FY2016 Executive Compensation Rises

Total compensation for CEOs and named executive officers of publicly held laboratory instrument and product companies returned to growth in FY16 following a modest decline in in FY15. Given the steady climb in equity prices, adjusted EPS and free cash flows for many companies in the tables in FY16, it comes as little surprise that executive compensation reflected these gains. Accordingly, total compensation for all executives in the tables below who have served in their respective roles for more than one year advanced 12% on median basis and 16% on average.

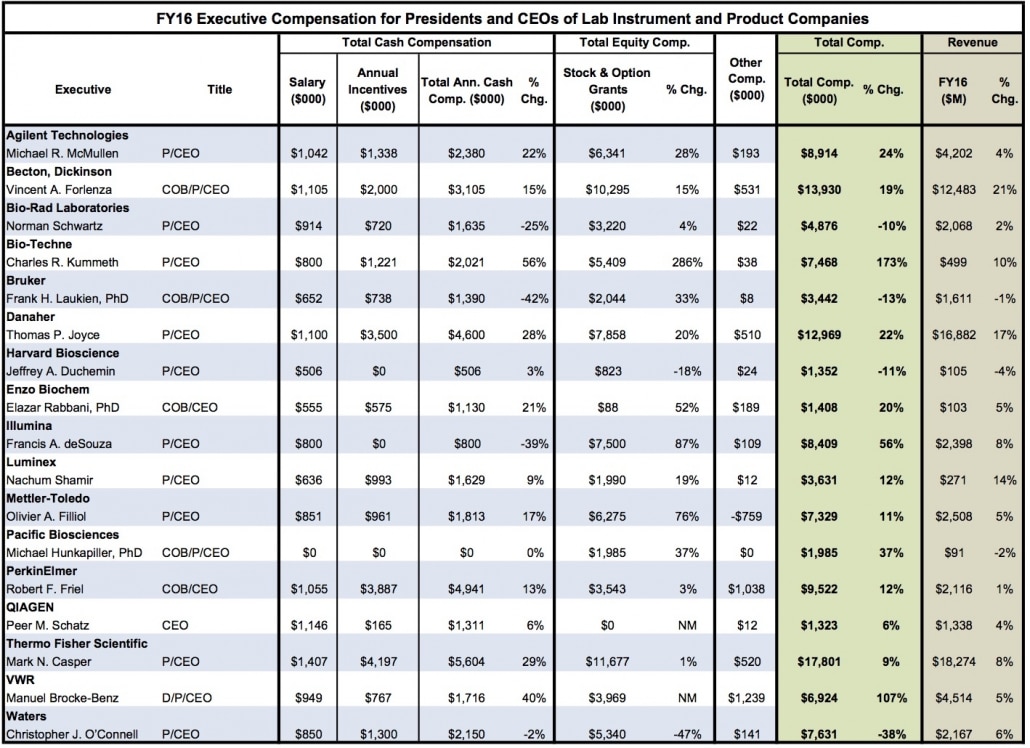

IBO analyzed the summary compensation tables in the proxy statements of 17 CEOs and 21 named executives of dedicated business units from a total of 20 companies. As usual, compensation packages vary year over year due to achieved performance targets, timing of equity awards, promotions and discretionary measures, among other influences.

Breakdown of CEOs Compensation

Total average compensation for the 17 CEOs in the table rose 16% to $7.0 million in FY16, with the largest distribution of salary allocated to long-term equity awards. The average value of combined stock and option awards grew 24% to $4.6 million to account for 66% of total compensation. Roughly half the CEOs recorded equity grants valued at more than $5 million, including more than $10 million for Mark N. Casper and Vincent A. Forlenza, presidents and CEOs of Thermo Fisher Scientific and Becton, Dickinson, respectively.

While the average split between stock- and option-based awards in FY16 trended towards the latter, the type of equity grants varied by company. For example, in FY16, Agilent Technologies included additional stock units in lieu of options to encourage retention. Equity awards for CEOs at Bio-Rad Laboratories, Illumina and Thermo Fisher were also predominantly weighted towards restricted stocks in FY16. Conversely, equity awards for executives at Enzo Biochem, Luminex and VWR were exclusively comprised of stock options.

Although stock awards provide greater financial security, options can offer huge rewards especially if granted during suppressed stock prices. In FY13, Mr. Casper received a special stock option grant of 600,000 shares at a strike price of $46.56. The estimated payout for these options listed in the 2009 SEC filing was $10.3 million. However, based on the sale of certain shares in FY13 and using the current share price for the remaining exercisable shares, his total potential estimated value for these options is over $55 million.

Accounting for 19% of total CEO compensation, average cash incentive awards also advanced at a steady pace for CEOs in the table in FY16, expanding 11% to $1.3 million. This increase was driven by attained or exceeded financial results, as well as awards for discretionary achievements tied to acquisitions or strategic business developments.

However, not all CEOs received cash incentives in FY16. Newly appointed Illumina CEO Francis A. deSouza (see IBO 3/15/16) and Harvard Bioscience President and CEO Jeffrey A. Duchemin failed to reach the minimum financial thresholds to be eligible for cash awards. Meanwhile, Pacific Biosciences President and CEO Michael Hunkapiller, PhD, waived all bonus incentives for the fourth consecutive year.

Base salaries grew for most CEOs in the table, climbing 5% on average to $845,189 to account for 12% of compensation. In his first full year as president and CEO of Agilent, Michael R. McMullen received an 11% pay raise, further adding to the list of five CEOs with salaries above $1 million. However, base salaries were unchanged for CEOs of Enzo Biochem and VWR, as well as for CEO of QIAGEN when excluding currency conversion. Mettler-Toledo President and CEO Olivier A. Filliol voluntarily reduced his base salary by 5% given the strengthening of the Swiss franc and company cost saving measures. Mr. Hunkapiller opted for an annual base salary of only $1. Also of note, Bruker President and CEO Frank H. Laukien, PhD, voluntarily took a 10% salary reduction beginning August 2016 through the remainder of the year.

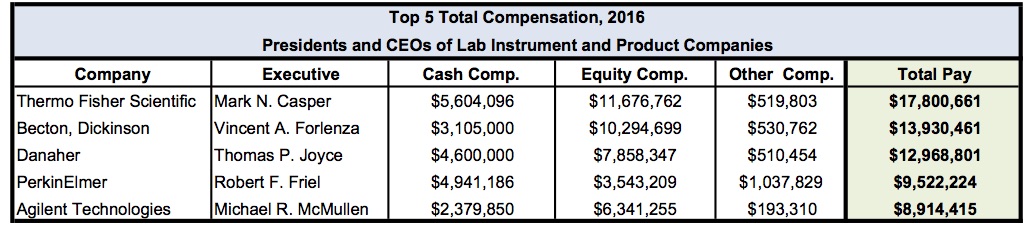

Largest Compensation

Given Thermo Fisher’s market capitalization and sales volume, it comes as little surprise that Mr. Casper recorded the largest total compensation package in FY16 among CEOs in the table, climbing 9% to $17.8 million. The pay increase was primarily driven by cash incentives, which jumped 40% to $4.2 million as the company exceeded most financial targets. However, Mr. Casper was also, along with other top Thermo Fisher executives, awarded a one-time supplemental bonus based on adjusted operating income to compensate for lower payments in the previous year due to extreme currency headwinds.

Compared to Mr. Casper, total compensation for CEOs of companies in the table within a comparable sales range were notably lower but expanded at a stronger rate. Mr. Forlenza’s pay increased 19% to $13.9 million, including a 15% increase in long-term equity awards to $10.3 million. Mr. Forlenza was awarded a maximum $2.0 million cash incentive due to strong financial performance measures as well as other strategic accomplishments. Total compensation for Danaher President and CEO Thomas P. Joyce jumped 22% to $13.0 million. Mr. Joyce’s cash incentive and long-term equity awards grew 35% and 20% to $3.5 million and $7.9 million, respectively, driven by incentives for the continued integration of Pall (see IBO 5/15/15) and acquisition of Cepheid (see IBO 9/15/16).

Inching closer to the $10 million compensation level was Mr. McMullen and PerkinElmer CEO Robert F. Friel, whose total pay advanced 24% and 12% to $8.9 million and $9.5 million, respectively. Mr. Friel’s cash incentive expanded 16% to $3.9 million, representing the second largest cash incentive award among CEOs in the list, only behind Mr. Casper.

Notable Pay Changes

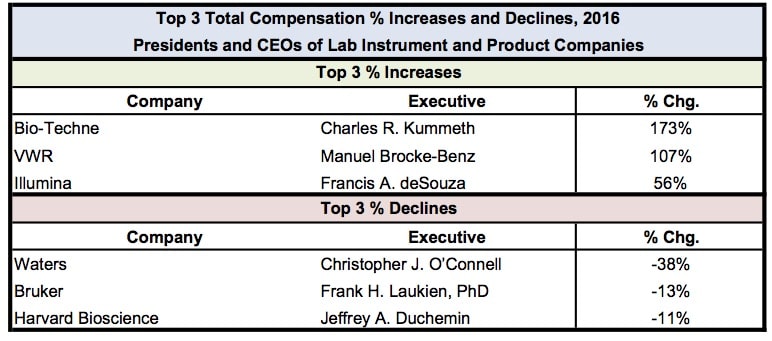

With the largest percentage and nominal pay increase among executives in the table, total compensation for Bio-Techne President and CEO Charles R. Kummeth soared 173% to $7.5 million. Surprisingly, Mr. Kummeth’s compensation level corresponded with payouts for CEOs of companies with four times the sales volume. However, Mr. Kummeth’s disproportionate increase in compensation was attributed to a delayed timing of equity grants and other compensation in FY15 that were in turn included in FY16.

Other significant pay increases were recorded by VWR President and CEO Manuel Brocke-Benz and Mr. deSouza. Total compensation for Mr. Brocke-Benz more than doubled to $6.9 due to timing of a $4.0 million equity grant and higher cash incentives. Despite missing the threshold for a cash incentive award, total compensation for Mr. deSouza climbed 56% to $8.4 million because of a mid-year equity grant following his promotion.

Conversely, Waters President and CEO Christopher J. O’Connell dropped from the list of top five earners in FY15, as his total compensation fell 38% to $7.6 million in FY16. This was the sharpest compensation decline among executives in the tables in FY16. However, the loss in pay was primarily attributable to a $1.7 million bonus and higher equity awards granted in FY15 in connection with his hiring (see IBO 6/30/15).

In addition, total compensation for Bio-Rad Laboratories President and CEO Norman Schwartz, Mr. Laukien and Mr. Duchemin declined roughly 10% or more each due to missed financial targets.

Discretionary & Individual Performance Awards

Aside from financial performance, cash incentive awards were also based on discretionary measures. Luminex President and CEO Nachum Shamir, whose FY16 total compensation advanced 12% to $3.6 million, was rewarded for certain product developments, FDA approvals and the acquisition of Nanosphere, which ultimately resolved the company’s strategic goal to either invest or acquire a new multiplex system.

Mettler-Toledo President and CEO Olivier A. Filliol was granted a one-time option award valued at $1.5 million, as the compensation committee concluded that cash compensation did not reflect the company’s growth in market capitalization and was lower compared to peer companies. Consequently, Mr. Filliol’s equity compensation jumped 76% to $6.3 million.

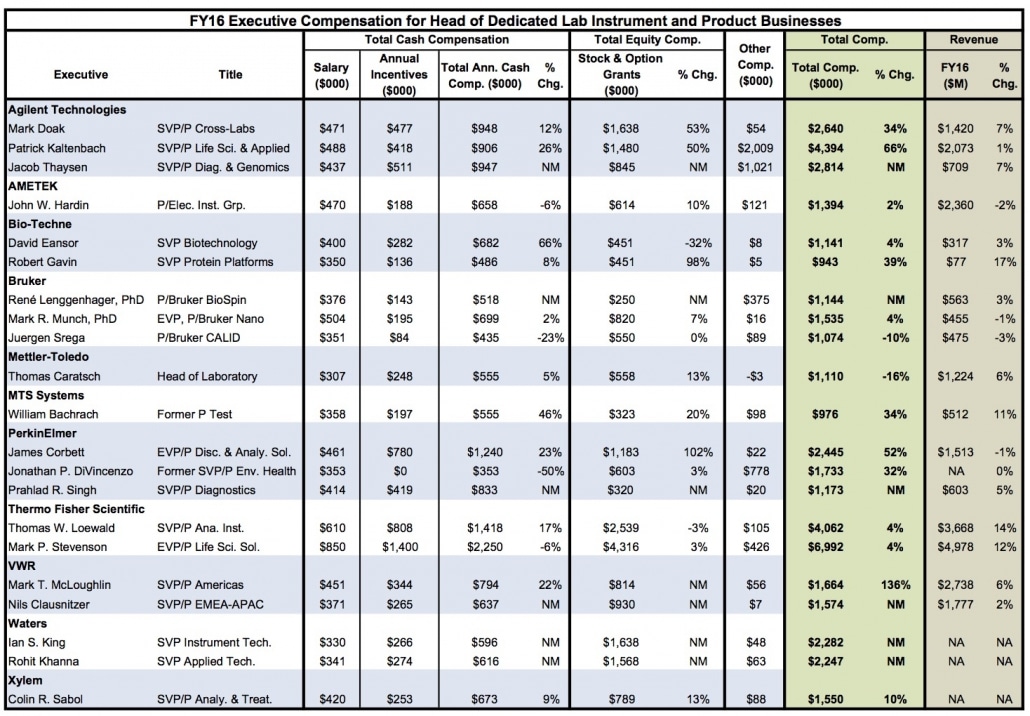

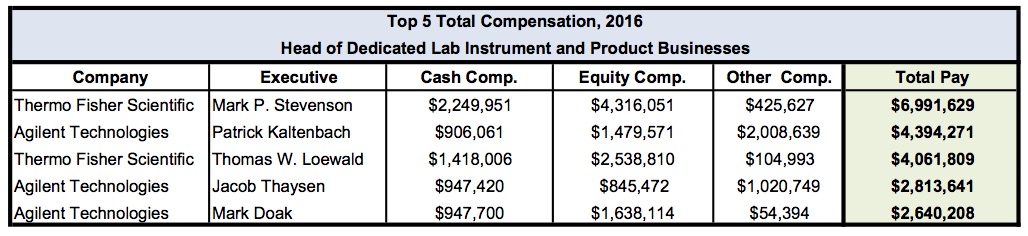

Executives of Dedicated Business Units

Total average compensation for active named executives in the table of dedicated business units at instrument and lab-related businesses accelerated 13% to $2.2 million in FY16. Similar to the list of CEOs, compensation for named executives varied by performance and size of dedicated business unit.

Average equity compensation for executives of dedicated business units advanced the fastest among compensation categories, rising 13% to $1.1 million, representing 51% of total compensation. Average base salary and cash incentives increased 1% and 6% to $438,044 and $384,380 to make up 20% and 18% of total compensation, respectively. Accounting for the remaining 11% of total compensation, Other pay rose sharply, but this was primarily due to the $1.5 million and $1.0 million relocation payments for Patrick Kaltenbach and Jacob Thaysen, SVP and president of Agilent’s Life Sciences & Applied Markets and Diagnostics & Genomics Groups, respectively. Both Mr. Kaltenbach and Mr. Thaysen relocated to the company’s headquarters in Santa Clara, California, from their home countries of Germany and Denmark, respectively.

All three named executives at Agilent, including SVP and President of Cross-Labs Mark Doak, received strong cash bonus awards based on overall end-market performance, such as sales growth in China and biopharmaceutical sales. Other business measures that exceeded planned financial targets included online order growth for Mr. Doak’s Group and SureSelect target enrichment sales for Mr. Thaysen’s Group. However, several business metrics fell below the target plan, such as a customer satisfaction survey, sales growth for an unspecified project and regulatory compliance measures.

The largest compensation package for executives of dedicated business units in FY16 went to Thermo Fisher EVP and President of Life Sciences Solutions Mark P. Stevenson, whose total pay advanced 4% to $7.0 million.

The most notable change in compensation among named executives of dedicated business units was for Mark T. McLoughlin, SVP and President of VWR’s Americas Lab and Distribution Services, whose compensation skyrocketed 136% to $1.7 million. This increase stemmed from option awards granted under the company’s equity incentive plan initiated in 2014.

In contrast, total compensation for Juergen Srega, president of Bruker CALID, declined 10% to $1.1 million as his business segment missed all five performance targets.

Aside from Mr. Thaysen, there were a number of newly announced executive officers in the table of dedicated business units. Ian S. King and Rohit Khanna were named SVP of Instrument Technology and SVP of Applied Technology for Waters effective January 25, 2016 (see IBO 2/15/16). VWR appointed Nils Clausnitzer as SVP and president of its EMEA-APAC Lab business (see IBO 2/29/16). President of Bruker BioSpin Bruker René Lenggenhager, PhD, was added to the list of named executives following his appointment on November 1, 2015 (see IBO 11/15/15). Finally, Prahlad R. Singh retained his title of SVP and President of PerkinElmer Diagnostics but was elevated to executive officer status on October 3, 2016 (see IBO 9/30/16).

PerkinElmer made additional changes to its named executive officers to align with its new organizational structure (see IBO 9/30/16). Accordingly, James Corbett was promoted from SVP and President of Human Health to EVP and President of Discovery and Analytical Solutions, effective October 3, 2016 (see IBO 9/30/16). Given the promotion, Mr. Corbett received a higher base salary and an additional restricted stock grant award valued at $0.5 million. As such, total compensation for Mr. Corbett jumped 52% to $2.4 million.

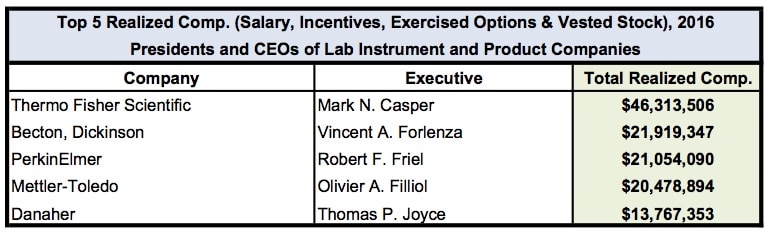

Realized Pay

Realized pay is an alternative calculation of executive compensation, which consists of base salary, cash incentives, vested restricted stock and gains from stock options exercised. This methodology is considered by some to be a more accurate portrayal of payments received during the fiscal year, as it reflects the impact of stock price fluctuations when equities actually vest rather than estimated at prior grant periods. In FY16, Mr. Casper recorded the largest realized pay among executives in the tables, valued at $46.3 million. Three other CEOs recorded realized compensation of more than $20 million in FY16: Mr. Forlenza, Mr. Friel and Mr. Filliol.