Have China’s Macro and Microeconomic Events Affected Scientific Instrument Companies So Far in 2019?

China has the world’s second-largest economy but is now experiencing its slowest economic growth since the early 1990s. On a quarterly basis, between the end of the calendar year of 2018 and the first half of 2019, China’s GDP growth has fallen, decreasing from 6.6% for the year to 6.4% in the first quarter and 6.2% in the second quarter. Various events have contributed to the region’s economic performance, such as the ongoing US-China trade talks; a global economic slowdown; Chinese exports to the US falling 16% in August; US businesses slowly transferring production out of China; and the region’s growth in industrial output, delivering its weakest pace since 2002.

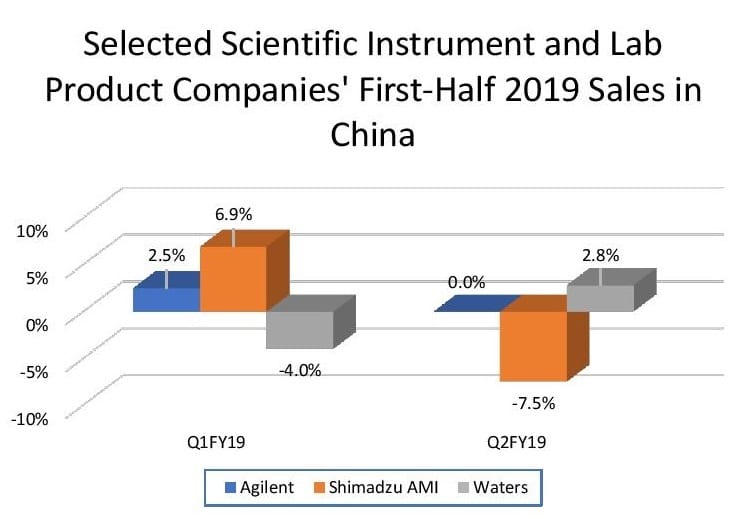

For the first half of the year, China’s slower economic growth has begun to show some effect on the 21 scientific instrument and lab product companies reviewed here. Agilent Technologies, PerkinElmer, Shimadzu Analytical & Measuring Instruments (AMI) and Waters have each spoken about the effects of such factors on instrument sales in China, attributing the uneven sales growth primarily to three trends through the first half of the year: the US trade dispute; the transfer of food testing from the government to privately owned laboratories; and the implementation of the“4+7” initiative for generic drugs.

Trade Dispute Impact

Since April 2017, the US-China trade disruption has been a source of uncertainty for the global economy. According to Reuters, as part of the trade war, the US has imposed 25% tariffs on $250 billion worth of Chinese products, while China has retaliated with tariffs, ranging from 5% to 25% on $110 billion worth of US products. Of the few scientific instrument and lab product companies that directly commented on the issue, some have reported adverse effects related to it.

Although PerkinElmer does not report financial figures for China, the company did highlight in its second quarter conference call that the Ministry of Commerce of P.R. China (MOFCOM) has delayed certain product line exports to China. PerkinElmer Chairman, CEO and President Robert Friel stated on the company’s second quarter conference call, “[W]e think some of that is macro slowdown overall in China. [W]e’re starting to see some anecdotal evidence that there’s starting to be a little bit of bias against US companies, particularly in some of the tenders.” Jamey Mock, company CFO, also said on the call, “Longer term, we remain bullish on China, and believe that a lot of these issues are short term in nature, and are mostly related to ongoing delays in export-controlled product approvals as well as the global trade war rhetoric.” In the second quarter, PerkinElmer commented that its Discovery and Analytical Solutions business’ Chinese sales were impacted, especially within the applied end-market.

Since its fiscal fourth quarter 2019 (ending March 31, 2019), Shimadzu AMI has noticed some effects of the US-China trade dispute on its industrial end-market. Despite 2% sales growth for the industrial end-market for the fiscal year, electrical/electronic industry revenue growth slowed in the second half, which the company tied to the US-China tariffs. In the fiscal first quarter 2020, Shimadzu AMI industrial end-market sales growth fell 3%, due to continued sales decline for the electrical/electronic industry as well as the materials industry. Despite these concerns, the company did not detail any further how the trade dispute affected this end-market.

China’s Food Safety Market Impact

Since China implemented its Food Safety Law in 2015, the region’s food safety testing market has expanded greatly. Over a four-year time span, starting in 2016, China’s food safety testing market is expected to rise 9.9% CAGR by 2020 (see IBO 6/15/17). Food safety regulations have become an important domestic issue in China due to various contamination incidents. China’s stricter regulations have been an opportunity for the scientific instrument and lab product industry to sell instruments to both government and private laboratories. Over half of China’s food safety testing market is made up of government-owned labs, while privately owned labs, mostly foreign-owned, make up the remainder (see IBO 6/15/17). However, food companies have begun to utilize more private sector labs in China, according to some instrument companies. Agilent Technologies, PerkinElmer and Waters have each commented on the impact of this development on their sales growth.

For Agilent’s fiscal second quarter 2019 (ending April 30), the company’s overall Chinese sales rose 3%, partly due to a 3% sales decline in the food end-market. This was significant, as the food testing market usually accounts for 15%–18% of Agilent’s Chinese sales. The company expected that after the creation of the State Administration for Market Regulation (SAMR) in the calendar year 2018 and the resulting changes, purchases by government-owned labs would stabilize. But in the fiscal third quarter 2019, food end-market sales for the company declined 3% again. On the firm’s fiscal third quarter conference call, CEO Mike McMullen commented, “The business from government-owned labs remains muted, while commercial testing labs’ activity is increasing.” Agilent also noted its particularly heavy presence in government food labs. The company’s sales to China were flat for the quarter.

PerkinElmer’s first quarter 2019 applied market sales, especially in the food end-market, were soft, thanks to food companies shifting more testing to privately owned laboratories. Mr. Friel explained on the company’s first quarter conference call, “[W]e’ve seen a little bit of a reduction in food testing, as the shift has occurred from public labs to private labs.” For the second quarter, PerkinElmer reported flat sales within the applied end-market, mostly from soft sales in China. PerkinElmer stated that despite headwinds in the food testing market, it saw significant demand for instruments from food production customers.

While PerkinElmer and Agilent experienced sales declines related to food testing in 2019, Waters experienced the opposite. For the first quarter, Waters claimed that the restructuring of food safety regulations impacted sales both in China’s food safety testing market and the region overall. The soft sales in China were significant, since the region accounts for 18% of the company’s global sales, and, within China, the food testing market represents 15%. On its second quarter conference call, Waters Chairman and CEO Christopher O’Connell commented, “We do see the evolution of that process maturing in the first or second quarter here. We do expect some ongoing caution but, over time, that’s the really important priority for the Chinese government—to invest in food safety testing.” The food testing market sales for Waters have stabilized due to increasing demand for its instrument from privately owned labs. However, the company stated this did not completely offset the dwindling demand from government-owned labs.

“4+7” Drug Bulk-Buy Program

In December 2018, China’s newly formed health insurance watchdog, the Joint Procurement Office (JPO), released the, “4+7” initiative that is designed to reduce prices for 31 generic drugs by 90% or more. China launched the program in 11 cities where pharmaceutical companies, whether domestic or multinational, would have to provide the lowest bid in order to be approved by the Chinese government to manufacture one or more of the 31 generic drugs. By September 2019, contracts were issued to 13 pharmaceutical companies to manufacture 25 generic drugs. The changes impacted pharmaceutical companies, which was a factor in certain scientific instruments and lab product companies reviewed by IBO experiencing slower demand in the pharmaceutical end-market.

For example, despite Agilent Technologies’ Chinese sales growing 3% in its fiscal second quarter 2019, regional instrument orders were delayed, particularly those related to small molecule pharma. This resulted in the company’s Life Sciences & Applied Markets Group (LSAG) business sales falling 1% for the quarter. For the fiscal third quarter 2019, small molecule pharma sales continued to decline, which the company again attributed in part to the “4+7” initiative, and hoped it would be completed in the latter part of the year. Mr. McMullen said on Agilent’s fiscal third quarter conference call, “[S]tarting with the 4+7 initiative in China, we saw sequential improvement in demand from generics manufacturers. This is driven by business coming from the winners of the first 4+7 pilot, resulting in growth in our instruments business.”

When Shimadzu AMI reported its fiscal 2019 sales, it stated it did not experience any impact from the Chinese “4+7” initiative on instrument sales. But that changed when the company reported its first quarter fiscal 2020 financials, stating that the 4% sales decline stemming from analysis/healthcare/food end-market was affected by the program.

Regarding Waters’s first quarter financials, generic pharmaceutical customers’ slow demand for its Water-branded instruments was a factor in its Chinese sales declining 4%. The company noted that since the generic pharmaceutical industry is more prominent in China than in other regions, the weak sales from generic pharmaceutical companies had a substantial impact. However, in its second quarter financials, Waters saw its generic pharmaceutical customer base resuming purchasing of its instruments. As Mr. O’Connell said on the call, “[S]ome generic customers that have withheld purchasing in Q1 resumed their purchasing of instruments in Q2, particularly those that were awarded tenders as part of the 4+7 pilot program.” Overall, China second quarter revenues rose 3%.

Despite the effect of changes in China, the scientific instrument and lab product industry in general, and Agilent, PerkinElmer, Shimadzu AMI and Waters in particular, are positive about their long-term revenue growth in the country, driven by key sectors such as the food and pharmaceutical end-markets. Nonetheless, calendar year 2019 shows signs of being an unpredictable year for these four companies in China and perhaps the industry in general. Although few companies have commented on revisions to their China outlook for the year, during its fiscal second quarter conference call, Agilent announced a reduction in its full-year revenue guidance for the country. In addition, in the second quarter, PerkinElmer revised its Discovery & Analytical Solutions’ full-year revenues forecasting mid-single-digit revenue growth from the previous guidance of high single-digit revenue growth due to continuing declining applied market sales in China. Despite what may transpire, China will remain a prominent player in the scientific instrument and lab products industry.

This article is based on information found in the IBO newsletter. For more information on IBO, please visit us at https://instrumentbusinessoutlook.com/.