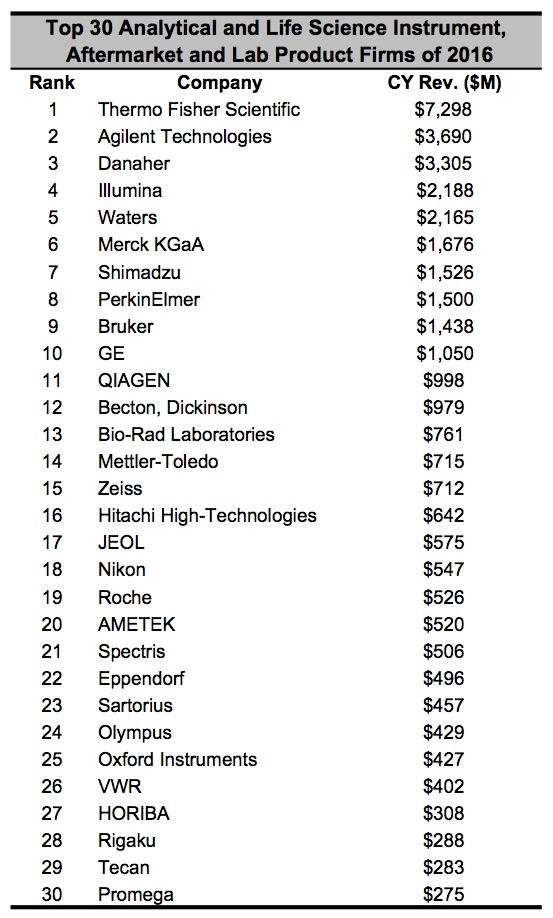

IBO’s Top 30 Companies of 2016

IBO’s 2016 list of the top 30 analytical and life science instrument, aftermarket and lab product companies experienced a dramatic rearrangement for first time in a number of years due to acquisitions, as well as organic revenue growth and currency implications. The most notable changes included the addition of two new companies to the Top 30 list, Rikagu and Promega, as well as the return of HORIBA, which last made the list in 2013 (see IBO 4/15/14). Furthermore, consolidation and sales performance resulted in significant reshuffling amongst the top 10 firms.

Overall, total sales growth for the top 30 companies was healthy in 2016, climbing 3.5% excluding acquisitions, or 4.1% organically, to $36.7 billion to account for 70% of total industry sales (see IBO 1/15/17). Growth was driven by strong biopharmaceutical demand, especially for LC, MS, automation and NGS products, including particular strength in China. However, similar to the previous year, demand was hindered by challenges in the core industrial and chemical markets, as well softness in Japan. European academic demand also slowed for a number of companies in the Top 30 list in the second half of 2016.

All sales and revenue growth figures in this article are based on IBO’s calculations of companies’ calendar year revenues that fall into the 10 technology categories in IBO’s forecast issue (see IBO 1/15/17). Recalculations of sales based on updated technology categories and new financial information have also altered rankings compared to IBO’s 2015 Top 30 list (see IBO 4/15/16).

Products excluded from IBO’s Top 30 list include process instruments, special-purpose clinical diagnostics products with regulatory approval and OEM sales.

All sales have been converted into US dollars. Exchange rates for foreign companies when converted into US dollars also impacted estimated revenues and rankings. Compared to 2015, sales for the seven Japanese companies benefited from the weakening of the US dollar, while the two UK-based firms were negatively impacted by the devaluation of the British pound when converted into US dollars. There was no material impact for the five companies reporting in euros.

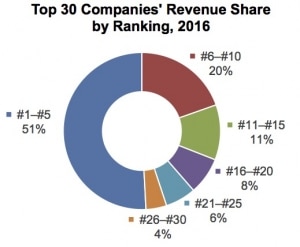

While the total industry remains relatively fragmented, the market share for the largest vendors continues to climb. In 2016, sales for the top 10 companies advanced roughly 10% to $25.8 billion due to acquisitions and strength in the biopharmaceutical end-markets. As a percentage of the total industry, sales for the top 10 companies accounted for 49% in 2016, compared to 46% in 2015 as adjusted for this issue.

Consolidation continues to play an integral role in the expansion of sales and market share for a number of the largest companies in the Top 30 list. Thermo Fisher Scientific extended its number 1 position in 2016 through the acquisition of Affymetrix (see IBO 1/15/16) and partial sales integration of FEI (see IBO 5/31/16). The company’s share of total industry revenue rose roughly 90 basis points to 14%, nearly double its closest rival, Agilent Technologies.

Acquisitions also elevated Merck KGaA into the list of top 10 companies. Following the full inclusion of Sigma-Aldrich (see IBO 11/30/15), Merck KGaA jumped six positions into the number 6 spot and substantially expanded its chromatography and lab equipment market shares.

Other notable changes among the rankings of the top 10 companies included Illumina’s rise to the number 4 spot. Since its initial debut on the list of Top 30 companies in 2008 (see IBO 4/15/09), Illumina has catapulted to the top of the list through the development of disruptive technologies and fast market adoption of its high-throughput NGS systems. However, the company experienced more normalized growth in 2016 due to slower demand for its HiSeq X systems. Illumina is also one of the only companies in the list of top 30 companies with a notable consumer end-market.

Despite losing ground to Illumina, Waters recorded a strong financial year in 2016 as sales benefited from its leadership position in the high-end LC market. The company has been successful in expanding existing technologies into adjacent markets, especially in applied markets, as well as for QA/QC applications.

Like Waters, Shimadzu experienced strong demand for LC and MS products in 2016 and was further boosted by the conversion to US dollars. As a result, the company climbed one spot to number 7. Conversely, both PerkinElmer and Bruker slipped two spots to number 8 and 9, respectively, due to continued challenges in industrial and academic markets.

Outside of the top 10 companies there were only a few notable changes. AMETEK advanced three positions to number 20 as the company benefited from partial integration of Brookfield Engineering Laboratories (see IBO 2/15/16) and Nu Instruments (see IBO 8/15/16). These acquisitions helped offset lower demand for the company’s surface science business.

Sartorius similarly climbed three spots, landing in the number 23 position. Sales growth for the company advanced due to strong demand for lab filters and bioreactors.

Like AMETEK, most other vendors in the surface science market, including JEOL, Nikon, Olympus, Oxford Instruments and Zeiss, either declined one spot or lost ground when excluding favorable currency impacts due to slowing demand.

The two new additions to this year’s Top 30 list benefited from the removal of Affymetrix, FEI and Sigma-Aldrich, but also from stronger demand. Rigaku, which debuts at number 28, gained a spot due to a stronger global footprint, currency conversion and the acquisition of Agilent’s XRD business (see IBO 3/31/15). Promega, which was the last addition at number 30, recorded stronger demand for PCR and nucleic acid preparation products.

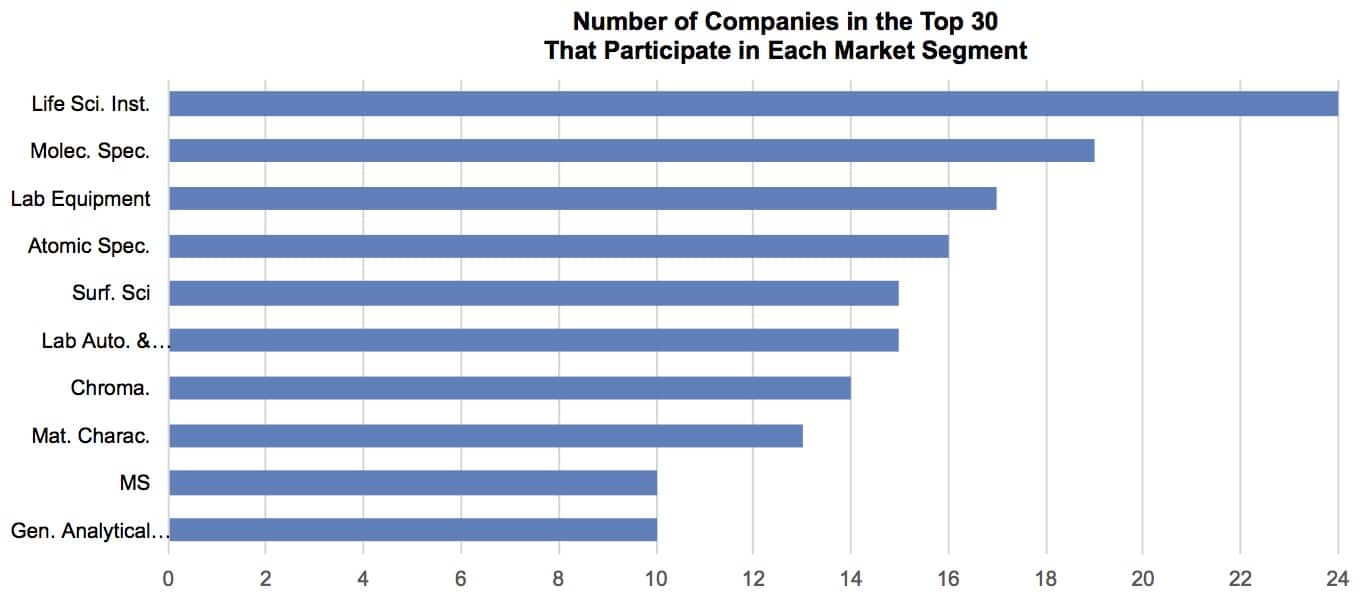

As the graph below shows, most Top 30 companies participate in more than one of the 10 market segments that IBO’s forecast issue covers. Due to the breadth of life science instruments and aftermarket products, it is the largest technology category for Top 30 companies, with 24 companies selling into that market. Molecular spectroscopy’s multiple applications and use in both research and QA/QC put it in the number 2 spot. Although MS is a powerhouse market segment for the top 30’s largest companies, it is a market segment for which participation is relatively narrow among the top 30 in general.

Although Thermo Fisher would seemingly be the broadest based company, Danaher also offers products in 10 market segments. However, participation in multiple technology segments does not automatically correlate with a higher ranking. Number 4 Illumina participates in only two market segments, as does Becton, Dickinson, Nikon, Roche and Zeiss.