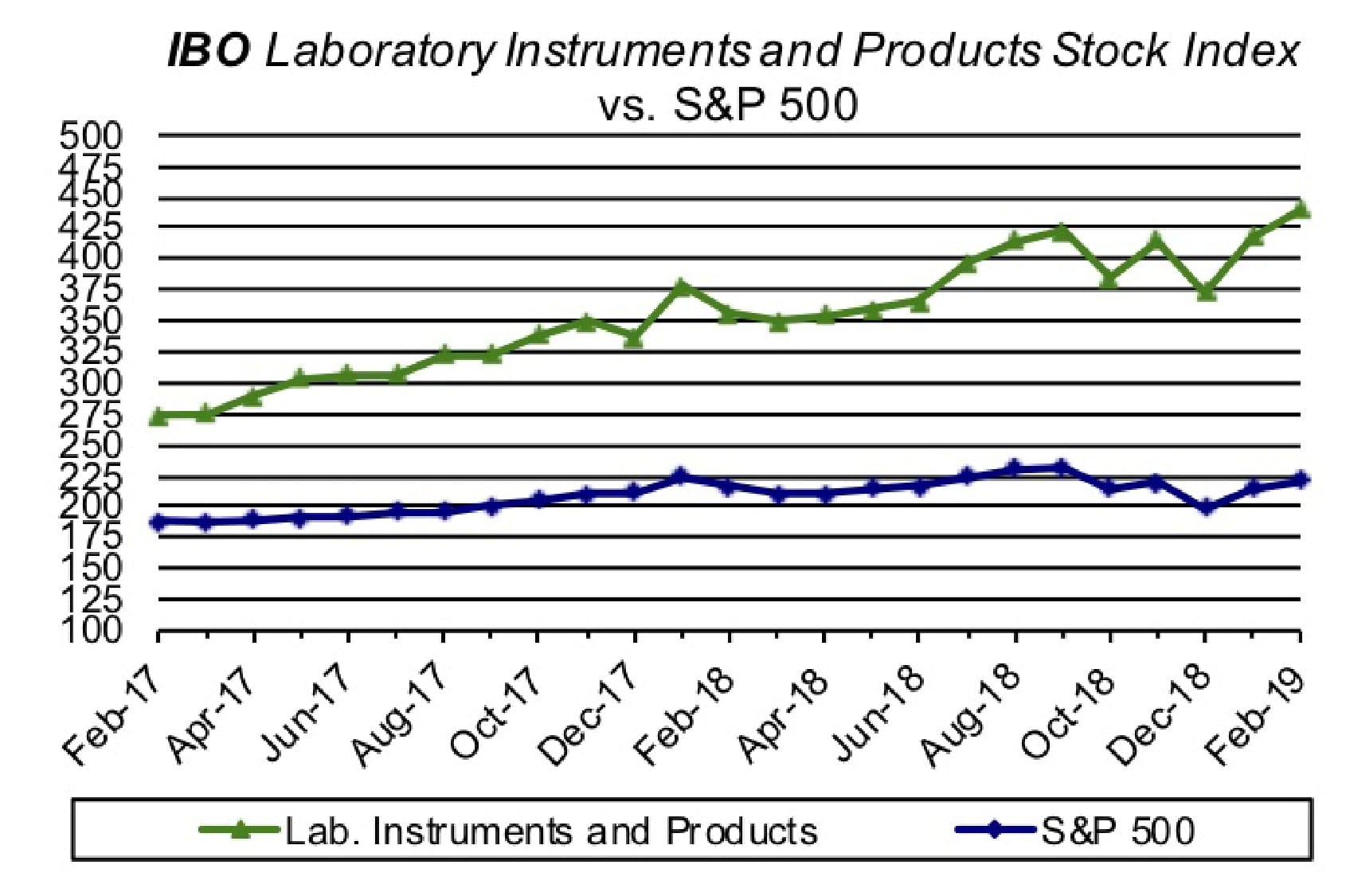

IBO Stock Indexes Continue Positive 2019 Performance

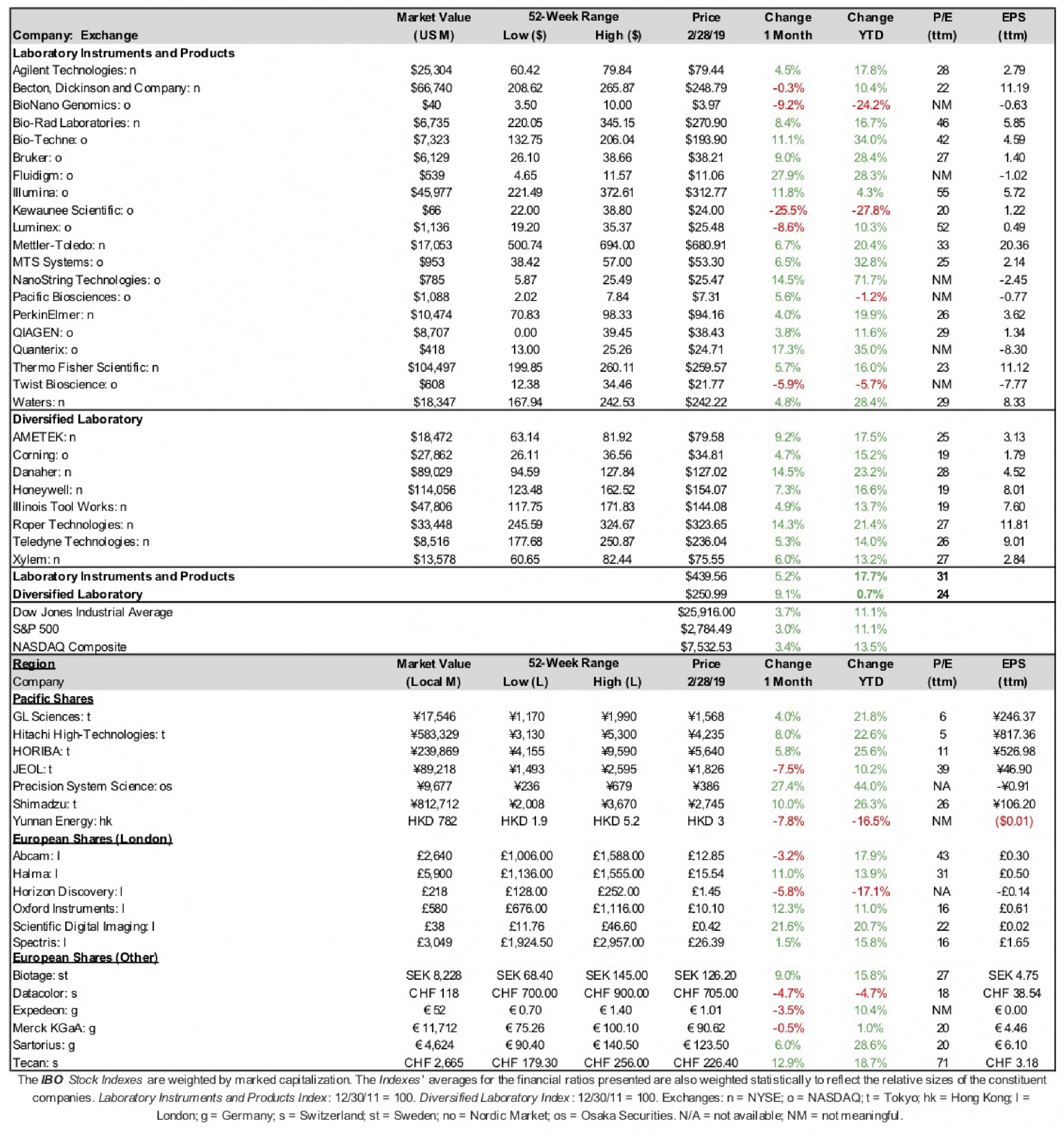

US markets continued their early year rally in February, thanks to the continued progress of trade talks between the US and China and the Fed continuing its conservative language regarding interest rate hikes. Both the Dow Jones Industrial Average and S&P 500 finished the month with their best two month starts since 1987 for the Dow, and 1990 for the S&P 500. On February 28, the US Commerce Department issued its fourth quarter GDP growth estimate of 2.6%. Despite the overall improved performance in the market, investors are still concerned about the US-China tariff issue despite the delay of the March 1 tariff deadline. The Dow Jones, S&P 500 and NASDAQ finished the month up 3.7%, 3.0% and 3.4%, respectively.

Laboratory Instruments and Products Stock Index

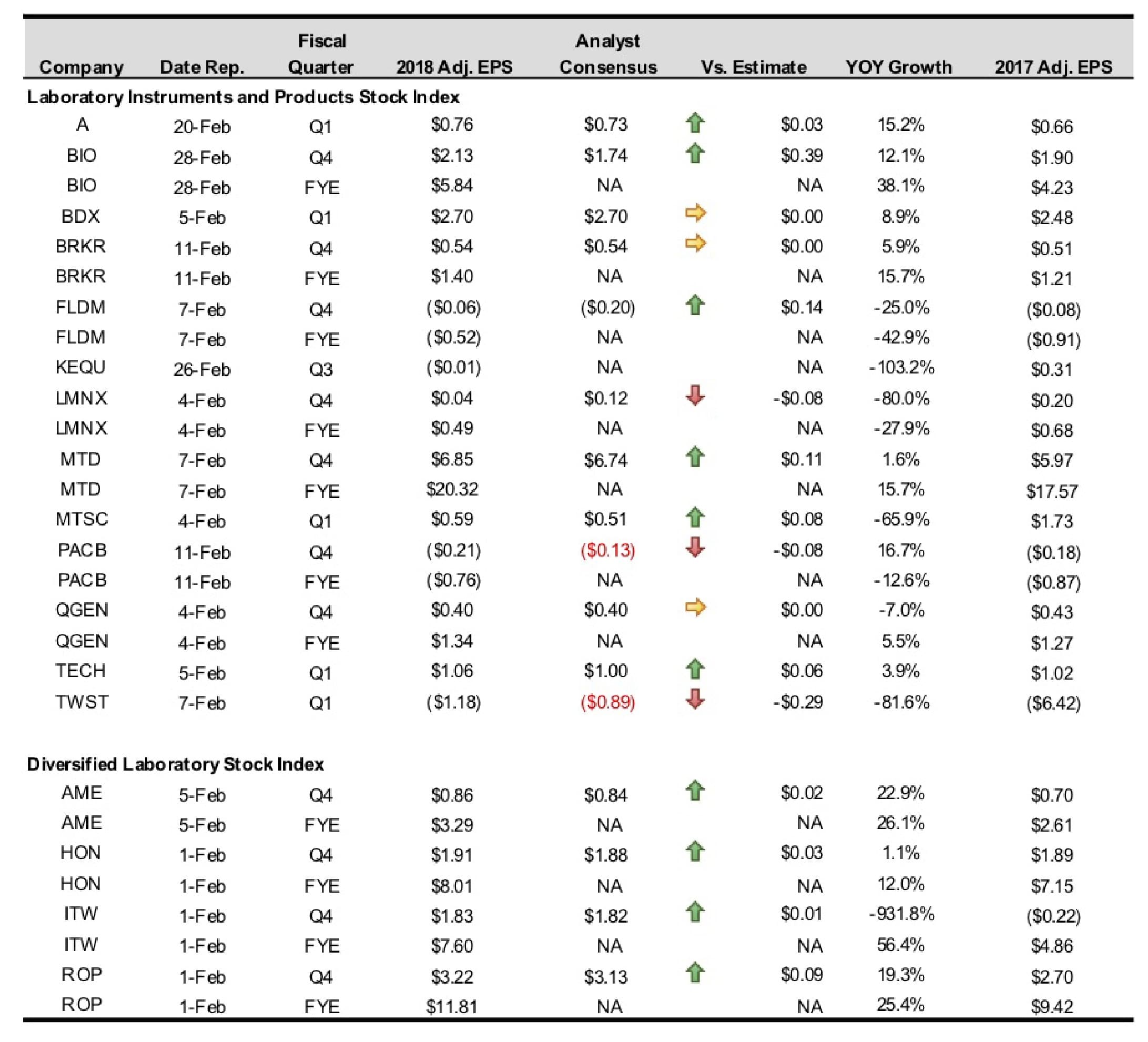

The Index advanced 5.2% to $439.56 this month and is up 17.7% for the year. The Index’s performance was mixed, with most companies trading higher this month. The top performing company for the month was Fluidigm, which jumped 27.9%. The worst performing company for the month was Kewaunee Scientific, declining 25.5%.

In other news, Agilent Technologies, on February 20, reported fiscal first quarter financials (see Bottom Line). The company forecasts fiscal second quarter adjusted EPS to be $0.70–$0.72. In rating news, on February 12, Deutsche Bank upgraded Agilent to a “buy” rating and raised the price target to $85.00, a 10.1% upside from its February 12 price of $77.17.

On February 5, Becton, Dickinson (BD) reported its fiscal first quarter financials (see IBO 2/15/19) and reaffirmed its fiscal 2019 adjusted EPS guidance of $12.05–$12.15. The company feels confident of the EPS guidance due to the expectations strong revenue growth and solid operating income performance, as well as benefits from a lower tax rate.

Bruker, on February 11, reported solid fourth quarter 2018 and full -year 2018 financials (see IBO 2/15/19). Revenue growth and margins performance exceeded the company’s expectations. Bruker forecasts full-year non-GAAP EPS to be $1.54–$1.58, resulting in 10%–13% growth.

On February 7, Mettler-Toledo reported fourth quarter 2018 and full-year 2018 financials (see IBO 2/15/19). For the first quarter, the company forecasts an adjusted EPS range of $4.00–$4.05, resulting in 7%–8% growth. The company attributed this forecast to its expectation of a local currency growth of 5.5%. For full-year adjusted EPS, Mettler-Toledo increased its guidance to $22.50–$22.70, a $0.10 increase for both its low range and high range, ultimately resulting in 11%–12% growth. Despite the increase in EPS guidance, the company predicted a 1.4% currency headwind to EPS for the year. The company still expects local currency sales growth of 5% for 2019.

On February 4, MTS Systems reported its fiscal first quarter financials (see IBO 2/15/19) and reaffirmed its guidance for its fiscal full-year of GAAP diluted EPS of $2.30–$2.60, which would represent 20% growth.

QIAGEN, on February 5, reported its fourth quarter 2018 and full-year 2018 financials (see IBO 2/15/19) and forecast its full-year adjusted EPS to be $1.45–$1.47, including a $0.03 dilution from investments into digital PCR.

The following companies did not provide EPS guidance when reporting quarterly results: Bio-Rad Laboratories, Bio-Techne, Fluidigm, Kewaunee Scientific, Luminex, Pacific Biosciences and Twist Bioscience.

In other news, on February 26, Thermo Fisher Scientific declared a $0.19 dividend, a 11.8% increase from the prior dividend of $0.17.

Diversified Laboratory Stock Index

In February, the Index increased 9.1% to $250.99, with all companies experiencing monthly gains. Danaher and Roper Technologies were the only companies in the Index to experience double-digit increases in share price. Corning experienced the smallest gains, rising only 4.7%.

On February 5, AMETEK announced its fiscal first quarter (see IBO 2/15/19) and full-year guidance. For the full-year, the company expects adjusted EPS of $3.95–$4.05, an 8%–11% increase. For the fiscal first quarter, AMETEK expects the adjusted EPS to be $0.95–$0.97, a 9%–11% increase. In other news, on February 13, the company increased the authorized level for repurchases of its common stock by $500 million. This increase will be added to the $1 million that is currently available from an existing authorization approved by its Board in November 2016. The company claimed that this increase would assist in the flexibility of shareholder value when it felt the need to repurchase its common stock.

Honeywell reported its fourth quarter 2018 and full-year 2018 financials on February 1 (see IBO 2/15/19), and provided both first quarter and full-year 2019 adjusted EPS guidance. For the first quarter, the company expects an adjusted EPS of $1.80–$1.85, resulting in a 6%–9% growth. For the full-year, Honeywell expects an adjusted EPS of $7.80–$8.10, resulting in a 6%–10% growth. In rating news, on February 4, Deutsche Bank upgraded Honeywell to a “buy” rating with an analyst price target of $160.00, a 9.8% upside from the February 4 price of $145.75

Also, on February 1, Illinois Tool Works reported its fourth quarter 2018 and full-year 2018 financials (see IBO 2/15/19). The company reaffirmed its full-year GAAP EPS guidance of $7.90–$8.20, which was first announced in December 7, 2018. In addition, the company decreased its full-year organic sales growth to the range of 1%–3%. In ratings news, on February 5, Bank of America downgraded Illinois Tool Works from a “neutral” rating to an “underperform” rating. The bank lowered the company’s price target to $124.00, a 9.7% downside from the February 5 price of $137.31.

Roper Technologies announced its fourth quarter 2018 and full-year 2018 financials on February 1 (see IBO 2/15/19). In addition, it projected its guidance for both first quarter and full-year adjusted EPS. The company expects first quarter adjusted EPS to be $2.74–$2.80, excluding the impact of future acquisitions. Meanwhile, full-year adjusted EPS is expected to be in the range of $12.00 to $12.40. On February 4, Wells Fargo upgraded Roper to an “outperform” rating and raised its price target to $345.00, a 18.2% upside from the February 4 price of $291.76.

In other news, on February 6, Corning declared a $0.20 dividend, a 11.1% increase.

On February 25, Danaher announced it would begin a public offering $1.35 billion share of common stock and $1.35 billion shares of Series A Mandatory Convertible Preferred Stock. The company will use the proceeds to fund a portion of the $21.4 billion purchase price of its pending acquisition of the Biopharma business from GE Life Sciences (see Danaher to Buy GE Biopharma for $21.4 Billion).

International Stocks

For the month, the Asia Pacific markets were mostly positive except for India’s Sensex, which had a 1.07% decline. China’s Shanghai Index was the only Asia Pacific market index to expand in the double digits, up 13.79%.

Prices for the Pacific region companies in the IBO Stock Table were mixed, with most companies experiencing monthly gains. Precision System Science and Shimadzu were the only companies whose share prices increased in the double digits, increasing 27.4% and 10.0%, respectively. The two companies with monthly declines were JEOL and Yunnan Energy, decreasing 7.5% and 7.8%, respectively.

European equity markets were positive in February. France’s CAC 40 and Italy’s FTSE MIB Index expanded 4.96% and 4.71%, respectively. London’s FTSE 100 experienced the smallest gains with a 1.52% increase.

Prices for the European stocks in the IBO Stock Table were mixed as well, with most companies showing gains in February. Scientific Digital Imaging had the highest growth this month with a 21.6% increase, followed by Tecan which rose 12.9%. In contrast, Horizon Discovery was the biggest loser, declining 5.8%.

In other news, the Sartorius announced on February 14 that it will declare a €0.61 ($0.69 at €0.88 = $1) dividend per ordinary share and a €0.62 ($0.70) per preference share, a 21.9% and 21.6% increase, respectively.