Life Science Tool Companies’ IPOs Show Impressive Gains

As the stock market continues its gyrations this year in the face of the unprecedented circumstances of COVID-19 and subsequent macroeconomic downtown, how are life science tool companies’ stocks doing? One way to answer this question is to look at companies that have completed IPOs over the past two years. New to the public market and still operating at net losses, these companies are one gage of investors’ confidence in the future of the sector.

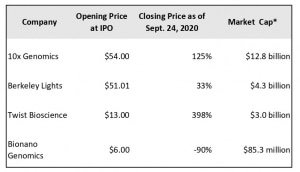

Four companies that make life science research tools have gone public on US stock exchanges from 2018 to year-to-date: 10x Genomics, Berkeley Lights, BioNano Genomics and Twist Bioscience. Although each company’s technology and its applications are distinct, all participate in a life science tools market that makes breakthroughs possible in understanding biological mechanisms as well as advancing drug development, cancer therapies and synthetic biology.

*Source: Bloomberg

The highest market capitalization for the four companies listed here is Berkeley Lights (see table), which is also the most recent company to publicly list its stock, having gone public on July 17 of this year, raising more than $200 million (before the deduction of commissions and expenses). Berkeley Lights’ Digital Cell Biology technology enables parallel measurement of multiple cell parameters in thousands of single cells. Target markets include antibody therapeutics, cell therapy and synthetic biology.

In 2019, company revenues grew 81.1% to $56.7 million as a result of an increase in system sales. Net loss was $23.3 million compared to $18.3 million in 2018. Berkeley Lights’ price per share has risen 33.4% since its market debut, reaching a closing high of $72.69 on September 18. The stock has been greeted with enthusiasm so far this year even though revenues are down due to the effects of COVID-19 on its customers and potential customers’ operations, with many labs shut down in the first half of the year.

The second-largest market cap of the life science companies listed above belongs to Twist Bioscience, which went public in October 2018, bringing in $75 million. The company manufactures oligonucleotides, essentially synthesized DNA, whose applications include next generation sequencing workflows. Twist Bioscience’s target markets are healthcare, drug discovery and industrial applications.

Driven by new product lines, company revenues increased 113.9% last fiscal year (ending September 30, 2019) to $54.4 million. Net loss reached $107.7 million compared to $71.2 million in fiscal 2018. Twist Bioscience’s closing share price reached a new high on September 1, hitting $71.72 per share. So far this year, the company has launched new products for COVID-19, including antibody panels for research and synthetic SARS-CoV-2 RNA controls to assist in the development and validation of diagnostic tests.

10x Genomics completed its IPO just over a year ago, on September 12, 2019. The company specializes in technology for gene, cell and protein analysis using barcoding technology. Among its products’ end-markets are basic research and the development of drugs and therapeutics. In its market debut, the company raised $30.9 million.

Like Twist Bioscience, this month, the price per share for NanoString stock reached its closing high, hitting $125.00 per share on September 11, 2020. Sales last year totaled $245.9 million, a 68.1% increase, and net loss fell from $112.5 million in 2018 to $31.3 million. First-half sales this year were impacted by COVID-19, as labs worldwide shut down or curtailed operations. However, the company still experienced demand for its products due to COVID-19-related research at labs that were still open.

BioNano Genomics is the only company in the table whose price per share has fallen since the stock’s public debut on August 21, 2018, which brought in $20.9 million (before the deduction of commissions and expenses). The company’s price per share has dropped 90.2%. BioNano Genomics provides the Syphyr system and consumables for mapping genomic structural variation to further the field of cytogenetics, or the study of chromosome structure. The company’s current target markets include cancer research and clinical tests.

BioNano Genomics’s 2019 revenues declined 18.5% to $10.1 million, as the number of systems sold and average price-per-system both fell. The firm’s net loss topped $28.8 million, growing from $18.5 million the year before. It has been two years since the company’s price per share closed at a high of $8.25 on September 27, 2018. This year, the company announced a new reagent-rental strategy, a model which does not require labs to purchase a system, as well as new clinical research and diagnostic partnerships.

Overall stock market gains were an upside for many US companies in 2019, with the S&P 500 up 28.9% and the NASDAQ gaining 35.2%. Although academic customers constitute many of these firms’ customer bases, the stock market’s strength has also been good news for their biotech customers as the NASDAQ Biotechnology Index rose 25.11% last year. But how these companies’ stock prices will fare in the future will depend on multiple factors.