2019 Analytical Instrumentation Demand for Oil & Gas Grows in Key Technology Segments

While global demand for oil is on a slow decline, natural gas consumption is steadily increasing. Analytical instrumentation is vital to these industries, as they facilitate the exploration, development, production, processing, and delivery of oil and gas products, and, according to new data, the demand for analytical instruments for applications in this industry is on the rise.

Last month, IBO’s publisher, Strategic Directions International, released the 2019 Analytical Instrumentation Market for Oil and Gas: Upstream and Downstream report, which examines the global analytical instruments market in the oil and gas industry, as well as other closely related sectors, including environmental testing for refinery waste and utilities/power generation.

The report categorizes the oil and gas industry into upstream, midstream and downstream sectors, and examines the various analytical instrumentation used in the market, such as benchtop, portable and process-scale application tools. The instruments are categorized into nine technologies that make up the oil and gas market, including chromatography, MS, molecular spectroscopy, petroleum analyzers and general analytical techniques.

Along with identifying trends, opportunities, and regional and industrial demand, the report details the market share and participation of major vendors in the industry, among them Agilent Technologies, Bruker, HORIBA, Shimadzu and Teledyne. As the report carefully analyzes a variety of technologies, the data provided can be utilized not only by instrument vendors selling to the oil and gas market, but also by those in the overall analytical instrumentation industry in general.

In 2018, the overall analytical instrumentation market for oil and gas applications was estimated to be more than $2 billion, and is estimated to achieve single-digit growth in 2019, according to the report. Process, chromatography and materials characterizations technologies made up the largest technology segments for the oil and gas market last year.

The majority of the market demand comes from the downstream sector, as the segment requires various key parameter measurements for ensuring the operational safety and efficiency in downstream facilities, such as refineries and plants. Contract testing, as well as exploration and production, also make up a significant portion of demand, but due to the overall slowing and plateauing demand in the oil industry, certain technology sectors’ growth is forecast to be below average.

Instrumentation demand is also being affected by regional trends in the oil and gas industry. For example, chromatography demand for oil and gas applications is forecast to surge in North America and Europe, but is growing more modestly in particular Asian countries. Similarly, Japan and Asia Pacific are forecast to have healthy demand for atomic spectroscopy technologies, while the vast majority of demand for certain process technologies are being solely driven by North America.

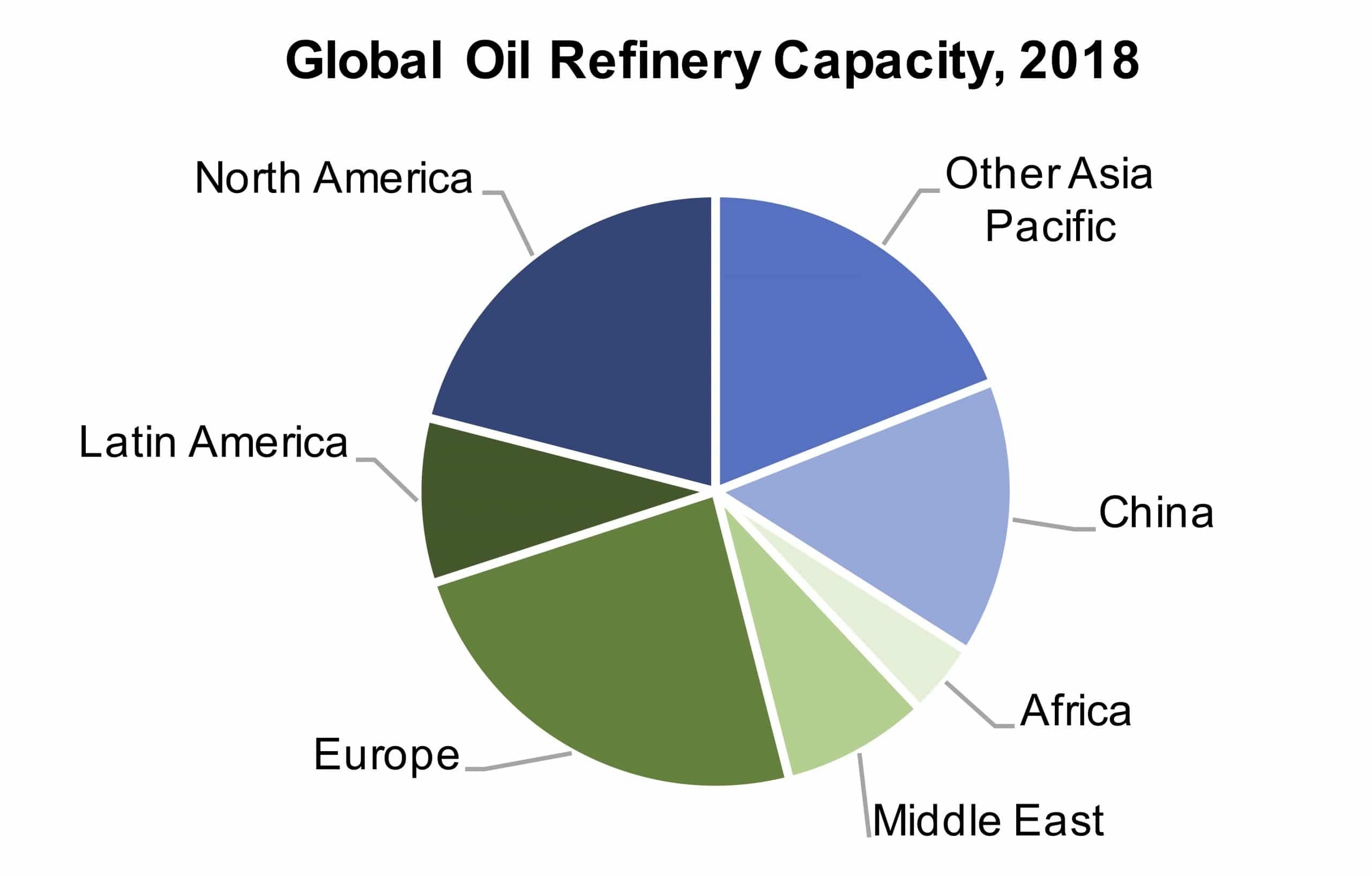

Europe, North America and China are responsible for the lion’s share of oil and gas production, with Other Asia Pacific countries (i.e., excluding Japan), such as Australia, Indonesia and Malaysia, also counted as strong competitors in the production market.

Russia’s increasing importation of oil and gas commodities, along with general rising natural gas usage on the continent, is driving demand growth in Europe, while Canada’s pipeline expansion plans and the US’ focus on petrochemical plants is boosting production in North America. However, with trade tensions still looming between the US and China, along with the economic uncertainties in Europe by way of Brexit, the oil and gas industry will no doubt be affected.