Danaher Investor Day 2022 Showcases Big Announcements and Focuses on Cytiva

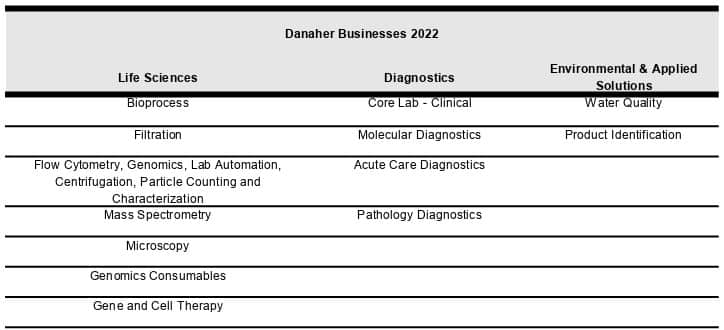

Danaher made major announcements at its September 15, 2022 investor day. A $29.5 billion company, Danaher spans three business segments: Life Sciences, Diagnostics, and Environmental & Applied Solutions. The segments encompass over 20 operating companies consisting of well-established brands and are known for a robust M&A track record.

The first major announcement was that Danaher is spinning off its Environmental & Applied Testing segment into a publicly traded company. The spinoff is expected to be completed by the end of next year. In 2021, this segment recorded made up 26% of Danaher revenues and represented two business areas: Water Quality Testing and Product Identification. Danaher estimates s long-term revenue growth rate for the segment in the high single digits. As Danaher President and CEO Rainer Blair told investors, “Both companies will be more focused, and they’ll be able to execute their respective strategies with greater clarity than ever.”

With the spinoff, the remainder of Danaher will consist of Life Sciences businesses, which recorded 2021 revenues of $15.0 billion, and the Diagnostics business, with $9.8 billion in 2021 revenues. Both are expected to have long-term growth rates in the high single digits.

A second major announcement, and the focus of the investor day, was the formation of the Biotechnology Group. The new segment brings together Cytiva and Pall Life Sciences, major bioprocess and lab tool suppliers and two of Danaher’s current Life Sciences companies, to represent $8.5 billion in revenues. The remainder of the Life Sciences businesses will consist of Danaher’s current life science instruments companies and genomics companies, at around 35% and 5% of 2021 Life Sciences revenues, respectively.

The $8.5 billion Biotechnology Group anticipates high single-digit plus core growth over the long term and will serve the Bioprocess, Lab & Medical and Research end-markets, with Bioprocessing accounting for $7.6 billion in sales. The segment will have 16,000 associates, 36 global manufacturing sites, and over 20 R&D and innovation centers worldwide.

Regarding the combination of Cytiva and Pall Life Sciences, Mr. Blair stated, “[When] you bring these two activities together under the Biotechnology Group, you have not only the broadest product portfolio in bioprocessing but also the deepest.” He further explained, “When I say the broadest, you can get any point solution that you need in the context of a bioprocessing workflow or you can get the entire end-to-end workflow. When I talk about depth of the portfolio, this combination can do that not just for monoclonal antibodies, but for cell and gene therapies, for mRNA, for oligo nucleotides, for CRISPR-Cas9; you name your therapeutic biologic modality and this combination can deliver it for you, either a point solution or end to end.”

The Group’s offerings for the bioprocessing workflow include cell culture and single-use technologies, chromatography, filtration and final product preparation, as well as services, according to the Danaher presentation. “It is easier [and] it is faster to work with a complete solution provider; but not only on the tools on the consumables, also on the service and the deep scientific experience and [expertise] that goes with it,” commented Emmanuel Ligner, Danaher VP & Group Executive.

Mr. Ligner also reviewed how large the market is that the Biotechnology Group will serve. Excluding R&D and clinical trials, this market last year included around $150 billion in monoclonal antibody (mAb) therapy sales; $50 million sales of mRNA therapies; $4 billion in cell and gene therapy sales; and $3 billion in sales of oligo therapies. Other markets included oligo therapies and mRNA therapies. Market expansion is only expected to increase as there are more than 20,000 biologics currently in development.

Discussing more about the Biotechnology Group’s commercial side, Amanda Halford, VP BioProcess & Commercial for Danaher, gave more insight into Danaher’s positioning. She explained, “[T]he majority of our revenues today come from the later phases, so Phase III and commercial manufacturing. This is when customers are scaling up for large-scale trials and moving into commercial manufacturing, which is repeat manufacturing.” According to Danaher’s presentation, over three-quarters of Danaher bioprocess revenues are from products either marketed or in Phase III development. She emphasized that Danaher works with customers at all stages, starting with research. “But the heart of our works starts early in the phase—that preclinical and Phase I stage.”

Danaher’s work with biopharma companies includes business and partnerships with multiple customer types: academia, translational medical centers, small biotechs, commercialized biologics and global strategic accounts, biologic novices and CDMOs/CMOs. To serve these markets, the Biotechnology Group’s workforce includes more than 4,000 customer facing associates. “We have an organization which has this global infrastructure, a global framework, and by that, I mean process systems and knowledge. But we deliver it locally to the customer, and this is where the scale of Pall Life Sciences and Cytiva come together will really enhance that customer experience as we increase our coverage in the market,” noted Ms. Halford.

The remainder of the investor day was devoted to additional presentations. These included an overview of how Danaher serves monoclonal antibody companies, and the Group’s product differentiation and flexible manufacturing solutions. Then, Emmanuel Abate, VP Genomics and Cellular Research at Danaher, discussed the Biotechnology Group’s Genomic Medicines solutions. Finally, a customer panel discussed biopharma development in general.