IBO Lab Instrument Stock Index Surprises in August

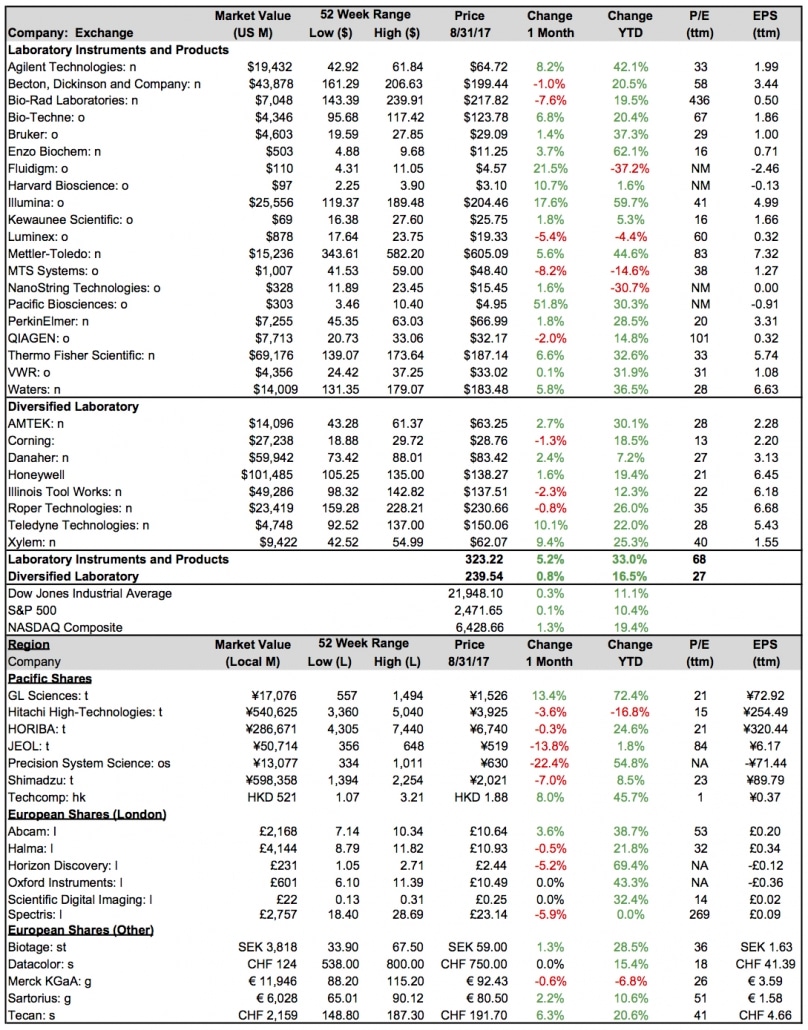

Despite the recent disaster caused by Hurricane Harvey, the US national economy remains strong as estimated GDP increased 3.0% in the second quarter, revised upwards from 2.6%, exceeding analysts’ expectations of a 2.7% increase. The growth in GDP reflected strong consumer spending. Furthermore, US equity markets finished in positive territory for the month, as the NASDAQ Composite led the surge, climbing 1.3%. The Dow Jones Industrial Average (DJIA) increased 0.3%, while the S&P 500 closed nearly flat, at 0.1%. Year to date, the NASDAQ composite is up 19.4%, leading the US equity markets in percentage growth. The DJIA is up 11.1% year to date, while the S&P 500 follows closely at 10.4%.

Laboratory Instruments and Products Stock Index

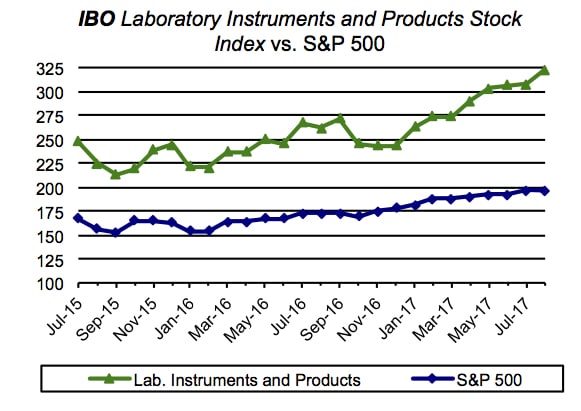

For August, the Index advanced 5.2% to 323.22, while increasing 33.0% for the year. Pacific Biosciences led the Index, leaping 51.8% for the month. Conversely, MTS Systems posted a loss of over 8%, closing at $48.40 for the month.

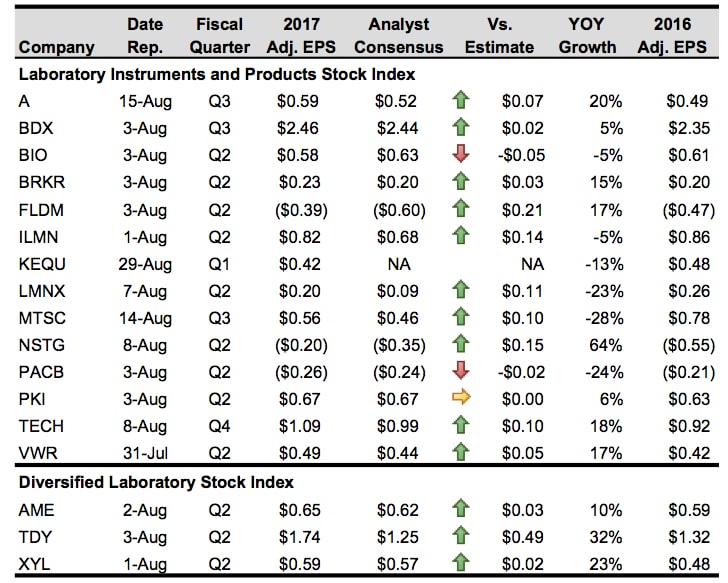

Agilent Technologies’ shares grew 8.2% for the month. On August 15, the company reported fiscal third quarter adjusted EPS of $0.59, surpassing analysts’ expectations of $0.52 and its own expectations of $0.50. Year over year, Agilent’s shares have increased 20.4%, as strong earnings were backed by sales growth in the pharmaceutical, consumables and chemical end-markets (see Second Quarter Results). For the fiscal fourth quarter, Agilent expects adjusted EPS to be $0.60–$0.62. As for the full fiscal year, Agilent projects an adjusted EPS range of $2.29–$2.31, an upgrade from the previously projected $2.13–$2.18.

Becton, Dickinson shares fell 1.0% for the month. On August 3, the company reported fiscal third quarter adjusted EPS of $2.46, a 4.7% increase. Compared to analysts’ expectations, Becton, Dickinson outperformed by $0.02 for adjusted EPS. The company raised its fiscal year adjusted EPS to $9.42–$9.47 from the previously projected $9.35–$9.45 due to favorable foreign currency movement.

Shares for Bio-Rad Laboratories declined 7.6% during August, as the company’s second quarter sales declined 2.3%. Sales slipped for the quarter due to a slowdown in productivity and a decline in volume. The company reported an adjusted EPS of $0.58, falling short of analysts’ expectations of $0.63. Year over year, adjusted EPS declined as well, decreasing 4.9%. For the full year, Bio-Rad reaffirmed its organic sales growth projection of 4.0% but downgraded its currency-neutral operating margin projection from 7% to 6%–6.5%.

Bruker shares remained steady for the month, growing 1.4%. On August 3, the company recorded second quarter adjusted EPS of $0.23, representing a 15.0% increase. Bruker surpassed analysts’ adjusted EPS expectations of $0.20 by $0.03. For the year, Bruker forecasts adjusted EPS to be $1.08–$1.12, an upgrade from its previous projection of $1.05–$1.09.

Fluidigm shares vaulted 21.5% despite the company having negative quarterly earnings. On August 3, the company reported sales figures for instruments and consumables, in which each declined by 25.0% and 16.5%, respectively. However, the company improved its product margins and earnings year over year. Fluidigm expects third quarter revenues to be around $24–$26 million, an upgrade from the previously projected $22–$24 million.

Shares for Illumina leaped 17.6% in August. However, earnings for the company declined year over year, as adjusted EPS reached $0.82, falling $0.04 short of last year’s second quarter adjusted EPS. On August 1, the company reported its earnings, exceeding analysts’ expectation of $0.68 adjusted EPS by $0.14. For the full year, Illumina projects its adjusted EPS to be $3.60–$3.70.

Kewaunee Scientific reported a 13% increase in its quarterly cash dividend to 17 cents per share outstanding. On August 29, the company reported its fiscal first quarter results, in which adjusted EPS fell short of last year’s adjusted EPS. However, shares for the month still rose 2.8%.

Luminex shares slipped 5.4% despite the company beating analysts’ EPS expectations. Luminex reported second quarter earnings on Aug 7, for which adjusted EPS reached $0.20, topping analysts’ expectations of $0.09 by $0.11. The slip was primarily due to the 23.1% decline in adjusted EPS. For the third quarter, Luminex expects revenues to be between $73–$75 million. As for the full year, Luminex maintained its previous sales projection of $300–$310 million.

MTS Systems shares slid 8.2% for the month. The company reported fiscal third quarter earnings on August 14, surpassing adjusted EPS estimates of $0.46 by $0.10, reaching $0.56 for the quarter. However, adjusted EPS declined 28.2% year over year. Even so, MTS Systems raised its full-year GAAP EPS guidance to $1.15–$1.30 from $0.80–$1.20.

Despite a 53% year-over-year revenue growth, NanoString Technologies’ shares remained flat. Adjusted EPS beat analysts’ expectations by $0.15 to hit -$0.26, as the company reported its second quarter earnings on August 8. The company upgraded its full-year revenue forecast to $114–$118 million, versus the previously projected $100–$105 million. Net loss per share was upgraded to -$2.03– -$2.20 from -$2.51– -$2.69.

Pacific Biociences shares soared nearly 52% for the month to close at $66.99 per share. On August 3, the company reported a strong second quarter performance from its product and services segment. However, EPS for the quarter was -$25.5 million, declining even further from last year’s -$18.5 million. Adjusted EPS for the quarter, -$0.26, missed analysts’ expectations by two cents, which declined 23.8% year-over-year.

Shares for PerkinElmer grew slightly by 1.8% for the month. On August 3, the company reported its second quarter earnings, in which adjusted EPS grew 6.3% to $0.67, in line with analysts’ expectations. Adjusted operating margins rose 70 basis points to 18.2%. For the full year, PerkinElmer upgraded its adjusted EPS guidance to $2.84–$2.92 from $2.80–$2.90.

Bio-Techne, which rose 6.8% for the month, reported fiscal fourth quarter earnings on August 8. Adjusted EPS increased 18.5% to $1.09, beating analysts’ expectations of $0.99 adjusted EPS. For the full fiscal year, adjusted EPS totaled $3.72, representing a 3.0% increase. Adjusted operating margin fell 20 basis points to 38.8% for the quarter, primarily due to negative impacts from the mix of acquisitions.

Similarly, VWR also beat analysts’ expectations, surpassing them by $0.05 to $0.49 adjusted EPS, an increase of 16.7%. However, shares remained flat for the month.

Diversified Instrumentation Stock Index

The Index increased 0.8% in August to 239.54 and is up 16.5% year to date. Most companies in the Index traded higher for the month, except for Illinois Tool Works and Corning, which fell 2.3% and 1.3%, respectively.

On August 2, AMETEK reported its second quarter earnings. Company shares grew 2.7%, as adjusted EPS rose above analysts’ expectations, as well as prior-year figures. For the third quarter, AMETEK expects adjusted EPS of $0.60–$0.62, an increase of 7%–11%. As for the full year, the company projects adjusted EPS to be between $2.46 and $2.52, an upgrade from its previous projection of $2.40–$2.48.

Shares for Teledyne Technologies rose 10.1% for the month, primarily due to strong sales figures in each of the company’s segment and in all major product lines. On August 3, the company reported its quarterly earnings, as adjusted EPS reached $1.74, topping analysts’ estimates of $1.25, increasing 31.8% year-over-year. For the third quarter, the company expects adjusted EPS to be in the range of $1.60–$1.65. As for the full year, Teledyne projects adjusted EPS to be between $6.15 and $6.25, an upgrade from its previous projection of $5.76–$5.86.

Xylem shares expanded 9.4% for the month, as adjusted net income rose 23.0% to $106 million, translating into $0.59 adjusted EPS. Analysts’ estimates for adjusted EPS were topped, as Xylem experienced a better-than-expected second quarter due to strong organic sales growth. For the full year, Xylem upgraded its adjusted EPS guidance $2.23–$2.38 to $2.30–$2.40.

International

Asia Pacific equity markets traded moderately this month, with China’s Shanghai Composite and Hong Kong’s Hang Seng leading the Index, growing 2.7% and 2.4%, respectively. Similarly, Thailand’s SET Index traded at 2.5% higher for the month. Conversely, India’s Sensex30 and South Korea’s Kospi Index traded 2.4% and 1.6% below last month’s figures, respectively.

Shares for the Pacific Rim companies in the IBO Stock Table finished mostly in negative territory, with only GL Sciences and Techcomp on positive grounds. On August 17, GL Sciences recorded a strong fiscal 2018 first quarter, in which sales increased 20.7%, lifting company shares by 13.4%. Techcomp’s shares climbed 8.0% for the month due to a solid quarterly performance. The company increased revenues by 2.2% for its first half (see Bottom Line), lifting company shares by 45.7% for the year. Precision System Science led the decline with a 22.4% contraction in share price. Similarly, JEOL’s shares fell 13.8% for the month, due to a 17.2% decrease in total revenues. However, company shares still remain positive for the year, up 1.8%. HORIBA’s shares fell slightly, down 0.3%, while its total second quarter increased by 7.6%. For the year, company shares are up 24.6%. Shimadzu’s shares also fell into negative territory, down 7.0%. However, the company reported a sales growth of 8.5% primarily due to its LC/MS products. For the year, Shimadzu’s shares are still in positive territory, up 8.5%.

All of the European equity markets performed negatively, with the exception of the UK’s FTSE 100, which increased 0.8% for the month. Tecan led European shares in the IBO Stock Table with an increase of 6.3%, and Abcam came in second, with a 3.6% bump. On August 16, Tecan recorded a strong first half result, with total revenues rising 7.7% and Life Science sales increasing 16.4% (see Bottom Line). For the year, Tecan shares are up 20.6%. Merck KGaA reported second quarter earnings on August 3, in which company revenues rose 4.6%, or 4.2% organically. Share price slipped 0.6% for the month and is down 6.8% for the year. Spectris and Horizon Discovery slid the most, decreasing 5.9% and 5.2%, respectively.