The Crucial Role of Scientific Instruments in the Bioprocessing Market in 2020

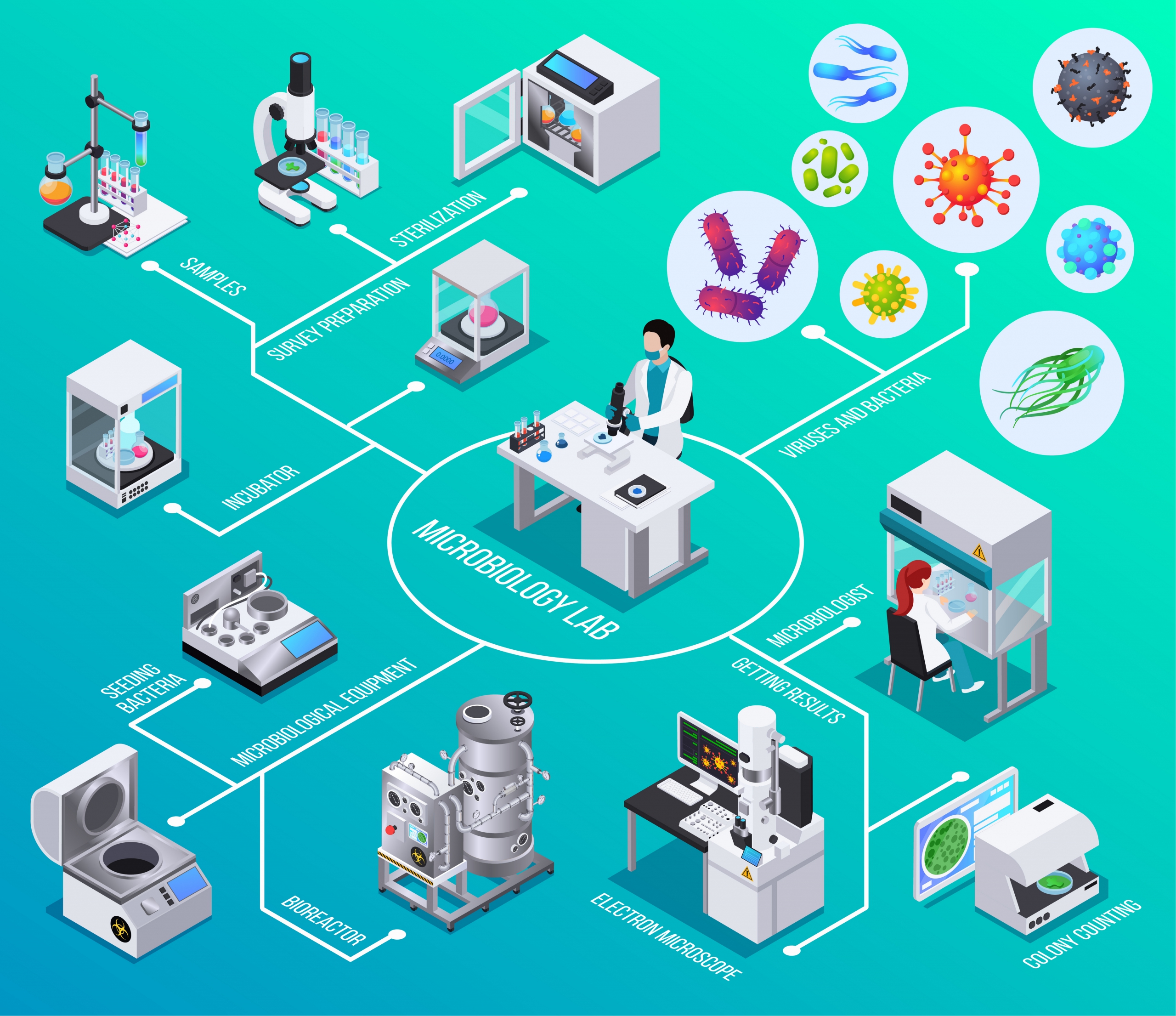

The biopharmaceutical industry serves the world’s need for treatments for a wide range of illnesses. The bioprocessing sector is a key part of the biopharmaceutical industry, manufacturing biological drugs to ensure safety and effectiveness. The scientific instrument industry plays a vital role in the bioprocessing market, with companies offering analytical techniques and products that can help the market adapt to changing demands. One such change has been the COVID-19 pandemic, which has caused bioprocessing businesses to shift their priorities to be able to manufacture treatments and vaccines related to the virus once a vaccine is approved.

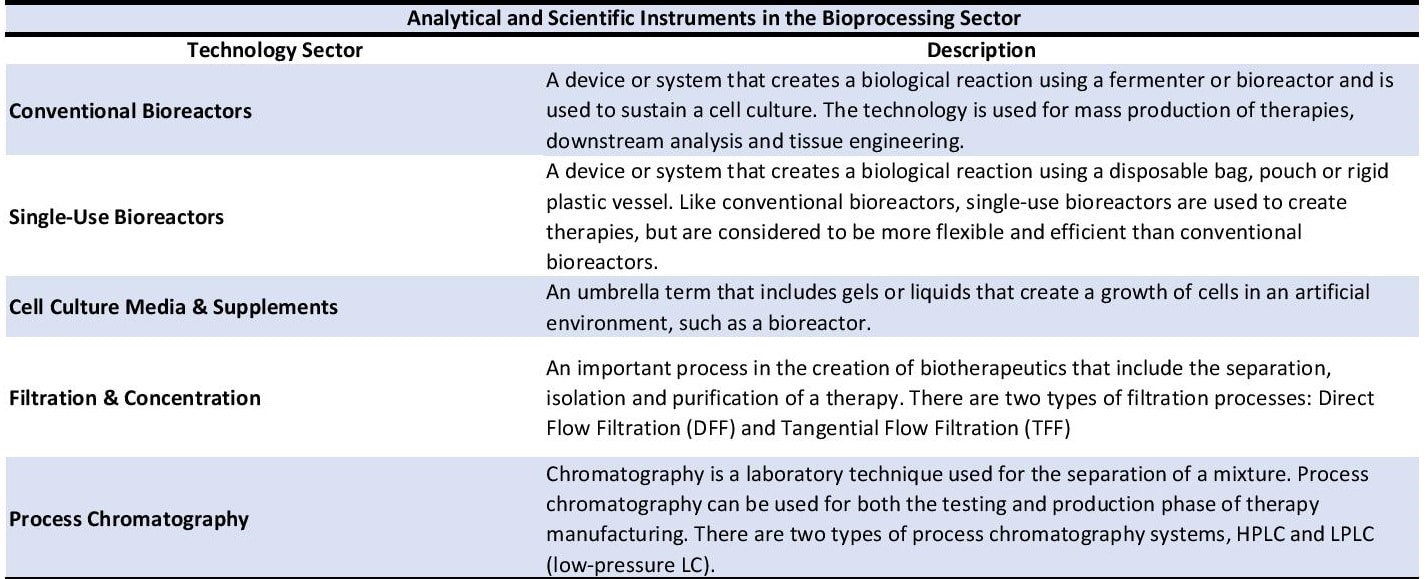

In May 2020, publisher Strategic Directions International (SDi) released the “2020 Pharma/Bio Bioprocessing Technologies Market” report, which provides a thorough overview of the current market situation for analytical and scientific instrumentation for the bioprocessing market. The report outlines the recent business activities, market trends and regional demand for both the overall market and five technologies in particular: conventional bioreactors, single-use bioreactors, cell culture media & supplements, filtration & concentration, and process chromatography. The report highlights the leading firms offering these technologies, which include Cytiva (formerly GE Healthcare Life Sciences), MilliporeSigma, Sartorius and Thermo Fisher Scientific. Additionally, the report also devotes a section to summarizing the market trends involving the COVID-19 pandemic and how companies are adapting to the impact of the virus. For the report, SDi utilized primary resources, including interviews, and secondary resources, such as company reports and industry publications.

According to the report, in 2019, the bioprocessing-related analytical and scientific instrumentation market was valued at $6.8 billion and is anticipated to achieve high single-digit sales growth to reach more than $10 billion by 2024. Single-use bioreactors are forecast to be the main growth driver due to the flexibility the technology affords pharmaceutical and biotech companies in vaccine and drug development. Unlike conventional bioreactors, single-use bioreactors have fewer contamination risks and can be less labor and time-sensitive. The report projects sales for single-use bioreactors to outpace conventional bioreactors in the coming years. The report also states with the advent of the COVID-19 virus, the need for single-use bioreactors will increase as pharmaceutical and biotech companies shift their focus to vaccine and therapy development related to the virus.

Geographically, in 2019, the US & Canada and Europe were the two largest markets for bioprocessing-related analytical instrumentation. However, the report projects that China will lead revenue growth because of the country’s investment in pharmaceutical R&D, mostly related to biosimilar production. Nevertheless, the report points out that China has a way to go to be considered a significant presence in the bioprocessing market. In addition, demand for biologics is coming from emerging markets that will mostly use single-use bioreactors for local drug and vaccine manufacturing.

In 2019, sales-wise, cell culture media & supplements, filtration & concentration and process chromatography were the highest-selling analytical technologies among the five profiled in the report in the bioprocessing market. The report predicts that out of those three, cell culture media & supplements and process chromatography will continue to be fast-growing sectors, along with single-use bioreactors. Cell culture media & supplements and process chromatography sales are each projected to increase in the high single digits through 2024. Also, the report expects single-use bioreactor sales to rise in double digits during the same period. Additionally, due to process chromatography and single-use bioreactors’ reliance on aftermarket products, both technologies are forecast to experience a significant increase in sales through 2024 for such products.

Within the single-use bioreactors sector, demand from China and the US & Canada is expected to increase significantly. As mentioned before, the report predicts vaccine and therapy development will be the primary applications for the technology. Production-scale units are forecast to be the main growth driver. Cytiva, Sartorius and Thermo Fisher Scientific are currently the top suppliers for this technology sector. In December 2019, Cytiva, established its industry presence in China by collaborating with the Guangzhou Development District investment Promotion Bureau to create the bioprocessing training center called Guangzhou Bioprocess Academy.

Like the single-use bioreactors sector, the cell culture media & supplement sector is expected to experience a fast rise in demand in China and the US & Canada. The report base this prediction on the use of perfusion culturing which consumes more media than batch bioprocessing. Also, the report predicts the technology will primarily be used for the development of novel therapeutics and stem cell therapies. Demand for both media and sera & supplements are forecast to increase in the high single digits, with media accounting for the highest percentage of sales. Thermo Fisher (Gibco), MilliporeSigma and Becton, Dickinson Biosciences are currently the top suppliers. Additionally, M&A activity has been one of the many avenues for companies to establish a presence in this sector. For instance, in December 2019, Sartorius further invested in cell culture media by acquiring the Israeli cell culture media manufacturer Biological Industries.

Demand for process chromatography is anticipated to grow thanks to the improvement of the downstream purification process. Geographically, the report expects the US & Canada and Europe to be the most significant for growth. By product type, single-use columns are predicted to be the main drivers. Cytiva, MilliporeSigma and Novasep are the top three process chromatography suppliers, according to the report. Novasep recently established a Biopharma Solutions Unit business to meet the demand for gene therapy and viral vector development.

In conclusion, the bioprocessing market is projected to significantly contribute to the growth of the biopharmaceutical industry through 2024, thanks in part to the analytical and scientific instruments utilized for biologics development and manufacturing. According to the report, these technologies also assist the bioprocessing industry in adapting to shifting demands, such as those created by the COVID-19 pandemic.