Modest Growth Expected for the Analytical and Scientific Instrumentation Industry in Europe

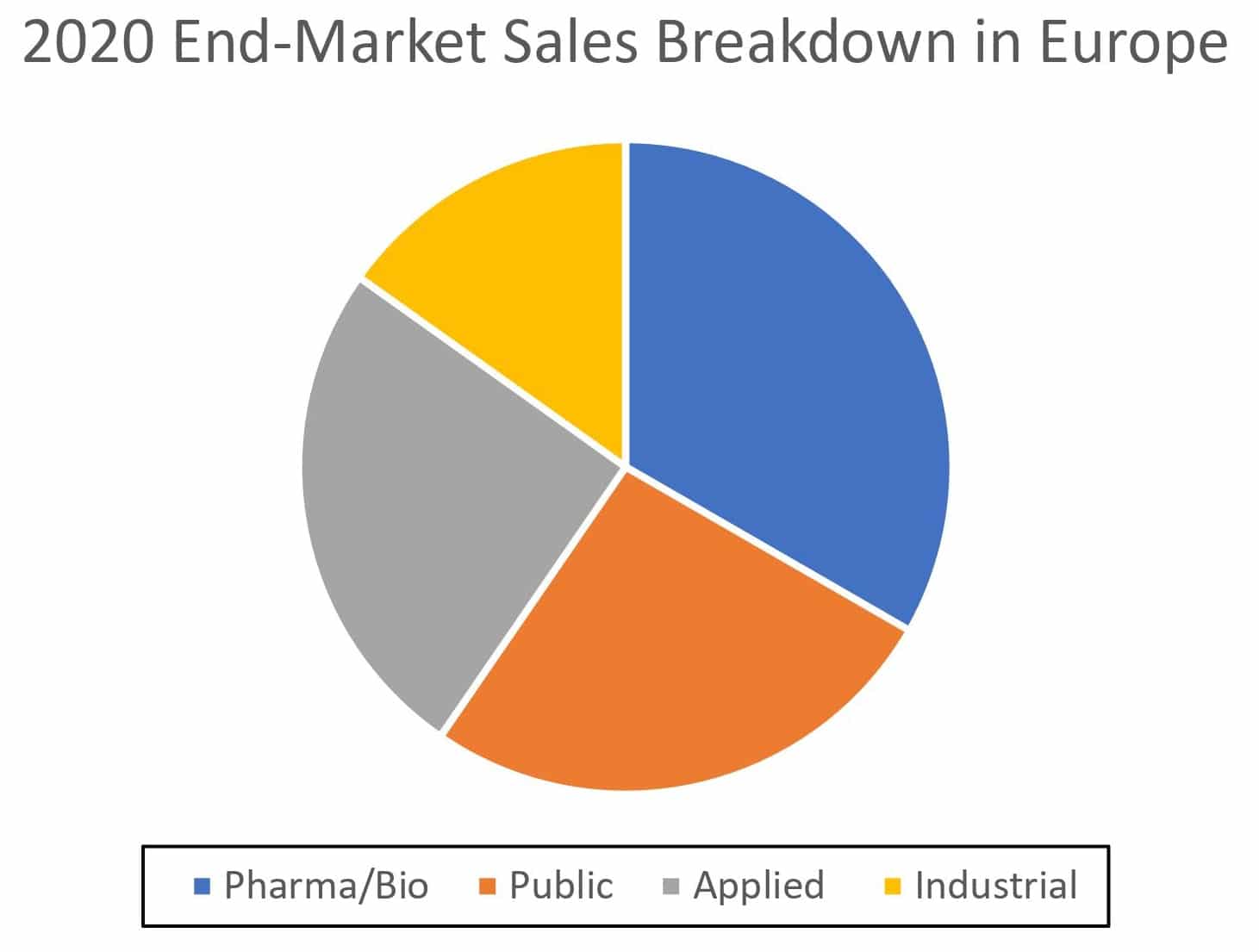

According to IBO’s publisher Strategic Directions International (SDi), part of Science and Medicine Group, the analytical and scientific instrument industry plays a crucial role in various end-markets in Europe. A prime example was the advent of the COVID-19 pandemic in 2020, with top vendors providing products and services to European pharmaceutical developers and manufacturers to create vaccines. Beyond the pandemic, the analytical and scientific instrument industry will continue to increase its installed base in Europe.

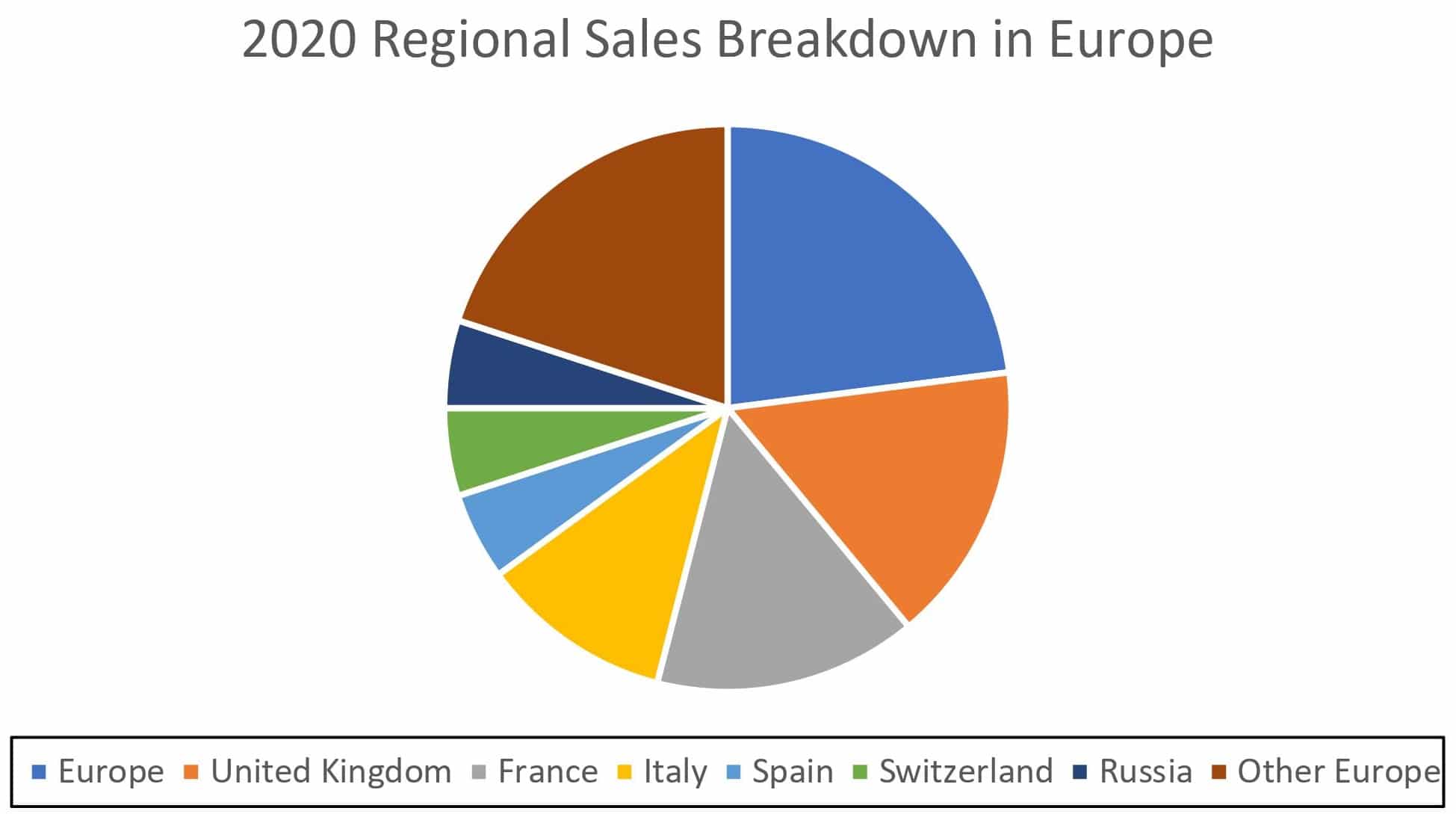

In June 2021, SDi released “Europe 2021: The Market for Laboratory Analytical & Life Science Instrumentation,” which provides an overview of the European market for analytical and life science instrumentation and forecasts for 2025. Specifically, the report reviews technologies, market developments and forecasts by country, product type, and other categories. The countries covered in the report are Belgium, Denmark, France, Germany, Italy, Other Europe (Eastern European countries), Spain, Sweden, Switzerland and the UK.

The report categorizes instrumentation into 10 technology sectors: atomic spectroscopy, chromatography, lab automation, lab equipment, life science instrumentation, materials characterization, molecular spectroscopy, mass spectrometry (MS), sample preparation and surface science. According to the report, Agilent Technologies, MilliporeSigma and Thermo Fisher Scientific are top vendors for analytical and scientific instrumentation in Europe. For the report, SDi used primary sources, including interviews, and secondary resources, such as company financial reports, industry publications and other resources.

In 2020, the analytical and scientific instrumentation market in Europe was worth over $18.5 billion, and it is forecast to rise at a low single-digit CAGR through 2025. The report forecasts MS instrumentation to be the primary growth driver.

Geographically, in 2020, Germany and the UK were the largest regional markets for scientific instrumentation. However, the report predicts that Russia will be an important market for revenue growth because of substantial investment in the country’s academic sector and gas and oil industry.

In 2021, chromatography, life science instrumentation and sample preparation are expected to be the largest analytical technology markets in Europe. However, the report forecasts materials characterization and MS will be the primary growth drivers through 2025. Additionally, the report expects atomic spectroscopy, life science instrumentation and surface science to show similar growth rates.

Materials Characterization

Drug discovery and R&D in the pharmaceutical and biotech end-markets are primary drivers of the materials characterization market in Europe. On a geographical basis, the report forecasts materials characterization demand to increase the most in Russia and various Eastern European countries. Particle characterization is expected to be the most popular technology within the sector over a five-year period. In 2020, Instron (Illinois Tool Works), Malvern Panalytical (Spectris) and TA Instruments (Waters) were the top vendors for materials characterization technology.

MS

The report predicts the MS sector will continue to expand its market presence in Europe thanks to strong demand from the applied, and pharmaceutical and biotech end-markets. One reason is increased activity in drug discovery and life science research. Among MS technologies, quadrupole and TOF LC-MS systems are projected to experience the greatest demand over the next five years. Agilent, SCIEX (Danaher) and Thermo Fisher were the top MS suppliers to this market last year.

Atomic Spectroscopy, Life Science Instrumentation and Surface Science

As aforementioned, the report anticipates revenues for the atomic spectroscopy, life science instrumentation and surface sciences sectors to rise at similar growth rates over the five-year period. Atomic spectroscopy market sales are projected to grow because of demand for XRF instruments in Europe’s applied and industrial end-markets. Thanks to playing an essential part in coronavirus vaccine and therapeutics development and surveillance, sequencing techniques are expected to drive the growth of Europe’s life science instrumentation market. Lastly, surface science instrument growth is anticipated due to the European public sector’s investment in confocal and advanced microscopy for life science and materials research.

Conclusion

Overall, the report concludes that instrument demand in Europe will be modest yet show strong pockets of growth in select countries, end-markets and technologies. One overarching factor increasing demand will be the rise in Europe’s aging population, making the healthcare sector a prime market for instrumentation industry growth. It will be interesting to see what will transpire after the COVID-19 pandemic becomes less of a dominating force in Europe.