The Top Lab Tool Industry Acquisitions 2010–2019

In the 2000s, the lab tool industry has been transformed by consolidation. Danaher and Thermo Fisher Scientific have been the major players overall, each with a track record of multi-million dollar deals. In the case of Thermo Fisher, the M&A has strengthened its status as the world’s largest laboratory instruments and consumables provider for the life science, applied and industrial markets. In the case of Danaher, its M&A has been aimed at building a comprehensive portfolio of lab solutions for the life science research market.

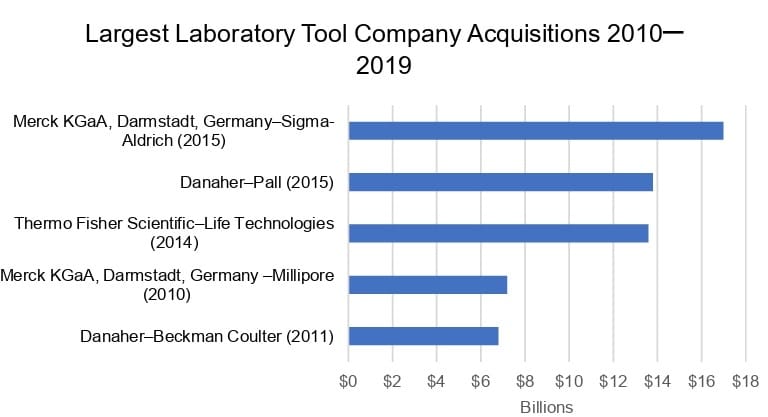

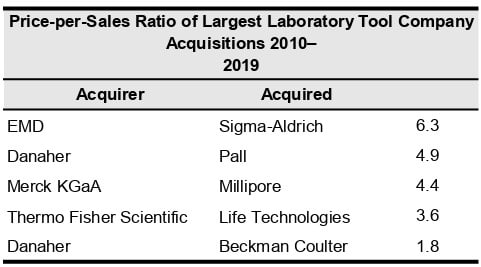

But neither company was behind the largest M&A deal completed between 2010 and 2019. In 2015, German pharmaceutical and chemical provider Merck KGaA, Darmstadt, Germany’s Life Science division, then known under the brand name EMD in North America, completed its $17.0 billion purchase of US-based lab chemicals and consumables supplier Sigma-Aldrich, creating a laboratory tool business with pro forma 2014 combined sales of €4.5 billion ($5 billion = €0.90 = $1). Merck KGaA, Darmstadt, Germany Chairman Karl-Ludwig Kley remarked, “In one of the world’s key industries, two companies that fit perfectly together have found each other to present a much broader product offering to our global customers in research, pharma and biopharma manufacturing and diagnostic and testing labs.” Sigma-Aldrich had annual 2013 revenues of $2.7 billion.

This was not the company’s only blockbuster purchase during the decade. Merck KGaA, Darmstadt, Germany closed a $7.2 billion deal for laboratory filtration and consumables firm Millipore in 2010, adding $1.7 billion in sales. Encompassing the results of both acquisitions and several smaller ones, Merck KGaA, Darmstadt, Germany Life Sciences generated 2018 sales totaling €6.2 billion ($7.3 billion = €0.85 = $1).

Like Merck KGaA, Darmstadt, Germany, Danaher also completed two the five of the industry’s largest deals during the decade, spending over $20 billion to significantly expand its Life Sciences and Diagnostics segments. In 2011, Danaher purchased Beckman Coulter for $6.8 billion. The size of the deal reflected the value of both Beckman Coulter’s diagnostics and life sciences laboratory product portfolios. At the time of the purchase, Beckman Coulter’s Life Science business comprised 12% of Beckman Coulter’s total revenues. Beckman Coulter Life Sciences joined Danaher’s Life Sciences division, contributing more than $450 million in revenues.

An even bigger acquisition for Danaher Life Sciences came five years later. In 2015, Danaher acquired filtration and separation technology company Pall for $13.8 billion. The main target of the acquisition, Pall’s Biopharmaceutical portfolio, part of its Life Sciences division, reported $992 million in sales in 2014 to make up 36% of total company sales. “Pall will provide us a leading business with significant runway for expansion and strengthens our life sciences position in the strategically attractive, high-growth biopharmaceutical market,” asserted Danaher President and CEO Thomas P. Joyce, Jr. Pall also serves other markets, including several industrial sectors.

Both Beckman Coulter Life Science and Pall joined Danaher’s Life Sciences division, which today generates annual revenues of $6.5 billion, and also encompasses two other lab tool major purchases in the decade: Phenomenex and Integrated DNA Technologies. This year, Danaher is scheduled to close its biggest acquisition ever and one focused squarely on the life science and associated bioprocess market. The proposed $21.4 billion purchase of GE BioPharma will add over $3 billion in revenues (following regulatory-required divestments) to Danaher’s total revenues.

Like the other four acquisitions that made up the decade’s five largest, Thermo Fisher’s $13.6 billion purchase of Life Technologies in 2017 was a major mover in the life sciences lab tool market, significantly expanding the company’s offerings and largely creating what is today Thermo Fisher’s Life Sciences Solutions (LSS) segment. The LSS business represents a quarter of the company’s $24.4 billion in revenues. Thermo Fisher paid $13.8 billion for Life Technologies, which had annual sales of $3.8 billion. “Our customers in research and applied markets will now be able to achieve even higher levels of innovation and productivity by working with the combined company. We’re especially excited about the new opportunities we will have to leverage our complementary offerings, fueled by a shared commitment to continuous innovation,” said Thermo Fisher President and CEO Marc N. Casper.

The laboratory tool industry may see higher-value deals in the decade ahead as major companies pursue an even larger share of the fast growing market for laboratory research and applied testing tools, especially for life science.