Latest R&D Figures for Japan Show a Return to Growth

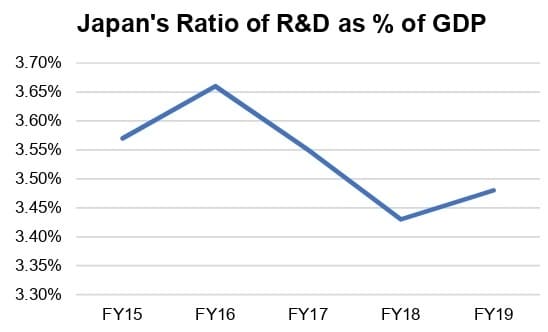

In fiscal year (FY) 2019 (ending March 31), Japan’s R&D spending as a percentage of GDP rose for the first time since FY16 to 3.48%, according to the recently published Statistical Handbook of Japan, prepared by Statistics Japan.

The change was congruent with the country’s increase in R&D spending last fiscal year. In FY19, following two years of decline, R&D investments grew 3.3% to ¥19,050 billion ($171.9 billion). The growth rate surpassed Japan’s 0.8% rise in GDP. Although the increase in total R&D expenditures was a welcome reversal of the decline, it was a not return to previous levels. In FY16, the last time R&D spending rose for the country, it grew 4.6%.

In FY19, the trend was also positive for growth in Japan’s number of researchers, which increased 1.6% to 867,000 in FY19 compared to a 0.8% increase in FY18 and a 2.3% decline in FY17. But the increase trailed the country’s overall increase in the number of employed persons in FY19, which rose 2.1%.

The country’s primary employer of R&D personnel is the business sector, accounting for 58% of all researchers in FY19, with more than 90% working in manufacturing. In fact, the business sector accounted for 73% of all R&D expenditures in FY18 (the last year for which information was available).

Within manufacturing, 40% of R&D personnel were employed by the automotive segment in FY19, followed by IT at 15%. The figures correlate with those industries’ percentage of business R&D expenditures in FY18 (the last year for which information is available), which stood at 36% and 21%, respectively.

6Like business, nonprofits and public organizations’ percentage of R&D spending compared to percentage of R&D workers was also larger. This sector represented 8% of FY18 R&D expenditures (the last year for which information is available), yet its R&D personnel made up just 4% of all researchers in FY19.

In contrast, the share of R&D personnel at universities and college in FY19 was larger than its share of R&D expenditures at 38% in FY19 versus 19% in FY18 (the last year for which information is available). By field, life science R&D was the largest with 17% of R&D expenditures. IT was the second largest at 12% and environmental science trailed at 6%.

Looking Ahead

This summer, Japan cut its 2019 GDP growth forecast from 1.3% to 0.9% for FY20, reflecting slower-than-expected growth in exports due to trade with China. Looking ahead, the uncertainty regarding exports is also affecting Japanese business spending. According to a Reuters survey of 504 companies released this week, 56% of companies surveyed reported they have put a portion of their worldwide capital investments on hold for the FY. Whether such cuts could affect businesses’ R&D spending this FY is not clear. But in a Nikkei July survey, 231 firms stated that R&D spending this year for their companies will increase 4.5%, with the automotive industry’s R&D investments estimated to rise 6.4%.