Cell and Gene Therapy and Lab Tool Demand

As one of the fastest growing segments of the biopharma market, cell and gene therapies (CGT) are creating a new era of medical treatments. Making cell and gene therapies possible are genetic manipulation and cell growth and maintenance. To accomplish these tasks in R&D, quality control and manufacturing, scientists are drawing on established laboratory tools as well as new advancements.

The laboratory tool market for CGT is valued at more than $2 billion, according to a recent report from Strategic Directions International (SDi) entitled, “Cell & Gene Therapy Technologies and Supplies.” The report lays out a market landscape characterized by a range of techniques, double-digit growth rates for many of them, and a variety of suppliers both large and small.

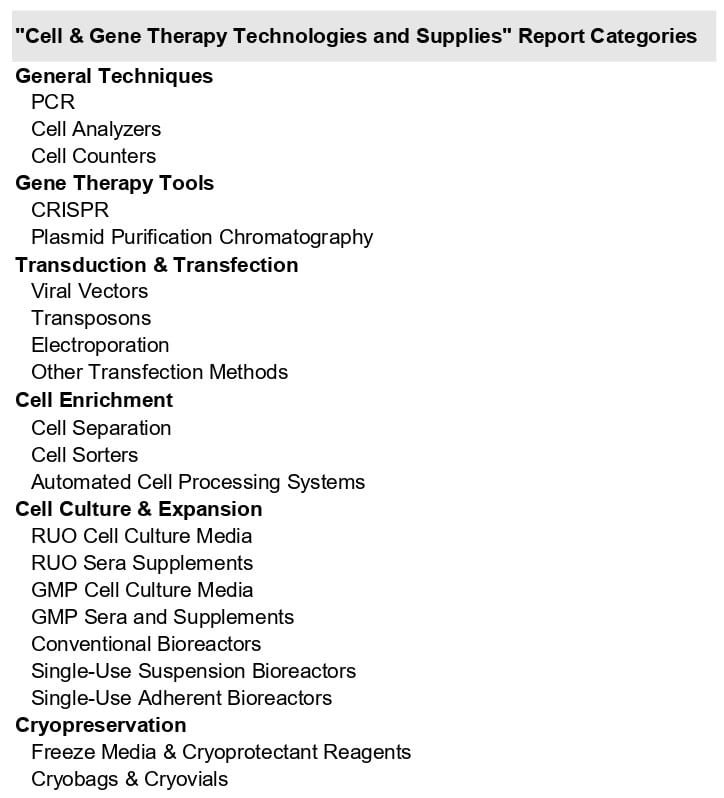

The report divides the CGT scientific tool market into six segments: General Techniques, Gene Therapy Tools, Transduction & Transfection, Cell Enrichment, Cell Culture & Expansion, and Cryopreservation. Each segment consists of a set of technologies, both instruments and consumables, that are widely used in the development and manufacture of CGTs. These include well-established laboratory techniques and products, such as PCR and flow cytometry, as well as newer advances, such as CRISPR and automated cell processing systems.

Source: SDi

Challenges of bringing CGT to market that analytical techniques are helping address range from product safety and regulatory compliance to manufacturing efficiency. Among the technologies being used to address these issues are microfluidics, real-time monitoring and informatics.

Cell Expansion products are the largest market for CGT tools, according to the report. The market’s worth reflects in part the high cost and volumes required of consumables to produce cell therapies. Among the consumables most heavily used are cell media and sera. On the instrument side of the Cell Expansion segment, demand for single-use bioreactors is fast growing. Advantages of single-use platforms include greater flexibility and time savings compared to conventional systems.

Although Cell Culture & Expansion is the largest total segment covered in the report, this segment does not include two largest individual technology segments by market size. These are found in the General Techniques and the Gene Therapy Tools markets and also represent markets both driven by consumables offerings. General Techniques are used across workflows.

Established lab product companies, such as Thermo Fisher Scientific and MilliporeSigma, play a major role in the CGT analytical tool market due to the wide range of products they offer and heavy presence in the Cell Culture & Expansion market. Other major lab product vendors with significate positions in the market include Cytiva (formerly GE Healthcare BioPharma and now a Danaher company), Becton, Dickinson (BD) and Corning.

There are also many smaller, private suppliers serving multiple technology segments. These include Eppendorf, Miltenyi Biotec and STEMCELL Technologies. Other companies specialize in particular technologies. For example, companies highly associated with the transduction & transfection market include Mirus Bio and Polyplus-transfection SA.

Multiple future growth opportunities exist for CGT analytical tools as more CGTs gain regulatory approval and standardized processes and workflows are adopted. Analytical technologies will help shape the CGT market’s future and be key to supporting ongoing progress.

Instrument Business Outlook (IBO) is a publication SDi.