The Long and the Short of It: Illumina to Buy Pacific Biosciences

Aiming to fortify and build upon its dominance of the sequencer market, Illumina announced this month an agreement to acquire Pacific Biosciences (PacBio) (see Executive Briefing). The acquisition will bring together the largest short-read and largest long-read sequencing companies, respectively, bridging a divide that has characterized the post-Sanger sequencing market since its inception.

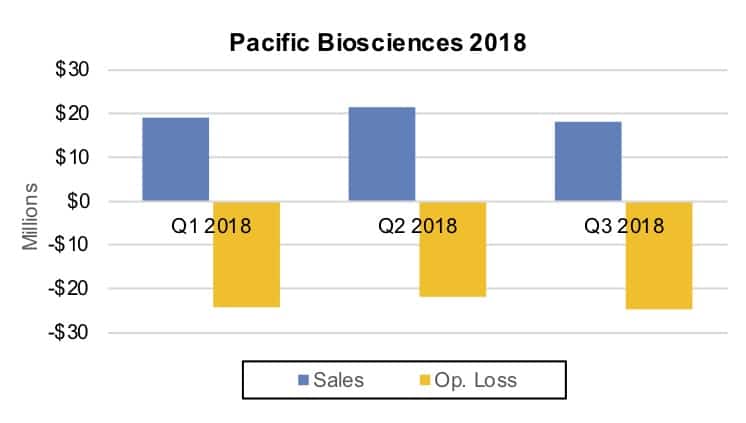

Illumina values the all-stock purchase at approximately $1.2 billion. In 2017, PacBio recorded sales of $93.5 million but a net loss of $92.2 million (see IBO 2/15/18). For the nine month period ending September 30, revenue dropped 13.8% to $59.1 million. The company had warned of slower sales due to an impending product update. Nine month net loss was nearly even with a year ago at $71.8 million.

Illumina asserts the acquisition enables it to offer sequencing systems for new applications and a wider range of researchers and labs, as well as those wanting both short- and long-read sequencing. Both companies offer sequencing by synthesis technologies, but while Illumina sequencers produce segments of DNA up to 600 bp in length, PacBio’s long-read technology produces DNA segments up to 20 kb. Short-read has generally been preferred for most applications due to its cost, speed and accuracy. In contrast, PacBio’s SMRT technology can characterize structural variants, repeat regions and DNA modification.

A New Era?

As Illumina stated in its conference call discussing the deal, being able to offer its customers both technologies will be a competitive advantage. “Over time, we will provide more seamless integration of the workflows and analytical pipelines to allow customers easier access to the combined power of the two technologies,” stated President and CEO Francis deSouza. “We expect that together these benefits will allow broader market access, enabling faster growth. Together, we will provide more researchers, more physicians, more patients and more consumers a more perfect view of a genome.”

Although PacBio had mainly made inroads into the NGS market with de novo sequencing of plants and animals, its latest product introductions are expected to make the company’s SMRT sequencing technology as affordable and accurate as Illumina’s short-read sequencing (see IBO 10/31/18), opening up new applications in human genomics, including drug development and clinical applications—a change that Illumina recognized. “With this level of accuracy, researchers will be able to create complete genome assemblies at Q50 consensus quality to comprehensively and accurately detect all classes of variance. Importantly, PacBio’s improved workflow will obviate the need for large quantities of high molecular-weight DNA, which hinders other long-read technologies,” said Mr. deSouza. The other widely commercialized long-read technology is Oxford Nanopore Technologies’ nanopore sequencing systems, which has reported read lengths of more than 1 Mb with its systems.

In its first quarter call, PacBio disclosed an installed base of around 400 systems. This compares with Illumina’s installed base of more than 11,000 systems. Consequently, Illumina expects to use its more extensive resources to grow PacBio. “[W]e have experience with global operations and manufacturing and distribution and support. And so we think that the combination strengthens the roadmap that PacBio has and strengthens the go-to-market motion around the offerings that they’re bringing to market next year,” noted Mr. deSouza.

Clinical Opportunities?

Clinical sequencing is the fastest growing segment of the sequencing market. Illumina discussed the existing and possible applications of the PacBio technology in clinical markets, as well as new opportunities made possible by PacBio’s latest technology upgrades. Mr. deSouza commented, “[T]he power to improve structural variant and CNV [copy number variation] analysis enables improved studies and potentially accelerates discovery in areas like rare and undiagnosed diseases, oncology and clinical microbiology that often involves phased genomes without access to a reference.”

As PacBio President and CEO Michael Hunkapiller told investors this spring on the company’s first quarter earnings call, “Our ongoing goal is to enable our customers to generate up to 150 Gb of data from a single SMRT cell, which would then enable us to provide high-quality human-size de novo genomes for approximately $1,000 and low-coverage genomes for structural variant analysis for substantially less.”

PacBio’s recent forays into the clinical market included HLA typing, for example, a partnership with GenDx (see IBO 8/15/14); newborn sequencing as part of collaboration with Mount Sinai (see IBO 7/15/11); and precision medicine through an agreement with Novogene. On recent earnings call, the company has discussed research results from clinical studies at HudsonAlpha, rare disease research at Radboud University Medical Center in the Netherlands and work with the American Association for Cancer Research using its Iso-Seq method for sequencing of full-length RNA transcripts.

The Future?

The acquisition will put Illumina in a unique position as none of the company’s existing sequencer competitors either in the short-read market, BGI, QIAGEN and Thermo Fisher Scientific, or long-read market, Oxford Nanopore, can offer both short- and long-read technologies. However, NanoString Technologies’ Hyb & Seq technology, which is scheduled to commercially launch in 2020, promises simultaneous short and long reads, and like PacBio’s technology, hybridization sequencing is an amplification-free, single molecule sequencing technique. The company also touts the technology provides parallel sequencing of RNA and DNA and a significantly shorter sample preparation workflow than existing short-read technologies. NanoString has stated that it expects to target the clinical sequencing market.

Addressing anti-trust concerns, Mr. deSouza said on the call, “[W]e serve the short-read market in sequencing. And the segments we serve are complementary to the segments that are served by the long-read players, in the sense that we are uniquely qualified for the segments that we play in, and we have a set of competitors in our short-read segment. And frankly, we don’t really play in some of the long-read segments at all.”

But other sequencer companies appear to be focused on either short- or long-read lengths techniques. Agilent Technologies is expected to extend its clinical NGS workflow targeting the routine clinical market with the introduction of a sequencing system, scheduled for release in 2020. In addition, Direct Genomics recently unveiled a short-read sequencing system for the clinical market.

On the long-read side, additional nanopore technologies are moving toward commercialization. Roche acquired nanopore sequencer developer Genia Technologies in 2014 (see IBO 6/15/14) and has invested in Stratos Genomics for nanopore chemistry (see IBO 8/15/16). Roche dissolved its partnership with PacBio for clinical systems in 2016 (see IBO 12/15/16). Other nanopore instrument developers include Beijing Meili Technology and Quantapore.

Illumina’s planned purchase of PacBio, and investments in these nanopore firms, only serve to further illustrate the value of long-read sequencing and the further progress of sequencing technology.