IBO Sales Indexes Off to Strong Start: Industrial Market Lifts First Quarter Growth

With mostly conservative sales outlooks for the first quarter of 2017, many publicly held instrument and lab product companies reported better-than-projected revenue growth. The relatively muted expectations were based on a strong year-over-year comparison, budget uncertainties and fewer selling days for several companies. Nevertheless, demand remained steadfast from biopharmaceutical and applied markets, especially for LC and MS products and services. Sales of life science products, specifically NGS and cell-analysis products, further contributed to growth. In addition, capital spending by industrial customers improved and even excelled for several companies, including Agilent Technologies and Waters. Geographically, demand in China and other Asia Pacific regions remained resilient, and apart from academic and government markets, European sales rallied. Lastly, currency fluctuations resulted in softer-than-expected headwinds for US-based companies.

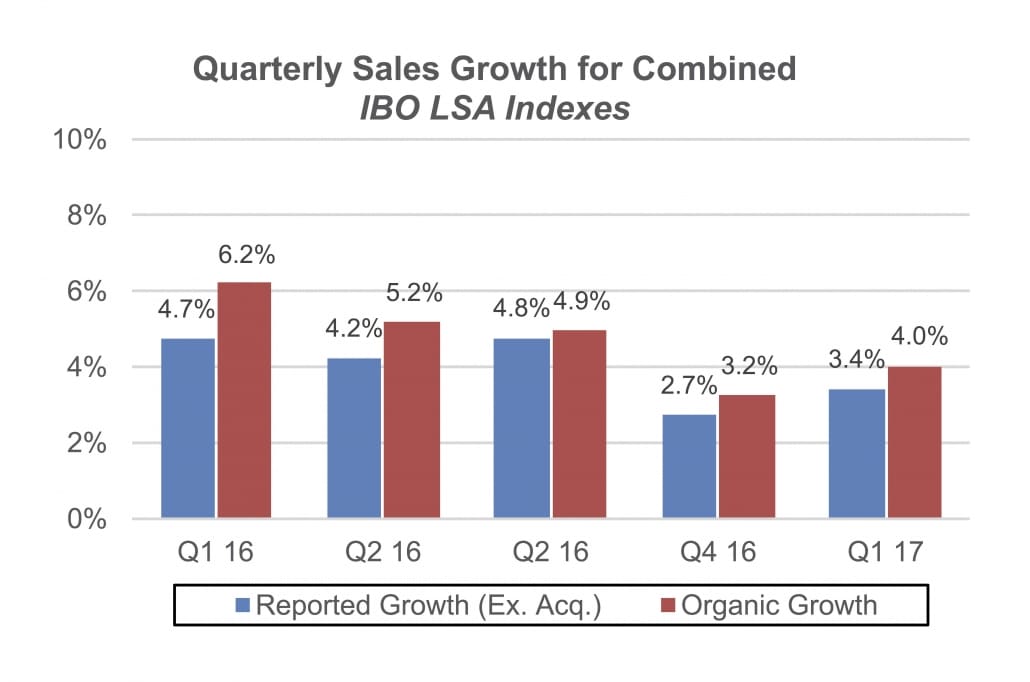

Combined calendar year first quarter sales for the 22 companies or business units in the IBO Life Science and Analytical Instrument Indexes (LSA Indexes) grew 3.4% on a reported basis. Growth accelerated compared to the fourth quarter of 2016 when it improved 2.7%, but was down compared to the first quarter a year ago, when it advanced 4.7%

Organic growth for the LSA Indexes, which excludes acquisitions, currency and is based on constant exchange rates for non-US companies when converted into US dollars, advanced 4.0%, compared to 3.2% in the fourth quarter of 2016 and 6.2% in the previous year.

Quarterly estimates were calculated for companies that have not yet reported: Oxford Instruments, Spectris Materials Analysis and Tecan Life Sciences. Further financial reviews of the companies can be found in this issue (see First Quarter Financial Results) and in the May 15 issue (see IBO 5/15/17) of IBO. All sales figures below are organic.

Biopharmaceutical Markets

Sales in biopharmaceutical markets for the LSA Indexes grew nearly 9%, slightly ahead of the fourth quarter of 2016. Demand was strong for bioproduction, LC, MS and services across most geographies and customer markets. Biopharmaceutical sales were particularly strong for Agilent, Biotage and Bio-Techne, which climbed double digits each. Furthermore, Thermo Fisher Scientific and Waters each recorded 9% biopharmaceutical sales growth. However, Bruker and PerkinElmer sales for this market were less robust, advancing 3% each.

Applied Markets

Like the biopharmaceutical markets, applied sales for the LSA Indexes maintained healthy demand, driven by strength in China and other emerging markets due to increased regulatory measures for food and environmental testing. Overall, applied sales for the LSA Indexes advanced roughly 6%, including double-digit sales growth for QIAGEN and Waters each.

Applied sales for QIAGEN climbed in the mid-teens due to timing of orders for new human ID forensics products and a weak year-over-year comparison. Biotage and Illumina also recorded strong applied sales growth, which climbed in the high single digits each.

Food sales for the LSA Indexes improved nearly 7%, while environmental sales expanded more than 5%. These markets were robust for both Thermo Fisher Analytical Instruments (AI) and Waters. However, sales growth in food markets for Agilent and PerkinElmer decelerated to roughly 4% and 3%, respectively, because of strong comparisons.

Industrial Markets

Industrial markets experienced a notable recovery in capital spending and improved order growth, as sales for the LSA Indexes expanded nearly 4%. A majority of this strength was driven by chemical and refining customers and, to a lesser extent, improved demand from mining and materials characterization markets. Aftermarket and service revenues were sturdy for this market, as was demand for lower-cost instrumentation. In addition, industrial order growth improved, including an expanded backlog of high-end systems. Despite the positive momentum in this market, most companies in the LSA Indexes maintained cautious outlooks due to persistent challenges in the energy markets.

Recording the strongest industrial sales growth among companies in the LSA Index, Agilent sales in this end-market climbed 10% due to strength in the chemical and refining markets, especially for GC products. Biotage and Waters also experienced steady demand in this market, as their sales grew roughly in the mid-single digits each, while Shimadzu Analytical and Measuring Instruments (AMI) and Thermo Fisher AI also recorded positive sales growth. Conversely, industrial sales for Bruker Scientific Instruments (SI) and PerkinElmer Discovery and Analytical Solutions remained in negative territory, sliding in the low single digits each.

Academic and Government Markets

Academic and government sales for the LSA Indexes were modestly higher, similar to the fourth quarter of 2016, due to mixed demand in Europe and the US. Bio-Rad Laboratories Life Science, Bio-Techne, Illumina and Shimadzu AMI reported resilient demand in this market, while sales for QIAGEN and Thermo Fisher improved in the low single digits each. In contrast, academic and government sales contracted for Agilent, Bruker SI, Merck KGaA Life Science, PerkinElmer and Waters.

Geographic Markets

Geographically, LSA Index sales in Asia Pacific remained robust, climbing more than 10%, including double-digit growth for Agilent, Biotage, Bio-Techne, Illumina, Thermo Fisher AI and Waters each. Sales in China were particularly strong, advancing roughly 15% for the LSA Indexes due to demand for biopharmaceutical, environmental and food testing applications. Several companies in the LSA Indexes recorded strong double-digit sales growth in this region, including 58% for Biotage.

Several companies also experienced strong demand in other Asia Pacific regions such as South Korea and India. Japanese demand was mixed as sales expanded for Agilent and QIAGEN, but declined for Bruker SI, Illumina, PerkinElmer and Waters.

Despite continued weakness in academic and government markets, European sales for the LSA Indexes expanded more than 3%, led by biopharmaceutical and applied markets.

Sales in the Americas for the LSA Indexes grew nearly 2%, as healthy demand from biopharmaceutical and applied markets were partially offset by tepid academic and government sales. Bio-Rad LS and Bruker SI both recorded softer sales growth in the Americas.

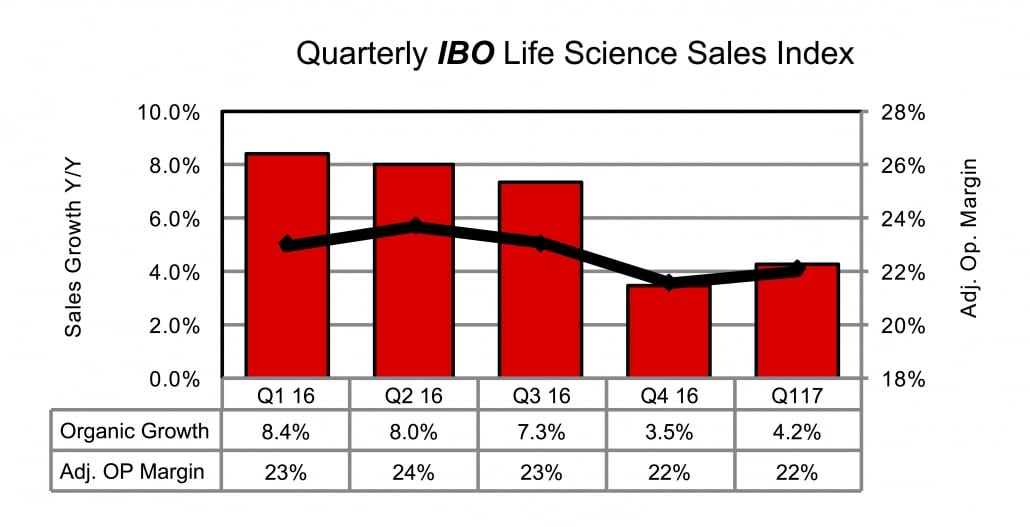

Life Science Index Sales

First quarter IBO Life Science Index sales grew 4.2% organically to $3,441.0 million. This growth represents a steady improvement compared to the 3.5% organic growth in the fourth quarter of 2016, but is half the growth experienced in the previous year (see IBO 5/31/16). The variance in sales growth compared to the previous year was due to a strong growth comparison in the biopharmaceutical and applied markets as well as fewer selling days for several companies in the first quarter of 2017. Nevertheless, demand in biopharmaceutical and applied markets remained healthy, especially for NGS consumables and sample preparation products, as well as for cell-analysis solutions, bioinformatics and services. Index adjusted operating margin contracted 10 basis points to 22.0% as a result of increased investments.

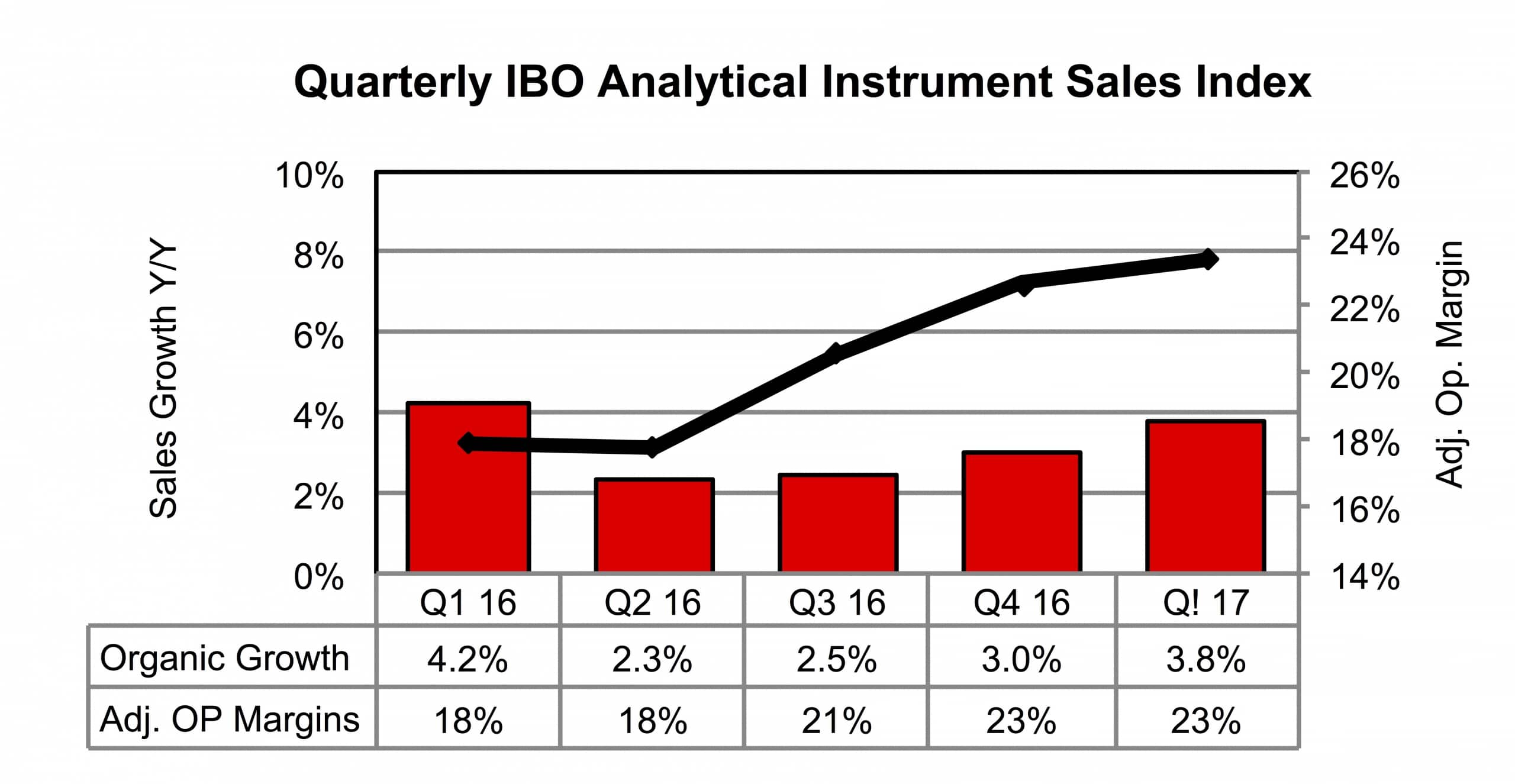

Analytical Instrument Index Sales

First quarter sales for the IBO Analytical Instrument Index grew 3.8% organically to $3,801.7 million. Growth was driven by sales of LC and MS products to biopharmaceutical and applied markets. Outside of energy markets, several companies in the Index experienced either improved demand or orders from industrial customers. Meanwhile, academic and government markets remained constrained with the exception of Asia Pacific. Index adjusted operating margin soared 550 basis points to 23.4%, driven by product mix, restructuring activity and cost control measures.

Reported IBO Indexes’ sales growth excludes acquisitions and are based on constant exchange rates for international companies when converted into US dollars.

IBO Life Science Index businesses: Becton, Dickinson (BD Biosciences); Bio-Rad Laboratories (Life Science); Biotage; Bio-Techne (Biotechnology, Protein Platforms); Fluidigm (Product); Illumina; Merck KGaA (Life Science); NanoString Technologies; Pacific Biosciences (Products, Services); PerkinElmer (Applied Genomics); QIAGEN (Life Sciences); Tecan (Life Sciences); Thermo Fisher Scientific (Life Science Solutions).

IBO Analytical Instrument Index businesses: Agilent Technologies (Life Sciences and Applied Markets, Agilent Crosslab); Bruker (Scientific Instruments); HORIBA (Process and Environmental Instruments & Systems, Scientific Instruments & Systems); Oxford Instruments; PerkinElmer (Discovery and Analytical Solutions); Shimadzu (Analytical and Measuring Instruments); Spectris (Materials Analysis); Thermo Fisher Scientific (Analytical Technologies); Waters.