Dividends as an Indicator for Laboratory Tool Industry Companies in 2022

In 2022, uncertainty was the dominant tone for the US stock market as investor sentiment waned due to geopolitical conflicts, high inflation, mixed macroeconomic data, recession fears and more. As a result, major stock indexes such as the Dow Jones Industrial Average, NASDAQ and S&P 500 posted declines for the year. In addition, many industries struggled to find their way in a challenging macroeconomic environment by enacting cost-saving measures, participating in M&A and adjusting business operations.

Public companies suspending or trimming quarterly dividend payments to shareholders was one cost-saving measure not widely utilized by companies in 2022—especially companies in the S&P 500 index. For example, the S&P Dow Jones Indices, a division of S&P Global, reported companies in the S&P 500 paid an estimated $564.6 billion toward dividends in 2022, a 10.4% increase. However, according to the Wall Street Journal, the main reason firms continued to pay dividends and even increased them was due to sufficient cash flow and resilient corporate earnings.

As mentioned in a previous Instrument Business Outlook (IBO) blog, “Dividends and the Financial and Market Status of Laboratory Tool Companies in 2020,” a consistent dividend payment schedule can indicate a company’s steady, optimistic financial outlook. Therefore, a recurring dividend payment encourages shareholders to maintain their investment in the company. Often an increase in dividend payment, whether quarterly, annually or intermittently, can indicate that a business’s financial position or market outlook is improving and thus may improve investor sentiment.

Also, an increase in dividend payment can engender a temporary rise in share price, which usually requires a new investor to pay a premium. Conversely, a decrease or suspension of a dividend payment signals a company’s financial situation or outlook has changed; for example, the company may need to save cash as revenues decline.

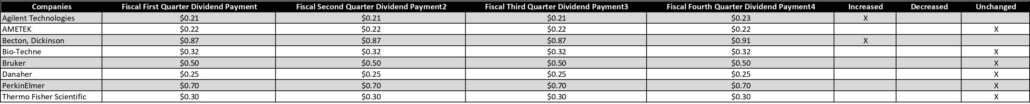

Eight laboratory tool firms that distribute regular dividend payments are reviewed here. Each company has a major and distinct presence in the scientific tools market. The companies highlighted here include Agilent Technologies, Bio-Techne, Bruker, Danaher, PerkinElmer and Thermo Fisher Scientific. In addition, AMETEK and Becton, Dickinson (BD), companies that have a select line of laboratory products through specific business segments, are included.

Please note that when mentioning the eight companies’ stock market performances and dividend payment schedules calendar year of 2022 is utilized. However, financial figures for revenue performance and cash and cash equivalent are based on each company’s fiscal 2022 reporting period. For example, AMETEK, Bruker, Danaher, PerkinElmer and Thermo Fisher follow the calendar year 2022 with annual reporting periods ending December 31, 2022. As a result, only their first nine-month 2022 revenues, and cash and cash financials are utilized in this blog.

On the other hand, Agilent, BD and Bio-Techne’s fiscal 2022 reporting periods fell during the calendar year-end rather than at year-end. Agilent, BD and Bio-Techne’s fiscal years ended in October 31, 2022, September 30, 2022, and June 30, 2022, respectively. As a result, the information presented here does include their total fiscal 2022 revenues and cash and cash equivalent used, encompassing the whole of fiscal 2022 including some information from calendar year 2021.

Full-Year 2022

2022 was a transitional year for some lab tools firms, such as PerkinElmer, Danaher and Thermo Fisher Scientific, as demand for COVID-19-related products lessened, but demand for all companies from the biopharma market remained strong across a variety of application areas. Out of the eight corporations, seven posted sales growth for financial results for calendar year 2022 ranging from mid-single-digits to the high teens. For their fiscal full-year 2022 sales, Agilent, BD and Bio-Techne’s revenues expanded 8.4%, 6.9% and 18.7%, respectively. For the first nine months of 2022, AMETEK, Bruker, Danaher and Thermo Fisher saw their sales grow 11.9%, 5.1%, 8.4% and 17.4%, respectively. Conversely, PerkinElmer was the only company to post a decline, with an 8.2% tumble for the first nine months of 2022 because of waning COVID-19-related demand and lockdown restrictions in China.

According to the Wall Street Journal, many companies boosted 2022 dividend payments to indicate strong business fundamentals, such as sufficient cash flows and strong outlooks. However, among the eight firms discussed here, only Agilent and BD increased their quarterly dividend payments in 2022, with both doing so in the calendar year fourth quarter (see table). Specifically, Agilent augmented its dividend by two cents to $0.23 from $0.21. At the same time, BD’s dividend went from $0.87 to $0.91 due to its confidence in meeting long-term goals through various corporate strategies.

BD was the only company to land in positive territory for its calendar year 2022 share price performance, recording a 1.1% increase. In contrast, share prices for Agilent, AMETEK, Bio-Techne, Bruker, Danaher, PerkinElmer and Thermo Fisher fell 6.3%, 5.0%, 84.0%, 18.5%, 19.3%, 30.3% and 17.5%, respectively. Most companies’ disappointing stock market performances exhibited they were just as vulnerable to changing investor sentiment and the markets’ overall performance due to external macroeconomic factors.

The remaining six companies kept a consistent dividend payment, maintaining their quarterly dividend schedules throughout 2022. Also, no company cut or suspended their dividend payments despite a double-digit decline in share price. Danaher was the only company with positive revenue growth.

A notable factor may have been cash flow, as most of these companies saw their cash flow decline throughout the calendar year 2022. Specifically, Agilent, AMETEK, BD, Bio-Techne, Bruker, PerkinElmer and Thermo Fisher’s cash and cash equivalent figures declined double digits, falling 29.0%, 10.6%, 56.0%, 13.3%, 41.4%, 33.6% and 34.8%, respectively. Danaher was the only company with a positive cash flow, posting a slight 1.0% uptick.

Conclusion

The steady dividend payments maintained by the eight laboratory tool companies in 2022 showed the industry’s ability to weather a challenging US stock market, waning COVID-19-related needs and changing customer sentiment. Nonetheless, these companies’ product and service offerings still allow most of them to record solid revenue growth despite declining share prices and cash flow contraction. If the lab tools industry can continue to adapt to a changing macroeconomy, dividend payments can continue to be an encouraging sign for shareholders.