The Growing Presence of the Analytical and Scientific Instruments Industry in the Asia Pacific Region

Demand for analytical and scientific instrumentation has grown in the Asia Pacific, excluding China and Japan (Asia Pacific). Specifically, these products have been utilized to address issues such as climate change and an aging population food production and new energy sources. Analytical and scientific instrumentation vendors have responded to the demands via distribution by local companies as well as direct sales. Also, due to trade tensions between the US and China in 2019, companies shifted some production and supply chains to countries in this region outside of China to circumvent disruption in business operations.

In September 2019, IBO’s publisher Strategic Directions International released “Instrumentation Markets in Asia Pacific: Korea, Taiwan, Southeast Asia & Oceania,” which examines the market trends and demands for analytical and scientific instrumentation in the Asia Pacific. The following Asia Pacific areas are covered in the report: South Korea, Taiwan, Mainland Southeast Asia, Island Southeast Asia and the Oceania region.

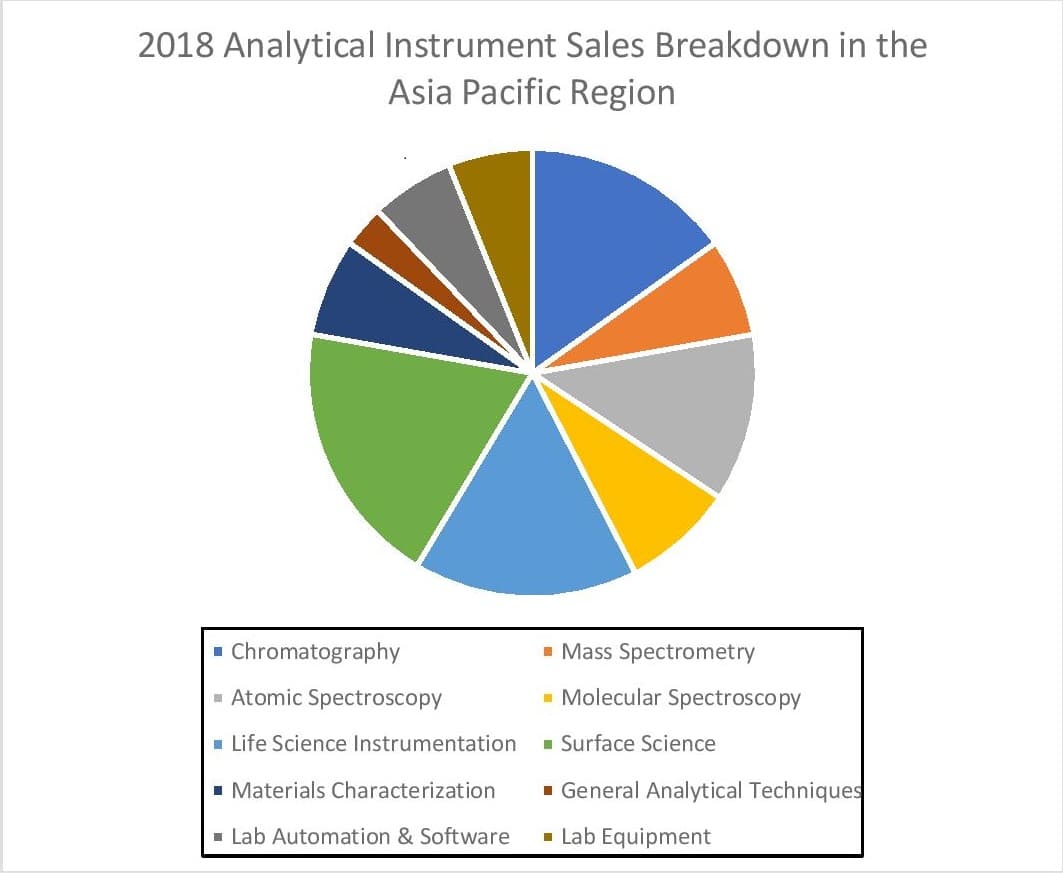

The report categorizes instrumentation into 10 technology sectors: chromatography, mass spectrometry (MS), atomic spectroscopy, molecular spectroscopy, life science instrumentation, surface science, materials characterization, general analytical techniques, lab automation, and software and lab equipment. The leading companies for such products in the region include Agilent Technologies, AMETEK, HORIBA, Thermo Fisher Scientific and others.

According to the report, in 2018, the analytical and scientific instrumentation market in the Asia Pacific grew in the high single digits to about $3.1 billion led by MS instrumentation sales. Industries driving significant demand for laboratory instrumentation in the region include the semiconductors/electronics pharmaceutical/biotech end-markets.

By technology, MS and atomic spectroscopy technologies were two of the fastest-growing sectors in 2018. Within MS, quadrupole LC/MS and MALDI-TOF technologies have been among the primary revenue drivers. Quadrupole LC/MS systems are in high demand due to being reasonably priced, while the use of MALDI-TOF systems has increased in the life science research sector. X-ray diffraction and ICP-MS systems are accounted for the highest percentage of atomic spectroscopy instrumentation sales in the region, with both technology sectors benefiting from demand from the semiconductor industry.

On a geographical basis, the report highlights the prospects for Mainland and Island Southeast Asia. Agilent and Japan-based Shimadzu are among the leading vendors in Mainland Southeast Asia, while HORIBA and Bruker are among the leaders in other areas of Southeast Asia. Also, Thermo Fisher Scientific has a dominant presence in both regions.

End-market wise, the pharmaceutical/biotech and semiconductor/electronics markets have been the fastest-growing industries in the Asia Pacific for analytical instruments. The Asia Pacific region is one of the largest producers of silicon chips. Factors such as foreign investment and government policies have positioned the pharmaceutical/biotech sector as having a major presence in the region. The report also states that hospitals and clinics are experiencing demand for analytical instruments due to demographic shifts.

As for the future, since the report was released in September 2019, the COVID-19 pandemic was not a factor in its forecast for the region’s analytical instrumentation demand. The pandemic has now created a cloud of uncertainty for various sectors and markets on a global scale, including those that the lab tool industry serves, and as a result market for scientific instruments in the Asia Pacific can expect to be affected.