The Scientific Instrument Market and the Chemical Industry: A Crucial Role in the Global Supply Chain

Since the Industrial Revolution, the chemical industry has played a critical yet relatively unseen role in developing consumer products and pharmaceutical ingredients and quality control of chemical product production. The chemical industry’s influence in the manufacturing sector is buoyed by the scientific instrument industry’s analytical techniques and product offerings.

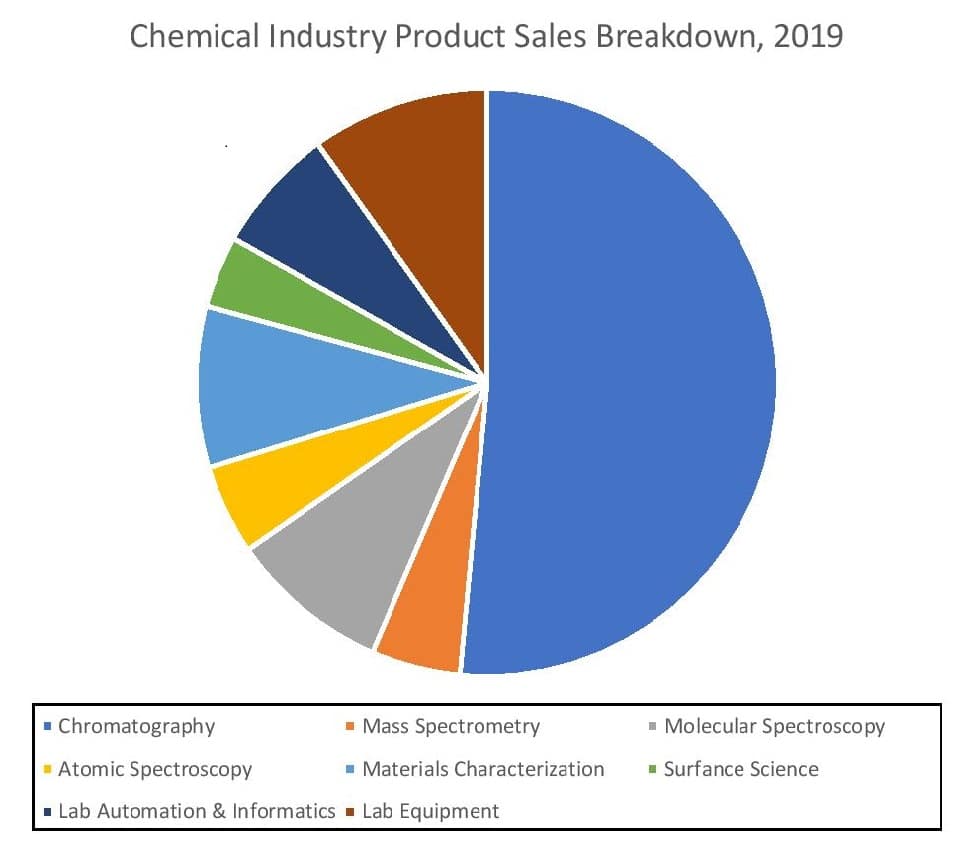

In October 2020, Strategic Directions International (SDi) released the “Market Opportunity for Analytical Instruments in the Chemical Industry.” The report outlines the market conditions in 2019 for analytical instrumentation used by the chemical industry. The report provides an overview of the laboratory technologies used in the chemical industry, developments in this market and regional demand in this market. It provides information for both the overall market and eight technology categories: chromatography, mass spectrometry (MS), molecular spectroscopy, atomic spectroscopy, materials characterization, surface science, lab automation & informatics, and lab equipment. The report highlights the leading vendors offering these technologies, including Agilent Technologies, MilliporeSigma, Shimadzu, Thermo Fisher Scientific and Waters. For the report, SDi used primary sources, including interviews, and secondary resources, such as annual and quarterly financial reports, government data, industry publications and other credible resources.

According to the report, in 2019, the laboratory instrumentation market for chemical laboratories was valued at $2.5 billion and is forecast to achieve low single-digit growth through 2024. MS instrumentation is expected to be the primary growth driver because of its use for basic/applied research, such as creating new chemical-based products. As the report outlines, the GC-MS instrument sector plays the primary role in advancing the MS market as it is widely used by the chemical industry.

Geographically, in 2019, the US & Canada and Europe were the largest regional markets for chemical processing and manufacturing analytical instrumentation. However, the report forecasts China is driving revenue growth due to its government passing stricter environmental regulations.

In 2019, chromatography, lab equipment and molecular spectroscopy were the largest analytical technology markets for chemical process and manufacturing among the eight markets summarized. The report forecast that out of these three, molecular spectroscopy will remain a prominent presence in the market, lab automation & informatics, and MS. Lab automation & informatics, molecular spectroscopy and MS sales are all forecasts to increase in the low single digits over the next five years.

Lab Automation & Informatics

The lab automation & informatics sector is expected to grow its chemical market presence in China and the US & Canada. Demand in China is driven by its investment in expanding chemical manufacturing and the adoption of automation by this sector. The chemical industry in the US & China is also embracing automation and utilizing informatics technologies to adhere to environmental and safety regulations. Within the lab automation & informatics sector, the liquid handling and LIMS, ELN & SDMS segment are projected to show the most -demand, with both technologies reaching low single-digit growth in demand over five years. LabWare, BIOVIA (Dassault Systèmes) and Thermo Fisher were the top lab automation & informatics suppliers to this market in 2019.

Molecular Spectroscopy

Regional demand and increased basic/applied research are the primary drivers of the molecular spectroscopy market in the chemical end-market. The report forecasts revenues in China and Other Asia Pacific for this sector to increase significantly. The Raman instrument sector is projected to be the main growth driver. In 2019, Bruker, PerkinElmer and Thermo Fisher were the top vendor of this technology to the market.

MS

Like molecular spectroscopy, the MS sector is predicted to grow its market presence in the chemical industry in China and “Other” Asia Pacific. One reason is chemical manufacturers building new facilities in the regions. GC/MS and LC/MS instruments are projected to be the most in-demand, with demand for both rising low single-digit growth over a five-year period. Agilent, SCIEX (Danaher) and Thermo Fisher were the MS suppliers to this market last year.

Conclusion

The chemical industry analytical instrumentation sector is projected to have a relatively small market presence in the overall analytical and scientific instrument market through 2024. SDi notes that business disruptions from the pandemic in 2020 will potentially hamper the sector’s performance during the next five years. Nevertheless, the technologies used in this industry are expected to contribute to the streamlining of both product manufacturing and quality control lab processes.