US Chromatograph and Spectrometer Imports from China Decline in 2018

In a blog published in June last year (see Tariffs to Affect US Imports of Chromatographs and Spectrometers from China), IBO examined the possible early implications of new US tariffs on imports from China for chromatographs (Harmonized Trade Schedule Code 9027.20) and spectrometers (Harmonized Trade Schedule Code 9027.30) imports, both of which are subject to the new tariffs, based on US International Trade Commission (ITC) data. We found that US imports of such systems had already declined in 2018 through April prior to the tariffs’ implementation, while imports from all other countries had increased, suggesting a possible connection to the preparation for the tariffs. The latest figures present a pattern for US imports of chromatographs as well as spectrometers and spectrophotometers from China that show significant declines.

Chromatograph Imports

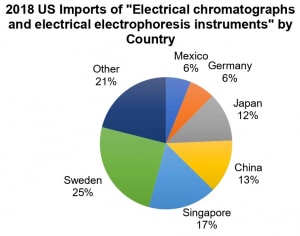

With final data for 2018 now available, US imports of “Chromatographs and electrophoresis instruments” (CEIs) from China plummeted 38.5% to $34.3 million for the year. In 2018, Chinese imports accounted for 13% of all chromatograph imports to the US, a notable change from 23% in 2017.

China’s double-digit decline compares to a 7.0% increase in 2018 for all countries (including China) of CEIs to $262.1 million. In fact, imports from the number one exporter of CEIs, Sweden, grew 15.4% to make up 25% of all such imports versus 23% in 2017. GE Life Sciences has LC manufacturing facilities in the country.

Source: US International Trade Commission DataWeb (USITC DataWeb), using data retrieved from the US Bureau of the Census (accessed May 6–8)

As with the worldwide figure, imports of CEIs from Singapore, the second largest exporter of CEIs to the US, also increased. In 2018, imports of chromatographs from Singapore increased 35.5% to $44.0 million to make up 17% of such imports, up from 13% the year before. The country is a US major manufacturing location for many gas chromatograph (GC) and liquid chromatograph (LC) makers, including Agilent Technologies, Thermo Fisher Scientific and Waters.

Source: US International Trade Commission DataWeb (USITC DataWeb), using data retrieved from the US Bureau of the Census (accessed May 6–8)

Spectrometer and Spectrophotometer Imports

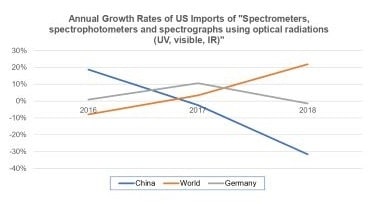

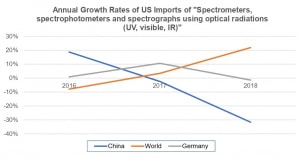

Spectrometer imports from China, worldwide and Germany show a pattern more indicative of possible tariff effects. This category is defined by the ITC as “Spectrometers, spectrophotometers and spectrographs using optical radiations (UV, visible, IR)” (SSS).

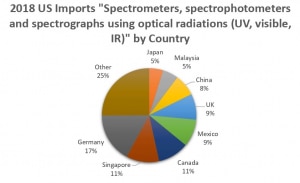

US exports of SSS form China dropped 31.6% last year to $36.9 million. This was equivalent to 8% of such all SSS imports into the US versus 13% in 2017.

Source: US International Trade Commission DataWeb (USITC DataWeb), using data retrieved from the US Bureau of the Census (accessed May 6–8)

In contrast, imports of SSS from all countries (including China) rose 21.9% to $497.0 million in 2018. Specifically, SSS imports from Germany, the largest exporter of SSS, also declined in 2018, but were down only 1.4% to $84.4 million to make up 17% of all such imports. Major spectrometer companies that manufacture products in Germany include Bruker and Thermo Fisher.

A 10% tariffs for for the specified imports from China were scheduled to increase from 10% to 25% in March, but were delayed due to ongoing negotiations between China and the US. But on May 5, the US government announced that the new deadline is this Friday, May 10. For CEIs and SSS imports from China, the tariffs may have already had an notable effect.

Source: US International Trade Commission DataWeb (USITC DataWeb), using data retrieved from the US Bureau of the Census (accessed May 6–8)