The Importance and Role of the Lab Instrumentation Service Market

Service revenues play a small yet pivotal role in lab instrumentation companies’ revenues. As analytical and life science technologies’ applications diversify in various end-markets, the maintenance and upkeep of associated instruments become even more important. For example, with the advent of the COVID-19 pandemic in 2020, remote and software support proved essential for end-users due to worksite closures and social distancing restrictions. In addition, service demand is now also benefiting from the ramp-up in analytical and life science instrumentation sales and the easing of safety protocols at worksites.

In September 2021, Strategic Directions International (SDi) released “The 2021 Analytical & Life Science Instrumentation Service Market” report. The report provides an overview of the lab instrumentation service market in 2020 and provides future estimates through 2025. The report includes overviews of service type, laboratory technologies and market demand history. Additionally, the report contains an analysis of survey results from 248 labs.

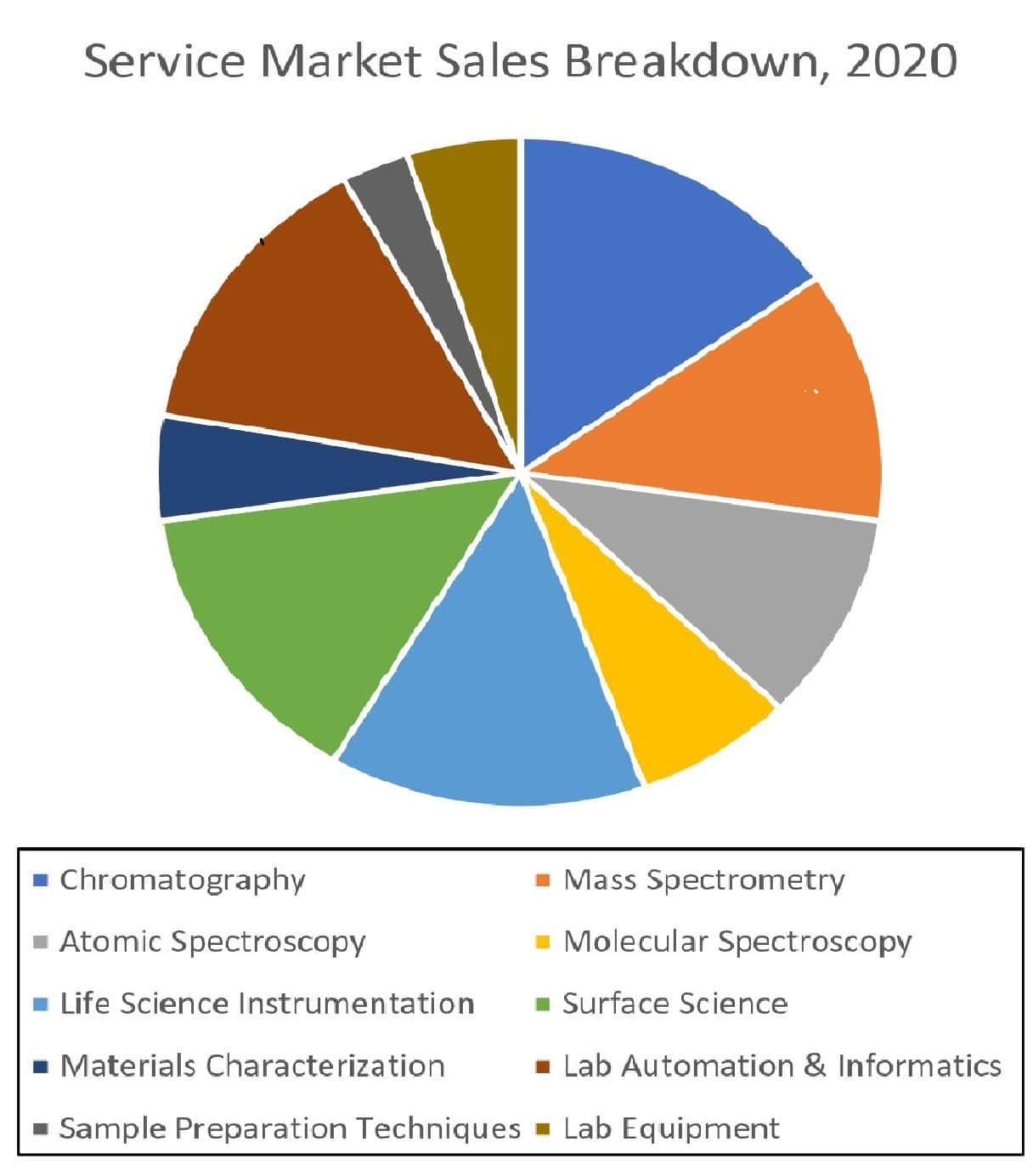

Several categories of laboratory technologies are covered in the report: atomic spectroscopy, chromatography, lab automation & informatics, lab equipment, life science instrumentation, mass spectrometry (MS), materials characterization, molecular spectroscopy, sample preparation techniques and surface science. Service types described in the report include extended warranty & service, initial warranty, lab and personnel support, maintenance & calibration and non-warranty instrument service. Additionally, the report highlights the leading vendors offering services, including Agilent Technologies, PerkinElmer, Thermo Fisher Scientific and Waters.

SDi used primary sources for the report, including survey data and knowledge of industrial personnel and other informed observers. Secondary resources used entailed financial reports, general and industry publications, and other internet information.

According to the report, in 2020, the lab instrumentation service market was valued at over $8.0 billion and is forecast to reach high single-digit growth through 2025. Services for life science instrumentation are predicted to be the main growth driver.

In the report, SDi also provides market forecasts by application, region, sector and service type for the overall lab instrumentation market and the 10 laboratory technologies categorized in the report. For instance, in 2020, the US & Canada and Europe were responsible for most of the regional demand. However, the report expects China to be the fastest-growing region through 2025 due to the country’s investment in biopharmaceutical, food and other end-markets.

Life Science Instrumentation

The service market for life science instrumentation is predicted to grow in the high single digits through 2025 due to these technologies’ growing presence in the biotech industry, which could spur demand for new instrumentation and supplemental services. Sequencing is expected to be the primary growth driver within the service market for life science instrumentation because this technology requires premium service to maintain instrument performance.

In 2020, the top vendors providing services for life science instrumentation were Illumina, Thermo Fisher and Becton, Dickinson’s (BD) Biosciences segment. Illumina specializes in sequencer services, while BD Biosciences is a major participant in the flow cytometry market.