A Window to Asia

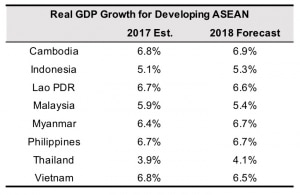

Asia Pacific is one of the world’s fastest growing markets. Within Asia Pacific, Southeast Asia is an emerging economic player. This year, real GDP for ASEAN nations (countries listed in table below) is forecast to grow 5.4%, according to the World Bank’s latest update. Although on par with last year’s growth, the growth rate is well ahead of Advanced Economies and faster than Emerging and Developing Economies.

As instrument and lab product companies look to expand in these markets, they face a number of challenges. “Even though overall, you would consider that market-entry barriers are decreasing, you still have a lot of obstacles for small and medium-sized enterprises to enter into Asia,” Hanno Elbraechter, head of the Business Unit Technology for DKSH, told IBO.

Operating in the region for over 150 years, Swiss firm DKSH offers market-entry service for scientific instrument businesses in 16 countries in Asia. Such services range from service and application engineering, to distribution and logistics, and marketing and sales, all the way to market analysis and business strategy. Partners include Agilent Technologies, Malvern PANalytical and Tecan. As Mr. Elbraechter told IBO, the company seeks to be “a window to Asia” for its scientific instrument providers.

“There are always hidden segments—the segments [the client] can’t see.”

The internal barriers described by Mr. Elbraechter may include the need for companies to prioritize financial resources to core competencies such as manufacturing and R&D, and thus away from development of emerging markets. “On the other side, you have external barriers, which are more related to the market environments, including regulations, the complexity of imports and logistics, especially in Southeast Asian countries like Vietnam and Cambodia, for example.” Other obstacles could include local customs, business practices, language, culture and, in particular, compliance, he noted.

In other cases, companies face headwinds in expanding beyond their end-markets of strength in a particular country or region. “[For example,] they are strong in pharma, cosmetics and mining, but they are weak in petrochemical, oil and gas,” explained Mr. Elbraechter. This is even true in established markets. “[I]n China, Korea or Japan, where the markets are—of course—huge, a lot of companies want to have a direct presence. Nevertheless, there are always hidden segments—the segments [the client] cannot see, or they are just weak in certain segments [or the countries are so big], so they will then outsource certain industries to us.”

DKSH’s Scientific Instrumentation business is increasingly providing industry-specific services for its clients. “One of the key elements to our success is industry focus. We develop solutions for pharma, for cosmetics, for oil and gas and build a portfolio—so we function as a solution provider,” said Mr. Elbraechter.

“Local food companies are ramping up to start to expanding internationally. To enable this, they have to improve their quality control capabilities and invest in new testing equipment.”

Not surprisingly, one area for which the demand for such services is growing is food. “[For] inner-Asian trade, to stay competitive, you need to meet certain standards. For instance, food safety is a huge topic,” explained Mr. Elbraechter. “’I want to export something from Myanmar to Thailand.’ In all these countries, you have a strong investment for commercial labs. The commercial testing labs can serve this industry because the majority of [the industry] does not have that critical mass yet to possess their own testing labs.”

As Marco Farina, general manager, Business Technology, Technology, Scientific Instrumentation, told IBO, “Local food companies are ramping up to start to expanding internationally. To enable this, they have to improve their quality control capabilities and invest in new testing equipment.”

A range of food requirements are growing. As one example, Mr. Elbraechter described DKSH’s work in the Philippines. “We developed an entire solution for halal testing, so also to safeguard the interest of the Muslim communities, which are important in Southeast Asia, especially in Indonesia and Malaysia,” he said. “The Department of Science and Technology asked us to develop a testing solution for halal food. We provided the concept around the lab, the application set-up, the testing standards, and set-up the entire lab for them.”

“What I think [the clients] appreciate the most is the application engineering part, the fact that we have it localized.”

Other developments driving regional demand for testing, and thus lab instrumentation, include health care and education. As Mr. Elbraechter told IBO, “It’s an aging population, so there are more requirements in terms of health care. There is a lot of investment also in pharma as well as generics, so there is also a lot of localization of certain pharma products.” Another driving force is government investments in universities. “They are competing against each other. In Thailand, for instance, they see that Vietnam is moving fast and, therefore, they want to increase their own investments in R&D,” explained Mr. Farina.

DKSH’s Scientific Instrumentation clients usually chose the full range of the company’s services, according to Mr. Elbraechter. “But what I think [the clients] appreciate the most is the application engineering part, the fact that we have it localized, because they know this is very valuable for the customer,” he explained. “The customer does not need to send the sample back to the factory and do it there. We can do it locally in most of the cases.”

But this does not mean a lack of connection to the customer, insisted Mr. Elbraechter. “We are the extended arm of the client. This is important, since that gives us a long-term perspective,” he said. “As we are bundling a lot of different products, we can invest into more market coverage. This means we have many more touch points in the market than they would not be able to create on their own.”