Thermo Fisher Scientific Details Future at Analyst Meeting

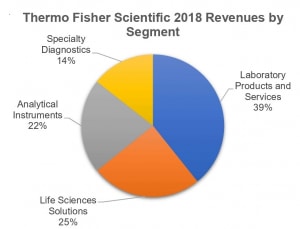

Thermo Fisher Scientific, the giant in the scientific instrument industry with $24.6 billion in sales last year, held its 2019 Analyst Meeting earlier this week. At the event, the company emphasized its broad product offerings, operational scale and market opportunities, with contributions in each of these areas from across its business segments. Highlighting these segments’ contributions, President and CEO Marc N. Casper told investors, “We have four complimentary segments and within them a number of businesses. Those four segments are industry leaders in their own right, and they add value to one another and create competitive advantage for the company as a whole.”

Source: Thermo Fisher Scientific

Thermo Fisher used the occasion to announce new expectations for organic revenue growth. “In the past, our long-term organic growth outlook was 4%–6%. As we look to the future, we see our organic growth outlook now being in the range of 5%–7%,” stated Mr. Casper. This would translate into $29.0–$30.4 billion in revenues by 2022. To reach this figure, the company expects further market share gains. “At the same point in time, our growth strategy has accelerated our ability to gain market share, and we now feel confident in our ability to grow at least 1% to 2% faster than the rate of the market going forward,” he commented.

However, as Mr. Casper emphasized, the expected increase in organic growth rate over three years is tied to the outlook for two markets in particular, pharmaceutical and biotech, and China and emerging nations. These two markets have an established track record of growth for Thermo Fisher. “Pharma and biotech now represent about 40% of our revenue [and] the emerging markets and high-growth regions represent about 22% of our revenue, up substantially from what they were in the past,” he remarked.

Pharma and Biotech Outlook

Pharma and biotech is Thermo Fisher’s fastest growing and largest market, said Mr. Casper. “We continue to increase our exposure to that through actively driving share gain and continuing to invest in capabilities to serve that customer set,” he noted. Presentations at the meeting about the company’s business segments detailed how its offerings are attuned to this market’s future.

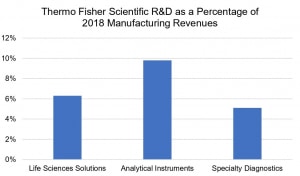

Source: Thermo Fisher Scientific

The company’s Life Sciences Solutions segment (LSS) consists of three divisions, biosciences, genetic sciences and bioproduction, each largely addressing the pharma and biotech market, and together supplying products for the entire pharma and biotech’s R&D process. “We’re able to help our customers, biotech and pharma, from early discovery through the creation of a molecule all the way to commercial manufacturing—a very unique position that is highly valued and relevant to this customer base,” commented Mark Stevenson, executive vice president and COO. Highlighted in his talk were three areas of the pharma and biotech market that each business is targeting: cell therapy, such as CAR-T therapy, with biosciences offerings, precision medicine, for example clinical NGS testing, with genetic sciences products, and in the case of the bioproduct business, cell media and single-use technology. The focus is each business, as laid out by Mr. Stevenson, is also aligned and informed by Thermo Fisher’s contract development and manufacturing business (CDMO), to which LSS supplies products. “Unique to us is the intimacy with now have with our pharmaceutical services business that allows us to work closely with that group and business to see some of the innovations that are needed and to hear about an experience we can create with those customers,” he stated.

The $3.6 billion CDMO business lies within Thermo Fisher’s Laboratory Products and Services segment. As with the LSS segment, it is addressing future market needs with investments to increase services and capacity for cell and gene therapy and single-use technology; for example, expanding sterile injectable capacity and continuous processing capabilities. The CDMO industry as a whole may be at an inflection point, according to Michel Lagarde, senior vice president and president of Pharma Services Opportunities. As an example, he cited the need for greater outsourcing that is being driven by the business’ two sets of customers. In regards to small and emerging biopharma firms, he stated, “Those people don’t have their own resources, they don’t have their own facilities and are completely comfortable relying on external parties.” As for larger biopharma companies, he explained how they are asking questions as they look to increase productivity, such as, “Where can I partner best with CDMOs to either complement [my] experience, to either drive productivity [or] to be a second source?”

Although the Analytical Instrument (AI) segment serves a broader set of end-markets, pharma and biotech remains a primary focus. This focus includes new opportunities in the use of mass spectrometry to address the complexity of biologic drugs and related safety concerns, said Dan Shine, senior vice president and president, Analytical Instruments. “There are lots of critical quality attributes (CQAs) that need to be measured, so companies are rethinking their current quality control system,” he noted. “Is it enough to protect the development and production of this medicine? Will this continue to meet regulatory approvals in this new environment with these new processes?” As an example, he cited the company’s multi-attribute method, combining sample preparation, LC/MS and data management to measure more CQAs in a single run.

China and Emerging Markets: Primed for Growth

A contributor to its increased estimates for three-year organic growth will also be China and emerging markets, which like pharma and biotech, has also been a major growth contributor in recent years. Of the 22% of Thermo Fisher revenues generated by China and emerging markets, China represents nearly half. Despite many years of double-digit growth in the country and current macroeconomic and trade uncertainty, China will remain a strong and fast growing market for the company, according to Mr. Casper.

As such, China is a component of each segments’ growth strategy. In LSS, growth opportunities in China lie with precision medicine and biopharmaceutical manufacturing. Similarly, the CDMO business sees future opportunities in biopharmaceutical manufacturing. “When you look at the pharma services offering within Asia Pacific and the emerging markets, it’s more limited today. Historically, there hadn’t been a huge innovative set of medicines other than Japan in those markets,” explained Mr. Casper. “That’s actually changing. In China today, there is a young but rapidly growing innovative market, and we are thinking about what is the best way to serve that market from a pharma services set of capabilities.” Detailing the company’s penetration of the pharma and biotech market in China and emerging markets, Mr. Casper stated, “As a percent of the total, it’s going to be meaningfully less than the 40% [as with the total company] today, just given the nature of the business as well as the fact that a number of the products are made outside of Asia and then shipped into the region.”

In contrast, business opportunities for AI segment in China target both the pharma and biotech market, and research and applied markets. In the life sciences, a focus for the segment is precision medicine, while in non-life science markets, growth opportunities are centered on a range of markets, including advanced materials development and food safety testing. “China still offers the best long-term potential,” commented Mr. Shine. He noted the stable market created by government-led initiatives in precision medicine and environmental safety, for example, and the segment’s local R&D and manufacturing presence, as well as local partnerships. As he said, “[Thermo Fisher is] partnering with companies to accelerate regulatory approvals for specific diagnostic tests based on our technology.” These partnerships include an OEM agreement serving the precision medicine market.

M&A

Beyond organic sales growth in the near future, the company also expects to continue its pattern of M&A, with Mr. Casper noting the model is based on expectations of mid-sized bolt-on purchase. In fact, the company anticipates deploying 60%–75% of its capital to M&A over the next five years, with the remaining percentage returned to shareholders. “Our main focus is clearly going to be on M&A,” said Senior Vice President and CFO Stephen Williamson. But in terms of annual capital deployment, he added, “The exact split in any one given year will depend on the timing, scale and availability of M&A.”

In the case of pharma and biotech, emerging markets and M&A, Thermo Fisher’s near-term growth will build upon areas of experience and focus.