The Role of the Scientific Instruments Market in Food and Beverage Safety Testing

The food and beverage safety testing market is critical to making sure the food and beverages people consume are safe. The manufacturing of GMO food products, developing countries enacting stricter food safety and quality regulations, and the potential effects of the COVID-19 pandemic are some of the issues that analytical instrument providers tackle to fulfill the ongoing demand for global food consumption. The scientific instrument industry plays a crucial part in food and beverage safety testing, with firms offering analytical techniques and products to aid end-markets’ in their research, manufacturing and processing activities.

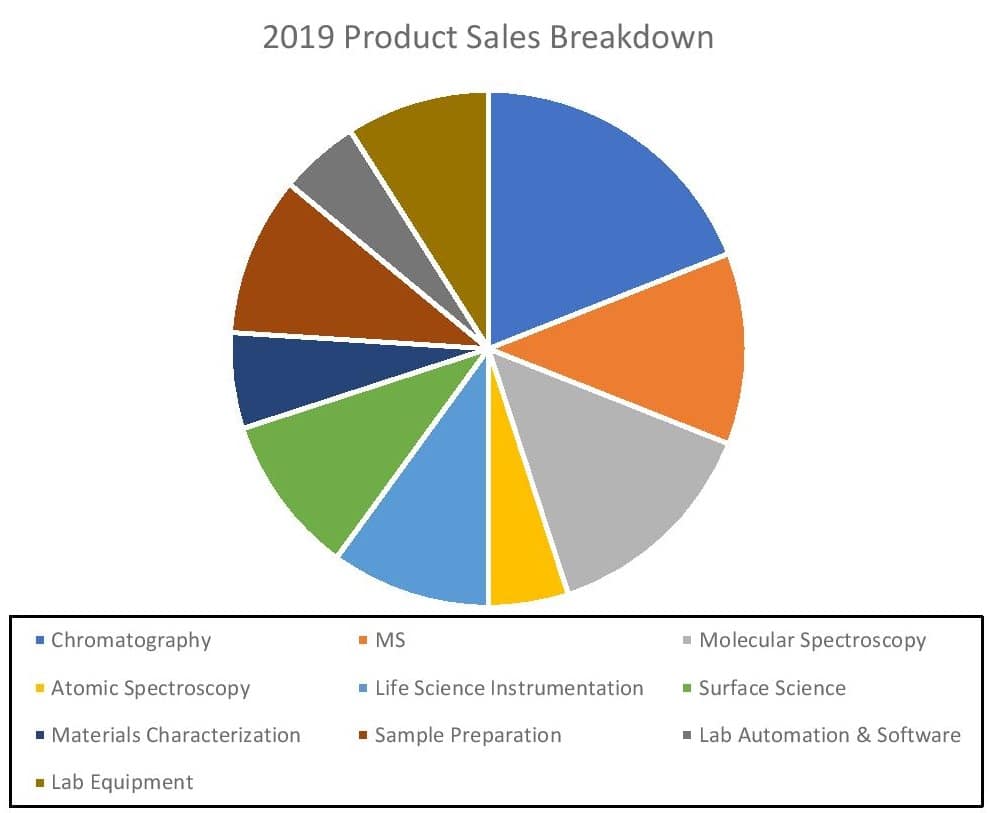

In August 2020, Strategic Directions International (SDi) released the “The Market for Analytical Instruments in the Food and Beverage Labs Sector” report, which outlines the market conditions in 2019 for analytical instrumentation used by food testing laboratories. The report provides an overview of the market developments, laboratory applications and regional demand for both the overall market and 10 technology categories: chromatography, mass spectrometry (MS), molecular spectroscopy, atomic spectroscopy, life science instrumentation, surface science, materials characterization, sample preparation, lab automation & software, and lab equipment. The report highlights the leading vendors offering these technologies, which include Thermo Fisher Scientific, Agilent Technologies, PerkinElmer, MilliporeSigma and Shimadzu. For the report, SDi utilized primary sources, including interviews, and secondary resources, such as industry publications, government data and other credible resources.

According to the report, in 2019, the food testing laboratory instrumentation market was valued at $3.8 billion and is anticipated to achieve mid-single-digit growth through 2024. MS instrumentation is considered the main growth driver because of the technology’s use for QA/QC applications, such as the detection of potentially harmful substances and pathogens in food. As the report outlines, the quadrupole LC/MS instrument sector’s role in furthering the MS market as this technology meets the growing demand for trace contaminant detection.

Geographically, in 2019, the US & Canada and Europe were the largest regional markets for food testing instrumentation. However, the report forecasts China will drive revenue growth because of global pressure on the country to enact stricter food and beverage safety regulations due to recent virus outbreaks stemming from local wet markets. COVID-19 originated in a wet market in Wuhan, China.

In 2019, chromatography, MS and molecular spectroscopy were the largest markets for analytical technologies for food testing instrumentation among the 10 profiled. The report anticipates that out of these 3, chromatography and MS will remain fast-growing sectors, along with sample preparation. Chromatography, MS and sample preparation instrument and consumables sales are all forecast to increase in the high single digits over the next five years.

Regional demand and increased utilization of QA/QC in food testing laboratories are the primary drivers of the chromatography market. Within the chromatography sector, the report forecasts revenues in China and India to increase significantly. The analytical HPLC instrument sector is projected to be the main growth driver. In 2019, Agilent, Thermo Fisher and MilliporeSigma were the top suppliers of this technology to the market. New product introductions are ongoing in this area. This June, Waters launched an HPLC system for QC testing for various end-markets, especially food testing.

Like the chromatography market, the MS sector is anticipated to grow its market presence in China and India. One reason is both regions are passing more stringent food safety regulations to curb virus outbreaks and foodborne illnesses and deaths. The quadrupole LC/MS and TOF LC/MS instrument sectors are projected to be the most in-demand, with quadrupole LC/MS revenue rising double digits and TOF LC/MS sales reaching high single-digit growth over a five-year period. Agilent, SCIEX (Danaher) and Thermo Fisher were the top MS suppliers to this market in 2019. Partnerships are furthering sales growth. In April 2019, through its partnership with the Food Safety and Standards Authority of India (FFSAI), Thermo Fisher opened the Customer Solution Center in Delhi, India. The center’s primary goal is to assist local food and beverage laboratories through training, developing new workflows, and providing solutions by utilizing chromatography and MS.

Market demand for sample preparation in food testing labs is expected to grow because of the need for nucleic acid preparation technologies, which accounted for the highest share of sales in this market in 2019. Along with nucleic acid prep, the report predicts that cell separation and extraction techniques will be the fastest-growing technologies in this segment. Demand for both nucleic acid prep and cell separation is expected to rise due to increased interest in GMO food R&D. In addition, extraction techniques are essential for isolating specific ingredients. Once again, China and India are predicted to be the main growth drivers due to both regions’ investment in food testing. Thermo Fisher, MilliporeSigma and QIAGEN were the top sample preparation suppliers to this market in 2019. Among the most popular sample preparation techniques for food testing is solid-phase extraction. Earlier this year, Restek increased its presence in the food testing market, expanding its Resprep SPE portfolio by launching a polymeric sorbents product that can be used for sample handling.

In conclusion, the food safety testing instrumentation sector is projected to significantly contribute to the overall analytical and scientific instrument market through 2024. Consequently, the technologies highlighted in the report are expected to play a significant part in the global need for safer food and beverage regulation and consumption.