IBO Indexes Maintain Strength

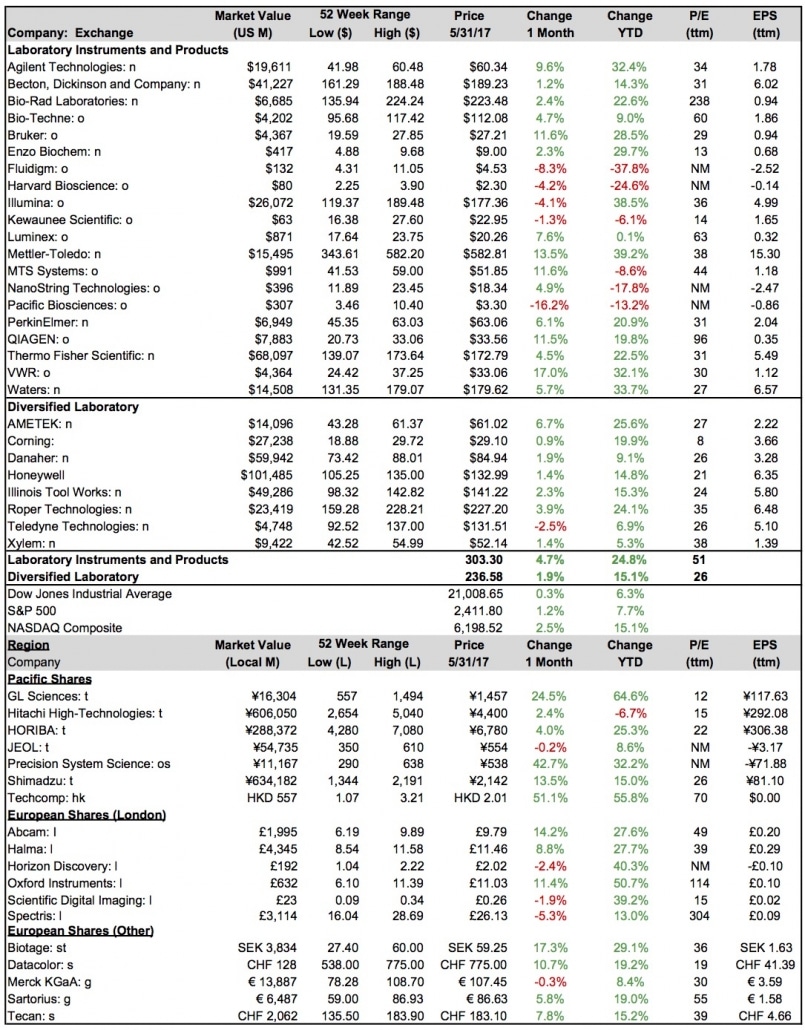

Despite news of an independent counsel to investigate the Trump Administration’s ties to Russia and the US Federal Reserve’s plan to reduce its securities holding this year, US equity markets ended the month in positive territory. Other economic data suggests second quarter US GDP is expected to miss projections following flat capital goods orders, weak exports and slow business investments. Nevertheless, equity prices maintained their upward trajectory, as the Dow Jones Industrial Average, S&P 500 and NASDAQ expanded 0.3%, 1.2% and 2.5% for the month, respectively. Year to date, the Dow, S&P 500 and NASDAQ are up 6.3%, 7.7% and 15.1%, respectively.

Laboratory Instruments and Products Stock Index

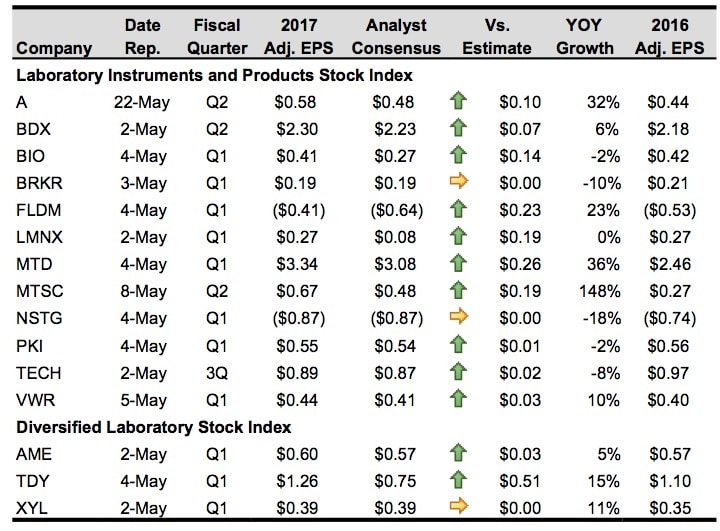

This month, the Index advanced 4.7% to 303.30 and is up 24.8% for the year. Most companies in the Index finished in positive territory, led by VWR, which jumped 17.0% due to the proposed acquisition by Avantor (see IBO 5/15/17). VWR also beat first quarter adjusted EPS on May 5 due to productivity gains and sturdier industrial sales.

Similarly, Agilent Technologies, Mettler-Toledo and MTS Systems each topped quarterly EPS estimates due to improved industrial sales and expanded margins. Furthermore, all three companies posted strong double-digit adjusted EPS growth, which climbed 32%, 36% and 148%, respectively. Earnings growth for MTS Systems benefited from a large project in the Test segment as well as acquisitions. On May 8, the company maintained its fiscal 2017 GAAP EPS of $0.80–$1.20, yet shares jumped 11.6% for the month.

Agilent and Mettler-Toledo, which climbed 9.6% and 13.5%, respectively, both raised their outlooks on May 4 and May 22, respectively. Agilent lifted its fiscal 2017 adjusted EPS guidance by $0.05 to $2.13–$2.18. Mettler-Toledo increased its 2017 adjusted EPS guidance from $16.55–$16.75 to $16.95–$17.15, including second quarter adjusted EPS of $3.85–$3.90.

Bruker also climbed double digits for the month, expanding 11.6%. On May 3, the company reported first quarter adjusted EPS in line with expectations; however, sales beat consensus due to healthy demand for NMR, aftermarket products and services (see First Quarter Results). The company maintained its 2017 adjusted EPS outlook of $1.05–$1.09. Also, on May 12, the company announced a new two-year $225 million share repurchase agreement.

A number of other companies benefited from stronger-than-expected financial results and elevated earnings projections. On May 2, Luminex beat first quarter adjusted EPS expectations due to product mix, cost containment and healthy sales volume. The company raised its 2017 sales outlook by $5 million to $300–$310 million for growth of 11%–14%.

Bio-Techne, which advanced 4.7% for the month, reported fiscal third adjusted EPS ahead of consensus on May 2 due to robust instrument sales. The company projected mid-single digits organic growth for the fiscal fourth quarter.

Despite increased investments, PerkinElmer beat first quarter adjusted EPS on May 4 due to expanded Diagnostics margins. The company raised its 2017 adjusted EPS range from $2.75–$2.85 to $2.80–$2.90. Shares climbed 6.1% for the month.

Bio-Rad Laboratories easily topped first quarter adjusted EPS expectations on May 4 due to operation improvements, leading share up 2.4% for the month. NanoString Technologies, which increased 4.9% for the month, met first quarter adjusted EPS consensus on May 4 but topped revenue consensus. The company reaffirmed its 2017 GAAP EPS loss of $2.51–$2.69.

Becton, Dickinson also beat earnings expectations on May 2 due to cost synergies, sturdy sales growth and product mix. The company reaffirmed its fiscal 2017 adjusted EPS guidance of $9.35–$9.45. However, on May 12, the company completed a $4.95 billion equity offering, including $2.25 billion of common stock, $2.25 billion of depositary shares and an additional $450 million in overallotment. As such, on May 23, Moody’s Investors Service placed the company new euro senior unsecured note offering under review for a downgrade. Shares still improved 1.2%.

Not all companies in the Index benefited from earnings results. Pacific Biosciences, which recorded a wider-than-expected loss at the end of the previous month (see IBO 4/30/17), fell 16.2% in May.

Fluidigm, which contracted 8.3% for the month, reported weak genomics instrument sales on May 4. Nevertheless, first quarter adjusted EPS sailed past expectations due to cost containment and restructuring measures. The company projected second quarter sales of $22–$24 million.

In new ratings, Janney Montgomery Scott upgraded Waters on May 1 from “Neutral” to “Buy,” and raised its price target from $185 to $200.

Click to enlarge

Diversified Instrumentation Stock Index

The Index improved 1.9% in May to 236.58, and is up 15.1% year to date. All companies in the Index traded higher for the month, except for Teledyne Technologies, which slipped 2.5%. However, the company beat first quarter adjusted EPS on May 4, and raised its 2017 adjusted EPS guidance from $5.40–$5.50 to $5.76–$5.86.

Conversely, AMETEK recorded the strongest price gain for the month among Index companies, gaining 6.7%. On May 2, the company posted first quarter adjusted EPS ahead of consensus due to positive organic growth and operational improvements. AMETEK raised its 2017 adjusted EPS from $2.34–$2.46 to $2.40–$2.48.

Xylem, which advanced 1.4% for the month, reported in line first quarter adjusted EPS on May 2. However, the company raised its 2017 adjusted EPS range from $2.20–$2.35 to $2.23–$2.38. Barclays PLC upgraded Xylem on May 15 from “Equal Weight” to “Overweight.”

International

Asia Pacific equity markets traded mostly higher, led by the South Korea’s Kospi and Hong Kong’s Hang Seng, which advanced 6.4% and 4.2%, respectively. In addition, Japan’s Nikkei 225 expanded 2.4%. Conversely, Australia’s All Ordinaries declined 3.1%.

Malaysia’s KLCI and Singapore’s STI indexes fell 2.8% and 1.7%, respectively.

Prices for the Pacific Rim companies in the IBO Stock Table all traded higher in May, except for JEOL, which slipped 0.2%. The company reported on May 12 that EPS for the fiscal year ending March 31 slumped 85% to ¥6.17 ($0.06) due to lower sales volume.

Techcomp recorded the strongest gain for the month, as shares soared 51.1% following news of a potential takeover (see Executive Briefing). Precision System Science (PSS) also posted a significant gain, climbing 42.7% as the company announced on May 15 a capital and business alliance with Hitachi High-Technologies (see Executive Briefing). However, on May 31, PPS reported that fiscal third quarter EPS declined 5% to ¥8.11 ($0.07).

On May 10, GL Sciences reported strong fiscal 2017 earnings growth, which jumped 70% to ¥125.52 ($1.13).

HORIBA, which climbed 4.0% for the month, reported on May 12 that first quarter EPS climbed 19% to ¥89.69 ($0.79). In addition, the company raised its projected 2017 EPS by 5% to ¥322.66 ($2.85) due to improved economic conditions in Japan and abroad.

On May 11, Shimadzu reported that net income for the fiscal fourth quarter climbed 23% to ¥10.6 billion ($93.7 million). The company projected fiscal 2018 net income to increase 2% to ¥27.0 billion ($236.8 million). Shares rose 13.5% for the month.

All major European Indexes traded higher in May, led by the UK’s FTSE 100 and Switzerland’s SMI, which scaled 4.4% and 2.3%, respectively.

Prices for UK-based companies in the IBO Stock Table were mixed this month.

Abcam and Oxford Instrument had the strongest returns for the month, advancing 14.2% and 11.2%, respectively, while Spectris fell 5.3%.

Prices for other European companies in the IBO Stock Table all traded high apart from Merck KGaA, which slipped 0.3%. On May 18, the company reported that first quarter adjusted EPS climbed 17% to €1.80 ($1.91) due to improved organic growth and stronger margins. However, fiscal 2017 adjusted EPS are projected to be €6.15–€6.50 ($6.54–$6.91) for a decline of 1% to growth of 5%. Biotage recorded the strongest gain for the month, climbing 17.3%.