Good News in 2018: New IBO Sales Reviews Track Quarterly Results

With this issue, IBO debuts its new Quarterly Review Summary. Designed to provide an overall view of the analytical instrument and life science lab tool industry, the Summary tracks the quarterly and annual revenue growth, as well as operating margins, of 17 of the industry’s largest public firms worldwide. These businesses were selected based on how their financial results are segmented and the financial information that each provides. The Review is based on a weighted average of these company’s organic sales. Estimates are made for companies that have not yet reported results. The Reviews replace IBO’s previous Analytical Instrument Sales, Life Science Sales and Combined Sales Indexes.

The Analytical Sales Review consists of companies that serve a wide array of end-markets, from life science to industrial to applied, giving a comprehensive view of the industry in general, including life science sales as many of the companies also participate in that market. It includes 6 of the industry’s top 10 companies (see IBO 4/15/18).

In contrast, the Life Science Sales Review consists of businesses whose primary or sole market is the life science market. Two businesses, Merck KGaA Life Science and Thermo Fisher Scientific Life Science Solutions, also include sizable bioprocessing offerings. Although some businesses such as Merck Life Science and Tecan also serve other markets, the bulk of the products sold by the business segments included in the Life Science Sales Review are geared toward life science applications.

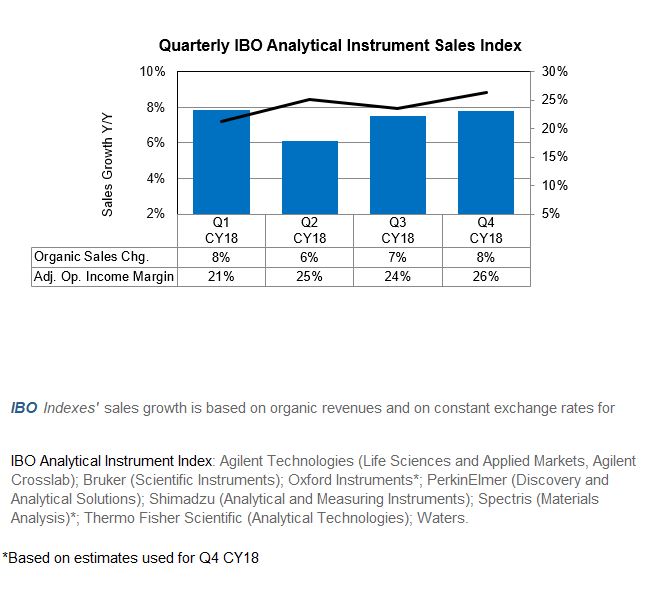

Analytical Sales Review

Organic sales growth for companies in the Analytical Sales Review stayed consistent throughout the year, led by the robust growth of Thermo Fisher’s Analytical Instruments business. Oxford Instruments was the only firm to post a decrease in sales. Operating margin increased as the year progressed. For the year in total, organic sales for Review companies rose 8% and operating margin was 24%.

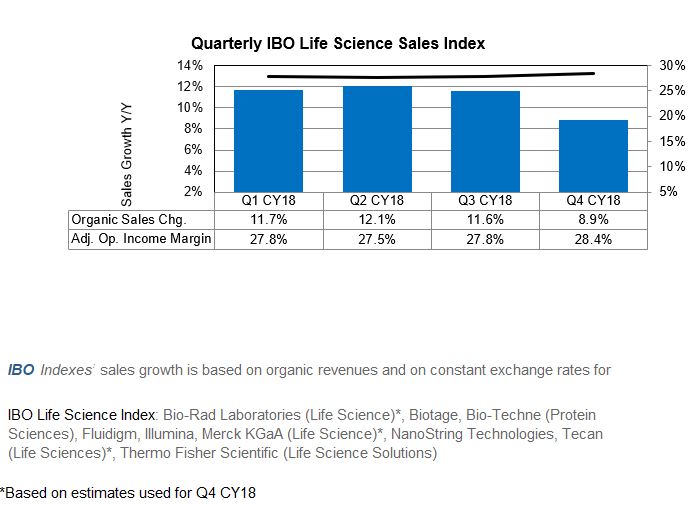

Life Science Sales Review

Recording faster revenue growth, companies in the Life Science Review grew a combined 15% in 2018. Illumina’s sales growth far outpaced the other companies’ results, followed by Fluidigm, whose revenue increase steadily increased during the year. Only NanoString Technologies posted a sales decrease. Review companies’ sales growth slowed in the year due in part to slower sales growth for Bio-Rad Laboratories Life Science. Illumina’s growth rates slowed, though they remained solid for the year in total. Despite slower sales in the latter part of 2018, operating margin remained largely the same each quarter, with an uptick in the fourth quarter.

Biopharmaceutical Market

In fourth quarter 2018, the biopharmaceutical market for companies in both Reviews was the strongest end-market for most businesses. Biotechnology sales and sales in China were high points. Agilent Technologies Life Sciences and Applied Markets and Agilent Crosslab, Bio-Techne Protein Sciences and Thermo Fisher Life Science Solutions each recorded double-digit revenue growth in this end-market for the quarter.

Applied Market

Sales in applied markets for businesses in the Reviews were mixed in the fourth quarter of 2018. Food sales growth showed some slowing; however, environmental sales were strong, bolstered by China. Agilent noted continued delays in sales due to the reorganization of the country’s food ministries.

Academic and Government Market

Fourth quarter 2018 academic and government sales for the Reviews were healthy with strength in the US and Asia Pacific. Bruker Scientific Instruments and PerkinElmer Discovery and Analytical Solutions noted good growth for the end-market due to instrument sales.

Industrial Market

Industrial markets for Review companies were mixed in the fourth quarter 2018. Growth was affected by year-over-year comparisons, but new products contributed to sales growth. Spectris Materials Analysis reported weakness in the metals sector, while Shimadzu Analytical and Measuring Instruments commented on the overall strength in the sector.

Geographic Markets

Asia Pacific and China remained the leading regions for sales growth for the Reviews companies in the fourth quarter 2018. Outside of China, businesses noted sales strength in South Korea. Sales in the Americas also grew double digits for several businesses. In contrast, Japanese sales continued to show weakness. Companies that reported double-digit sales increases in China included Bio-Techne Protein Sciences, Thermo Fisher Life Science Solutions and Waters.