand their operations in line with the industry’s technology focus, M&A activity and sales growth.

Companies that are financially stable and have extra cash flow either reinvest or pay investors dividends to encourage further investing. Stable dividend policies mean investors are getting paid dividends consistently despite a company’s fluctuation in earnings and boost dividends annually in order in many cases to show confidence in future profits and cash flow.

A positive side effect of a dividend payment announcement is investors buy a company’s stock before receiving payment, causing a temporary increase in share prices. Usually, investors pay a premium on the stock but are willing to do this because they profit from the stock increase in addition to receiving the dividend payment. In contrast, when a company decreases a dividend payment or does not do an annual dividend boost, it usually indicates a tactic of retaining earnings for reasons such as a decline in revenues. Since perception is everything in the US market, a dividend decrease can be considered a red flag despite the reason.

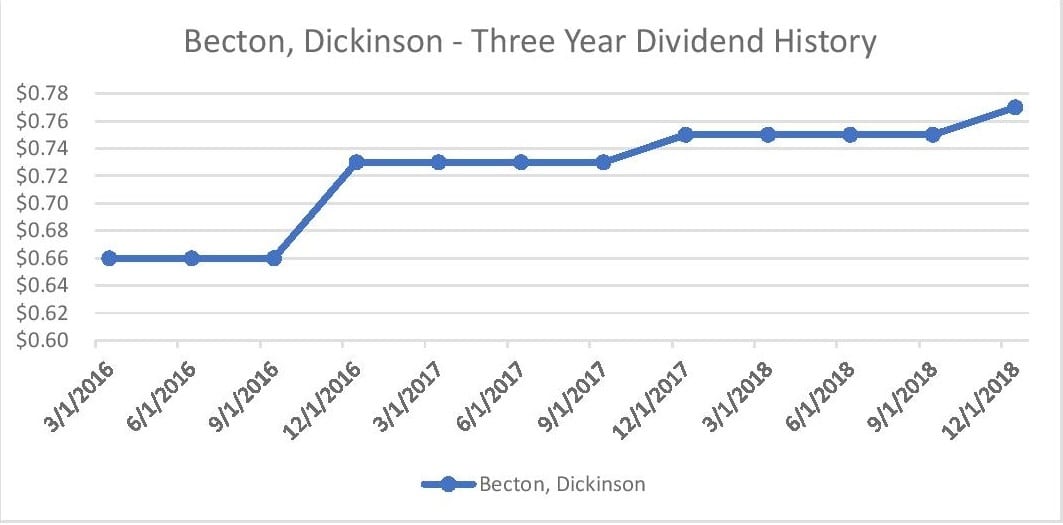

The market fundamentals of a company that would provide a dividend payment apply to the companies that do the 5 companies examined here. Each of these companies delivered gains in revenues and share prices for the year ending December 31, 2018. Gains in revenues for these 5 companies ranged from the low single digits to mid-thirties. Specifically, fiscal year revenues for Agilent Technologies, BD, Danaher, Kewaunee Scientific, Luminex and Thermo Fisher Scientific rose 6.0%, 35.1%, 7.0%, 15.2%, 3.0% and 16.4%, respectively. Each company’s share price experienced gains in calendar year 2018, which highlighted the stable nature of the companies amongst mixed stock price performance for the 21 companies reviewed here. Specifically, 2018 share price gains for Agilent Technologies, BD, Danaher, Kewaunee Scientific, Luminex and Thermo Fisher Scientific rose 0.7%, 5.3%, 11.1%, 14.6%, 17.3%, and 17.9%, respectively. Each company’s increases in share price and revenues distinctly showed that its strong financial performances justified distributing dividends.

Another common denominator was each company had an established stable dividend policy, meaning they distributed cash dividends quarterly last year. In contrast, dividend boosts varied amongst the companies regarding when they occurred and their growth rates. Agilent Technologies and BD’s dividends boost occurred in December 2018, with their cash dividends rising 10.1% and 2.6%, respectively. In 2018, cash dividends for Thermo Fisher Scientific, Luminex and Danaher increase but did this year. Thermo Fisher Scientific and Luminex’s dividend boost occurred in March 2019, while Danaher’s did not happen until September 2019. Lastly, Kewaunee Scientific’s dividend boost occurred in the middle of 2018, with an 11.8% increase.

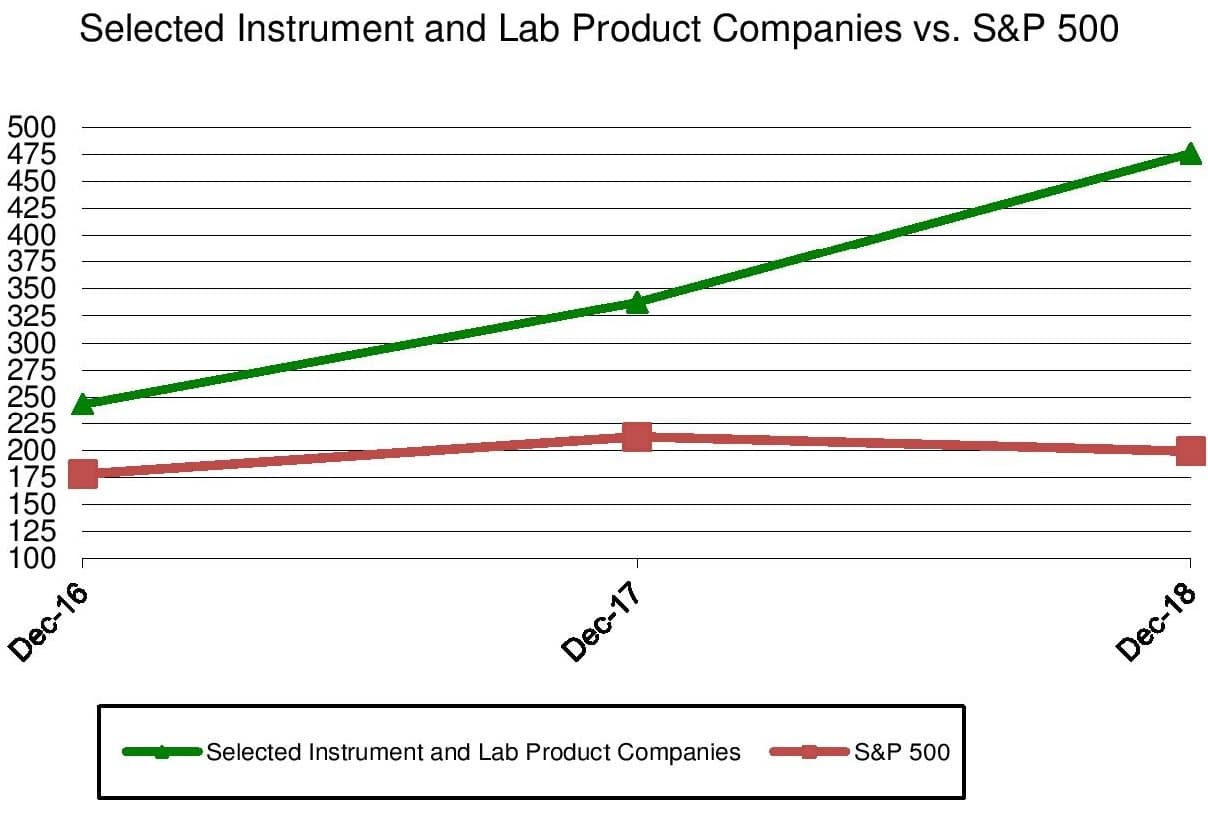

For 2018, 21 scientific instruments and lab products tracked here delivered double-digit gains in share price, precisely 10.5%, compared to the S&P 500, which declined 6.2%. Despite more than 300 companies in the S&P 500 distributing or increasing dividend payments in that year resulting in a 9% increase in dividend payments in total, the S&P 500 index total return was impacted by multiple factors. These factors included the US-China trade dispute, which began in January 2018, a 25-percentage point increase in interest rates that occurred on December 20, 2018, and a steep drop in oil prices due to concerns of slowing demand for the commodity. As a result, it was the worst year for the S&P 500 since 2009. By comparison, the 21 companies reviewed here delivered a mixed performance with 12 out of 20 companies experiencing share-priced gains.

In conclusion, the scientific instrument and lab product companies that provided 2018 cash dividend payments were aligned with the US market tradition of companies with a stable dividend policy. However, due to the nature of the industry, most companies examined reinvested their capital. As a whole, the scientific instrument and lab product industry delivered an exceptional stock performance in the US market despite various macroeconomic events occurring in that year.

This article is based on the IBO newsletter stock index. For more information on IBO, please visit us at https://instrumentbusinessoutlook.com/